Investors Are Piling Into This Hot New SPAC Stock: Should You Follow Suit?

Table of Contents

Understanding the Current SPAC Market Boom

The resurgence of SPACs is largely due to a confluence of factors. The SPAC market has experienced explosive growth in recent years, driven by several key trends. This boom isn't just a fleeting phenomenon; it reflects significant shifts in the investment landscape.

- Increased retail investor participation: The accessibility of online brokerage accounts has broadened participation, leading to increased demand for alternative investment vehicles like SPACs.

- Lower barriers to entry compared to traditional IPOs: SPACs often present a less complex and quicker route to market for companies, attracting both established businesses and startups.

- Potential for high returns (but also high risk): The potential for substantial gains is a significant draw, though this is naturally counterbalanced by the inherent risks.

- Growing number of high-profile SPAC mergers: Successful mergers involving well-known companies and brands have fueled further interest and investment in the SPAC market.

These factors have contributed to the current SPAC market boom, making it a space worth understanding for any serious investor interested in SPAC investments and Special Purpose Acquisition Companies.

Analyzing the "Hot" SPAC Stock: [Name of SPAC] (Example: GreenTech Acquisition Corp.)

Let's analyze a specific example: GreenTech Acquisition Corp. (Example SPAC Name – replace with your chosen SPAC). This SPAC is attracting significant attention due to its planned merger with [Target Company Name] (Example: SolarPower Solutions Inc.), a company in the rapidly growing renewable energy sector.

- Target company details and industry: SolarPower Solutions Inc. is a leading developer and manufacturer of solar panels, operating in a sector experiencing robust growth driven by increasing environmental concerns and government incentives.

- Management team experience and reputation: The combined management team boasts extensive experience in the renewable energy and finance sectors, enhancing investor confidence.

- Financial projections and valuation: GreenTech's projections suggest substantial revenue growth in the coming years, but a thorough independent review of these projections is crucial before investing. The valuation, relative to industry peers, requires careful analysis using metrics like price-to-earnings ratio and other relevant SPAC valuation tools.

- Strengths and weaknesses of the business model: SolarPower Solutions benefits from economies of scale and a strong brand reputation. However, its dependence on government subsidies and competition from established players represent potential weaknesses.

- Competitive landscape analysis: The solar panel market is competitive. Analyzing market share, pricing strategies, and technological innovation of competitors is paramount in performing due diligence for this SPAC stock.

Thorough analysis of these factors is essential for performing effective SPAC due diligence on GreenTech Acquisition Corp. and similar SPAC stock offerings.

Assessing the Risks of SPAC Investments

While the potential rewards are tempting, investing in SPACs carries significant risks that should not be overlooked. These risks are inherent to the nature of SPACs themselves.

- Lack of detailed information before the merger: Investors commit capital with limited information about the target company, relying heavily on the SPAC sponsor's due diligence.

- Potential for management conflicts of interest: The SPAC sponsor's incentives might not always align perfectly with the interests of public shareholders.

- Dilution of shares after the merger: The number of outstanding shares can increase significantly post-merger, diluting existing shareholders' ownership.

- Market volatility and potential for significant losses: SPACs are subject to market fluctuations, and a downturn could lead to substantial losses.

- Difficulty in exiting the investment if the target company underperforms: If the merger target fails to meet expectations, exiting the investment could prove challenging, potentially locking in losses.

Understanding these SPAC risks is crucial for informed decision-making. Effective SPAC risk management strategies are essential for mitigating potential losses.

Should You Invest in This SPAC Stock? Weighing the Pros and Cons

The decision of whether or not to invest in GreenTech Acquisition Corp., or any SPAC, hinges on a careful weighing of the potential benefits against the significant risks involved.

- Pros:

- Potential for high returns: Successful SPAC mergers can deliver substantial returns for early investors.

- Early access to promising companies: SPACs provide access to companies that might not otherwise be publicly available.

- Cons:

- Significant risk of loss: The inherent risks discussed above could lead to substantial financial losses.

- Lack of transparency pre-merger: Limited information is available about the target company before the merger is finalized.

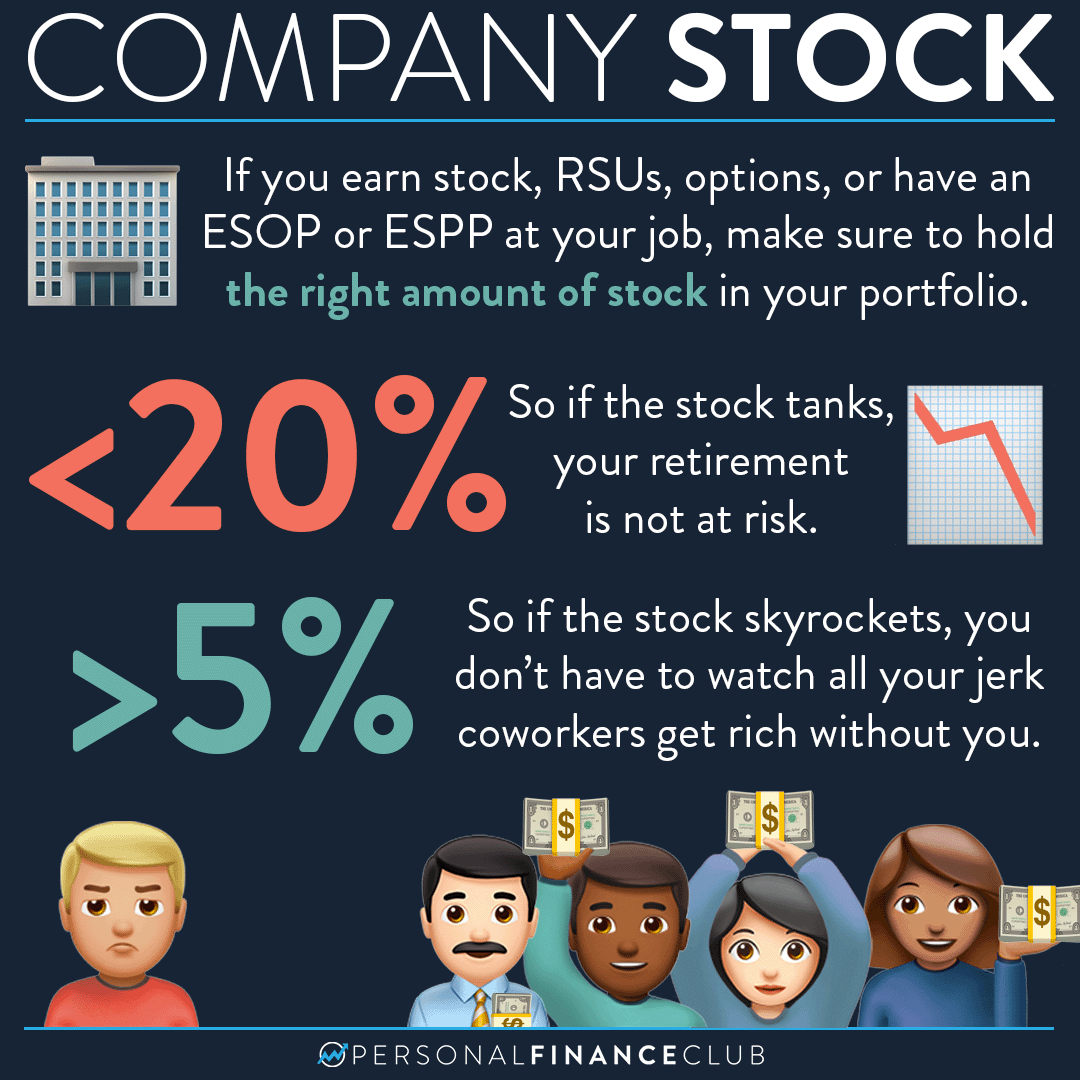

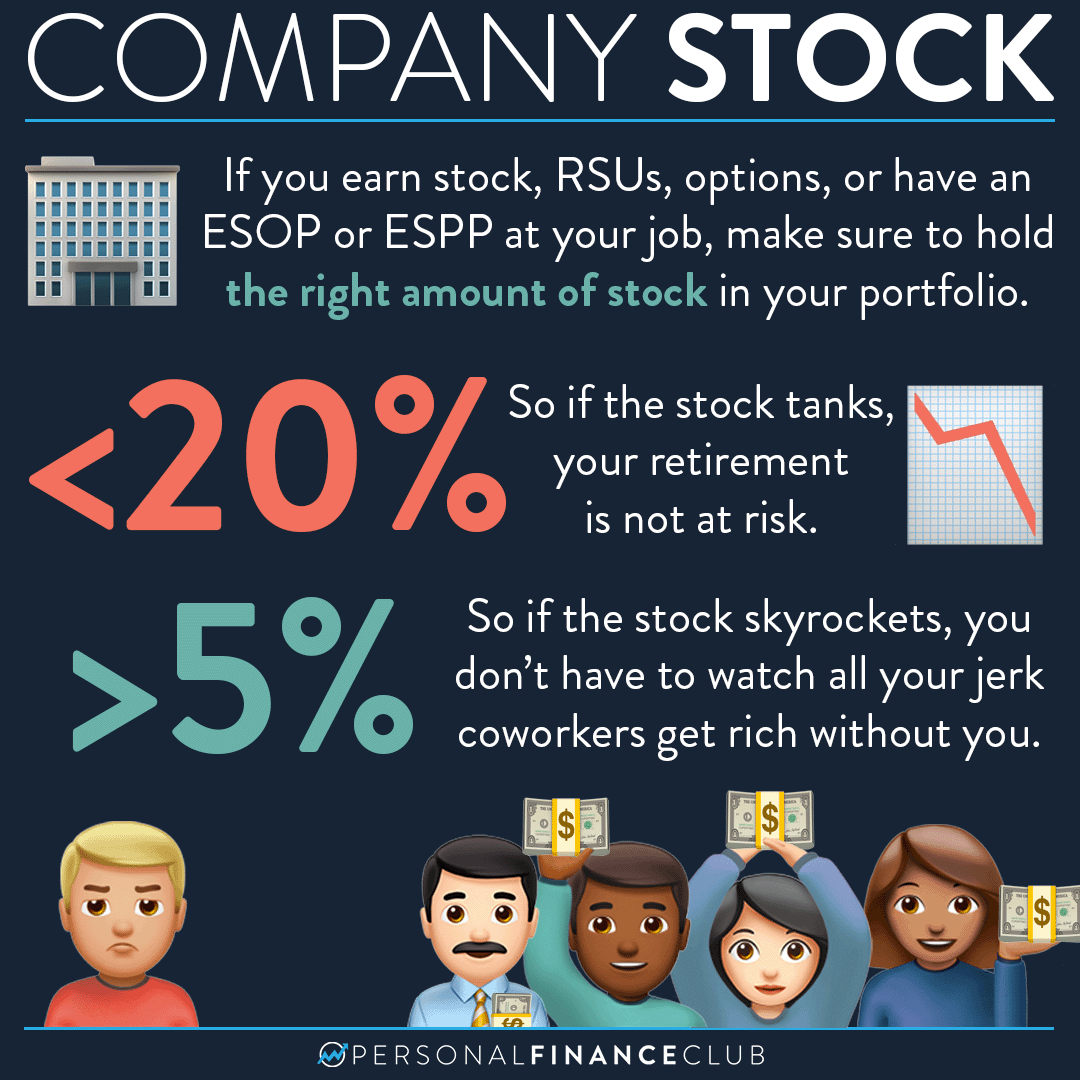

Consider your risk tolerance and investment goals. Conservative investors with a low risk tolerance should probably avoid SPAC investments. Those with higher risk tolerance and a longer time horizon might consider allocating a small portion of their portfolio to SPACs. Diversification is key – don't put all your eggs in one SPAC basket. Effective SPAC portfolio diversification is crucial for mitigating risks.

Conclusion

Investing in SPACs like GreenTech Acquisition Corp. (or any SPAC) offers the potential for significant returns but comes with considerable risk. Understanding the current SPAC market, thoroughly researching the specific SPAC, and carefully assessing your risk tolerance are crucial before investing. Remember that past performance is not indicative of future results.

Call to Action: Before making any investment decisions, conduct thorough due diligence on GreenTech Acquisition Corp. and other SPACs that interest you. Carefully weigh the potential rewards against the considerable risks involved in this volatile market. Consider consulting a financial advisor to determine if investing in this hot new SPAC stock aligns with your investment strategy and risk tolerance. Remember, responsible investing in the SPAC market is key.

Featured Posts

-

Arsenal Domakjin Na Ps Zh Shto Da Ochekuvame Od Prviot Mech

May 08, 2025

Arsenal Domakjin Na Ps Zh Shto Da Ochekuvame Od Prviot Mech

May 08, 2025 -

Arsenal Psg Semi Final More Difficult Than A Real Madrid Clash

May 08, 2025

Arsenal Psg Semi Final More Difficult Than A Real Madrid Clash

May 08, 2025 -

Purchase Psl 10 Tickets Sale Commences Today

May 08, 2025

Purchase Psl 10 Tickets Sale Commences Today

May 08, 2025 -

Could Bitcoin Reach New Heights A 1 500 Growth Prediction Analyzed

May 08, 2025

Could Bitcoin Reach New Heights A 1 500 Growth Prediction Analyzed

May 08, 2025 -

Arsenal Ps Zh Statistika I Rezultaty Evrokubkovykh Matchey

May 08, 2025

Arsenal Ps Zh Statistika I Rezultaty Evrokubkovykh Matchey

May 08, 2025