Investment In CoreWeave (CRWV): Understanding Last Week's Market Activity

Table of Contents

Analyzing CoreWeave's (CRWV) Fundamental Performance

Understanding CoreWeave's intrinsic value is crucial to assessing its stock performance. This involves examining its financial health, competitive standing, and technological innovation.

Revenue Growth and Projections

CoreWeave's recent financial reports reveal impressive revenue growth. While precise figures require referencing official company statements, analysts predict strong continued growth fueled by increasing demand for high-performance cloud computing solutions.

- Q[Insert Quarter] 2024 Revenue: [Insert projected revenue figure] – showcasing a [Insert percentage]% growth compared to the previous quarter.

- Projected Annual Revenue Growth (2024-2025): [Insert projected growth range] – fueled by strategic partnerships with [mention key partners] and expansion into new markets.

- Key Contracts: Securing large-scale contracts with [mention key clients] significantly boosts revenue projections.

Competitive Landscape and Market Position

CoreWeave operates in a competitive market alongside giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. However, CRWV differentiates itself through its specialization in high-performance computing, catering to specific market needs often underserved by general-purpose cloud providers.

- Key Competitors: AWS, Azure, Google Cloud, other specialized HPC providers.

- CRWV's Unique Selling Proposition (USP): Focus on high-performance computing, specialized infrastructure, and strong customer support.

- Market Share Estimation: While precise market share data is limited, CoreWeave is gaining traction in the high-performance computing niche.

Technological Innovation and Future Outlook

CoreWeave's continued investment in research and development fuels its innovative edge. The company's commitment to cutting-edge technologies ensures it remains competitive and adaptable within the dynamic cloud computing landscape.

- Key Technologies: GPU computing, advanced networking, specialized hardware.

- New Product Launches: [Mention any recent product releases or upcoming announcements] significantly expand the company's service offerings and target market.

- R&D Investment: Significant investment in research and development ensures CoreWeave remains at the forefront of technological advancements.

External Factors Influencing CRWV Stock Price

Beyond CoreWeave's internal performance, several external factors influence its stock price. Understanding these macroeconomic and market-specific elements is crucial for interpreting stock fluctuations.

Overall Market Sentiment and Economic Indicators

Broader market conditions significantly impact individual stock prices. Periods of economic uncertainty or negative investor sentiment can lead to decreased demand and price drops, even for fundamentally sound companies like CoreWeave.

- Inflation and Interest Rates: Rising interest rates often dampen investor enthusiasm, affecting stock valuations across the board.

- General Market Trends: A bear market generally leads to decreased investor confidence and stock price declines.

- Investor Sentiment: Negative news coverage or uncertainty surrounding the cloud computing sector can negatively impact investor sentiment towards CRWV.

News and Analyst Ratings

Significant news events and analyst reports directly impact stock prices. Positive news, such as a successful product launch or strategic partnership, can boost investor confidence. Conversely, negative news can trigger sell-offs.

- Recent News: [Summarize recent relevant news affecting CRWV and the wider market] significantly impacted investor perception.

- Analyst Ratings: [Summarize recent analyst ratings and their rationale] – these provide valuable insight into expert opinions on the company's prospects.

- Press Releases: Carefully analyze official press releases from CoreWeave for important updates on company performance and future plans.

Impact of Geopolitical Events

Geopolitical events, while seemingly distant, can unexpectedly influence the technology sector. Global instability or regulatory changes can impact investor confidence and market activity.

- Geopolitical Risks: [Mention specific geopolitical events and their potential impact on the cloud computing sector and CRWV.]

- Regulatory Changes: New regulations or changes in international trade policies can impact the operations and profitability of companies like CoreWeave.

- Supply Chain Disruptions: Global events can disrupt supply chains, potentially affecting the availability of essential hardware components.

Conclusion: Making Informed Investment Decisions on CoreWeave (CRWV)

Last week's CoreWeave (CRWV) stock fluctuations resulted from a combination of fundamental factors – including revenue growth, competitive positioning, and technological advancements – and external influences such as broader market sentiment, news events, and geopolitical factors. Understanding both internal performance and the external environment is crucial for assessing the long-term potential of CoreWeave. The most important takeaway is the need to consider both short-term volatility and the company's strong long-term prospects.

Before making any investment decisions regarding CoreWeave (CRWV) stock, conduct thorough research, assess your CRWV investment strategy, and consult with a financial advisor. Analyze your CoreWeave (CRWV) portfolio carefully and consider diversification to mitigate risk. Further resources on CoreWeave and the broader cloud computing industry are readily available online. Remember, informed investment decisions are key to success in the dynamic world of stock market investing.

Featured Posts

-

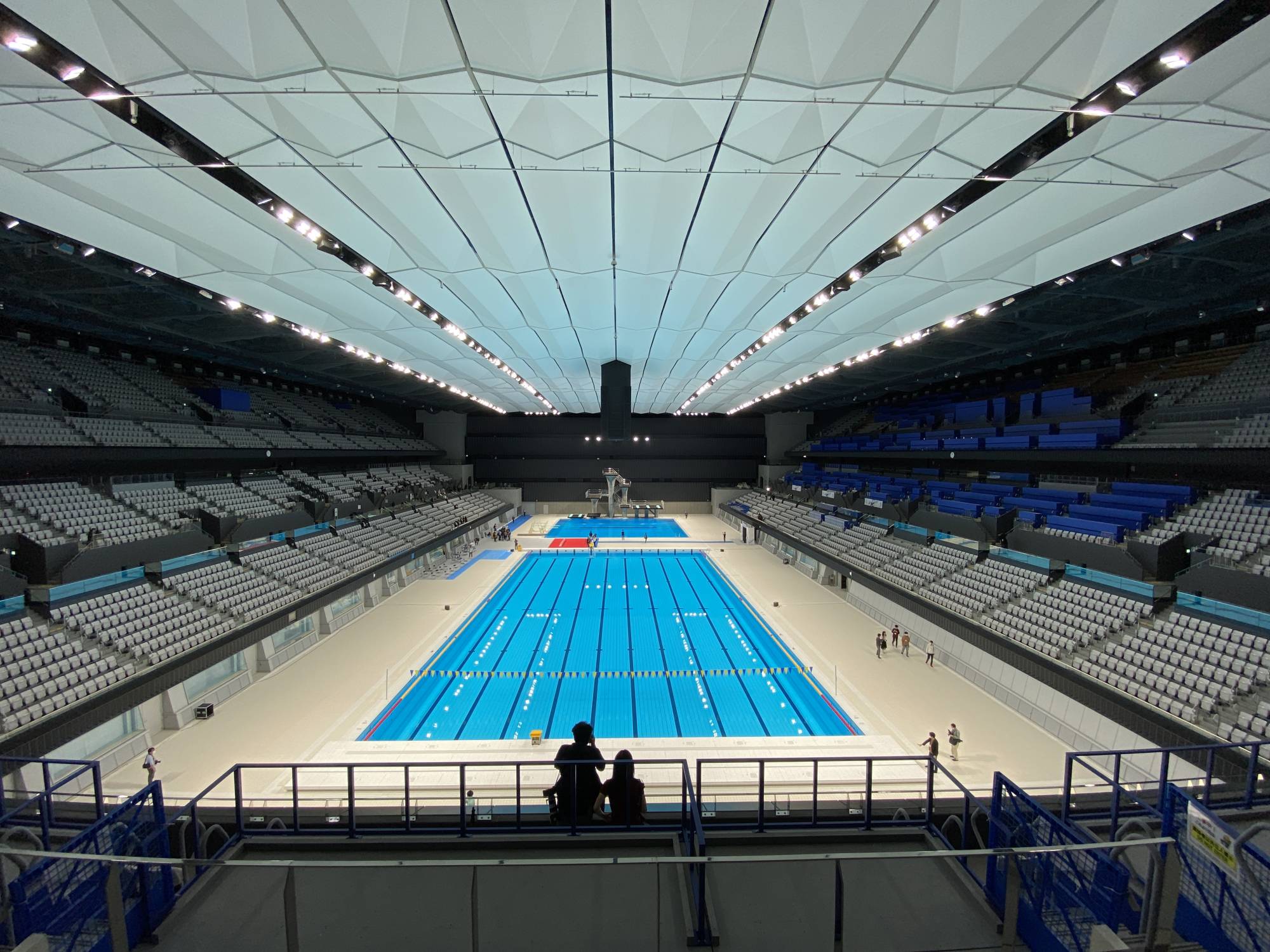

New Olympic Swimming Venue Planned For Nice Details Of The Ambitious Project

May 22, 2025

New Olympic Swimming Venue Planned For Nice Details Of The Ambitious Project

May 22, 2025 -

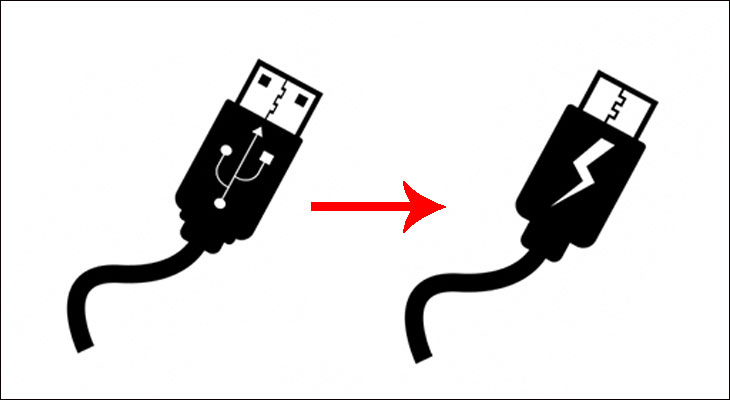

Cong Usb Co Hai Lo Vuong Nho Tim Hieu Y Nghia Va Cong Dung

May 22, 2025

Cong Usb Co Hai Lo Vuong Nho Tim Hieu Y Nghia Va Cong Dung

May 22, 2025 -

Real Madrid In Juergen Klopp Plani Ancelotti Nin Yerine Kim Geliyor

May 22, 2025

Real Madrid In Juergen Klopp Plani Ancelotti Nin Yerine Kim Geliyor

May 22, 2025 -

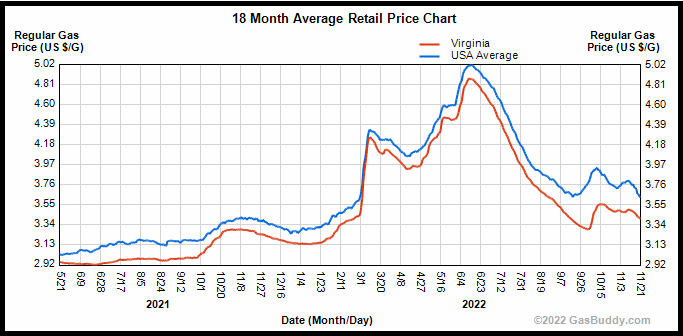

Significant Drop In Virginia Gas Prices 50 Cents Less Per Gallon

May 22, 2025

Significant Drop In Virginia Gas Prices 50 Cents Less Per Gallon

May 22, 2025 -

Oh Jun Sung Claims Wtt Star Contender Chennai Title

May 22, 2025

Oh Jun Sung Claims Wtt Star Contender Chennai Title

May 22, 2025

Latest Posts

-

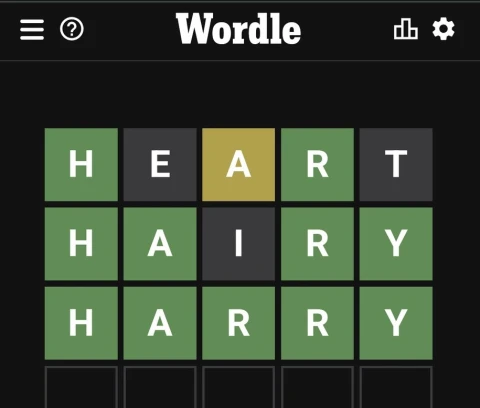

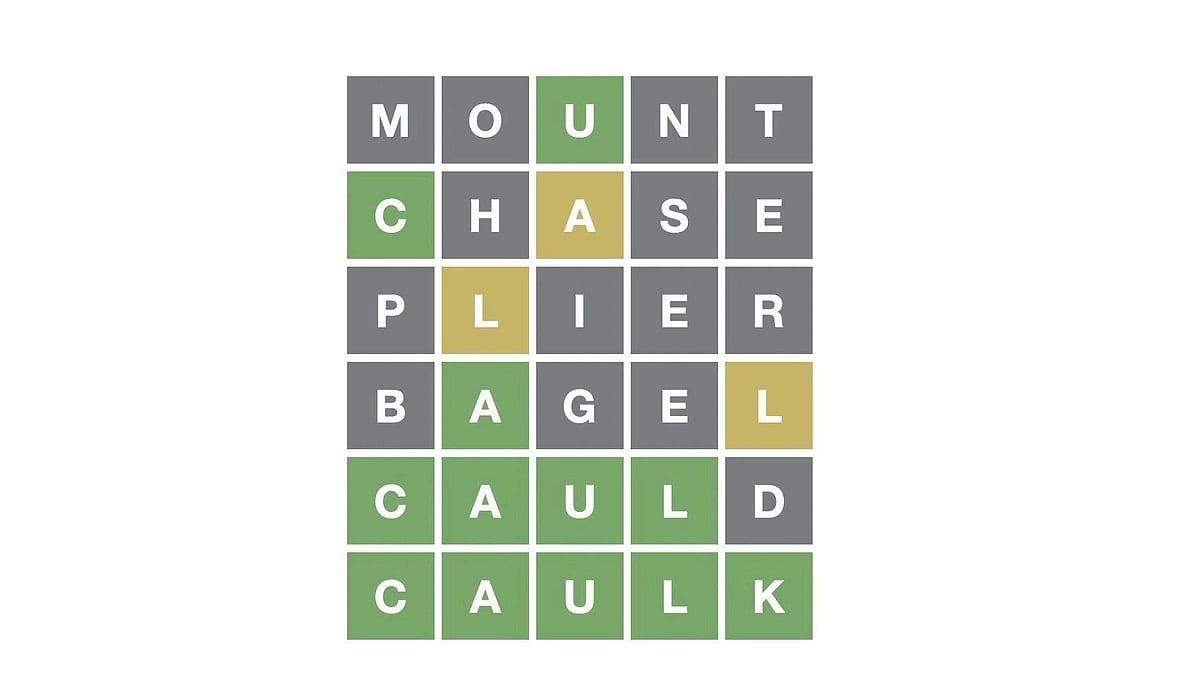

Solve Wordle 1408 April 27th Hints And The Answer

May 22, 2025

Solve Wordle 1408 April 27th Hints And The Answer

May 22, 2025 -

Wordle 1408 April 27th Hints And Solution

May 22, 2025

Wordle 1408 April 27th Hints And Solution

May 22, 2025 -

Wordle Today 1408 Hints Clues And Answer For Sunday April 27th

May 22, 2025

Wordle Today 1408 Hints Clues And Answer For Sunday April 27th

May 22, 2025 -

Wordle Game 1370 March 20th Tips Clues And Answer

May 22, 2025

Wordle Game 1370 March 20th Tips Clues And Answer

May 22, 2025 -

March 20th Wordle Answer 1370 Clues To Help You Solve

May 22, 2025

March 20th Wordle Answer 1370 Clues To Help You Solve

May 22, 2025