Investing In Ripple (XRP): Can It Make You A Millionaire In 2024?

Table of Contents

The cryptocurrency market is buzzing with potential, and 2024 holds a special allure for investors eyeing life-changing returns. Amidst the excitement, Ripple (XRP) stands out as a prominent player, captivating many with its potential for substantial growth. But can investing in Ripple truly make you a millionaire in 2024? This article delves into the intricacies of XRP, exploring its technology, legal battles, market position, and future prospects to help you assess the realistic potential and risks involved. We'll examine factors influencing XRP's price in 2024 and provide insights into crafting a sound investment strategy.

2. Main Points:

H2: Understanding Ripple (XRP) and its Potential

H3: XRP's Technology and Functionality: Ripple's underlying technology centers around RippleNet, a global network facilitating fast and cost-effective cross-border payments. XRP, the native cryptocurrency of the network, plays a crucial role in enabling these transactions. Solutions like xRapid and On-Demand Liquidity leverage XRP to expedite transactions, reducing reliance on intermediary banks and significantly cutting costs.

- Faster Transactions: XRP transactions are processed within seconds, a stark contrast to traditional banking systems that often take days.

- Lower Costs: XRP significantly reduces transaction fees compared to SWIFT and other traditional payment methods.

- Global Reach: RippleNet boasts a growing network of financial institutions, expanding XRP's reach and utility.

- Key Partnerships: Collaborations with major banks and payment providers strengthen Ripple's position in the global financial landscape.

H3: Ripple's Legal Battles and Their Impact on XRP Price: The ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) casts a significant shadow on XRP's price. The SEC alleges that XRP is an unregistered security, a claim Ripple vehemently denies. The outcome of this "Ripple vs. SEC" case will significantly influence XRP's future trajectory.

- Key Arguments: The SEC argues that XRP sales constitute unregistered securities offerings, while Ripple maintains that XRP is a utility token with functional use cases.

- Potential Outcomes: A favorable ruling could send XRP's price soaring, while an unfavorable judgment could lead to a significant price decline. The uncertainty creates market volatility.

- Expert Opinions and Market Sentiment: Analyst opinions are divided, reflecting the uncertainty surrounding the lawsuit's outcome. Market sentiment directly impacts trading volume and price.

H3: XRP's Market Position and Adoption: XRP consistently ranks among the top cryptocurrencies by market capitalization. Its trading volume fluctuates based on market conditions and news related to the SEC lawsuit. While adoption is growing, it still faces competition from other cryptocurrencies in the payments space.

- Market Cap and Trading Volume: Analyzing these metrics provides a snapshot of XRP's current standing in the cryptocurrency market.

- Cryptocurrency Market Share: Compared to Bitcoin and Ethereum, XRP holds a significant but not dominant market share.

- Partnerships and Collaborations: Ongoing partnerships with financial institutions and technological advancements contribute to increased adoption.

H2: Factors Influencing XRP's Price in 2024

H3: Market Sentiment and Investor Confidence: The cryptocurrency market is notoriously volatile. A "bull market" characterized by optimism can drive XRP's price up, while a "bear market" fueled by fear and uncertainty can lead to significant price drops. Investor sentiment is crucial.

- News and Regulations: Positive regulatory developments or technological breakthroughs can boost investor confidence.

- Crypto Market Volatility: External factors affecting the broader crypto market significantly impact XRP's price.

- Influencer Opinions: Social media and prominent figures in the crypto space can influence investor sentiment.

H3: Technological Advancements and Ripple's Roadmap: Ripple's ongoing development efforts and innovations in blockchain technology will likely influence XRP's future value. Improvements in scalability and efficiency could boost adoption.

- Blockchain Technology Upgrades: Enhanced features and improvements in the underlying technology can increase XRP's utility.

- Innovation and Development: Ripple's commitment to innovation will shape XRP's long-term prospects.

- Ripple Roadmap: Analyzing Ripple's publicly available roadmap provides insights into future developments and their potential impact.

H3: Macroeconomic Factors and Global Events: Global economic conditions, geopolitical events, and regulatory changes worldwide significantly impact the cryptocurrency market. Inflation, interest rates, and global economic uncertainty all influence investor behavior.

- Inflation and Interest Rates: Monetary policy decisions by central banks directly influence cryptocurrency prices.

- Geopolitical Events: Global instability can lead to increased demand for safe haven assets, potentially affecting XRP's price.

- Regulatory Changes: Changes in cryptocurrency regulations in various countries can significantly influence the market.

H2: Assessing the "Millionaire" Potential of XRP

H3: Realistic Expectations and Risk Assessment: While XRP holds potential for growth, it's crucial to acknowledge the inherent risks involved. Cryptocurrency investments are inherently volatile, and substantial losses are possible.

- Risk Management: Implementing a sound risk management strategy is paramount before investing in XRP.

- Diversification: Diversifying investments across different asset classes is essential to mitigate risk.

- Investment Strategy: A well-defined investment strategy is key to managing risk and achieving your financial goals.

- High-Risk, High-Reward: The cryptocurrency market, including XRP, embodies a high-risk, high-reward scenario.

H3: Long-Term vs. Short-Term Investment Strategies: Long-term investors aim to hold XRP for extended periods, potentially weathering market fluctuations. Short-term traders seek quick profits by capitalizing on price swings. Both strategies involve different levels of risk.

- Long-Term Investment: This strategy requires patience and a tolerance for volatility.

- Short-Term Trading: This strategy demands a keen understanding of market dynamics and technical analysis.

- Holding Strategy vs. Trading Strategy: Each strategy requires a different approach and risk tolerance.

3. Conclusion: Investing in Ripple (XRP) – Your Path Forward in 2024

Investing in Ripple (XRP) presents both significant opportunities and substantial risks. The SEC lawsuit, market sentiment, technological advancements, and macroeconomic factors all play crucial roles in determining XRP's price trajectory in 2024. While the "millionaire" potential exists, it's crucial to approach XRP investment with a clear understanding of the risks involved and a well-defined investment strategy. Thorough research, risk management, and diversification are paramount before committing your capital. Consider investing in Ripple wisely, conducting thorough due diligence, and aligning your investment with your risk tolerance. Learn more about XRP investment and make informed decisions to navigate the exciting, yet volatile, world of cryptocurrency.

Featured Posts

-

Xrp Future Price Analyzing The Post Sec Lawsuit Market

May 01, 2025

Xrp Future Price Analyzing The Post Sec Lawsuit Market

May 01, 2025 -

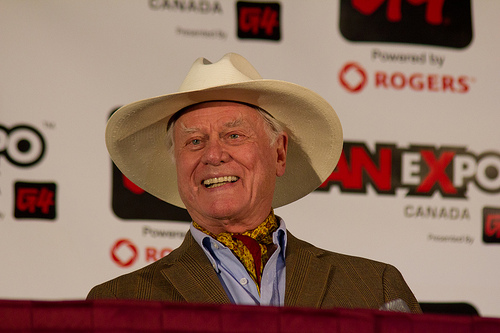

Centennial Celebration Ends Dallas Icon Passes

May 01, 2025

Centennial Celebration Ends Dallas Icon Passes

May 01, 2025 -

Kashmir Gets Railway Connection Pm Modis Inaugural Train Date Announced

May 01, 2025

Kashmir Gets Railway Connection Pm Modis Inaugural Train Date Announced

May 01, 2025 -

80s Tv Icon And Dallas Star Dies A Tribute

May 01, 2025

80s Tv Icon And Dallas Star Dies A Tribute

May 01, 2025 -

Tongas U 19 Womens Team Secures Spot In 2025 Ofc Championship

May 01, 2025

Tongas U 19 Womens Team Secures Spot In 2025 Ofc Championship

May 01, 2025

Latest Posts

-

Tributes Pour In After Passing Of Dallas Star 100

May 01, 2025

Tributes Pour In After Passing Of Dallas Star 100

May 01, 2025 -

Dallas Stars Death Reflecting On The 80s Soap Opera Golden Age

May 01, 2025

Dallas Stars Death Reflecting On The 80s Soap Opera Golden Age

May 01, 2025 -

Dallas Icon Passes Away At The Age Of 100

May 01, 2025

Dallas Icon Passes Away At The Age Of 100

May 01, 2025 -

The End Of An Era Dallas Star And 80s Soap Legend Passes Away

May 01, 2025

The End Of An Era Dallas Star And 80s Soap Legend Passes Away

May 01, 2025 -

100 Year Old Dallas Star Passes Away

May 01, 2025

100 Year Old Dallas Star Passes Away

May 01, 2025