Investment Opportunities: Locating The Country's Booming Business Regions

Table of Contents

Identifying Key Economic Indicators for Booming Regions

Identifying the country's most promising regions for investment requires a meticulous analysis of key economic indicators. These indicators paint a clear picture of a region's economic health and future prospects, directly impacting its investment potential. Analyzing these metrics helps investors pinpoint areas ripe for growth and significant returns.

-

GDP Growth Rate: A consistently high GDP growth rate is a primary indicator of a thriving economy. Regions experiencing above-average national GDP growth signal robust economic activity and increased investment potential. For example, a region with a sustained GDP growth of 7% year-over-year exhibits significantly higher investment potential than a region growing at 2%.

-

Job Creation and Unemployment Rates: Low unemployment rates and high job creation figures demonstrate a healthy and expanding economy, attracting further investment. Regions experiencing robust job growth often signify a dynamic and competitive business environment.

-

Foreign Direct Investment (FDI) Inflows: High FDI inflows indicate confidence in a region's economic future and its ability to generate returns. A significant influx of FDI often fuels further economic expansion and creates additional investment opportunities.

-

Per Capita Income: Rising per capita income suggests increased consumer spending and a stronger market for goods and services, indicating a favorable environment for businesses and investment.

-

Infrastructure Development: Investment in infrastructure (roads, railways, ports, utilities) is crucial for economic growth and attracts businesses seeking efficient operations and logistics. Improved infrastructure reduces business costs and enhances productivity.

-

Government Incentives and Support for Businesses: Government initiatives, such as tax breaks, subsidies, and streamlined regulations, significantly influence a region's attractiveness to investors. Favorable government policies can reduce investment risk and increase profitability.

Analyzing Regional Industry Clusters and Growth Sectors

Understanding regional industry clusters and emerging sectors is crucial for identifying promising investment opportunities. Industry clusters, concentrations of interconnected businesses in a specific sector, benefit from knowledge sharing, specialized labor pools, and efficient supply chains. Targeting regions with strong clusters in high-growth sectors offers significant advantages.

-

Technology Hubs: Regions with thriving technology sectors, particularly in software development, fintech, and artificial intelligence, offer substantial investment opportunities due to rapid innovation and high demand.

-

Manufacturing Centers: Established manufacturing centers in sectors like automotive, pharmaceuticals, and advanced materials often provide stable investment opportunities, particularly those focusing on automation and technological upgrades.

-

Renewable Energy Sectors: The burgeoning renewable energy sector offers significant long-term investment potential, especially in regions with supportive government policies and abundant resources (solar, wind, etc.).

-

Tourism and Hospitality: Regions with strong tourism sectors provide diverse investment opportunities, ranging from hotels and resorts to restaurants and entertainment venues. Growth in this sector is often driven by infrastructure improvements and marketing initiatives.

-

Agriculture and Food Processing: Investment in advanced agricultural techniques and food processing facilities offers strong potential, particularly in regions focusing on sustainable practices and value-added products.

Assessing Regional Infrastructure and Business Environment

A supportive business environment and reliable infrastructure are paramount for successful investments. A region's ease of doing business, regulatory framework, and access to skilled labor directly impact investment returns.

-

Transportation Networks: Efficient transportation networks (roads, railways, airports, ports) are essential for cost-effective logistics and timely delivery of goods and services.

-

Utilities: Reliable access to electricity, water, and high-speed internet is critical for business operations and productivity.

-

Regulatory Environment and Ease of Doing Business: A streamlined regulatory environment and transparent processes are crucial for reducing bureaucratic hurdles and facilitating business operations. Regions with high scores on "ease of doing business" indices are generally more attractive to investors.

-

Availability of Skilled Labor: Access to a skilled and adaptable workforce is vital for successful business operations, particularly in technology-driven industries.

-

Tax Incentives and Government Regulations: Favorable tax policies and supportive government regulations can significantly improve the profitability and attractiveness of investment opportunities.

Case Studies of Successful Investments in Booming Regions

Analyzing successful investment case studies provides valuable insights into the factors that contribute to high returns and mitigates potential risks.

-

Case Study 1: [Insert details of a successful investment in a booming region. Include investment type, ROI, challenges overcome, etc.]

-

Case Study 2: [Insert details of another successful investment, highlighting different aspects of the investment process and regional factors].

Regional Risk Assessment

Conducting a thorough risk assessment is critical before making any investment decision. This involves carefully considering potential challenges and developing strategies to mitigate those risks.

-

Political Stability: Political stability and a predictable policy environment are crucial for long-term investment success. Political instability can disrupt business operations and negatively impact returns.

-

Economic Volatility: Economic volatility can affect demand for goods and services, impacting profitability and the overall success of the investment.

-

Potential Natural Disasters: Regions prone to natural disasters (earthquakes, floods, hurricanes) require careful risk assessment and appropriate insurance coverage to protect investments.

Conclusion: Unlocking Investment Opportunities in the Country's Booming Business Regions

Identifying lucrative investment opportunities requires a comprehensive analysis of key economic indicators, regional industry clusters, infrastructure, and the overall business environment. This includes understanding the potential risks involved and implementing effective risk management strategies. By focusing on regions exhibiting strong GDP growth, robust job creation, and supportive government policies, investors can significantly increase their chances of success. Start your search for lucrative investment opportunities today by analyzing the key indicators outlined in this guide. Identify the country's booming business regions and unlock your potential for significant returns. For further resources on investment opportunities, please visit [Insert Links to Relevant Government Websites and Investment Databases].

Featured Posts

-

Reddit Outage Is Reddit Down Right Now

May 18, 2025

Reddit Outage Is Reddit Down Right Now

May 18, 2025 -

Taylor Swifts Un Hot Status Trumps Announcement And The Maga Response

May 18, 2025

Taylor Swifts Un Hot Status Trumps Announcement And The Maga Response

May 18, 2025 -

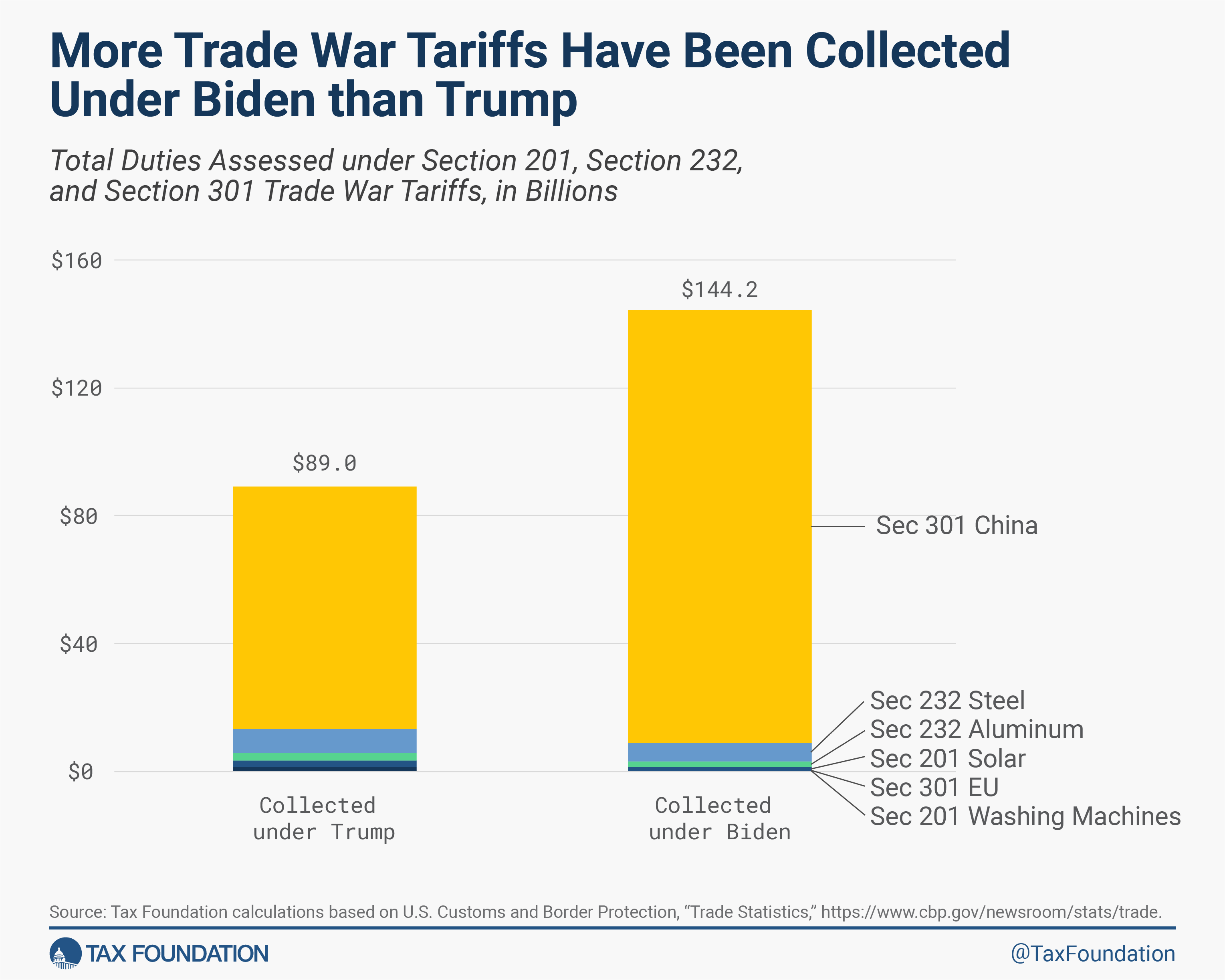

Us China Trade War 30 Tariffs Predicted To Remain Until 2025

May 18, 2025

Us China Trade War 30 Tariffs Predicted To Remain Until 2025

May 18, 2025 -

Fortnite I Os Absence Why You Cant Play On I Phone Or I Pad

May 18, 2025

Fortnite I Os Absence Why You Cant Play On I Phone Or I Pad

May 18, 2025 -

Pregnant Cassie Shares Third Babys Gender With Fans

May 18, 2025

Pregnant Cassie Shares Third Babys Gender With Fans

May 18, 2025

Latest Posts

-

Bowen Yangs Alejandro Tattoo Gets Lady Gagas Honest Opinion

May 18, 2025

Bowen Yangs Alejandro Tattoo Gets Lady Gagas Honest Opinion

May 18, 2025 -

Shrek On Bbc Three Tv Guide And Episode Listings

May 18, 2025

Shrek On Bbc Three Tv Guide And Episode Listings

May 18, 2025 -

Did Bowen Yang Get Shane Gillis Fired From Snl The Truth

May 18, 2025

Did Bowen Yang Get Shane Gillis Fired From Snl The Truth

May 18, 2025 -

The Wedding Banquet Exploring Themes Of Identity And Family In A Queer Asian American Context

May 18, 2025

The Wedding Banquet Exploring Themes Of Identity And Family In A Queer Asian American Context

May 18, 2025 -

The Three Words Mike Myers Used To Describe Shrek

May 18, 2025

The Three Words Mike Myers Used To Describe Shrek

May 18, 2025