Investing In Uber's Autonomous Vehicle Future: An ETF Analysis

Table of Contents

Understanding Uber's Autonomous Vehicle Initiatives

Uber's ambition in the autonomous vehicle space is significant. Their Advanced Technologies Group (ATG) is at the forefront of developing self-driving technology, aiming to integrate it seamlessly into their ride-sharing platform. This represents a potentially massive shift in the transportation industry, moving beyond simply connecting drivers and passengers to a fully automated, on-demand system.

- Uber ATG Progress: Uber ATG has been actively testing and refining its self-driving technology in various cities, accumulating valuable real-world data and experience. Their progress, while facing challenges, indicates a commitment to bringing autonomous vehicles to market.

- Strategic Partnerships: Uber has strategically partnered with several technology companies specializing in artificial intelligence (AI), mapping, and sensor technologies. These collaborations provide access to cutting-edge advancements and accelerate their development timelines.

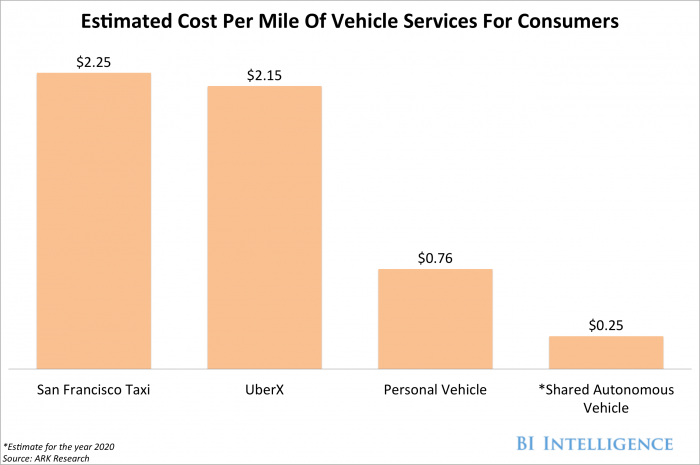

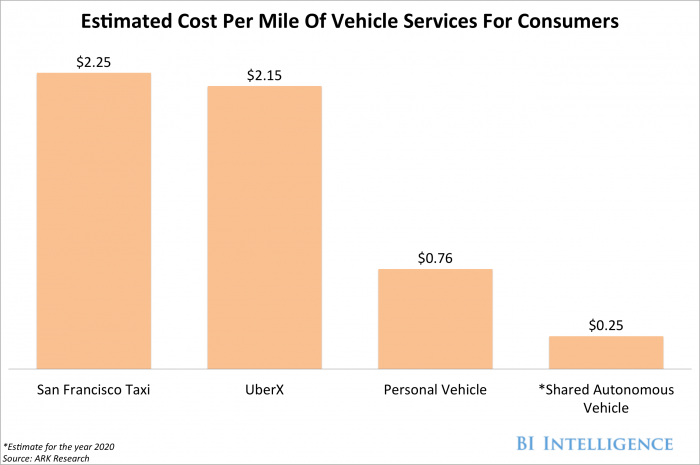

- Market Impact Potential: The successful implementation of Uber's autonomous vehicle technology could dramatically reshape urban transportation, potentially reducing traffic congestion, improving safety, and offering more efficient and affordable ride-sharing options.

- Challenges: The path to autonomous vehicle dominance isn't without hurdles. Uber faces significant challenges including stringent regulations, intense competition from other tech giants and established automakers, and the need to overcome technological limitations and ensure public safety.

Identifying Relevant ETFs

Directly investing in Uber's autonomous vehicle division is currently not feasible for most individual investors. However, accessing this exciting sector is possible through ETFs that offer exposure to companies involved in the broader autonomous vehicle ecosystem. These ETFs often hold shares in companies developing key technologies like self-driving systems, robotics, AI, and advanced mapping solutions.

- Specific ETFs: While there isn't a dedicated "Uber Autonomous Vehicle ETF," several ETFs provide indirect exposure. Investors should research ETFs focused on technology, robotics, and AI. Examples (Note: Always conduct your own research and confirm current holdings before investing; specific ETF holdings can change): Consider ETFs with significant holdings in companies like NVIDIA (NVDA), Mobileye (MBLY), or Alphabet (GOOGL), which are heavily involved in autonomous vehicle technology. Check their fact sheets for details.

- Comparison and Contrast: Carefully compare and contrast the investment strategies of different ETFs. Some may focus on specific segments of the autonomous vehicle market, while others offer broader exposure to the technology sector.

- Expense Ratios and Fees: Pay close attention to the expense ratios and management fees associated with each ETF. Lower fees generally translate to better returns over the long term.

- Historical Performance and Future Returns: While past performance doesn't guarantee future results, analyzing the historical performance of relevant ETFs can provide insights into the potential for growth. However, remember that investing in emerging technologies carries inherent risk.

Assessing the Risks and Rewards

Investing in emerging technologies like autonomous vehicles presents both significant risks and potential rewards. A thorough understanding of these factors is critical before making any investment decisions.

- Regulatory Uncertainty: The regulatory landscape surrounding autonomous vehicles is constantly evolving. Changes in regulations could significantly impact the development and deployment of self-driving technology, creating uncertainty for investors.

- Competition: The autonomous vehicle market is highly competitive, with major players vying for market share. Intense competition could affect profitability and the overall growth trajectory of companies in the sector.

- Technological Hurdles: Significant technological hurdles remain before fully autonomous vehicles become mainstream. Unforeseen challenges in software development, sensor technology, or infrastructure could delay widespread adoption.

- Potential for Significant Returns: Despite the risks, the potential rewards are substantial. The successful integration of autonomous vehicles into the transportation system could unlock massive economic benefits and generate significant returns for investors who are positioned correctly.

Diversification Strategies

Diversification is crucial for mitigating risk in any investment portfolio. To reduce the impact of volatility within the autonomous vehicle sector, consider diversifying your ETF holdings. Include ETFs focused on different aspects of the technology, or combine them with other asset classes like bonds or real estate to create a more balanced and resilient portfolio.

Conclusion

This article explored the potential for investing in Uber's autonomous vehicle future through ETFs. While direct investment in Uber's autonomous vehicle division might be difficult, indirect exposure via carefully selected ETFs offers a viable path for investors seeking to participate in this transformative technology. Understanding the risks and rewards, and employing appropriate diversification strategies, is crucial for successful investment in the Uber Autonomous Vehicle ETF market.

Call to Action: Start your research on Uber Autonomous Vehicle ETFs today! Carefully analyze the options discussed, and consult with a financial advisor before making any investment decisions related to the rapidly evolving autonomous vehicle sector. Remember to conduct thorough due diligence before investing in any ETF.

Featured Posts

-

Impact Of Injuries On Mariners Tigers Series March 31 April 2

May 17, 2025

Impact Of Injuries On Mariners Tigers Series March 31 April 2

May 17, 2025 -

Zhizn V Dubae Mify I Realnost Dlya Rossiyan

May 17, 2025

Zhizn V Dubae Mify I Realnost Dlya Rossiyan

May 17, 2025 -

Mapping The Countrys Hottest New Business Hubs

May 17, 2025

Mapping The Countrys Hottest New Business Hubs

May 17, 2025 -

The Donald Trump Presidency Sexual Misconduct Accusations And Their Political Fallout

May 17, 2025

The Donald Trump Presidency Sexual Misconduct Accusations And Their Political Fallout

May 17, 2025 -

Lynas The First Heavy Rare Earths Producer Outside Of China

May 17, 2025

Lynas The First Heavy Rare Earths Producer Outside Of China

May 17, 2025

Latest Posts

-

All The Latest On Tracy Morgan News Rumors And More

May 17, 2025

All The Latest On Tracy Morgan News Rumors And More

May 17, 2025 -

How Cade Cunningham Impacts The Knicks Strategy Against The Pistons

May 17, 2025

How Cade Cunningham Impacts The Knicks Strategy Against The Pistons

May 17, 2025 -

Tracy Morgan Breaking News Updates And Recent Headlines

May 17, 2025

Tracy Morgan Breaking News Updates And Recent Headlines

May 17, 2025 -

Knicks Vs Pistons Game Prediction And Betting Tips

May 17, 2025

Knicks Vs Pistons Game Prediction And Betting Tips

May 17, 2025 -

The Knicks Plan To Contain Cade Cunningham And Secure Victory Against The Pistons

May 17, 2025

The Knicks Plan To Contain Cade Cunningham And Secure Victory Against The Pistons

May 17, 2025