Investor Concerns About High Stock Market Valuations: BofA's Response

Table of Contents

Elevated Stock Market Valuations: What are the Key Concerns?

High stock market valuations represent a significant concern for many investors. Several factors contribute to this anxiety, fueling debates about potential market corrections.

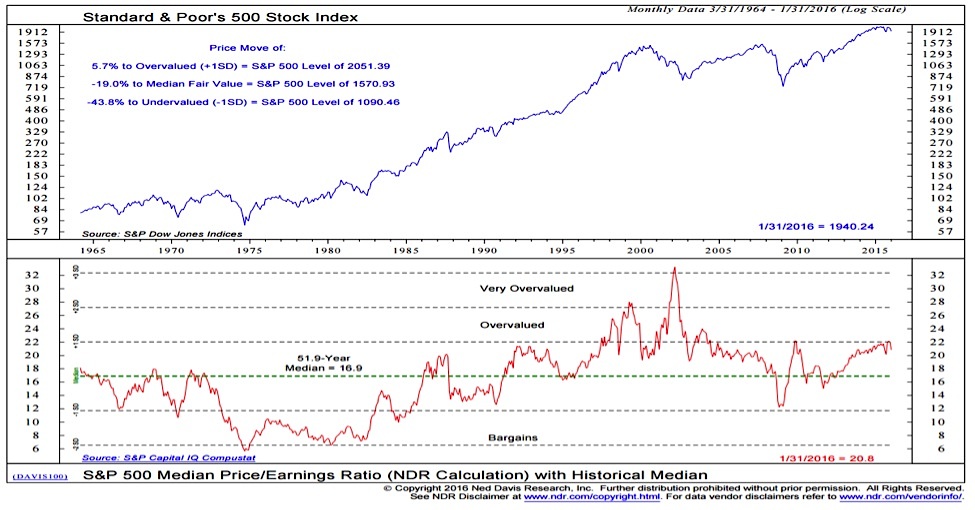

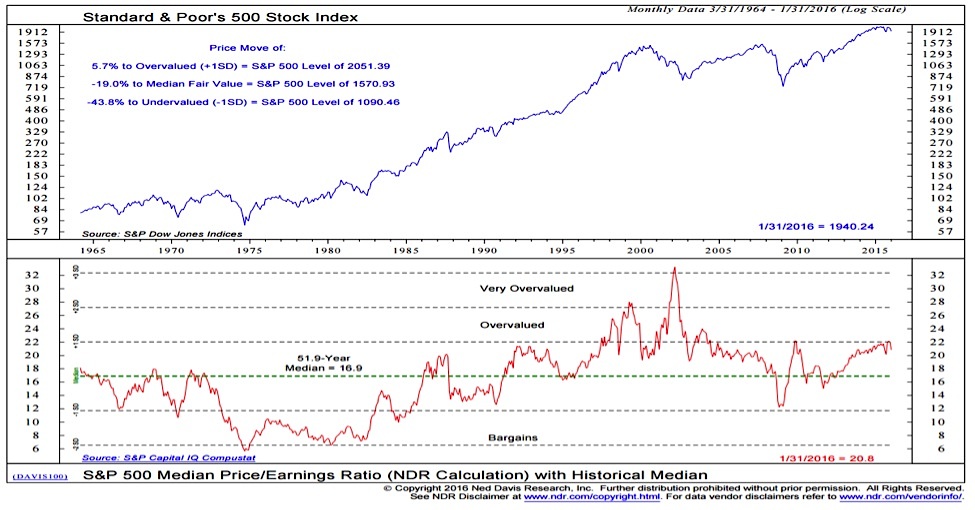

Price-to-Earnings Ratios (P/E): A Key Indicator

Price-to-earnings ratios (P/E ratios) are a fundamental metric used to assess whether a stock or the overall market is overvalued or undervalued. It's calculated by dividing a company's stock price by its earnings per share (EPS). High P/E ratios generally suggest that investors are paying a premium for each dollar of earnings, potentially indicating overvaluation. For instance, some tech sectors currently boast exceptionally high P/E ratios, raising concerns among cautious investors.

- Forward P/E: Uses projected future earnings, offering a forward-looking perspective.

- Trailing P/E: Based on past earnings, providing a historical view.

- Limitations: P/E ratios should not be used in isolation. They must be considered within the context of the specific industry, company growth prospects, and overall market conditions. Comparing a company's P/E to its historical average and industry peers provides a more complete picture.

Interest Rate Hikes and Their Impact

The Federal Reserve's monetary policy, particularly interest rate hikes, significantly impacts stock market valuations. Rising interest rates increase the cost of borrowing for companies, potentially slowing down economic growth and reducing corporate profits. Higher rates also make bonds more attractive relative to stocks, as they offer a fixed income stream with less risk.

- Discounted Cash Flow (DCF) Valuation: Higher interest rates directly reduce the present value of future earnings in DCF models, a common valuation technique used by investors and analysts. This leads to lower valuations for stocks.

- Opportunity Cost: Increased interest rates increase the opportunity cost of investing in stocks, as investors could earn a higher return with less risk by investing in bonds.

Geopolitical Risks and Uncertainty

Global events introduce uncertainty and volatility into the stock market, further contributing to investor concerns about high stock market valuations. Factors such as inflation, war, and supply chain disruptions can significantly impact investor sentiment and market performance.

- Inflation: High inflation erodes purchasing power and can lead to increased interest rates, negatively impacting stock valuations.

- Geopolitical Instability: Conflicts and political unrest can create uncertainty, prompting investors to seek safer havens and potentially sell off stocks.

- Supply Chain Disruptions: These disruptions can lead to increased costs and reduced profitability for companies, affecting their stock prices.

BofA's Perspective and Analysis of High Stock Market Valuations

Bank of America, a leading financial institution, offers valuable insights into the current market environment and addresses investor concerns about high stock market valuations.

BofA's Stance on Current Market Conditions

BofA's recent reports acknowledge the elevated valuations in certain sectors. While not necessarily declaring a market bubble, their analysts highlight the risks associated with high P/E ratios and rising interest rates. They emphasize the need for caution and selective investment strategies. (Specific quotes and citations from BofA reports would be included here.)

BofA's Recommendations for Investors

BofA generally recommends a balanced approach, emphasizing diversification and risk management. Their recommendations may include:

- Sector Rotation: Shifting investments from overvalued sectors to those with more attractive valuations.

- Defensive Positioning: Increasing allocations to less volatile asset classes, such as high-quality bonds.

- Value Investing: Focusing on undervalued companies with strong fundamentals.

BofA's Long-Term Outlook for the Market

BofA's long-term outlook often incorporates a blend of optimism and caution. They acknowledge potential challenges posed by inflation and geopolitical risks but also highlight the potential for long-term growth driven by technological innovation and economic recovery. (Specific factors influencing their long-term outlook would be detailed here, supported by citations).

Strategies for Investors to Mitigate Risks Associated with High Valuations

To effectively address investor concerns about high stock market valuations, investors should adopt proactive risk mitigation strategies.

Diversification: Spreading the Risk

Diversification is crucial for reducing overall portfolio risk. Investors should spread their investments across different asset classes:

- Stocks: Diversify across various sectors and market caps.

- Bonds: Include government, corporate, and municipal bonds to balance risk and return.

- Real Estate: Consider direct property investment or REITs.

- Commodities: Gold, silver, and other commodities can act as a hedge against inflation.

Risk Management: Protecting Your Investments

Implementing effective risk management techniques is essential:

- Stop-Loss Orders: Automatically sell a stock when it reaches a predetermined price, limiting potential losses.

- Position Sizing: Avoid over-concentrating investments in any single asset.

- Regular Portfolio Reviews: Regularly assess your portfolio's performance and adjust your strategy as needed.

Fundamental Analysis: Due Diligence is Key

Before investing in any company, conduct thorough due diligence:

- Financial Statements: Analyze a company's earnings, revenue growth, debt levels, and cash flow.

- Industry Analysis: Compare the company's performance to its peers.

- Valuation Metrics: Assess the company's valuation using various metrics, including P/E ratios, price-to-sales ratios, and discounted cash flow analysis. Compare these to historical data and industry benchmarks.

Conclusion: Addressing Investor Concerns About High Stock Market Valuations

Understanding investor concerns about high stock market valuations is crucial. This article highlighted key concerns, including high P/E ratios, rising interest rates, and geopolitical risks. BofA's analysis emphasizes the need for caution and strategic diversification. By incorporating the strategies outlined—diversification, risk management, and fundamental analysis—investors can make informed decisions and navigate the current market effectively. Use BofA's insights and the strategies discussed to build a well-informed investment strategy that addresses your concerns and secures your financial future.

Featured Posts

-

Dealers Double Down Fighting Back Against Ev Sales Requirements

Apr 28, 2025

Dealers Double Down Fighting Back Against Ev Sales Requirements

Apr 28, 2025 -

Shop The Hudsons Bay Liquidation Deep Discounts Inside

Apr 28, 2025

Shop The Hudsons Bay Liquidation Deep Discounts Inside

Apr 28, 2025 -

Trump Zelensky Meeting Before Popes Funeral A Post Shouting Match Summit

Apr 28, 2025

Trump Zelensky Meeting Before Popes Funeral A Post Shouting Match Summit

Apr 28, 2025 -

Luxury Carmakers Face Headwinds In China Analyzing The Bmw And Porsche Cases

Apr 28, 2025

Luxury Carmakers Face Headwinds In China Analyzing The Bmw And Porsche Cases

Apr 28, 2025 -

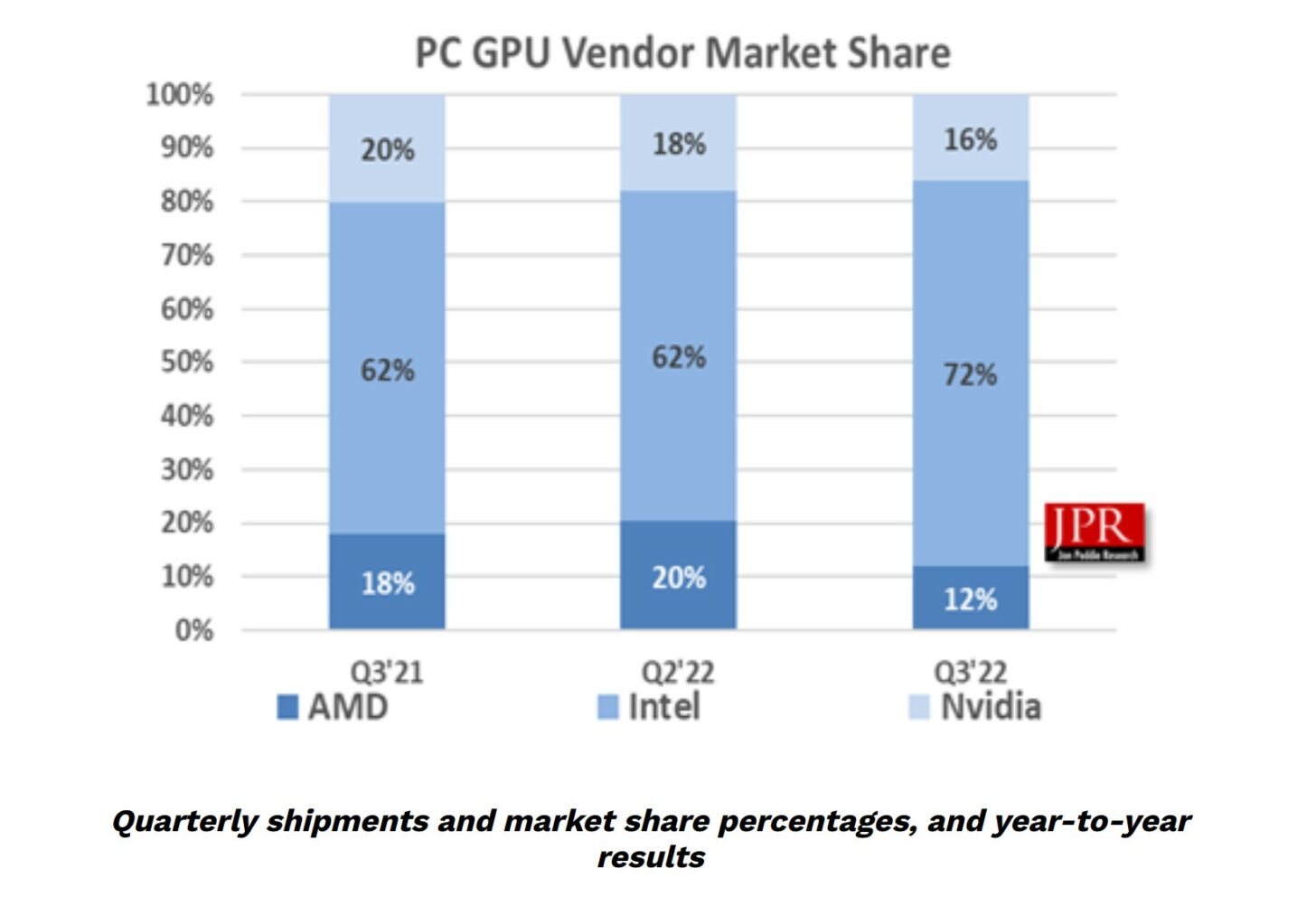

Are Gpu Prices Out Of Control Again A Market Analysis

Apr 28, 2025

Are Gpu Prices Out Of Control Again A Market Analysis

Apr 28, 2025

Latest Posts

-

Richard Jefferson Promoted By Espn Nba Finals Assignment Still Pending

Apr 28, 2025

Richard Jefferson Promoted By Espn Nba Finals Assignment Still Pending

Apr 28, 2025 -

Nba Finals Coverage Richard Jeffersons Espn Promotion And Future Role

Apr 28, 2025

Nba Finals Coverage Richard Jeffersons Espn Promotion And Future Role

Apr 28, 2025 -

Richard Jeffersons New Espn Role Uncertainty Surrounds Nba Finals Coverage

Apr 28, 2025

Richard Jeffersons New Espn Role Uncertainty Surrounds Nba Finals Coverage

Apr 28, 2025 -

Espn Promotes Richard Jefferson Will He Be At The Nba Finals

Apr 28, 2025

Espn Promotes Richard Jefferson Will He Be At The Nba Finals

Apr 28, 2025 -

Richard Jeffersons Espn Promotion Nba Finals Role Remains Uncertain

Apr 28, 2025

Richard Jeffersons Espn Promotion Nba Finals Role Remains Uncertain

Apr 28, 2025