Is An Ethereum Price Breakout On The Horizon?

Table of Contents

Analyzing Recent Ethereum Price Action and Trends

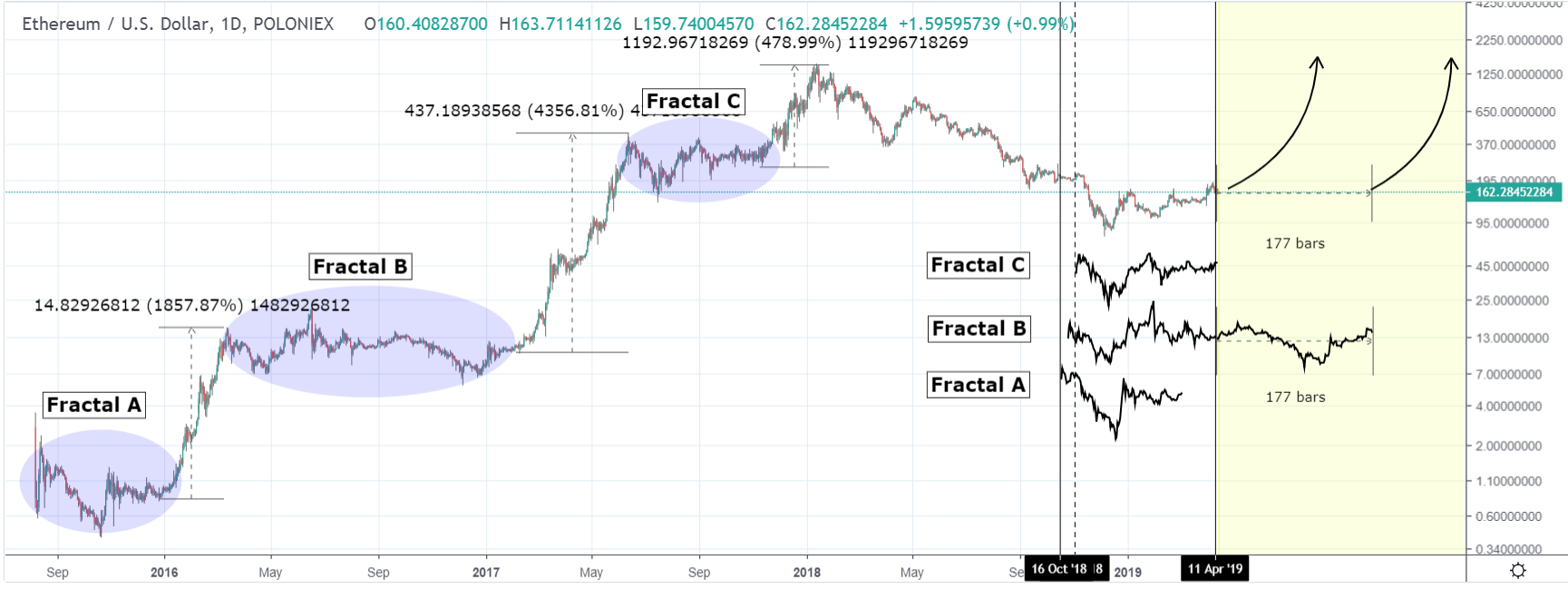

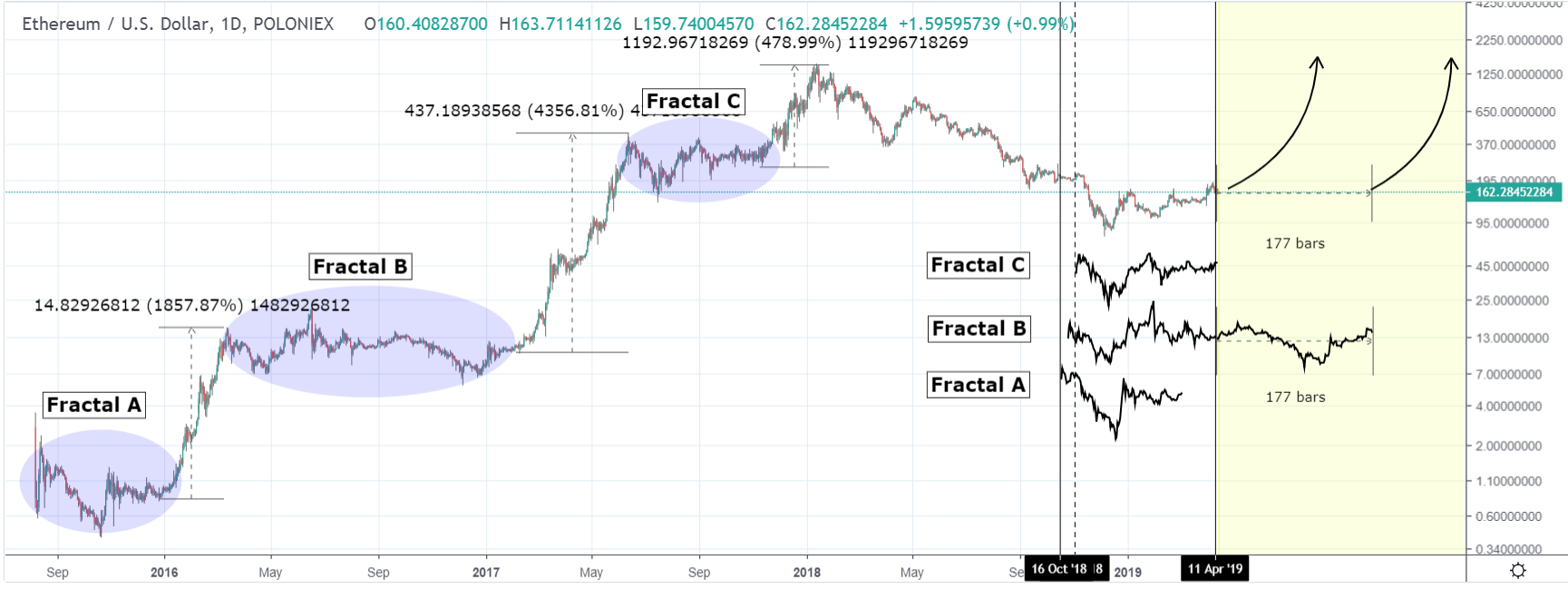

Understanding recent Ethereum price action is crucial for predicting future movements. Analyzing the ETH price chart, we can identify key support and resistance levels, providing clues about potential price targets. Examining trading volume offers insights into market sentiment – high volume alongside price increases indicates strong bullish momentum, while low volume suggests weaker price action. Reviewing Ethereum price history can also reveal recurring patterns and predict future trends.

- Examination of recent price lows and highs: Tracking recent price fluctuations helps determine the strength of support and resistance levels. A sustained break above a significant resistance level often signals a potential breakout.

- Analysis of key technical indicators (e.g., RSI, MACD): Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can signal overbought or oversold conditions, providing insights into potential price reversals or continuations.

- Discussion of potential support and resistance levels: Identifying these levels allows for a more informed assessment of potential price targets. Breaks above resistance often lead to significant price increases.

- Assessment of trading volume and its implications: High trading volume accompanying price increases confirms strong market interest and supports the potential for an Ethereum price breakout.

The Impact of Ethereum's Development and Upgrades on Price

Ethereum's ongoing development, particularly the highly anticipated Ethereum 2.0 upgrade, significantly impacts its price. Improvements in scalability and efficiency, driven by features like sharding, are expected to boost adoption and increase demand for ETH. The role of smart contracts and the flourishing Decentralized Finance (DeFi) ecosystem further contribute to the demand for ETH.

- Explanation of Ethereum 2.0 and its potential benefits: Ethereum 2.0 aims to drastically improve transaction speeds, reduce fees, and enhance the overall network scalability. These improvements are expected to attract more users and developers.

- Discussion of the impact of sharding on transaction speeds and costs: Sharding, a key component of Ethereum 2.0, will divide the network into smaller parts, improving transaction processing speeds and reducing congestion.

- Analysis of the role of smart contracts and decentralized finance (DeFi) in driving ETH demand: The Ethereum blockchain powers a vast and rapidly growing DeFi ecosystem, creating significant demand for ETH as gas fees and collateral.

Macroeconomic Factors and their Influence on Ethereum's Price

The price of Ethereum is also influenced by broader macroeconomic factors. The cryptocurrency market cap, Bitcoin's price (as a bellwether for the entire crypto market), and the possibility of an "altcoin season" all play a role. External factors such as inflation, interest rates, and regulatory developments also significantly impact investor sentiment and Ethereum price predictions.

- Analysis of the correlation between Bitcoin's price and Ethereum's price: Ethereum often follows Bitcoin's price movements, indicating a correlation between the two leading cryptocurrencies.

- Discussion of the impact of inflation on cryptocurrency investment: In times of high inflation, investors may seek alternative assets like cryptocurrencies as a hedge against inflation.

- Assessment of the role of government regulations on the crypto market: Clearer regulations could boost investor confidence, potentially driving up the price of Ethereum.

Institutional Investment and its Effect on Ethereum's Price

The increasing involvement of institutional investors in the cryptocurrency market is a key factor to consider. The potential launch of an Ethereum ETF (Exchange-Traded Fund) could significantly increase liquidity and attract a new wave of investment. Increased whale activity (large-scale investments by wealthy individuals and institutions) can also cause significant price swings.

Conclusion

Analyzing recent Ethereum price action, the impact of Ethereum 2.0 and its upgrades, macroeconomic factors, and the growing influence of institutional investment, suggests a strong possibility of an Ethereum price breakout. While predicting the exact timing of such a breakout remains impossible, the factors discussed indicate a bullish outlook for ETH. However, remember that cryptocurrency investments are inherently risky, and price predictions should be viewed with caution.

Call to Action: While the exact timing of an Ethereum price breakout is uncertain, the potential is significant. Stay informed about Ethereum developments, monitor market trends, and conduct thorough research before making any investment decisions. Continue researching Ethereum price predictions and consider diversifying your cryptocurrency portfolio strategically. Keep an eye on the latest news surrounding the Ethereum price and stay ahead of the curve. Understanding the factors that influence Ethereum price helps navigate the market effectively.

Featured Posts

-

Thunder Bulls Offseason Trade Separating Fact From Fiction

May 08, 2025

Thunder Bulls Offseason Trade Separating Fact From Fiction

May 08, 2025 -

Fieis Dormem Nas Ruas Do Vaticano Em Vigilia Para O Funeral Do Papa

May 08, 2025

Fieis Dormem Nas Ruas Do Vaticano Em Vigilia Para O Funeral Do Papa

May 08, 2025 -

Analysis The New Superman Footage Krypto And A Crucial Overlooked Scene

May 08, 2025

Analysis The New Superman Footage Krypto And A Crucial Overlooked Scene

May 08, 2025 -

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 08, 2025

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 08, 2025 -

The Greenland Question Are Trumps Worries About China Justified

May 08, 2025

The Greenland Question Are Trumps Worries About China Justified

May 08, 2025