Is A Housing Market Correction Imminent In Canada? A Posthaste Perspective

Table of Contents

H2: Current Market Indicators Suggesting a Potential Correction

Several indicators suggest the Canadian housing market may be heading for a correction, albeit the timing and severity remain uncertain.

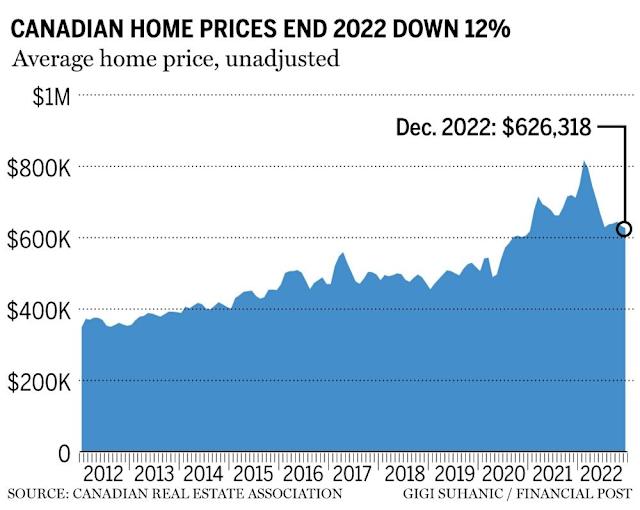

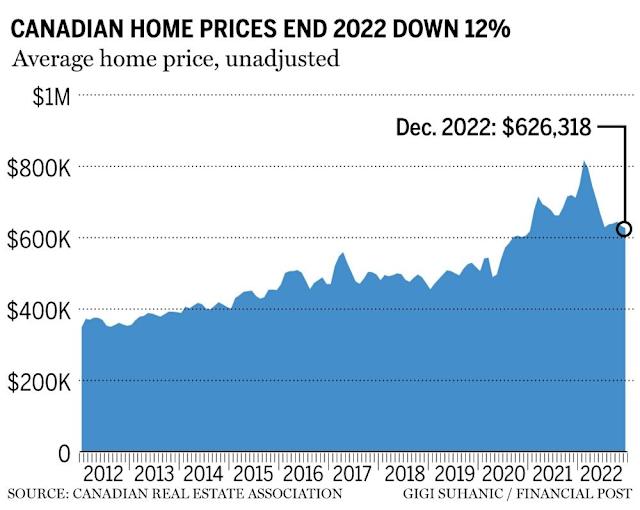

H3: High Home Prices and Affordability Concerns

Affordability is a major concern across Canada. Home prices in major cities like Toronto and Vancouver have soared, creating a significant gap between average incomes and the cost of owning a home.

- Price-to-income ratios: In many Canadian provinces, the price-to-income ratio for homes has reached unsustainable levels, making homeownership increasingly difficult for first-time buyers. For example, Statistics Canada data shows a significant increase in this ratio in Ontario and British Columbia over the past decade.

- Rising interest rates: The Bank of Canada's recent interest rate hikes have significantly increased mortgage payments, further reducing affordability and potentially dampening demand. This impact is particularly acute for those with variable-rate mortgages.

- First-time homebuyers: The challenge for first-time homebuyers is intensifying, forcing many to reconsider their homeownership aspirations or settle for smaller properties further from city centers. This reduced demand in certain segments could contribute to a market slowdown.

H3: Rising Interest Rates and Their Impact

The Bank of Canada's efforts to curb inflation through interest rate hikes have had a direct impact on the Canadian housing market.

- Variable-rate mortgages: Borrowers with variable-rate mortgages have already seen their monthly payments increase substantially, impacting their disposable income.

- Decreased borrowing capacity: Higher interest rates reduce the amount potential buyers can borrow, leading to lower demand and potentially slowing price growth.

- Future interest rate forecasts: Economists' forecasts for future interest rate movements will significantly influence market sentiment and buyer behavior. Further increases could trigger a more pronounced correction.

H3: Inventory Levels and Market Saturation

While inventory levels have increased in some areas, they are still historically low in many parts of Canada, particularly in major urban centers.

- Comparison to historical data: Current inventory levels, while higher than during the peak of the pandemic, are still below the levels seen in previous decades.

- Regional variations: Inventory levels vary significantly across different provinces and cities. Some markets are experiencing a more significant increase in supply than others.

- New housing construction: While new housing construction is increasing, it is often not enough to keep pace with demand, especially in areas with strict zoning regulations and land constraints. This continued supply shortage could limit the extent of any price correction.

H2: Factors That Could Mitigate a Sharp Correction

Despite the indicators suggesting a potential correction, several factors could mitigate a sharp downturn in the Canadian housing market.

H3: Strong Canadian Economy

Canada's relatively strong economy provides a foundation of support for the housing market.

- Employment rates: Low unemployment rates contribute to consistent demand for housing.

- GDP growth: Positive GDP growth generally supports healthy economic conditions and sustained housing demand.

- Government support programs: Government initiatives aimed at supporting housing affordability can also influence market stability.

- Immigration: Continued high levels of immigration contribute to robust housing demand, counteracting potential downward pressures.

H3: Limited Housing Supply

The ongoing shortage of housing supply in many Canadian cities acts as a significant buffer against a drastic price correction.

- Construction challenges: Challenges in increasing housing construction, such as zoning regulations, land scarcity, and labor shortages, limit the speed at which supply can increase.

- Impact of zoning regulations: Strict zoning regulations in many cities restrict the development of higher-density housing, contributing to the supply shortage.

- Long-term implications: The long-term implications of limited housing supply are a continued upward pressure on prices, even in a cooling market.

H3: Resilience of the Canadian Housing Market

Historically, the Canadian housing market has demonstrated resilience, even during periods of economic uncertainty.

- Past market cycles: Examination of previous market cycles reveals periods of both growth and correction, demonstrating the market's inherent capacity to adjust.

- Factors contributing to resilience: Factors like strong immigration, limited supply, and government interventions have historically contributed to market resilience.

- Potential for a soft landing: A "soft landing," characterized by a gradual cooling rather than a sharp correction, remains a plausible outcome.

H2: Potential Outcomes and Their Implications

Two contrasting scenarios illustrate the potential outcomes of the current market dynamics.

H3: Scenario 1: A Soft Landing

A soft landing would involve a gradual cooling of the market, with a moderate decrease in home prices and a slowdown in sales activity.

- Implications for homeowners: Homeowners might experience slower price appreciation but would avoid significant losses.

- Implications for investors: Investors would likely see lower returns but avoid substantial losses.

H3: Scenario 2: A Sharp Correction

A sharp correction would entail a significant drop in home prices, increased market volatility, and potentially a recessionary environment.

- Consequences for homeowners: Homeowners could face significant equity losses, impacting their financial stability.

- Consequences for investors: Investors could experience substantial losses on their real estate investments.

- Impact on the broader economy: A sharp correction could trigger a broader economic slowdown, impacting various sectors.

3. Conclusion:

The question of whether a Canadian housing market correction is imminent remains complex. While several indicators point towards a potential slowdown, the severity and timing are uncertain. High prices, rising interest rates, and increased inventory in some areas are counterbalanced by a strong economy, limited housing supply, and the historical resilience of the Canadian housing market. A soft landing is a plausible outcome, but the possibility of a sharper correction cannot be dismissed. Staying informed about the latest developments in the Canadian housing market and seeking professional financial advice are crucial for navigating this period effectively. For continuous updates on the Canadian housing market correction, and related topics such as housing market forecasts, continue to follow our blog for regular updates.

Featured Posts

-

Millions Stolen Through Office365 Hacks Criminal Investigation Update

May 22, 2025

Millions Stolen Through Office365 Hacks Criminal Investigation Update

May 22, 2025 -

Oh Jun Sung Claims Wtt Star Contender Chennai Title

May 22, 2025

Oh Jun Sung Claims Wtt Star Contender Chennai Title

May 22, 2025 -

El Superalimento Que Supera Al Arandano Beneficios Para La Salud Y La Longevidad

May 22, 2025

El Superalimento Que Supera Al Arandano Beneficios Para La Salud Y La Longevidad

May 22, 2025 -

Teroerizm Ve Deniz Guevenligi Antalya Da Nato Parlamenter Asamblesi Nin Guendemi

May 22, 2025

Teroerizm Ve Deniz Guevenligi Antalya Da Nato Parlamenter Asamblesi Nin Guendemi

May 22, 2025 -

Blake Lively And Taylor Swift Subpoena Report Sparks Friendship Strain Speculation

May 22, 2025

Blake Lively And Taylor Swift Subpoena Report Sparks Friendship Strain Speculation

May 22, 2025

Latest Posts

-

Interstate 83 Closed After Produce Truck Accident

May 22, 2025

Interstate 83 Closed After Produce Truck Accident

May 22, 2025 -

Produce Truck Rollover Shuts Down Part Of I 83

May 22, 2025

Produce Truck Rollover Shuts Down Part Of I 83

May 22, 2025 -

Produce Hauling Truck Accident On Interstate 83

May 22, 2025

Produce Hauling Truck Accident On Interstate 83

May 22, 2025 -

Fed Ex Truck Inferno Shuts Down Route 283 In Lancaster County

May 22, 2025

Fed Ex Truck Inferno Shuts Down Route 283 In Lancaster County

May 22, 2025 -

Route 283 Closed Due To Fed Ex Truck Fire In Lancaster County Pa

May 22, 2025

Route 283 Closed Due To Fed Ex Truck Fire In Lancaster County Pa

May 22, 2025