Investing In Palantir: Should You Buy Before May 5th?

Table of Contents

Palantir Technologies (PLTR) stock has experienced significant volatility in recent months. With a potential earnings report and other market events looming, many investors are asking: is now the time to buy Palantir stock? This article provides a pre-May 5th analysis of Palantir investment opportunities, weighing the potential rewards against the inherent risks involved in purchasing PLTR stock. We'll examine Palantir's recent performance, future outlook, and the factors you should consider before making a Palantir investment.

Palantir's Recent Performance and Future Outlook

Q1 2024 Earnings and Revenue Growth

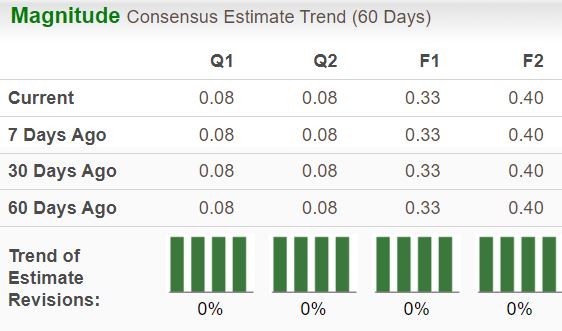

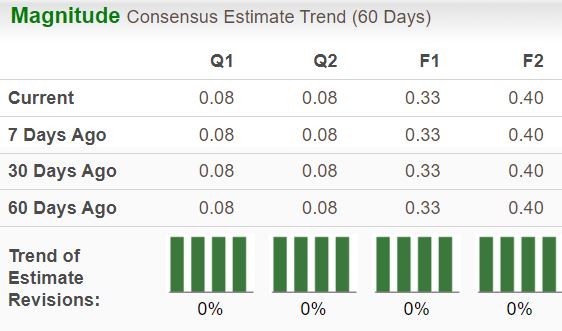

Analyzing Palantir's Q1 2024 earnings (assuming data is available before May 5th) is crucial for any Palantir investment strategy. We need to look at key metrics like revenue growth, profitability margins, and overall financial performance. A strong showing in these areas would bolster confidence in the PLTR stock price. Charts and graphs visualizing Palantir earnings and PLTR revenue growth will provide a clearer picture.

- Revenue growth compared to previous quarters: A consistent upward trend signifies positive momentum.

- Profitability margins and trends: Increasing margins indicate improved efficiency and profitability.

- Key drivers of revenue growth: Identifying the sources of growth (e.g., increased government contracts, successful commercial partnerships) is vital for understanding future prospects. Strong growth in commercial sectors might signal reduced reliance on government contracts, a factor which impacts Palantir's risk profile.

Government Contracts and Commercial Growth

Palantir's business model relies significantly on government contracts, particularly in defense and intelligence. However, its commercial expansion is vital for long-term sustainability. Analyzing the balance between these two revenue streams is essential for any Palantir stock analysis.

- Significant government contracts secured recently: Large contracts provide revenue stability but can also indicate over-reliance on one sector.

- Growth potential in specific sectors (e.g., healthcare, finance): Success in diverse commercial sectors suggests a broader and more resilient business model.

- Challenges faced in expanding the commercial market: Competition and the complexities of integrating Palantir's platform into existing commercial workflows present hurdles to overcome.

Analyzing the Risks of Investing in Palantir Before May 5th

Market Volatility and Geopolitical Factors

The technology sector, and particularly data analytics companies like Palantir, is sensitive to market volatility. Geopolitical instability can further impact the PLTR stock price.

- Recent market trends and their impact on tech stocks: Understanding overall market sentiment is essential before making any investment in Palantir stock.

- Potential risks associated with international conflicts or economic downturns: These events can significantly impact government spending and commercial investment, affecting Palantir's revenue streams.

- Sensitivity analysis of Palantir's valuation to market fluctuations: A thorough risk assessment should quantify how much Palantir's valuation changes in response to market shifts.

Competition and Technological Disruption

Palantir operates in a competitive landscape with established players and emerging startups. Technological advancements could disrupt its core business.

- Key competitors and their strengths: Understanding the competitive landscape, including rivals' strengths and weaknesses, is essential for a comprehensive Palantir investment strategy.

- Potential threats from emerging technologies: The field of big data analytics is constantly evolving; Palantir needs to adapt to stay ahead of the competition.

- Palantir's strategies to maintain its competitive edge: Analyzing Palantir's innovation efforts and its ability to adapt to changing market dynamics is crucial.

Should You Buy Palantir Stock Before May 5th? A Balanced Perspective

The decision of whether to buy Palantir stock before May 5th requires careful consideration of the factors discussed above. While Palantir's innovative technology and strong government relationships offer potential upside, market volatility, competitive pressures, and dependence on large contracts present significant risks.

- Pros and cons of investing before May 5th: Weigh the potential for high returns against the possibility of significant losses.

- Consideration of your personal risk tolerance: Only invest an amount you're comfortable potentially losing.

- Alternative investment options: Diversification is key; don't put all your eggs in one basket.

Conclusion: Making Informed Decisions about Palantir Stock

Investing in Palantir stock before May 5th involves both significant potential rewards and considerable risks. Thorough due diligence, including an in-depth understanding of Palantir's financial performance, competitive landscape, and the broader market conditions, is crucial before making any investment decisions. Remember, this article provides an analysis, not financial advice. Conduct your own research on Palantir stock investing and consider consulting a financial advisor before making a PLTR stock purchase. Only invest what you can afford to lose. Research Palantir before investing to make informed choices about your portfolio.

Featured Posts

-

Why Is Abc Re Airing High Potential Shows In March 2025

May 09, 2025

Why Is Abc Re Airing High Potential Shows In March 2025

May 09, 2025 -

Clarification Politique Borne Envisage Une Fusion Entre Renaissance Et Le Modem

May 09, 2025

Clarification Politique Borne Envisage Une Fusion Entre Renaissance Et Le Modem

May 09, 2025 -

Behoud Van De Band Tussen Brekelmans En India Belangrijke Overwegingen

May 09, 2025

Behoud Van De Band Tussen Brekelmans En India Belangrijke Overwegingen

May 09, 2025 -

11 Shja E Psg Se Analiza E Lojtareve Me Te Forte

May 09, 2025

11 Shja E Psg Se Analiza E Lojtareve Me Te Forte

May 09, 2025 -

Dog Teams And Mushers Push On A Fur Rondy Update

May 09, 2025

Dog Teams And Mushers Push On A Fur Rondy Update

May 09, 2025