Is An Angry Elon Musk Good For Tesla's Stock?

Table of Contents

The Impact of Elon Musk's Public Persona on Investor Sentiment

Elon Musk's public image is a double-edged sword for Tesla's stock. His actions create both significant positive and negative impacts on investor sentiment.

Positive Impacts:

-

Increased Brand Visibility and Media Attention: Musk's controversial statements and actions generate substantial media coverage, keeping Tesla at the forefront of public consciousness. This constant buzz, even if negative, translates into increased brand awareness and visibility, ultimately impacting Tesla stock price. For example, his frequent Twitter interactions, even when controversial, often lead to a surge in searches for "Tesla stock" and related keywords.

-

Passionate and Driven Leadership Style: Some investors are drawn to Musk's seemingly relentless drive and visionary leadership. His public persona, while unconventional, projects an image of passion and dedication, which can inspire confidence in the company's future and potentially boost Tesla stock. The perception of a strong, decisive leader can outweigh concerns about his volatile behavior for certain investors.

-

Cultivating a Cult-like Following: Musk has cultivated a devoted following among consumers and investors alike. This fervent loyalty translates into robust demand for Tesla products and a willingness to overlook negative news impacting Tesla stock. This dedicated fanbase acts as a significant buffer against negative publicity.

Negative Impacts:

-

Alienating Potential Investors: Musk's unpredictable behavior and controversial statements can alienate potential investors who value stability and predictability. The uncertainty surrounding his actions can deter cautious investors from investing in Tesla stock.

-

Creating Market Volatility: His impulsive tweets and pronouncements can cause significant volatility in Tesla's stock price. Sudden drops or surges in the Tesla stock price are often linked to specific actions or comments from Musk, creating uncertainty for investors.

-

Damaging Tesla's Brand Reputation: While some find Musk's persona engaging, others view it as arrogant or reckless, damaging Tesla's brand image and potentially affecting sales and investor confidence in Tesla's stock. This is particularly true among certain demographics more sensitive to ethical concerns.

Analyzing the Correlation Between Musk's Actions and Tesla's Stock Price

Understanding the direct correlation between Elon Musk's actions and Tesla's stock price is crucial.

Case Studies:

Numerous instances highlight the impact of Musk's actions on Tesla's stock. For example, his tweets announcing price cuts often resulted in immediate market reactions, both positive and negative. Conversely, controversies involving his other ventures have also influenced Tesla's stock performance, showcasing a clear interconnectivity. Detailed analysis of these instances with charts and graphs is crucial to demonstrate the precise correlation.

Statistical Analysis:

A rigorous statistical analysis is needed to determine the long-term correlation between Musk's public actions and Tesla's stock performance. This requires examining the frequency of his actions, their nature (positive or negative sentiment), and the consequent immediate and lagged effects on Tesla's stock price, market capitalization, and trading volume.

The Role of External Factors on Tesla's Stock Performance

While Elon Musk's influence is undeniable, it's crucial to acknowledge other factors impacting Tesla's stock performance.

Market Trends:

Tesla's stock is subject to broader market forces, economic conditions, and general investor sentiment towards the electric vehicle sector. These external factors play a significant role independent of Musk's actions.

Competition:

Increased competition from established automakers and new entrants in the EV market directly impacts Tesla's market share and, consequently, its stock price. The competitive landscape is a major external factor influencing Tesla stock.

Regulatory Changes:

Government policies, subsidies, and regulations regarding electric vehicles and autonomous driving significantly impact Tesla's operations and profitability, consequently affecting its stock performance. These regulatory changes can create both opportunities and challenges.

Conclusion

The relationship between Elon Musk's public persona and Tesla's stock performance is undeniably complex and multifaceted. While his actions can generate positive brand visibility and passionate investor support, they also introduce significant volatility and risk. It's clear there's no straightforward correlation; many external factors influence Tesla's stock price. Understanding this intricate interplay is crucial for investors navigating this dynamic market.

Understanding the intricate relationship between Elon Musk's actions and Tesla's stock remains crucial for informed investment decisions. Keep an eye on the latest news and analysis regarding Tesla stock price trends and the impact of Elon Musk on Tesla to stay ahead in this dynamic market. The future of Tesla stock hinges on a complex interplay of factors, and continuous monitoring is essential.

Featured Posts

-

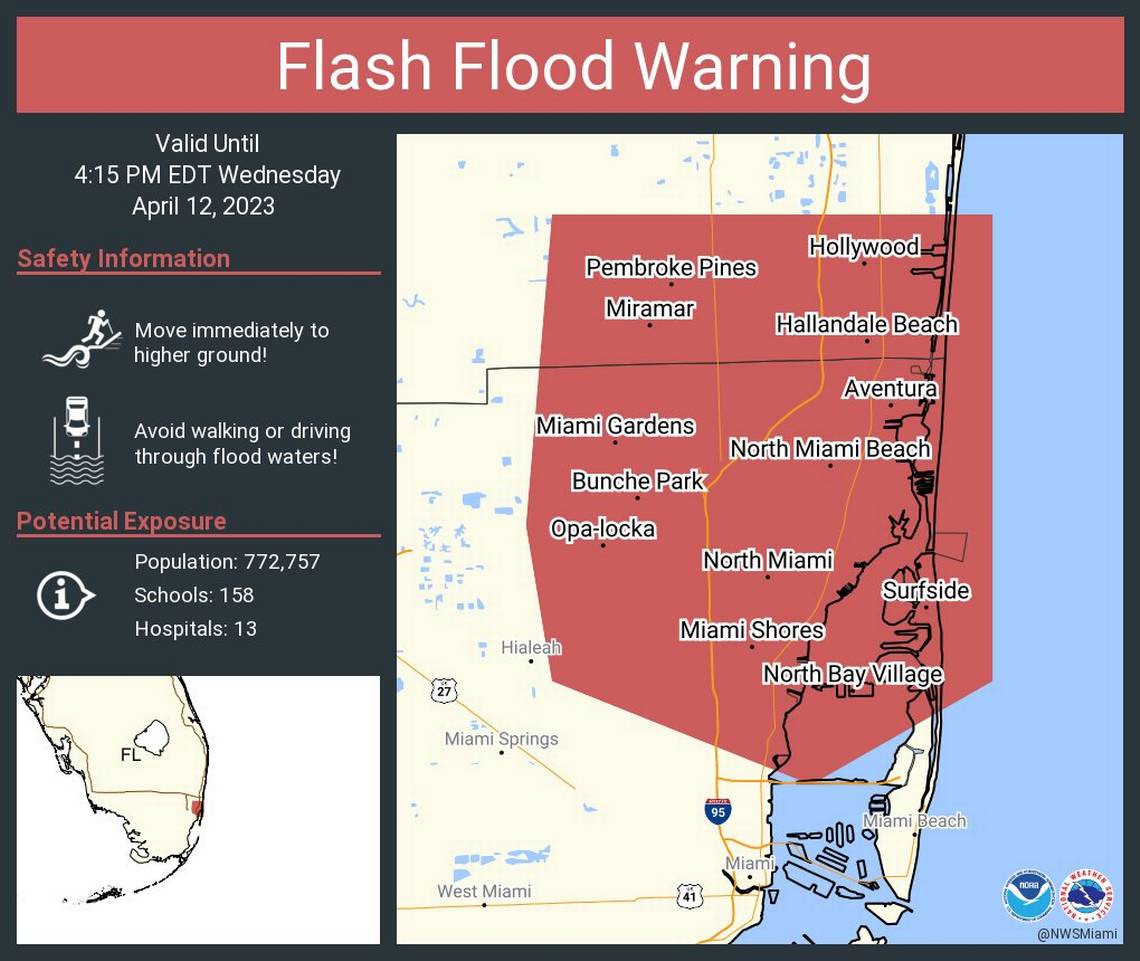

South Florida On High Alert Flash Flood Warning Issued Following Heavy Showers

May 26, 2025

South Florida On High Alert Flash Flood Warning Issued Following Heavy Showers

May 26, 2025 -

Zheng Qinwen Makes Italian Open Last 16

May 26, 2025

Zheng Qinwen Makes Italian Open Last 16

May 26, 2025 -

Naomi Campbells Alleged Met Gala 2025 Ban A Feud With Anna Wintour

May 26, 2025

Naomi Campbells Alleged Met Gala 2025 Ban A Feud With Anna Wintour

May 26, 2025 -

Panne Technique A La Rtbf Impact Sur Les Programmes Et Les Telespectateurs

May 26, 2025

Panne Technique A La Rtbf Impact Sur Les Programmes Et Les Telespectateurs

May 26, 2025 -

Dc Black Pride Where Culture Protest And Celebration Unite

May 26, 2025

Dc Black Pride Where Culture Protest And Celebration Unite

May 26, 2025

Latest Posts

-

Gyoekeres Viktor Arsenal Statisztikak Es Teljesitmenyertekeles

May 28, 2025

Gyoekeres Viktor Arsenal Statisztikak Es Teljesitmenyertekeles

May 28, 2025 -

Kanye West And Bianca Censori Reunite Dinner Date In Spain Fuels Reconciliation Rumors

May 28, 2025

Kanye West And Bianca Censori Reunite Dinner Date In Spain Fuels Reconciliation Rumors

May 28, 2025 -

Kanye West And Bianca Censori Spain Dinner Date After Breakup Claims

May 28, 2025

Kanye West And Bianca Censori Spain Dinner Date After Breakup Claims

May 28, 2025 -

Arsenal Gyoekeres A Transzfer Hatasa Es Elorejelzesek

May 28, 2025

Arsenal Gyoekeres A Transzfer Hatasa Es Elorejelzesek

May 28, 2025 -

Bianca Censori And Kanye West Spotted Together In Spain

May 28, 2025

Bianca Censori And Kanye West Spotted Together In Spain

May 28, 2025