Investing In Palantir Before May 5th: A Data-Driven Analysis

Table of Contents

Palantir's Recent Performance and Upcoming Catalysts

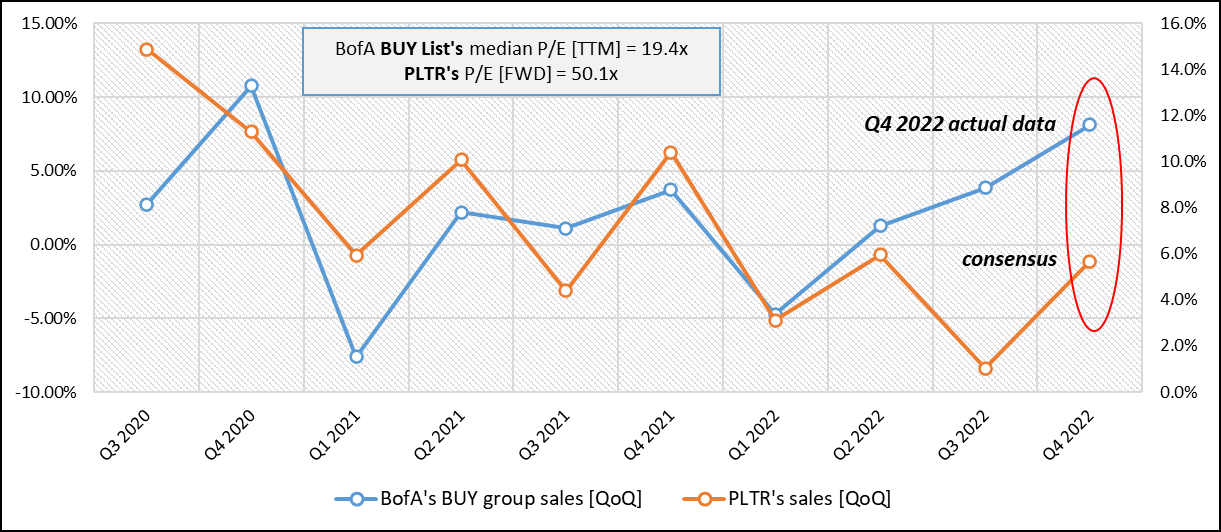

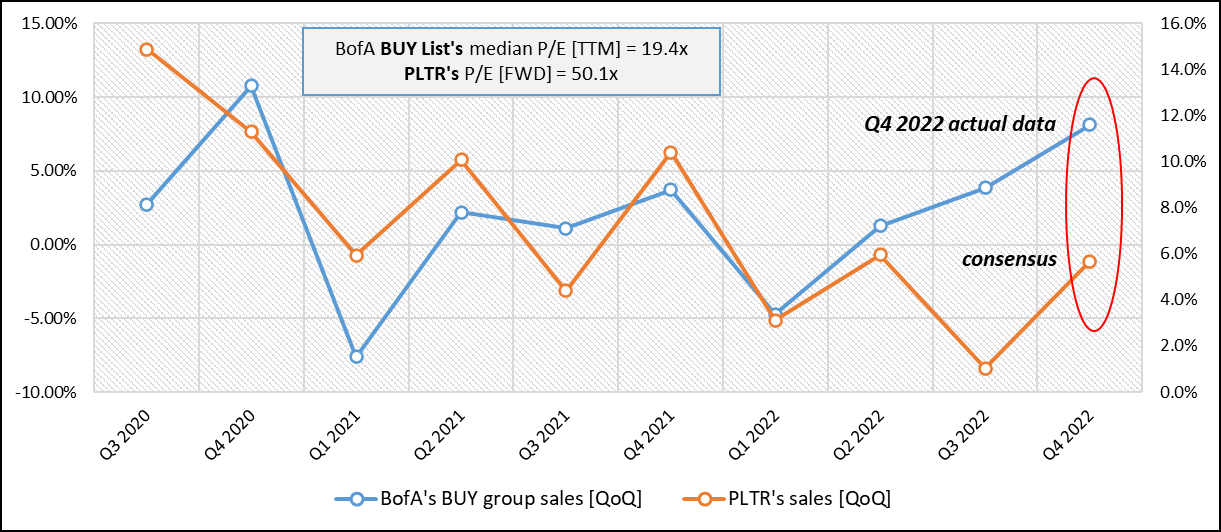

Analyzing Palantir's recent performance is essential before making any investment decisions. This involves scrutinizing Palantir stock price movements, examining Palantir earnings reports, and assessing the overall market sentiment surrounding PLTR stock.

-

Quarterly Earnings and Revenue Growth: Review Palantir's recent quarterly earnings reports to understand its revenue growth trajectory. Look for trends in revenue generation from both government contracts and commercial contracts. Consistent growth indicates a healthy and expanding business. Significant deviations from projected figures should be carefully examined.

-

Contract Wins: Significant contract wins, both within the government sector (Palantir Gotham) and the commercial sector (Palantir Foundry), are crucial indicators of future growth. Monitoring announcements of new large contracts before May 5th can significantly impact the Palantir stock price. Assess the size and long-term implications of these contracts.

-

Upcoming Catalysts: Keep an eye out for upcoming product launches, partnerships, or strategic initiatives. These announcements often trigger significant market reactions and can substantially influence the PLTR stock price. Anticipating such events and understanding their potential impact is vital.

-

Market Sentiment: Gauge the overall market sentiment towards Palantir. News articles, analyst reports, and social media discussions can provide valuable insights into investor confidence and expectations regarding Palantir stock. Negative sentiment could signify increased risk.

-

Pre-May 5th News: Scrutinize any significant news or events impacting Palantir before May 5th. Unexpected regulatory changes, competitive developments, or geopolitical events can all influence investment decisions.

Understanding Palantir's Business Model and Future Potential

Palantir's success hinges on its unique business model and the future potential of its core offerings: Palantir Gotham and Palantir Foundry. A deep understanding of these platforms is crucial for evaluating the long-term prospects of investing in Palantir stock.

-

Core Offerings: Palantir Gotham caters to government agencies, offering data integration and analytics capabilities for national security and intelligence applications. Palantir Foundry serves commercial clients, providing a platform for data integration and analysis across various industries.

-

Market Growth Potential: Analyze the potential for growth in both the government and commercial sectors. The increasing reliance on big data analytics and artificial intelligence presents significant opportunities for Palantir.

-

Competitive Landscape: Assess Palantir's competitive advantages against other players in the big data analytics and data integration space. Consider factors such as technological innovation, market share, and customer relationships.

-

Long-Term Potential: Evaluate the long-term potential of Palantir's technology. Its applications extend across numerous sectors, including healthcare, finance, and energy. The adoption of artificial intelligence and machine learning capabilities further enhances its future potential.

-

Investment Risks: Acknowledge the inherent risks, such as competition from established players and dependence on large government contracts. These factors should be carefully considered before investing in PLTR stock.

Technical Analysis and Chart Patterns of PLTR Stock

Technical analysis provides valuable insights into potential price movements of PLTR stock. Studying charts and using relevant indicators can help identify potential entry and exit points.

-

Price Action Analysis: Examine the recent price action of PLTR stock, noting significant highs and lows. Identify trends and patterns that might predict future price movements.

-

Support and Resistance Levels: Identify key support and resistance levels on the PLTR chart. These levels represent price points where buying or selling pressure is expected to be strong.

-

Trading Volume: Analyze trading volume to gauge the strength of price movements. High volume confirms trends, while low volume suggests weaker momentum.

-

Technical Indicators: Utilize technical indicators such as moving averages and the Relative Strength Index (RSI) to gauge momentum and potential overbought or oversold conditions.

-

Chart Patterns: Look for potential chart patterns, such as head and shoulders or double bottoms, which could indicate future price movements. Remember that chart patterns are not foolproof predictions.

Risk Assessment and Diversification Strategies

Investing in Palantir, or any individual stock, involves risk. A sound investment strategy includes assessing these risks and implementing diversification strategies.

-

Individual Stock Risk: Understand the inherent risks of investing in individual stocks, especially technology stocks, which can experience significant volatility.

-

Palantir-Specific Risks: Assess risks specific to Palantir, such as its valuation, dependence on specific clients, and the competitive landscape.

-

Diversification: Emphasize the importance of diversifying your investment portfolio. Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce risk.

-

Risk Management: Develop a robust risk management strategy that aligns with your risk tolerance and investment goals.

Conclusion

This analysis explored Palantir's recent performance, future prospects, technical indicators, and associated risks to offer a data-driven perspective on investing in Palantir before May 5th. We've examined factors influencing your decision, highlighting both opportunities and risks inherent in PLTR stock. Remember, this is for informational purposes only, and not financial advice. Conduct thorough research and consider consulting a financial advisor before making investment decisions. Make informed choices about investing in Palantir before May 5th based on your own risk tolerance and financial goals.

Featured Posts

-

Ray Epps Defamation Lawsuit Against Fox News January 6th Allegations

May 10, 2025

Ray Epps Defamation Lawsuit Against Fox News January 6th Allegations

May 10, 2025 -

Pre Failure Warnings Investigating The Newark Air Traffic Control System Crisis

May 10, 2025

Pre Failure Warnings Investigating The Newark Air Traffic Control System Crisis

May 10, 2025 -

Summer Travel 2024 Navigating Real Id Requirements At Airports

May 10, 2025

Summer Travel 2024 Navigating Real Id Requirements At Airports

May 10, 2025 -

Putins Ceasefire Declaration Analysis And Implications

May 10, 2025

Putins Ceasefire Declaration Analysis And Implications

May 10, 2025 -

Resultat National 2 Dijon 0 1 Concarneau 28e Journee

May 10, 2025

Resultat National 2 Dijon 0 1 Concarneau 28e Journee

May 10, 2025