Investing In Palantir: Analyzing The 40% Growth Projection For 2025 And Beyond

Table of Contents

Palantir's Current Market Position and Competitive Advantages

Palantir's success hinges on its strong market position and competitive advantages within the rapidly expanding data analytics sector.

Dominating the Government and Commercial Sectors

Palantir has established itself as a leader in providing advanced data analytics solutions to both government and commercial clients. Its strong presence in government contracts, including significant partnerships with agencies like the CIA, provides a stable revenue stream and a strong foundation for future growth. Simultaneously, Palantir is aggressively expanding its commercial footprint, targeting industries such as finance, healthcare, and energy.

- Successful Government Partnerships: Palantir's Gotham platform is used by numerous intelligence agencies for data integration and analysis, supporting national security efforts.

- Key Commercial Clients: Palantir works with leading financial institutions, helping them detect fraud, manage risk, and improve operational efficiency. Furthermore, their solutions are adopted by major corporations in diverse sectors for enhanced data-driven decision making.

- Unique Value Proposition: Palantir's platforms offer unparalleled data integration and analysis capabilities, allowing clients to unlock the value hidden within their vast datasets. This powerful combination of data integration and intuitive user interface gives Palantir a significant edge over competitors. Keywords: Palantir government contracts, Palantir commercial clients, data integration, data analytics software.

Technological Innovation and Future Product Development

Palantir's commitment to research and development (R&D) is a key driver of its future growth. The company consistently invests in cutting-edge technologies such as artificial intelligence (AI), machine learning, and data mining to enhance its existing platforms and develop new, innovative products.

- AI and Machine Learning Integration: Palantir is integrating AI and machine learning capabilities into its platforms to improve accuracy, automation, and the overall user experience. This enhances the value proposition for existing and prospective clients.

- Disruptive Innovations: The company is exploring new applications of its technology in emerging fields, potentially creating new revenue streams and market opportunities. This proactive approach is critical for maintaining a leading position in the dynamic data analytics landscape.

- Impact on Future Growth: Continuous innovation is vital for Palantir to stay ahead of the competition and capitalize on the growing demand for advanced data analytics solutions. Keywords: Palantir technology, Palantir innovation, AI, machine learning, data mining.

Factors Contributing to the Projected 40% Growth

The projected 40% growth for Palantir by 2025 is supported by several key factors:

Expanding Government Spending on Data Analytics

Government agencies worldwide are significantly increasing their spending on advanced data analytics solutions to improve national security, enhance public services, and combat cyber threats. This trend presents a significant growth opportunity for Palantir.

- Increased Budget Allocations: Governments are recognizing the critical importance of data analytics in addressing complex challenges, leading to increased budget allocations for related technologies and services.

- National Security and Intelligence: The demand for advanced data analytics solutions is particularly high in the national security and intelligence sectors, where Palantir holds a strong competitive advantage.

- Cybersecurity Concerns: The rising threat of cyberattacks is driving demand for sophisticated cybersecurity solutions, which further strengthens Palantir's position in the market. Keywords: Government data analytics, national security, intelligence agencies, cybersecurity.

Growth in the Commercial Data Analytics Market

The commercial data analytics market is experiencing explosive growth, driven by the increasing availability of data, the rise of big data, and the growing adoption of data-driven decision-making across various industries.

- Market Size and Projections: The global commercial data analytics market is projected to reach hundreds of billions of dollars in the coming years, presenting substantial opportunities for growth.

- Industry Trends: The increasing adoption of cloud-based data analytics solutions, the rise of fintech, and the growing demand for real-time data analysis are key trends driving market growth.

- Palantir's Market Share Strategy: Palantir is strategically positioned to capture significant market share by leveraging its advanced technology, strong customer relationships, and expanding product offerings. Keywords: Commercial data analytics, big data, data science, market share, Fintech.

Successful Execution of Palantir's Business Strategy

Palantir's ability to execute its business strategy effectively is crucial for achieving its ambitious growth targets. Success depends on maintaining strong customer relationships, expanding into new markets, and effectively managing its operations.

- Key Performance Indicators (KPIs): Tracking key metrics such as revenue growth, customer acquisition cost, and customer churn is vital for monitoring progress and making necessary adjustments.

- Successful Case Studies: Demonstrating the value of Palantir's solutions through compelling case studies helps to build credibility and attract new clients.

- Sales and Marketing Effectiveness: Effective sales and marketing efforts are essential for reaching target customers and driving revenue growth. Keywords: Palantir strategy, Palantir KPIs, revenue growth, customer acquisition.

Risks and Challenges to Achieving the 40% Growth Projection

Despite the promising outlook, several risks and challenges could hinder Palantir's ability to achieve its projected 40% growth.

Competition from Established Players and New Entrants

Palantir faces competition from established players and emerging startups in the data analytics market. This competitive landscape necessitates continuous innovation and adaptation.

- Key Competitors: Companies like AWS, Microsoft Azure, and Google Cloud Platform offer competing data analytics solutions. Furthermore, numerous smaller startups are constantly innovating.

- Competitive Pressures: Intense competition could impact Palantir's pricing strategies, market share, and overall growth trajectory.

- Maintaining Competitive Advantage: Palantir needs to continually innovate and adapt to maintain its competitive advantage in this dynamic market. Keywords: Palantir competitors, competitive landscape, market competition, data analytics competition.

Economic Uncertainty and Geopolitical Risks

Economic downturns and geopolitical instability can significantly impact Palantir's growth prospects, particularly its government contracts and commercial clients' spending.

- Impact of Global Economic Conditions: Recessions or periods of economic uncertainty can lead to reduced spending on data analytics solutions, impacting Palantir's revenue.

- Geopolitical Risks: Global conflicts or political instability can create uncertainty and disrupt business operations, potentially affecting Palantir's contracts and partnerships.

- Mitigation Strategies: Palantir needs to develop strategies to mitigate the impact of these external factors on its financial performance. Keywords: Economic uncertainty, geopolitical risk, global economy, recession.

Maintaining Profitability While Scaling Operations

Balancing profitability with the need to scale operations and expand into new markets presents a significant challenge for Palantir.

- Profitability Margins: Maintaining healthy profit margins while investing in growth initiatives is crucial for long-term sustainability.

- Costs Associated with Growth: Expanding operations, hiring new talent, and investing in R&D require substantial financial resources.

- Balancing Growth and Profitability: Palantir needs to strike a delicate balance between investing in growth and maintaining profitability. Keywords: Palantir profitability, operating margins, cost efficiency, scaling operations.

Conclusion

Investing in Palantir presents a compelling opportunity, given its ambitious 40% growth projection for 2025 and beyond. While considerable risks exist, the company's strong position in the government and commercial data analytics markets, coupled with its ongoing technological innovation, offers significant potential for long-term growth. However, careful consideration of the competitive landscape and macroeconomic factors is crucial before making any investment decisions. To learn more about evaluating Palantir's potential and making informed investment choices, consider consulting with a financial advisor. Remember to thoroughly research Palantir stock and its potential before investing. Start your Palantir investment journey today!

Featured Posts

-

Jeanine Pirros Stock Market Warning Ignore The Market For Weeks

May 10, 2025

Jeanine Pirros Stock Market Warning Ignore The Market For Weeks

May 10, 2025 -

New Initiative Technical Skills Training For Transgenders In Punjab

May 10, 2025

New Initiative Technical Skills Training For Transgenders In Punjab

May 10, 2025 -

Hertls Injury Will He Play For The Golden Knights

May 10, 2025

Hertls Injury Will He Play For The Golden Knights

May 10, 2025 -

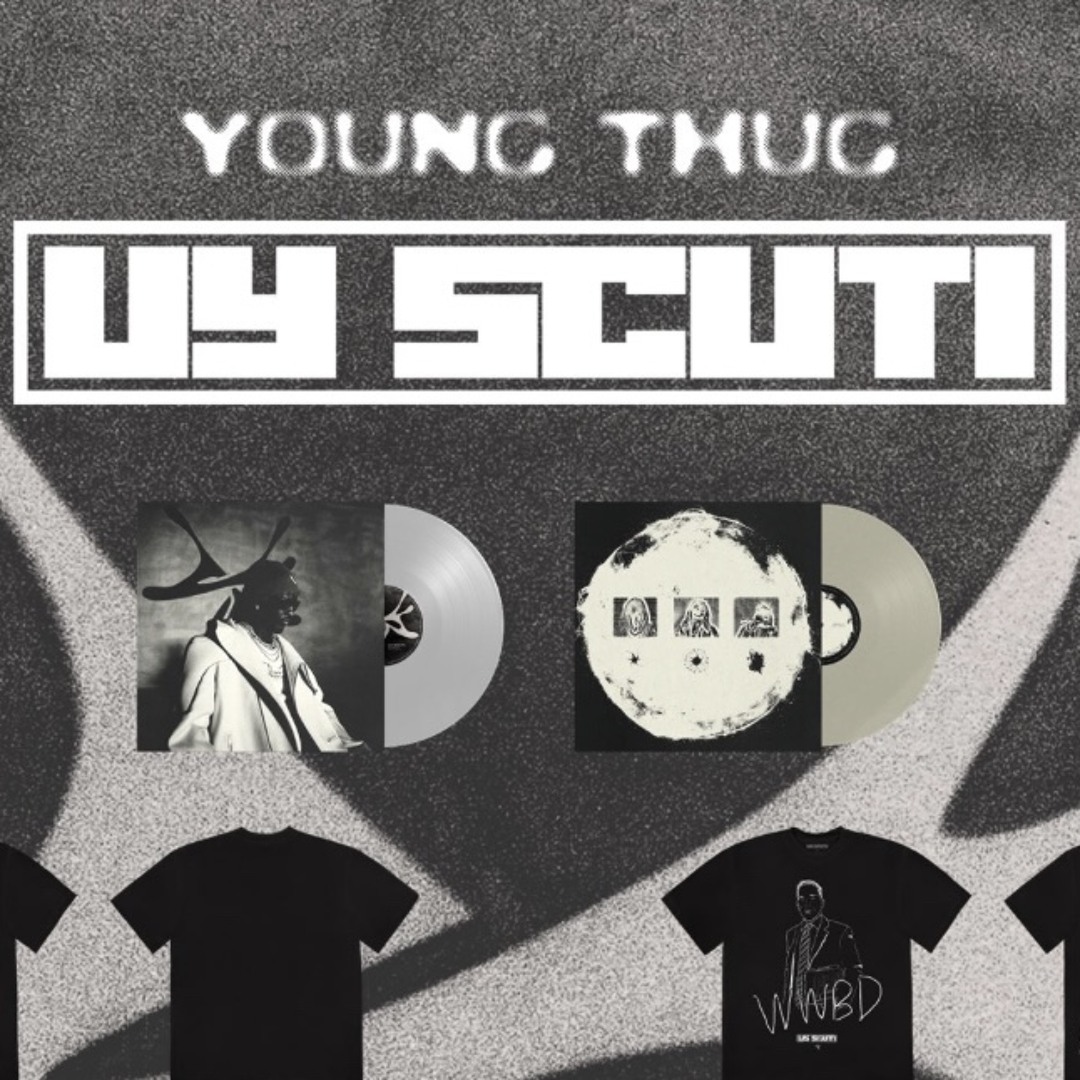

Uy Scuti Release Date Young Thug Drops Hints

May 10, 2025

Uy Scuti Release Date Young Thug Drops Hints

May 10, 2025 -

Community Rallies Around Family After Unprovoked Racist Killing

May 10, 2025

Community Rallies Around Family After Unprovoked Racist Killing

May 10, 2025