Investing In XRP (Ripple) In 2024: Is It A Smart Move Below $3?

Table of Contents

The cryptocurrency market is known for its volatility, and XRP, Ripple's native token, is no exception. Currently trading below $3, XRP presents a complex investment proposition. Investing in XRP (Ripple) in 2024 requires careful consideration of its potential for growth against the backdrop of its ongoing legal battle with the Securities and Exchange Commission (SEC). This article will analyze whether investing in XRP below $3 in 2024 is a wise decision, weighing the risks and potential rewards.

2. Main Points:

H2: XRP's Current Market Position and Price Prediction:

H3: Analyzing the Current Price:

XRP's current price is significantly lower than its all-time high, a reflection of both market-wide crypto fluctuations and the uncertainty surrounding the SEC lawsuit. Several factors influence its price, including overall market sentiment towards cryptocurrencies, regulatory developments, and the adoption of RippleNet. Understanding these dynamics is crucial before considering an XRP investment.

H3: Price Predictions for 2024:

Predicting the future price of any cryptocurrency is inherently speculative. However, various sources offer XRP price forecasts for 2024, ranging from optimistic to pessimistic projections. Analyzing these predictions provides a clearer picture of potential outcomes.

Bullet Points:

- Bullish Predictions: Some analysts predict a significant price surge for XRP, driven by a positive resolution to the SEC lawsuit and increased adoption of RippleNet. Price targets often cited range from $3 to potentially much higher, depending on the source.

- Bearish Predictions: Conversely, others forecast a continued price decline, citing the ongoing legal uncertainty and the competitive landscape of the cryptocurrency market as contributing factors. These forecasts often predict a continued period of consolidation or even further price drops.

- Diversification is Key: It's crucial to remember that cryptocurrency investments are inherently risky. Diversification across multiple asset classes is vital to mitigate potential losses.

H2: Ripple's Legal Battle with the SEC and its Impact on XRP:

H3: Understanding the SEC Lawsuit:

The SEC lawsuit against Ripple alleges that XRP is an unregistered security. The outcome of this case will significantly impact XRP's price and future. The SEC vs Ripple case has been a long and complex legal battle, with ongoing developments and legal arguments. Following updates on "Ripple lawsuit update" is crucial for informed investment decisions.

H3: Potential Outcomes and Their Impact on XRP Price:

A favorable ruling for Ripple could potentially lead to a substantial price increase for XRP, unlocking its potential for wider adoption. Conversely, an unfavorable ruling could result in a prolonged price decline or even delisting from major exchanges. The uncertainty surrounding the "XRP SEC case" presents a significant risk factor.

Bullet Points:

- Positive Outcome: A win for Ripple could lead to a surge in XRP's price, as the uncertainty surrounding its legal status would be removed. Increased institutional investment could also follow.

- Negative Outcome: A loss for Ripple could lead to a significant price drop, potentially causing investors to lose confidence and leading to sell-offs.

- Uncertainty: The ongoing legal battle creates substantial uncertainty for potential investors. The lack of clarity significantly impacts investment decisions.

H2: Technological Advancements and Ripple's Future Roadmap:

H3: RippleNet and its Adoption:

RippleNet, Ripple's payment network, is experiencing growth and increased adoption among financial institutions globally. This expanding network enhances cross-border payments, potentially driving increased demand for XRP and boosting its value. The increasing "RippleNet adoption" is a significant factor to watch.

H3: Future Developments and Innovations:

Ripple continues to invest in research and development, aiming to improve its technology and expand its offerings. Future innovations could enhance the functionality and utility of XRP, potentially influencing its market value. Understanding "Ripple technology" and its potential for future advancements is critical.

Bullet Points:

- RippleNet Features: RippleNet offers speed, cost-effectiveness, and transparency in international transactions, advantages attractive to businesses.

- Upcoming Advancements: Ripple's ongoing developments, such as improvements to xRapid and other innovative solutions, could significantly impact the future price of XRP.

- Impact on XRP Value: Positive technological advancements and increased RippleNet adoption could lead to a rise in XRP's value.

H2: Risks and Rewards of Investing in XRP Below $3:

H3: Potential Risks:

Investing in XRP involves significant risks. The cryptocurrency market is highly volatile, and XRP's price is susceptible to sharp fluctuations. The ongoing legal battle adds further uncertainty, and regulatory changes could negatively impact its value.

H3: Potential Rewards:

Despite the risks, investing in XRP below $3 offers the potential for substantial returns if the price increases significantly. A positive resolution to the SEC lawsuit or increased adoption of RippleNet could drive significant price appreciation.

Bullet Points:

- Key Risks: Market volatility, regulatory uncertainty, legal risks, competition from other cryptocurrencies.

- Potential Rewards: High potential returns, positive legal outcome, increased adoption of RippleNet.

- Risk Management: Thorough research, diversification, and careful risk management are crucial for any XRP investment strategy.

3. Conclusion:

Investing in XRP (Ripple) below $3 in 2024 presents a complex scenario. While the potential rewards are significant, the risks associated with the ongoing SEC lawsuit and the inherent volatility of the cryptocurrency market cannot be ignored. The future price of XRP is dependent on several factors, including the outcome of the legal battle, the adoption of RippleNet, and overall market sentiment.

Final Verdict:

Whether or not investing in XRP below $3 is a "smart move" depends entirely on your individual risk tolerance, investment goals, and thorough research. A balanced approach is essential.

Call to Action:

Before making any investment decisions related to XRP, conducting your own thorough research is crucial. Consider consulting with a financial advisor to determine if investing in Ripple aligns with your risk profile and financial objectives. What are your thoughts on investing in Ripple? Share your opinions and perspectives in the comments section below. Let's discuss XRP investment strategy and share our insights on whether to buy XRP.

Featured Posts

-

Six Nations Dalys Last Minute Score Secures Englands Win Over France

May 01, 2025

Six Nations Dalys Last Minute Score Secures Englands Win Over France

May 01, 2025 -

Investasi Pekanbaru Bkpm Incar Rp 3 6 Triliun Tahun Ini

May 01, 2025

Investasi Pekanbaru Bkpm Incar Rp 3 6 Triliun Tahun Ini

May 01, 2025 -

Voyage A Velo De 8000 Km L Exploit De Trois Jeunes Ornais

May 01, 2025

Voyage A Velo De 8000 Km L Exploit De Trois Jeunes Ornais

May 01, 2025 -

Six Nations 2025 Analyzing Scotlands Performance Fluke Or Foundation

May 01, 2025

Six Nations 2025 Analyzing Scotlands Performance Fluke Or Foundation

May 01, 2025 -

Carolina Panthers 8th Pick Can They Repeat Last Years Draft Success

May 01, 2025

Carolina Panthers 8th Pick Can They Repeat Last Years Draft Success

May 01, 2025

Latest Posts

-

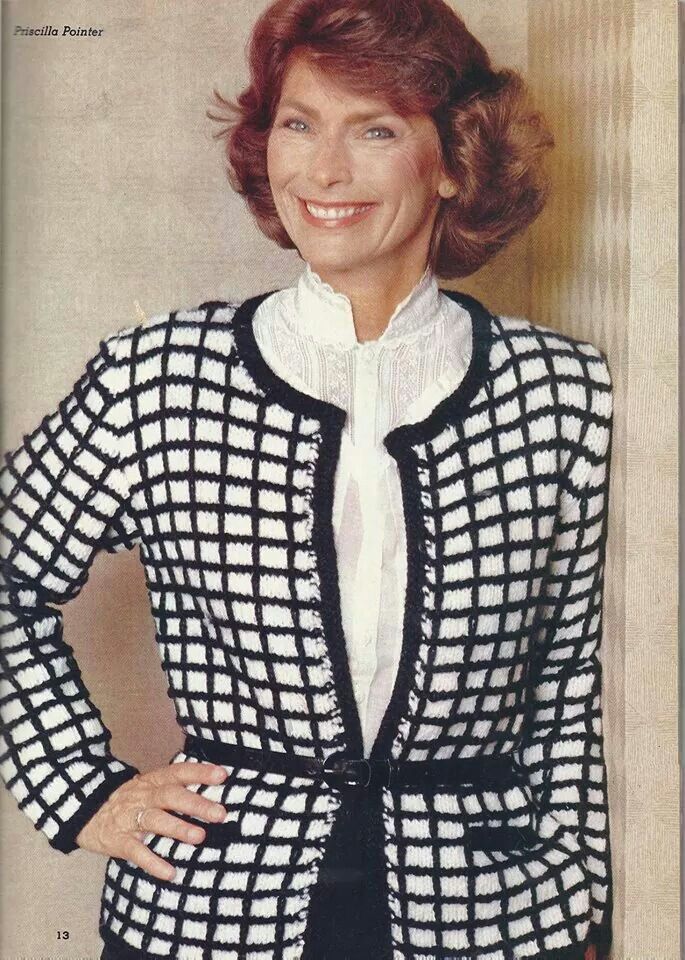

Dallas Star Passes Away At 100

May 01, 2025

Dallas Star Passes Away At 100

May 01, 2025 -

Veteran Actress Priscilla Pointer Amy Irvings Mother Dead At 100

May 01, 2025

Veteran Actress Priscilla Pointer Amy Irvings Mother Dead At 100

May 01, 2025 -

Priscilla Pointer Carrie Actress And Amy Irvings Mother Passes Away At 100

May 01, 2025

Priscilla Pointer Carrie Actress And Amy Irvings Mother Passes Away At 100

May 01, 2025 -

100 Year Old Actress Priscilla Pointer Known For Carrie Passes Away

May 01, 2025

100 Year Old Actress Priscilla Pointer Known For Carrie Passes Away

May 01, 2025 -

Death Of Priscilla Pointer Actress And Mother Of Amy Irving Aged 100

May 01, 2025

Death Of Priscilla Pointer Actress And Mother Of Amy Irving Aged 100

May 01, 2025