Investing In Palantir Before May 5th: A Comprehensive Overview

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies operates primarily through two core platforms: Gotham and Foundry. Understanding these platforms is key to understanding Palantir revenue and the overall investment thesis.

-

Gotham: This platform is primarily focused on serving government and intelligence agencies. It provides advanced data analytics and integration capabilities, assisting in complex investigations, national security operations, and other critical government functions. This segment contributes significantly to Palantir revenue, but its reliance on government contracts presents both opportunities and challenges.

-

Foundry: This platform targets commercial clients across a diverse range of sectors, including finance, healthcare, and manufacturing. Foundry offers a similar suite of data analytics tools as Gotham, but with a focus on streamlining business operations, improving decision-making, and fostering innovation within private organizations. The expansion of Foundry is crucial for Palantir's long-term growth and diversification away from its reliance on government contracts.

-

Growth Potential and Diversification: The growth potential for both platforms is significant. The increasing adoption of big data analytics across both the public and private sectors suggests a large addressable market. Palantir's strategy of diversifying revenue streams across Gotham and Foundry mitigates risk, making it a potentially attractive investment for those looking for long-term growth.

-

Recurring Revenue and Long-Term Contracts: A key factor to consider when analyzing Palantir revenue is the significant portion of recurring revenue generated from long-term contracts. This provides predictability and stability to the company's financial performance, a crucial aspect for investors seeking steady returns.

Analyzing Palantir's Financial Performance and Growth Prospects

Analyzing Palantir's financial performance is vital before deciding on investing in Palantir. Recent financial reports provide insights into the company's trajectory.

-

Key Financial Metrics: Investors should closely monitor key metrics such as revenue growth rate, operating margin, and free cash flow. Positive trends in these areas indicate a healthy and growing company. Analyzing Palantir earnings reports over several quarters gives a clearer picture of long-term performance.

-

Comparison to Competitors: Palantir faces competition from other big data and analytics companies. Comparing Palantir's financial performance and market share to competitors helps determine its competitive advantage and its ability to sustain growth in a challenging market.

-

Future Growth Potential: Palantir's future growth prospects are tied to several factors, including the continued adoption of its platforms, successful expansion into new markets, and effective competition. Market trends in the data analytics sector, the increasing demand for data-driven decision-making, and the ongoing digital transformation across industries suggest a positive outlook.

-

Long-Term Strategic Goals: Analyzing Palantir's long-term strategic goals and their execution is essential for assessing the company's capacity for sustainable growth. Investors should consider the company's investments in research and development, its ability to attract and retain talent, and its overall strategic vision.

Assessing the Risks Involved in Investing in Palantir

Investing in Palantir, like any investment, involves inherent risks. It's essential to carefully consider these before committing your capital.

-

Market Volatility: The stock market is inherently volatile, and Palantir's stock price is subject to fluctuations based on broader market trends, economic conditions, and company-specific news. Understanding the impact of market volatility on Palantir stock price is crucial.

-

Competition: The big data and analytics market is highly competitive. Palantir faces competition from established players and emerging startups, posing a risk to its market share and profitability.

-

Dependence on Government Contracts (Gotham): Gotham's reliance on government contracts exposes Palantir to the inherent risks associated with government spending, including budgetary constraints and potential changes in procurement policies.

-

Commercial Adoption Challenges (Foundry): While Foundry shows significant potential, expanding its adoption in the commercial sector requires overcoming challenges related to market penetration, competition, and customer acquisition.

-

Overall Market Sentiment: The overall market sentiment towards technology stocks can significantly impact Palantir's stock price. Negative investor sentiment can lead to a decline in the stock price, regardless of the company's underlying performance.

May 5th and its Potential Impact on Palantir Stock

While we cannot predict the future, it's prudent to consider potential events around May 5th that could affect Palantir's stock price. This section aims to highlight potential factors, not provide financial advice.

-

Upcoming Announcements: Any upcoming earnings reports, product launches, or strategic partnerships around May 5th could influence investor sentiment and consequently, the stock price.

-

Market Conditions: Broader market conditions and overall investor sentiment towards technology stocks will play a significant role in determining Palantir's stock performance.

-

Significant News: Any unexpected news events (positive or negative) relating to Palantir or the broader industry could trigger substantial price movements.

-

Staying Informed: Staying informed through reliable financial news sources and conducting thorough due diligence is crucial before making any investment decisions.

Conclusion

Investing in Palantir before May 5th presents both opportunities and risks. Careful consideration of the company's financial performance, growth prospects, and potential market influences is crucial. Understanding the intricacies of Palantir's business model (Gotham and Foundry) and assessing the inherent risks are vital steps in making an informed decision. Before making any investment decisions regarding investing in Palantir, conduct thorough due diligence and consult with a qualified financial advisor. Stay informed about Palantir's progress and market conditions leading up to May 5th and beyond to make the most strategic investment decisions. Remember that this information is for educational purposes only and is not financial advice.

Featured Posts

-

The 10 Best Film Noir Movies Ever Made

May 10, 2025

The 10 Best Film Noir Movies Ever Made

May 10, 2025 -

Jeanine Pirro A Closer Look At Her Legal Career Education And Finances

May 10, 2025

Jeanine Pirro A Closer Look At Her Legal Career Education And Finances

May 10, 2025 -

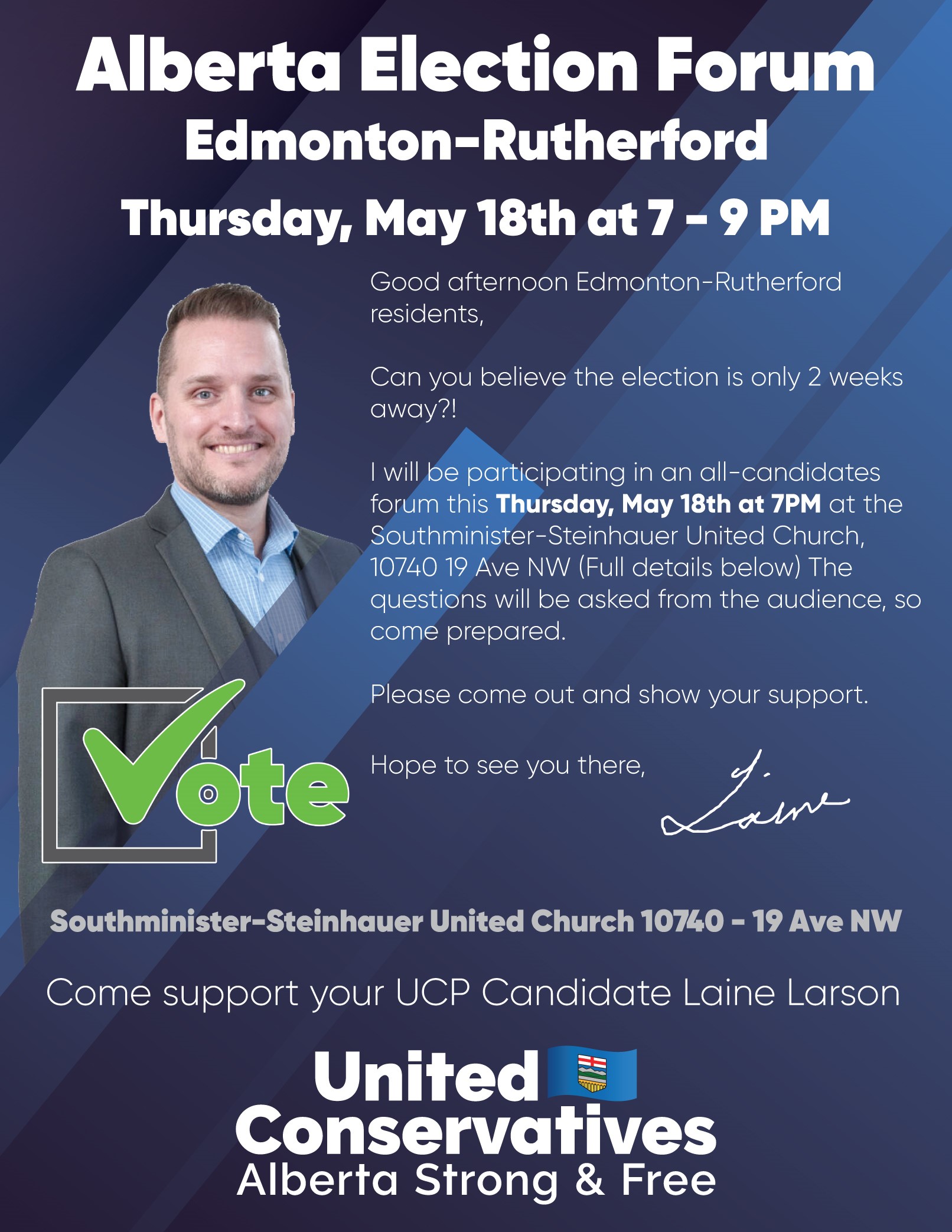

How Federal Riding Redistribution Will Impact Edmonton Voters

May 10, 2025

How Federal Riding Redistribution Will Impact Edmonton Voters

May 10, 2025 -

Oilers Edge Golden Knights 3 2 Yet Vegas Still Makes Playoffs

May 10, 2025

Oilers Edge Golden Knights 3 2 Yet Vegas Still Makes Playoffs

May 10, 2025 -

Analyzing The China Market Why Bmw And Porsches Strategies Need Adjustment

May 10, 2025

Analyzing The China Market Why Bmw And Porsches Strategies Need Adjustment

May 10, 2025