Investing In The Amundi Dow Jones Industrial Average UCITS ETF (Dist): NAV Analysis

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF (Dist), this means the total value of the holdings that track the Dow Jones, minus liabilities, divided by the number of outstanding shares. Understanding NAV is crucial because it reflects the intrinsic value of the ETF. This is different from the market price, which fluctuates throughout the trading day based on supply and demand. While the market price can deviate from the NAV in the short term, over the long run, they tend to converge. NAV fluctuations directly reflect the performance of the underlying Dow Jones Industrial Average. A rising Dow Jones generally leads to a rising NAV, and vice versa.

- NAV Calculation Methodology: The NAV is calculated daily by the fund manager, typically at the end of the trading day, using the closing prices of the underlying assets.

- Importance of Daily NAV Updates: Daily NAV updates are essential for investors to track the ETF's performance and make informed decisions about buying, selling, or holding.

- NAV as a Performance Indicator: Comparing the ETF's NAV to the benchmark index (Dow Jones) helps assess its tracking efficiency—how closely the ETF mirrors the index's performance.

Amundi Dow Jones Industrial Average UCITS ETF (Dist): A Deep Dive into its NAV Performance

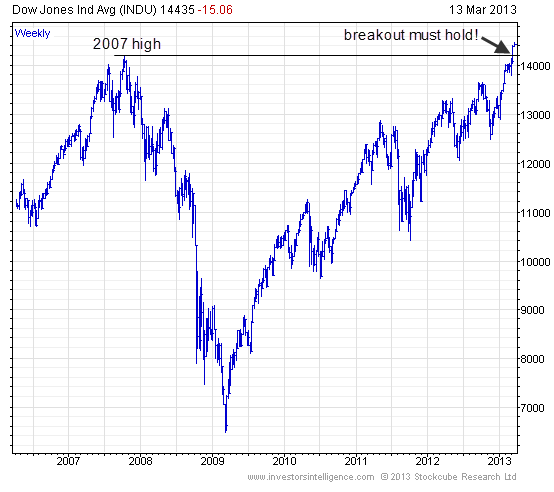

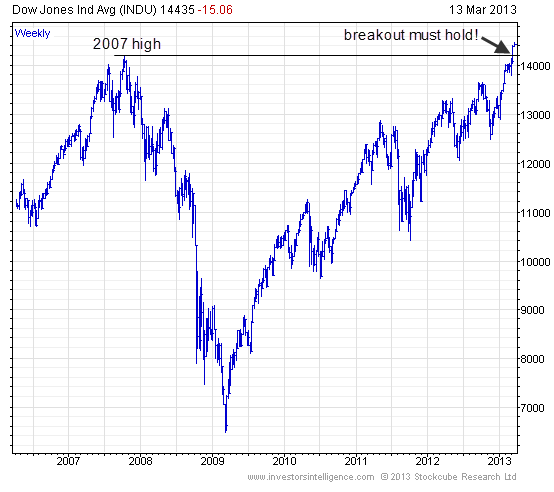

Analyzing the historical NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) reveals important trends. (Insert chart or graph showing historical NAV data here). This visual representation shows the highs and lows, allowing investors to identify periods of significant growth and decline. The correlation between the ETF's NAV and the Dow Jones Industrial Average's performance is generally very high, demonstrating the ETF's effectiveness in tracking the index. However, slight deviations can occur due to various factors.

- Key Periods of Significant NAV Change: (Explain specific periods of significant NAV change, e.g., during market crashes or economic booms, and the reasons behind them, referencing external events.)

- Comparison with Similar ETFs: (Compare the NAV performance of the Amundi ETF with other Dow Jones tracking ETFs to highlight strengths and weaknesses.)

- Dividend Distribution Impact: The distribution of dividends impacts the NAV, as the payment reduces the fund's assets. Understanding this impact is crucial for accurate NAV interpretation.

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV

Numerous factors influence the Dow Jones and, consequently, the NAV of the Amundi ETF. Macroeconomic conditions play a significant role. Interest rate changes, for example, can impact the valuations of companies within the Dow Jones, leading to NAV fluctuations. Geopolitical events and sector-specific performance also contribute. The performance of individual Dow Jones components has a direct influence on the overall NAV. A strong performance from technology giants, for instance, will likely boost the NAV, while underperformance in other sectors might have the opposite effect.

- Impact of Interest Rate Changes: Higher interest rates can negatively affect company valuations, potentially leading to a lower NAV.

- Influence of Geopolitical Events: Global events such as trade wars or political instability can cause market volatility and impact the NAV.

- Effect of Sector-Specific Performance: Strong performance in certain sectors (e.g., technology) can positively impact the NAV, while underperformance in others can negatively impact it.

Interpreting NAV Data for Investment Strategy

Analyzing NAV data helps investors make informed decisions. For instance, a consistently rising NAV might suggest a strong upward trend, while a persistent decline might indicate a bearish market. This information, combined with other market analysis, allows investors to develop suitable strategies. Long-term NAV analysis is generally more significant than short-term fluctuations. However, short-term trends can still be useful in identifying opportunities to buy low and sell high. Risk management is crucial. Understanding potential NAV drops and the factors driving them allows investors to mitigate risks.

- Assessing Relative Valuation: Compare the ETF's NAV to its market price to determine if it's undervalued or overvalued.

- Capitalizing on NAV Fluctuations: Use NAV trends to identify buying and selling opportunities, potentially benefiting from market corrections or growth periods.

- Risk Management: Implement strategies to manage potential losses during periods of NAV decline, such as diversification or stop-loss orders.

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV Analysis

Understanding the Net Asset Value is crucial for successful investing in the Amundi Dow Jones Industrial Average UCITS ETF (Dist) and similar ETFs. This analysis highlights the importance of considering NAV in conjunction with other market indicators to make informed investment decisions. By regularly monitoring the NAV and understanding the factors influencing it, investors can better manage their risk and potentially maximize their returns. We encourage you to conduct thorough research and utilize NAV analysis as a key tool for your investment strategy. For further information on NAV analysis and ETF investing, explore resources like [link to relevant financial websites or educational materials]. Remember, consistent monitoring of the Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV, coupled with broader market analysis, is key to successful long-term investing.

Featured Posts

-

Your Escape To The Country Choosing The Right Rural Property

May 24, 2025

Your Escape To The Country Choosing The Right Rural Property

May 24, 2025 -

2 Fall On Amsterdam Stock Exchange Following Trumps Tariff Announcement

May 24, 2025

2 Fall On Amsterdam Stock Exchange Following Trumps Tariff Announcement

May 24, 2025 -

Joy Crookes Shares Powerful New Single I Know You D Kill

May 24, 2025

Joy Crookes Shares Powerful New Single I Know You D Kill

May 24, 2025 -

Mamma Mia The Hottest New Ferrari Hot Wheels Sets Unveiled

May 24, 2025

Mamma Mia The Hottest New Ferrari Hot Wheels Sets Unveiled

May 24, 2025 -

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025

Latest Posts

-

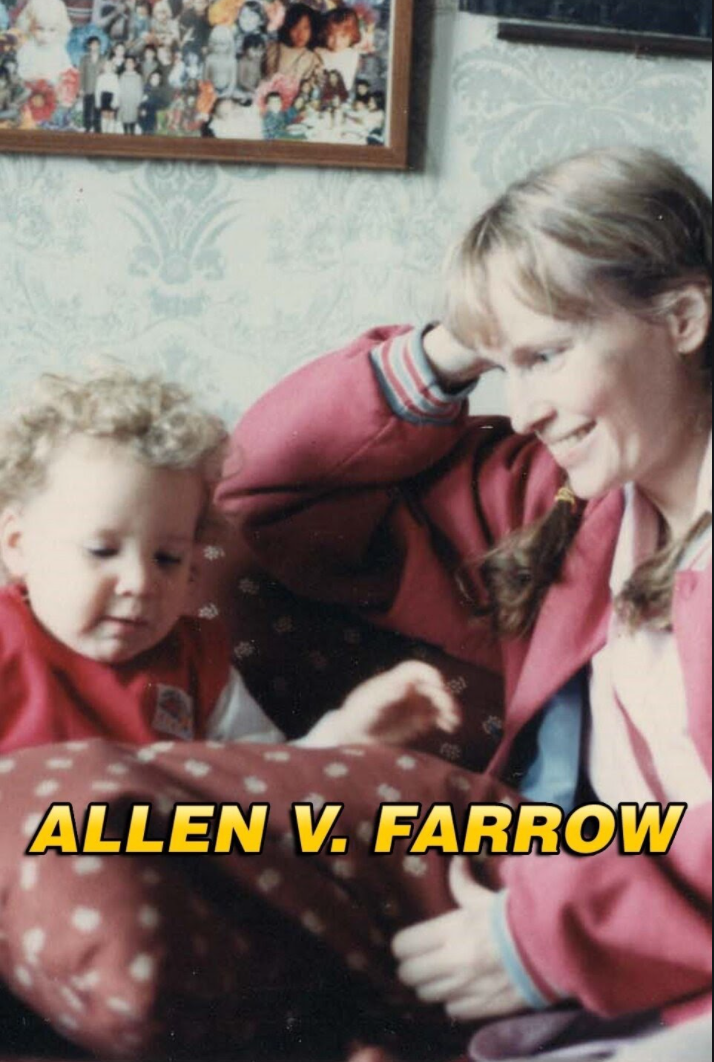

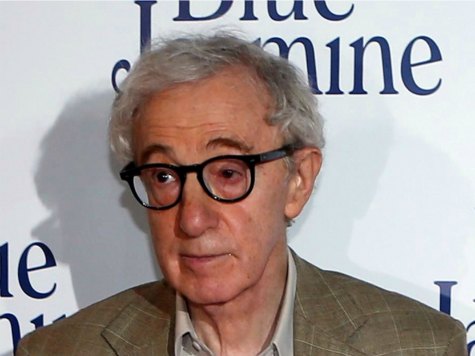

Dispute Over Dylan Farrows Accusations Sean Penns Perspective

May 24, 2025

Dispute Over Dylan Farrows Accusations Sean Penns Perspective

May 24, 2025 -

Dylan Farrow And Woody Allen Sean Penn Weighs In

May 24, 2025

Dylan Farrow And Woody Allen Sean Penn Weighs In

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Case

May 24, 2025 -

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025 -

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 24, 2025

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 24, 2025