Investor Guide: Navigating High Stock Market Valuations With BofA

Table of Contents

Understanding Current Market Conditions and BofA's Assessment

The current high stock market valuations are a result of several interconnected factors. Low interest rates, implemented by central banks globally to stimulate economic growth, have fueled borrowing and investment, driving up asset prices. Strong corporate earnings, despite inflationary pressures, have also contributed to higher stock valuations. However, inflation itself poses a significant risk, as it can erode purchasing power and potentially trigger interest rate hikes, impacting market performance.

- BofA's Recent Analyses: BofA regularly publishes reports analyzing market valuations, employing key metrics such as the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio). These reports often highlight potential overvaluations in specific sectors. [Insert relevant chart or graph from a BofA report here, with proper attribution and link to the original source].

- Key Metrics: BofA's analysis incorporates various metrics to assess market valuations. High P/E ratios, for instance, can suggest that stocks are overvalued relative to their earnings. The Shiller PE ratio, which considers inflation-adjusted earnings over a longer period, provides a more nuanced perspective on long-term valuations.

- BofA's Cautions: While BofA acknowledges the positive aspects of strong corporate earnings, it also issues warnings about the potential risks associated with high valuations. These warnings often emphasize the vulnerability of the market to shifts in interest rates, inflation, or geopolitical events. BofA's analysts consistently stress the importance of prudent investment strategies in this environment.

Strategies for Investing in a High-Valuation Market

Investing in a market characterized by high stock market valuations requires a cautious yet proactive approach. Diversification is paramount to mitigating risk.

- Value Investing: The value investing approach, focusing on undervalued companies with strong fundamentals, can be particularly effective in a high-valuation market. Identifying companies trading below their intrinsic value can offer protection against market downturns.

- Dividend-Paying Stocks: Dividend-paying stocks provide a steady income stream, offering a degree of stability in a volatile market. This strategy is particularly attractive for investors seeking regular returns.

- Asset Allocation and Diversification: Diversifying your portfolio across various asset classes, including stocks, bonds, real estate, and potentially alternative investments, helps reduce overall risk. A well-diversified portfolio is less susceptible to the fluctuations of any single asset class.

- Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy helps mitigate the risk of investing a large sum at a market peak.

- Alternative Investments (with caveats): Consideration of alternative investments like commodities or private equity might be warranted for diversification but requires thorough due diligence and understanding of the inherent risks.

BofA's Recommended Portfolio Adjustments

BofA's recommendations often emphasize a strategic shift towards more defensive sectors during periods of high valuations.

- Sector Recommendations: BofA may suggest overweighting sectors considered less sensitive to economic cycles, such as consumer staples or healthcare, while potentially reducing exposure to more cyclical sectors like technology or discretionary consumer goods. [Insert specific examples from recent BofA reports, with appropriate disclaimers].

- Stock Recommendations: While specific stock recommendations should always be discussed with a financial advisor, BofA's analysts might highlight individual companies demonstrating strong fundamentals and potential for long-term growth even in a challenging market. [Again, include appropriate disclaimers].

- Asset Allocation Shifts: BofA might recommend adjusting asset allocation, perhaps increasing exposure to bonds or other less volatile assets to counterbalance the risk associated with high stock valuations.

Risk Management in a High-Valuation Market

Effective risk management is crucial in navigating high stock market valuations.

- Realistic Return Expectations: It's essential to set realistic return expectations. High valuations often imply lower potential returns compared to periods of lower valuations.

- Managing Portfolio Volatility: Regularly monitor your portfolio's volatility and adjust your investment strategy accordingly. This may involve reducing exposure to riskier assets or implementing hedging strategies.

- Portfolio Review and Rebalancing: Regularly review and rebalance your portfolio to ensure it aligns with your investment goals and risk tolerance. This helps maintain diversification and optimize asset allocation.

- Stop-Loss Orders: Stop-loss orders can help limit potential losses by automatically selling an asset when it reaches a predetermined price. However, they should be used cautiously and as part of a broader risk management strategy.

Seeking Professional Advice: It's crucial to consult with a qualified financial advisor before making any significant investment decisions. A financial advisor can help you create a personalized investment strategy that aligns with your individual financial goals and risk tolerance.

Conclusion: Actionable Takeaways and Call to Action

Navigating high stock market valuations requires a strategic approach that balances growth potential with risk mitigation. This investor guide, informed by BofA's analysis, underscores the importance of diversification, rigorous risk management, and a long-term investment horizon. Remember to focus on value investing, consider dividend-paying stocks for income generation, and regularly review and rebalance your portfolio. Don't let high stock market valuations deter you. Use this investor guide and BofA's resources to build a robust investment strategy. Contact your financial advisor today to discuss your options for navigating high stock market valuations effectively. Remember to conduct thorough research and consider your own financial situation before making any investment decisions.

Featured Posts

-

Chainalysis Expands With Ai Agent Startup Acquisition Alterya Deal Details

May 05, 2025

Chainalysis Expands With Ai Agent Startup Acquisition Alterya Deal Details

May 05, 2025 -

Understanding The Nhl Playoffs Key Insights Into The First Round

May 05, 2025

Understanding The Nhl Playoffs Key Insights Into The First Round

May 05, 2025 -

Australias 2024 Election A Test Of Global Anti Trump Sentiment

May 05, 2025

Australias 2024 Election A Test Of Global Anti Trump Sentiment

May 05, 2025 -

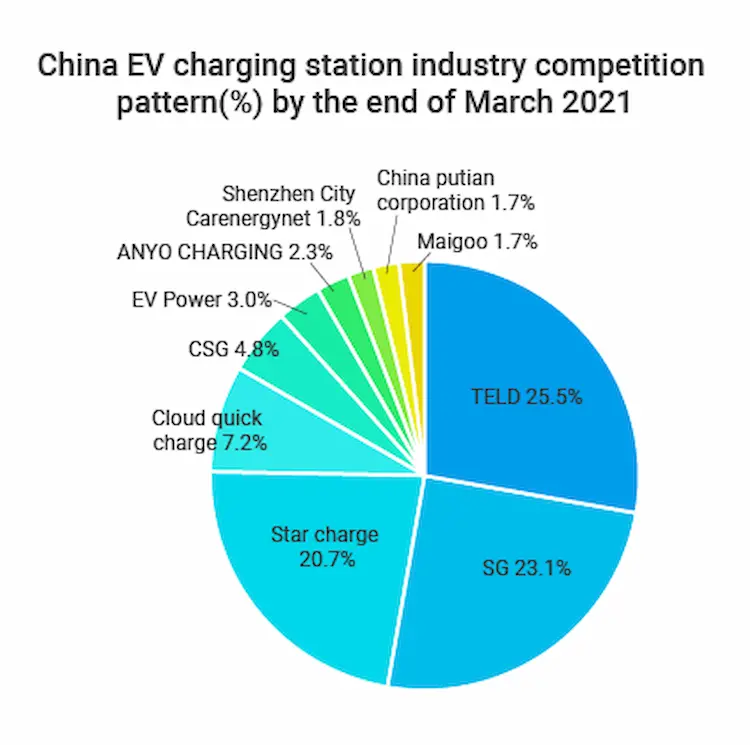

Chinas Ev Industry A Global Powerhouse Americas Response

May 05, 2025

Chinas Ev Industry A Global Powerhouse Americas Response

May 05, 2025 -

Lizzos Transformation Before And After Photos From The Oscars

May 05, 2025

Lizzos Transformation Before And After Photos From The Oscars

May 05, 2025

Latest Posts

-

1 2 Inches Of Spring Snow Possible Tomorrow In Select Nyc Suburbs

May 05, 2025

1 2 Inches Of Spring Snow Possible Tomorrow In Select Nyc Suburbs

May 05, 2025 -

Darjeeling Tea Industry A Look At Current Concerns

May 05, 2025

Darjeeling Tea Industry A Look At Current Concerns

May 05, 2025 -

Unexpected Spring Snow 1 2 Inches Possible In Some Nyc Suburbs

May 05, 2025

Unexpected Spring Snow 1 2 Inches Possible In Some Nyc Suburbs

May 05, 2025 -

Is Darjeeling Teas Production In Jeopardy

May 05, 2025

Is Darjeeling Teas Production In Jeopardy

May 05, 2025 -

Anna Kendricks Three Word Answer About Blake Lively

May 05, 2025

Anna Kendricks Three Word Answer About Blake Lively

May 05, 2025