Is A Bitcoin Price Rally Imminent? Analyst's Chart Suggests So (May 6)

Table of Contents

Analyst's Chart and Technical Indicators

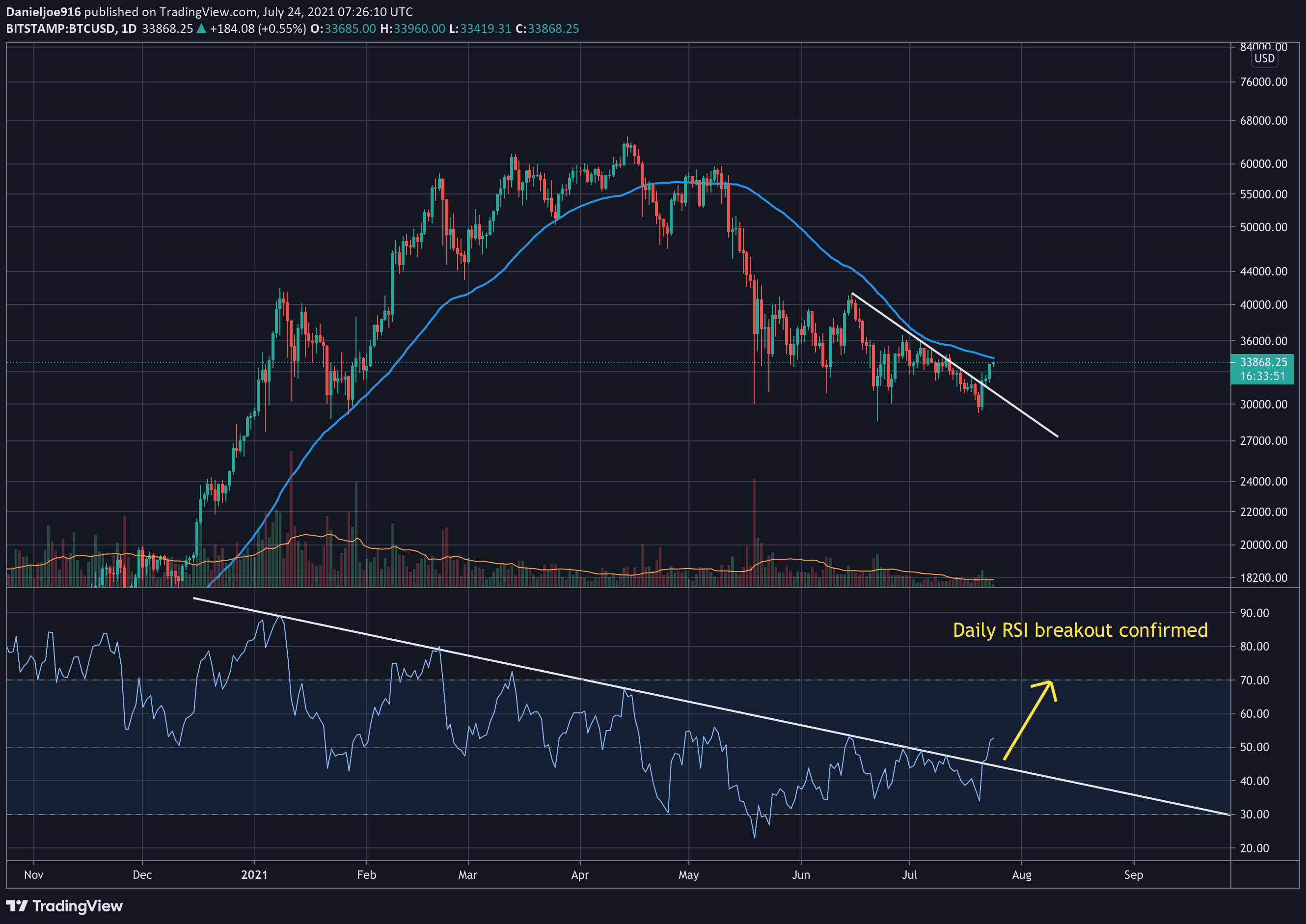

The analysis centers around a detailed candlestick chart showing Bitcoin's price action over the past few months. This chart incorporates several key technical indicators:

- Relative Strength Index (RSI): The RSI, currently showing a reading of [insert current RSI value], is approaching oversold territory, suggesting a potential bounce back. Historically, when the RSI dips below 30, Bitcoin has often experienced a period of price recovery.

- Moving Averages: The 50-day and 200-day moving averages are beginning to converge, a pattern often interpreted as a bullish signal, potentially signaling a shift from bearish to bullish momentum.

- Bollinger Bands: The price is currently nearing the lower Bollinger Band, often interpreted as a sign of potential price reversal. A break above the upper band would strongly confirm bullish sentiment.

[Insert image of the chart here with clear labels and annotations. Alt text: "Bitcoin price chart showing bullish indicators including RSI, moving averages, and Bollinger Bands."]

The analyst interprets these indicators as strongly suggesting a potential Bitcoin price surge in the near future. The convergence of these signals, all pointing towards bullish momentum, forms the basis of their prediction.

On-Chain Data Supporting a Bitcoin Price Rally

Beyond technical analysis, on-chain data offers further insights into potential Bitcoin price movements. Several key metrics support the possibility of a rally:

- Exchange Outflows: A notable increase in Bitcoin moving from exchanges to private wallets suggests decreasing sell pressure and growing holder confidence. This indicates less likelihood of large sell-offs impacting the price.

- Active Addresses: The number of active Bitcoin addresses is [insert data], showing [increase/decrease]. This metric reflects the level of network activity, and a rise often correlates with increased market interest and potential price increases.

- Mining Hash Rate: The mining hash rate remains consistently high, indicating a robust and secure network. A strong hash rate often suggests strong network health and can contribute to a positive market sentiment.

[Include links to credible sources for on-chain data, such as Glassnode or CoinMetrics.] These on-chain indicators paint a picture consistent with the technical analysis, reinforcing the possibility of a Bitcoin price rally.

Macroeconomic Factors Influencing Bitcoin's Price

While technical and on-chain analysis are crucial, macroeconomic factors also play a significant role in Bitcoin's price.

- Inflation: Persistently high inflation could drive investors towards Bitcoin as a hedge against inflation, potentially increasing demand.

- Interest Rates: Changes in interest rates can influence the overall market sentiment and investor risk appetite. Lower interest rates could potentially stimulate demand for riskier assets like Bitcoin.

- Regulatory Changes: Regulatory developments, both positive and negative, can significantly impact the price. Favorable regulatory frameworks could lead to increased institutional investment.

[Include links to relevant news articles or reports on macroeconomic factors affecting Bitcoin.] These macroeconomic trends, while complex, can create conditions favorable or unfavorable for a Bitcoin price rally.

Potential Price Targets and Timeframes

Based on the analyst's interpretation of the chart and supporting data, potential Bitcoin price targets range from [lower target] to [higher target] within the next [timeframe, e.g., few weeks, several months]. However, it's crucial to remember that these are predictions and subject to considerable uncertainty. Market volatility and unforeseen events could significantly impact the actual price movements. The basis for these predictions combines technical analysis, on-chain metrics and macroeconomic considerations.

Conclusion: Bitcoin Price Rally – Is it Time to Invest?

The analysis presented suggests a strong possibility of an imminent Bitcoin price rally, supported by converging technical indicators, positive on-chain metrics, and potentially favorable macroeconomic conditions. However, it is vital to remember that investing in cryptocurrencies carries significant risk. This analysis should be considered alongside your own research and risk tolerance. Don't make any investment decisions based solely on this article.

Is a Bitcoin price rally right for your portfolio? Before making any decisions, conduct thorough research and consider consulting a financial advisor. Stay updated on the latest Bitcoin price movements and learn more about potential Bitcoin price rallies by following reputable news sources and market analysis.

Featured Posts

-

Play Station 5 Pro Teardown A Comprehensive Internal Analysis

May 08, 2025

Play Station 5 Pro Teardown A Comprehensive Internal Analysis

May 08, 2025 -

Este Betis Un Hito En La Historia Del Futbol

May 08, 2025

Este Betis Un Hito En La Historia Del Futbol

May 08, 2025 -

Kryptos Summer Adventure Supermans Special Whistle

May 08, 2025

Kryptos Summer Adventure Supermans Special Whistle

May 08, 2025 -

Sifresiz Kripto Para Mirasi Ne Yapmali

May 08, 2025

Sifresiz Kripto Para Mirasi Ne Yapmali

May 08, 2025 -

The Loonies High Value Challenges And Opportunities For Canada

May 08, 2025

The Loonies High Value Challenges And Opportunities For Canada

May 08, 2025