Investing In XRP (Ripple) Under $3: Risks And Rewards

Table of Contents

Understanding XRP and its Potential

Ripple's Technology and Use Cases

XRP, the native cryptocurrency of Ripple Labs, is designed to facilitate fast and low-cost cross-border payments. RippleNet, Ripple's payment network, utilizes XRP to enable real-time transactions between financial institutions globally. This technology offers a significant advantage over traditional banking systems, which often involve lengthy processing times and high fees.

- Real-world use cases: XRP is already being used by several banks and financial institutions worldwide for international money transfers, significantly reducing transaction costs and processing time. Examples include MoneyGram's partnership with Ripple, showcasing the practical applications of XRP in the financial sector.

- Partnerships and collaborations: Ripple has forged strategic partnerships with numerous banks and financial institutions, further strengthening XRP's position in the global payments landscape. These partnerships contribute to the increased adoption and credibility of XRP within the financial industry.

- Potential for increased adoption and market share: As cross-border payments continue to grow, the demand for faster, cheaper, and more efficient solutions is expected to increase. XRP, with its unique capabilities, is well-positioned to capture a significant share of this growing market.

Market Analysis and Price Prediction

Analyzing the current market trends for XRP is crucial for understanding its potential. Several factors influence XRP's price, including regulatory developments, market sentiment, and adoption rates. While predicting future price movements is inherently speculative, examining historical price performance and volatility can offer valuable insights.

- Historical price performance and volatility: XRP has shown significant price volatility in the past, reflecting the general volatility of the cryptocurrency market. Analyzing past price trends can help identify potential patterns and understand the factors that drive price fluctuations. (Note: Charts and graphs would be included here in a published article).

- Expert opinions and predictions: Various market analysts and experts offer their perspectives on XRP's future price. It's essential to critically evaluate these opinions, acknowledging that price predictions are inherently uncertain. (Note: Citations would be provided for all expert opinions).

- Disclaimer: It is crucial to remember that cryptocurrency investments are highly speculative and involve significant risk. Past performance is not indicative of future results.

Risks Associated with Investing in XRP

Regulatory Uncertainty

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) poses a significant risk to XRP investors. The SEC alleges that XRP is an unregistered security, which could have serious implications for the cryptocurrency's future and its price.

- The SEC lawsuit and its implications: The outcome of the SEC lawsuit remains uncertain, creating substantial uncertainty for XRP investors. A negative ruling could lead to significant price drops and even delisting from major exchanges.

- Uncertainty surrounding future regulatory frameworks: The regulatory landscape for cryptocurrencies is still evolving, and future regulations could significantly impact XRP's price and its ability to operate freely. This uncertainty adds to the inherent risk of investing in XRP.

Market Volatility and Price Fluctuations

The cryptocurrency market is notoriously volatile, and XRP is no exception. Sudden price swings can occur due to various factors, including market sentiment, news events, and regulatory developments.

- Factors that cause price swings: News related to Ripple, broader market trends in cryptocurrencies, and even social media sentiment can trigger significant price fluctuations. Understanding these drivers is vital for managing risk.

- Importance of risk management and diversification: Investors should implement appropriate risk management strategies, such as dollar-cost averaging and portfolio diversification, to mitigate potential losses.

Technological Risks

While XRP's technology has demonstrated potential, technological risks remain. These include potential security vulnerabilities, scalability issues, and competition from other blockchain technologies.

- Potential competition from other blockchain technologies: The blockchain space is constantly evolving, with new technologies and platforms emerging regularly. Competition from other cryptocurrencies and payment systems could affect XRP's market share and price.

- Ongoing development and improvement of the XRP Ledger: Ripple continues to develop and improve the XRP Ledger. However, unforeseen technical challenges could impact the functionality and performance of the platform.

Strategies for Investing in XRP Under $3

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a strategy where investors invest a fixed amount of money at regular intervals, regardless of price fluctuations. This reduces the risk of investing a large sum at a market peak.

Setting Realistic Investment Goals

Before investing in XRP or any cryptocurrency, it's crucial to define your investment goals and risk tolerance. Understand how much you're willing to lose and align your investment strategy accordingly.

Diversification

Diversification is key to mitigating risk. Don't put all your eggs in one basket. Spread your investments across different asset classes, including other cryptocurrencies, stocks, bonds, and other suitable investments.

Conclusion

Investing in XRP (Ripple) under $3 presents both significant potential rewards and considerable risks. The potential for high returns driven by technological innovation and increased adoption is balanced by regulatory uncertainty, market volatility, and inherent technological risks. While XRP’s technology and partnerships are promising, the SEC lawsuit and the unpredictable nature of the cryptocurrency market necessitate careful consideration.

We've highlighted the key advantages and disadvantages, emphasizing the need for thorough research and a clear understanding of your risk tolerance before investing in XRP. Remember to conduct thorough due diligence and consider consulting with a qualified financial advisor before making any investment decisions regarding investing in XRP (Ripple) under $3 or any other cryptocurrency. Further research into Ripple's legal battles and the broader cryptocurrency market is strongly recommended.

Featured Posts

-

Resolving Nuclear Related Disputes Legal Perspectives And Solutions

May 02, 2025

Resolving Nuclear Related Disputes Legal Perspectives And Solutions

May 02, 2025 -

Mqbwdh Kshmyr Myn Bharty Zlm W Stm Eyd Ky Khwshyan Khwn Myn Rngyn

May 02, 2025

Mqbwdh Kshmyr Myn Bharty Zlm W Stm Eyd Ky Khwshyan Khwn Myn Rngyn

May 02, 2025 -

South Korean Homes A Cultural Exhibition

May 02, 2025

South Korean Homes A Cultural Exhibition

May 02, 2025 -

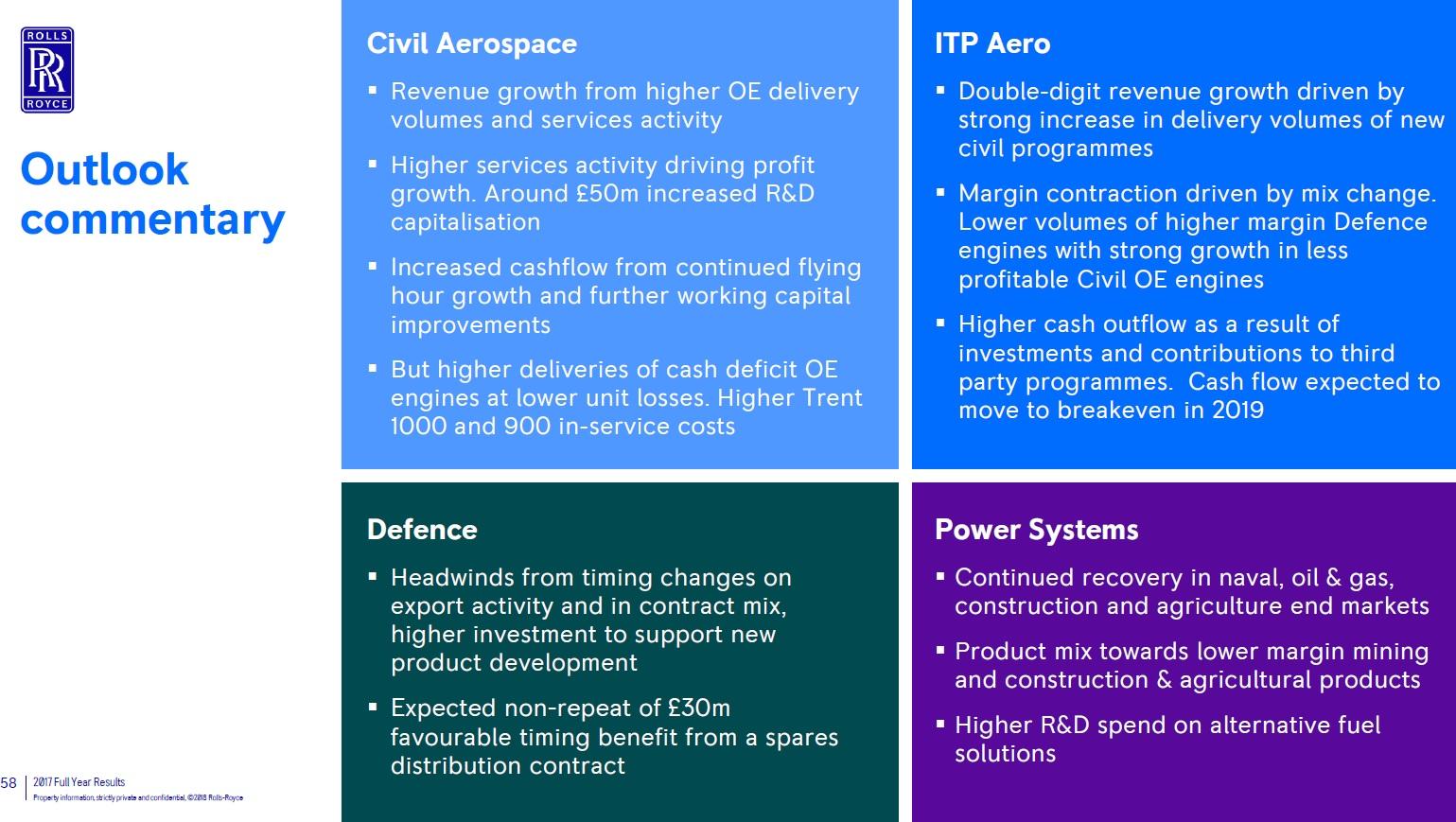

Rolls Royce Confirms 2025 Goals Despite Trade Tariff Challenges

May 02, 2025

Rolls Royce Confirms 2025 Goals Despite Trade Tariff Challenges

May 02, 2025 -

Mstqbl Alaleab Nzrt Mtemqt Ela Blay Styshn 6

May 02, 2025

Mstqbl Alaleab Nzrt Mtemqt Ela Blay Styshn 6

May 02, 2025

Latest Posts

-

Sucesso Nas Redes A Mini Camera Chaveiro Que Voce Precisa Conhecer

May 02, 2025

Sucesso Nas Redes A Mini Camera Chaveiro Que Voce Precisa Conhecer

May 02, 2025 -

Mini Cameras Chaveiro Guia Completo De Compra E Utilizacao

May 02, 2025

Mini Cameras Chaveiro Guia Completo De Compra E Utilizacao

May 02, 2025 -

Mini Camera Chaveiro Onde Comprar E Como Usar

May 02, 2025

Mini Camera Chaveiro Onde Comprar E Como Usar

May 02, 2025 -

Ukraine Conflict Swiss President Denounces Russian Aggression

May 02, 2025

Ukraine Conflict Swiss President Denounces Russian Aggression

May 02, 2025 -

Swiss Presidents Call For Peace Amidst Russian Aggression In Ukraine

May 02, 2025

Swiss Presidents Call For Peace Amidst Russian Aggression In Ukraine

May 02, 2025