Investor Concerns: Explaining The D-Wave Quantum (QBTS) Stock Drop On Thursday

Table of Contents

Market Sentiment and the Broader Tech Sector

Thursday's D-Wave Quantum stock drop didn't occur in isolation. The broader technology sector experienced a period of significant sell-off, impacting many tech stocks, including QBTS. This negative market sentiment played a significant role in the decline.

- Market Indices Performance: The Nasdaq Composite, a key indicator of the tech sector's health, experienced a notable decline on Thursday. Similarly, other major tech-focused indices showed negative movement, suggesting a widespread downturn rather than an issue solely affecting D-Wave Quantum.

- Investor Anxieties: Prevailing investor anxieties, such as concerns about rising interest rates, persistent inflation, and potential future economic slowdowns, likely contributed to the overall market sell-off and amplified the impact on QBTS stock. These macroeconomic factors often influence investor risk appetite, leading to a flight from riskier assets like many technology stocks.

- Correlation with Other Tech Stocks: Analysis of QBTS's performance relative to other quantum computing stocks and broader tech indices reveals a strong correlation, suggesting the drop was partly due to the overall market trend rather than company-specific issues alone. This correlation highlights the systemic risks inherent in investing in the technology sector.

D-Wave Quantum Specific News and Announcements

While the broader market contributed significantly, it's crucial to examine whether any D-Wave Quantum-specific news or announcements might have exacerbated the stock drop. Analyzing press releases and financial reports from around that time is vital.

- Press Releases and Financial Reports: A thorough review of D-Wave Quantum's public communications around Thursday’s drop is necessary to identify any potential triggers. Any negative news concerning partnerships, technological setbacks, or financial performance could have influenced investor sentiment.

- Missed Earnings Expectations: If D-Wave Quantum released earnings reports or provided guidance that fell short of market expectations, this could have triggered a sell-off. Disappointment in financial results frequently leads to immediate negative market reaction.

- Impact on Investor Confidence: Even if no explicitly negative news was released, any perceived uncertainty or lack of positive momentum could have contributed to investor apprehension and selling pressure. The absence of positive news can be as impactful as negative news on investor confidence.

Competition in the Quantum Computing Space

The quantum computing industry is highly competitive, with several major players vying for market share. Developments from competitors could indirectly influence investor perception of D-Wave Quantum.

- Key Competitors: Companies like IBM, Google, IonQ, and others are actively developing and commercializing quantum computing technologies. Advancements by these competitors might shift investor sentiment towards alternative quantum computing investments.

- Competitive Advancements: Significant breakthroughs or announcements from competitors could overshadow D-Wave Quantum's progress, leading to a relative decline in investor interest. Perceived competitive disadvantage can negatively impact stock valuation.

- Market Share Dynamics: The struggle for market share in a nascent industry like quantum computing is intense. Any perceived loss of market share or competitive pressure could impact investor confidence in D-Wave Quantum's long-term prospects.

Analyst Ratings and Price Target Adjustments

Changes in analyst ratings and price target adjustments from financial institutions can significantly influence investor behavior and stock price movements.

- Rating Changes: A review of analyst reports from leading financial institutions around Thursday’s drop is crucial. Downgrades or negative comments from influential analysts could directly contribute to selling pressure.

- Price Target Adjustments: Lowered price targets reflect a decreased valuation of the company, prompting investors to re-evaluate their holdings and potentially sell their shares. This adjustment often contributes to negative market sentiment.

- Analyst Report Analysis: Examining the reasoning behind any rating changes or price target adjustments offers valuable insights into the factors driving the shift in investor sentiment and the perceived risks associated with QBTS stock.

Investor Psychology and Speculative Trading

Investor psychology and speculative trading play a significant role in stock price fluctuations, especially in volatile sectors like quantum computing.

- Short-Selling and Market Manipulation: Short-selling, where investors bet against a stock's price, can amplify downward pressure. Potential market manipulation, though difficult to prove, should be considered as a contributing factor.

- Social Media and News Coverage: Negative news coverage or social media sentiment can fuel panic selling, exacerbating the stock price decline. The spread of misinformation also contributes to market volatility.

- Risk Appetite in Quantum Computing: The quantum computing sector is inherently risky, and investor appetite for risk can fluctuate dramatically. A shift towards risk aversion in the broader market can disproportionately impact high-growth, high-risk stocks like QBTS.

Conclusion

The D-Wave Quantum (QBTS) stock drop on Thursday was likely a confluence of factors, including broader market trends, company-specific news (or lack thereof), intense competition within the quantum computing sector, analyst sentiment shifts, and volatile investor psychology. Understanding these interconnected factors is essential for navigating the inherent volatility within the quantum computing investment landscape.

Call to Action: Stay informed about future developments in the quantum computing industry and monitor the D-Wave Quantum (QBTS) stock closely to make informed investment decisions. Understanding the factors influencing QBTS stock price fluctuations is crucial for mitigating risk. Further research into the quantum computing sector and D-Wave Quantum’s performance is highly recommended before making any investment choices related to QBTS or other quantum computing stocks.

Featured Posts

-

Transfer News Manchester Uniteds 62 5m Pursuit Of Top Target

May 20, 2025

Transfer News Manchester Uniteds 62 5m Pursuit Of Top Target

May 20, 2025 -

World Class Striker In Man Utd Transfer Talks Agents Visit Spurs Speculation

May 20, 2025

World Class Striker In Man Utd Transfer Talks Agents Visit Spurs Speculation

May 20, 2025 -

Min Xasete Tampoy Epistrefei Sto Mega

May 20, 2025

Min Xasete Tampoy Epistrefei Sto Mega

May 20, 2025 -

Agatha Christie Deepfake Investigating The Bbcs Involvement

May 20, 2025

Agatha Christie Deepfake Investigating The Bbcs Involvement

May 20, 2025 -

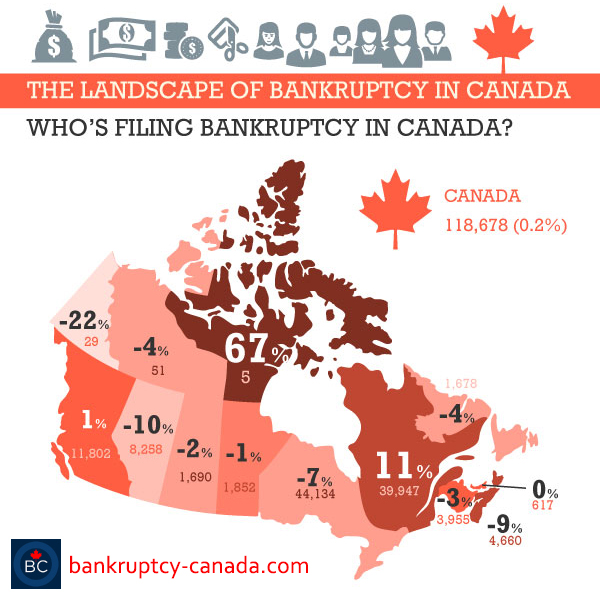

Is Canada Post Facing Bankruptcy The Case For Ending Door To Door Mail Service

May 20, 2025

Is Canada Post Facing Bankruptcy The Case For Ending Door To Door Mail Service

May 20, 2025