Investment Opportunities: Mapping The Country's Rising Business Hubs

Table of Contents

Identifying Key Emerging Business Hubs

The country boasts several dynamic regions experiencing exceptional economic growth. Understanding the underlying factors driving this expansion is crucial for identifying prime investment opportunities.

Metropolitan Areas with High Growth Potential

Major cities are leading the charge, fueled by technological advancements, significant infrastructure development, and a continuous influx of skilled labor. This combination creates a fertile ground for investment and high returns.

- City A: Booming tech sector attracting substantial foreign direct investment, coupled with government initiatives fostering innovation and infrastructure upgrades, creating a robust ecosystem for tech startups and established businesses. Real estate prices are steadily rising, offering lucrative opportunities for both residential and commercial property investors.

- City B: A strategic port city with a strong export market and a growing manufacturing sector. Its location facilitates international trade, making it an attractive hub for logistics and supply chain businesses. The city also benefits from government incentives targeting foreign investors.

- City C: Experiencing rapid population growth driven by internal migration and job creation in diverse sectors, including finance and healthcare. This population surge is increasing demand for housing and commercial spaces, leading to favorable prospects for real estate investors.

- City D: A center for renewable energy projects, with significant government support and investment in green technologies. This creates a unique niche for investment in sustainable energy infrastructure and related businesses.

- City E: A thriving financial center attracting both domestic and international financial institutions. The city's robust regulatory framework and highly skilled workforce make it an attractive location for financial services investment.

Regional Centers with Untapped Potential

Beyond the major cities, numerous regional centers offer compelling investment opportunities with potentially higher returns and lower competition. These areas often benefit from unique advantages, including access to natural resources, government incentives, and a strong local economy.

- Region X: A rapidly growing agricultural region benefiting from increasing demand for locally sourced food and agricultural products. This presents opportunities for investment in farming technology, agricultural processing, and food distribution.

- Region Y: Rich in natural resources such as minerals and timber, attracting companies in the extractive industries. Government incentives for businesses operating in this sector offer additional investment advantages.

- Region Z: A tourism hotspot experiencing a surge in visitor numbers due to its natural beauty and cultural attractions. This creates opportunities for investment in hospitality, tourism-related services, and infrastructure development.

- Region W: Known for its skilled workforce in the manufacturing sector, attracting businesses seeking cost-effective production facilities. Government initiatives to improve infrastructure and attract foreign investment further enhance its appeal.

- Region V: A center for renewable energy generation, benefiting from abundant solar or wind resources. Government policies supporting renewable energy development make this region highly attractive for investors in the green energy sector.

Analyzing Investment Opportunities by Sector

Identifying high-growth sectors is crucial for maximizing investment returns. The following sectors are particularly promising:

High-Growth Sectors to Watch

Several sectors are experiencing exponential growth, presenting significant investment opportunities.

- Renewable Energy: Government subsidies, increasing environmental awareness, and the growing demand for clean energy sources are driving significant investments in solar, wind, and other renewable energy technologies.

- Technology: Rapid technological advancements and a burgeoning startup ecosystem are creating numerous investment opportunities in software development, artificial intelligence, and fintech.

- Healthcare: An aging population and increasing healthcare expenditure are driving growth in the healthcare sector, creating opportunities for investments in medical technology, pharmaceuticals, and healthcare services.

- Tourism: The increasing popularity of domestic and international tourism is creating investment opportunities in hotels, resorts, tourism-related services, and infrastructure development.

- E-commerce: The rapid adoption of e-commerce is transforming retail, creating opportunities for investment in logistics, online marketplaces, and digital marketing.

Real Estate Investment in Emerging Hubs

Real estate investment in these rising business hubs presents both significant opportunities and potential risks. Thorough due diligence is essential.

- Strong rental yields in City A: High demand for rental properties in City A due to its growing population and job market makes it an attractive market for real estate investors seeking consistent rental income.

- Growing demand for commercial properties in Region X: The expansion of businesses in Region X is driving increased demand for office spaces and retail outlets, leading to potential appreciation in commercial property values.

- Infrastructure development projects in City B: Government investment in infrastructure projects is increasing property values and creating opportunities for investors in land development and construction.

- Potential for capital appreciation in City C: Rapid population growth and increasing demand for housing in City C are creating potential for significant capital appreciation in the residential real estate market.

- Government incentives for green building projects in City D: Government incentives for sustainable building projects offer additional benefits for investors developing environmentally friendly real estate projects.

Navigating the Investment Landscape

Success in this dynamic market requires careful planning and risk management.

Due Diligence and Risk Assessment

Thorough due diligence is paramount before committing to any investment.

- Market research: Conduct comprehensive market research to understand the local market dynamics, competition, and potential risks.

- Financial analysis: Perform thorough financial analysis to assess the financial viability of potential investment opportunities.

- Legal review: Engage legal professionals to review contracts and ensure compliance with all relevant regulations.

- Environmental impact assessment: For certain investments, especially real estate and infrastructure, an environmental impact assessment is crucial to mitigate potential environmental risks.

- Political and economic risk analysis: Assess the potential impact of political instability and economic fluctuations on your investment.

Accessing Funding and Resources

Several funding options are available to support your investment ventures.

- Venture capital: Seek funding from venture capital firms specializing in high-growth sectors.

- Angel investors: Connect with angel investors who provide early-stage funding for promising startups.

- Government grants: Explore government grants and incentives aimed at stimulating economic growth in specific regions or sectors.

- Crowdfunding platforms: Utilize crowdfunding platforms to raise capital from a larger pool of investors.

- Banks and financial institutions: Secure loans or other financing options from banks and financial institutions specialized in investment financing.

Conclusion

The country's emerging business hubs present a wealth of investment opportunities across diverse sectors. From the dynamic metropolises to the promising regional centers, the potential for significant returns is substantial. However, success requires careful due diligence, a thorough risk assessment, and a well-defined investment strategy. Remember to leverage available resources and funding options to maximize your chances of success. Discover the exciting investment opportunities waiting for you in the country's emerging business hubs. Start your research today and unlock the potential for substantial growth!

Featured Posts

-

Bahia Derrota Al Paysandu 0 1 Goles Y Cronica Del Partido

May 16, 2025

Bahia Derrota Al Paysandu 0 1 Goles Y Cronica Del Partido

May 16, 2025 -

Padres Fall To Rays In Series Sweep Real Radio 104 1 Post Game Report

May 16, 2025

Padres Fall To Rays In Series Sweep Real Radio 104 1 Post Game Report

May 16, 2025 -

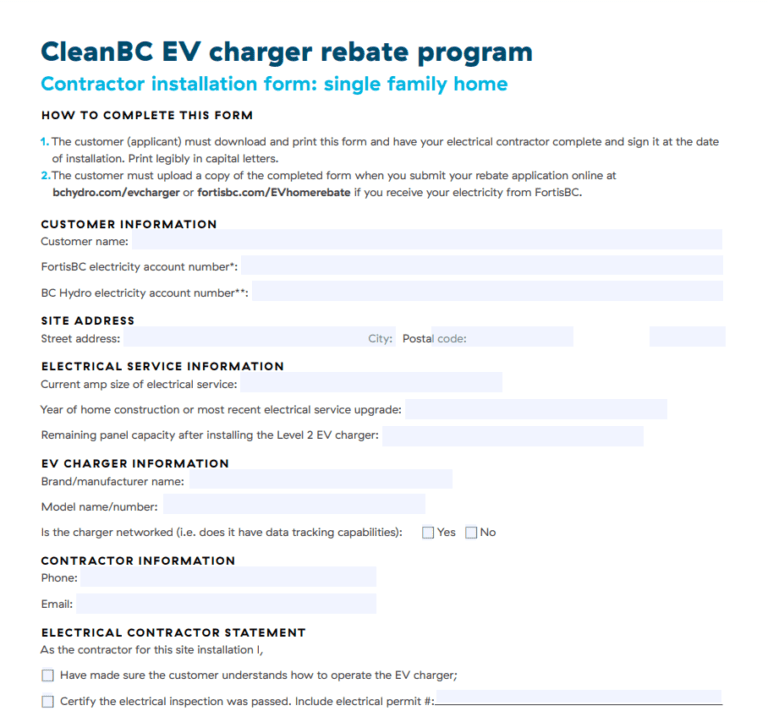

Hondas Ontario Ev Investment On Hold Impact Of Market Slowdown

May 16, 2025

Hondas Ontario Ev Investment On Hold Impact Of Market Slowdown

May 16, 2025 -

Boston Celtics Prepare For Crucial Game 3 In Orlando

May 16, 2025

Boston Celtics Prepare For Crucial Game 3 In Orlando

May 16, 2025 -

Berlin U Bahn Techno Djs Could Soon Take Over Stations

May 16, 2025

Berlin U Bahn Techno Djs Could Soon Take Over Stations

May 16, 2025