Investor Guide: Navigating High Stock Market Valuations With BofA's Analysis

Table of Contents

Understanding BofA's Current Market Outlook

Key Takeaways from BofA's Recent Reports on High Stock Market Valuations

BofA's recent reports paint a nuanced picture of the current market landscape, highlighting both opportunities and risks associated with high stock market valuations. Their analysts consistently monitor key economic indicators and market trends to inform their predictions. Here are some key takeaways:

- Expected Market Returns: BofA's analysis often suggests more moderate returns compared to historical averages, given the already elevated valuations. Specific figures vary depending on the report and timeframe, but generally reflect a more cautious outlook. For example, a recent report might project an annualized return of X% for the next Y years.

- Sector-Specific Outlooks: BofA typically provides sector-specific analysis, identifying sectors potentially more resilient or less sensitive to high valuations. This often involves analyzing P/E ratios and projected growth rates within various sectors. For instance, they might highlight defensive sectors like consumer staples as potentially better positioned in a high-valuation environment.

- Risk Assessments: BofA consistently emphasizes the risks associated with high valuations, including the potential for market corrections. Their analyses often incorporate quantitative measures of risk, providing context for investors to make informed choices. They often warn about the increased sensitivity to interest rate hikes.

These insights are typically derived from reports by prominent BofA analysts such as [insert name and title of a relevant BofA analyst if available], and their findings often include supporting data points such as specific P/E ratios, projected growth rates, and other relevant market indicators.

Identifying Potential Risks Associated with High Valuations

Investing in a market characterized by high stock market valuations presents several inherent risks:

- Potential for Market Corrections: High valuations inherently increase the likelihood of a market correction or even a bear market. BofA's analysis often incorporates scenarios that account for potential market downturns.

- Inflation Risk: High inflation erodes purchasing power and can negatively impact corporate profits, potentially leading to decreased stock prices. BofA’s analysis includes assessments of inflation’s potential impact on various sectors.

- Interest Rate Sensitivity: Higher interest rates increase borrowing costs for companies and can reduce investor appetite for equities, especially growth stocks sensitive to interest rate changes. BofA’s reports frequently incorporate interest rate scenarios and their impact on valuations.

Strategies for Investing in a High-Valuation Market

Defensive Investment Strategies for High Stock Market Valuations

To mitigate risks associated with high stock market valuations, investors should consider these defensive strategies:

- Diversification: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) and sectors reduces overall portfolio risk.

- Value Investing: Focusing on undervalued companies with strong fundamentals can offer better risk-adjusted returns in a high-valuation environment.

- Dividend Stocks: Companies that pay consistent dividends can provide a steady income stream, reducing reliance on capital appreciation in a potentially volatile market.

These strategies improve risk mitigation and ensure better portfolio resilience against market fluctuations inherent with high stock market valuations.

Opportunities within High-Valuation Sectors (Based on BofA's Analysis)

Despite overall high valuations, BofA's analysis may identify specific sectors or asset classes that still present opportunities:

- [Insert Sector 1 based on BofA's analysis]: BofA might highlight this sector due to [reason based on their analysis, e.g., strong underlying growth, less sensitivity to interest rates].

- [Insert Sector 2 based on BofA's analysis]: This sector may be identified as potentially undervalued relative to its growth prospects, according to BofA’s research.

These opportunities showcase the importance of detailed sector-specific analysis provided by financial experts like BofA, allowing for smart sector rotation and capitalizing on undervalued assets.

Tools and Resources for Navigating High Stock Market Valuations

Utilizing BofA's Research and Analytical Tools

While access to BofA's most comprehensive research might be restricted to clients, publicly available materials, such as summaries of market outlooks and key economic indicators, can offer valuable insights. [Mention any publicly accessible resources or platforms if available, such as BofA's website].

Importance of Financial Planning and Professional Advice

Navigating high stock market valuations effectively requires careful planning and, ideally, professional guidance. A qualified financial advisor can help you develop a personalized investment strategy tailored to your risk tolerance, financial goals, and the current market environment.

Conclusion: Investor Guide: Navigating High Stock Market Valuations with BofA's Analysis

BofA's analysis reveals a market landscape characterized by high stock market valuations, presenting both challenges and opportunities. Understanding the potential risks, including market corrections, inflation, and interest rate sensitivity, is critical. Employing a diversified investment strategy, incorporating defensive measures like value investing and dividend stocks, and actively utilizing sector analysis can help mitigate these risks. Remember to leverage available resources, including publicly accessible information from BofA, and strongly consider seeking professional financial advice to create a strategy that aligns with your individual financial goals. Further research into BofA's reports on high stock market valuations will enhance your understanding and decision-making abilities in this complex market.

Featured Posts

-

Dramatic 9th Inning Taylor Wards Grand Slam Secures Angels Win Against Padres

May 28, 2025

Dramatic 9th Inning Taylor Wards Grand Slam Secures Angels Win Against Padres

May 28, 2025 -

Stock Market Today Dow S And P 500 Live Updates For May 27

May 28, 2025

Stock Market Today Dow S And P 500 Live Updates For May 27

May 28, 2025 -

Samsung Galaxy S25 128 Go A 648 E Le Meilleur Smartphone Du Moment

May 28, 2025

Samsung Galaxy S25 128 Go A 648 E Le Meilleur Smartphone Du Moment

May 28, 2025 -

Review Baseball Book Released To Coincide With Opening Day

May 28, 2025

Review Baseball Book Released To Coincide With Opening Day

May 28, 2025 -

Smartphone Samsung Galaxy S25 Ultra 256 Go Vente Flash Exceptionnelle

May 28, 2025

Smartphone Samsung Galaxy S25 Ultra 256 Go Vente Flash Exceptionnelle

May 28, 2025

Latest Posts

-

Increased Fire Risk Prompts Special Weather Statement For Cleveland Akron

May 31, 2025

Increased Fire Risk Prompts Special Weather Statement For Cleveland Akron

May 31, 2025 -

Northeast Ohio Rain Forecast For Thursday

May 31, 2025

Northeast Ohio Rain Forecast For Thursday

May 31, 2025 -

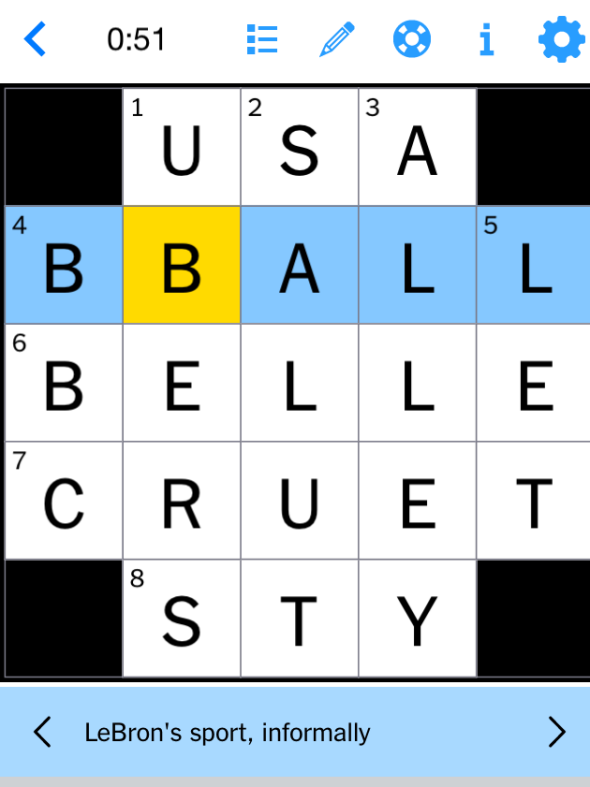

Nyt Mini Crossword March 24 2025 Solutions And Help

May 31, 2025

Nyt Mini Crossword March 24 2025 Solutions And Help

May 31, 2025 -

Complete Guide To Nyt Mini Crossword March 24 2025 Answers

May 31, 2025

Complete Guide To Nyt Mini Crossword March 24 2025 Answers

May 31, 2025 -

April 10th Nyt Mini Crossword Clues And Answers

May 31, 2025

April 10th Nyt Mini Crossword Clues And Answers

May 31, 2025