Is An Ethereum Price Drop To $1,500 Imminent? Support Levels Under Scrutiny

Table of Contents

Current Market Sentiment and Technical Indicators

Market sentiment surrounding Ethereum is currently mixed. While some analysts remain bullish on Ethereum's long-term prospects, citing the network's robust development and growing adoption, others express concerns about the broader macroeconomic climate and the potential for further price corrections. The Fear & Greed Index, a popular gauge of market sentiment, often reflects this volatility, fluctuating between fear and greed as the price moves.

Analyzing technical indicators provides further insight into the potential for an Ethereum price drop to $1,500.

- Moving Averages: A bearish crossover of key moving averages, such as the 50-day and 200-day moving averages, could signal further downward pressure.

- RSI (Relative Strength Index): An RSI reading below 30 suggests the market is oversold, potentially indicating a bounce. However, an extended period below this level could signal continued weakness.

- MACD (Moving Average Convergence Divergence): A bearish MACD histogram could reinforce the possibility of a price drop. Conversely, a bullish crossover might signal a potential recovery.

Potential support levels to watch include the $1,600 and $1,700 zones. A break below these levels could accelerate the decline towards $1,500. Resistance levels around $1,800 and $2,000 will be crucial to watch for any potential rebounds. Significant divergence between price action and these indicators warrants close attention.

Impact of Macroeconomic Factors

Broader macroeconomic conditions significantly influence cryptocurrency prices, including Ethereum. Inflation, interest rate hikes, and recessionary fears create uncertainty in the market, leading investors to move towards safer assets.

- Inflation and Interest Rates: High inflation and rising interest rates increase the opportunity cost of holding cryptocurrencies, potentially driving down prices.

- Recessionary Fears: Concerns about a global recession can trigger risk-aversion among investors, causing them to sell off riskier assets like crypto.

- Regulatory Changes: Government regulations and policies concerning cryptocurrencies can greatly impact investor confidence and market sentiment. Stringent regulations could lead to price decreases.

- Institutional Investor Sentiment: The actions of large institutional investors heavily influence the price of Ethereum. A shift towards selling could trigger a significant price drop.

The correlation between traditional markets and cryptocurrency performance is undeniable. Negative trends in equities markets often correlate with declines in crypto markets.

Ethereum's Development and Network Activity

Ethereum's ongoing development and network activity play a crucial role in determining its price. The Shanghai upgrade, for example, impacted the price significantly. Upcoming upgrades and improvements to the network can boost investor confidence and potentially increase the price. Conversely, delays or unforeseen complications could negatively impact sentiment.

- Shanghai Upgrade Impact: The successful completion of the Shanghai upgrade, allowing for withdrawals of staked ETH, initially caused some price volatility, but long-term effects remain to be seen.

- Upcoming Developments: Future upgrades and developments in the Ethereum ecosystem will continue to influence the market.

- On-Chain Metrics: Analyzing metrics such as transaction volume, active addresses, and gas fees provides valuable insights into the network's health and user activity. High levels of activity typically correlate with a healthier market and potentially higher prices.

Positive developments in the Ethereum ecosystem can be a strong catalyst for price increases, offsetting the impact of negative macroeconomic factors.

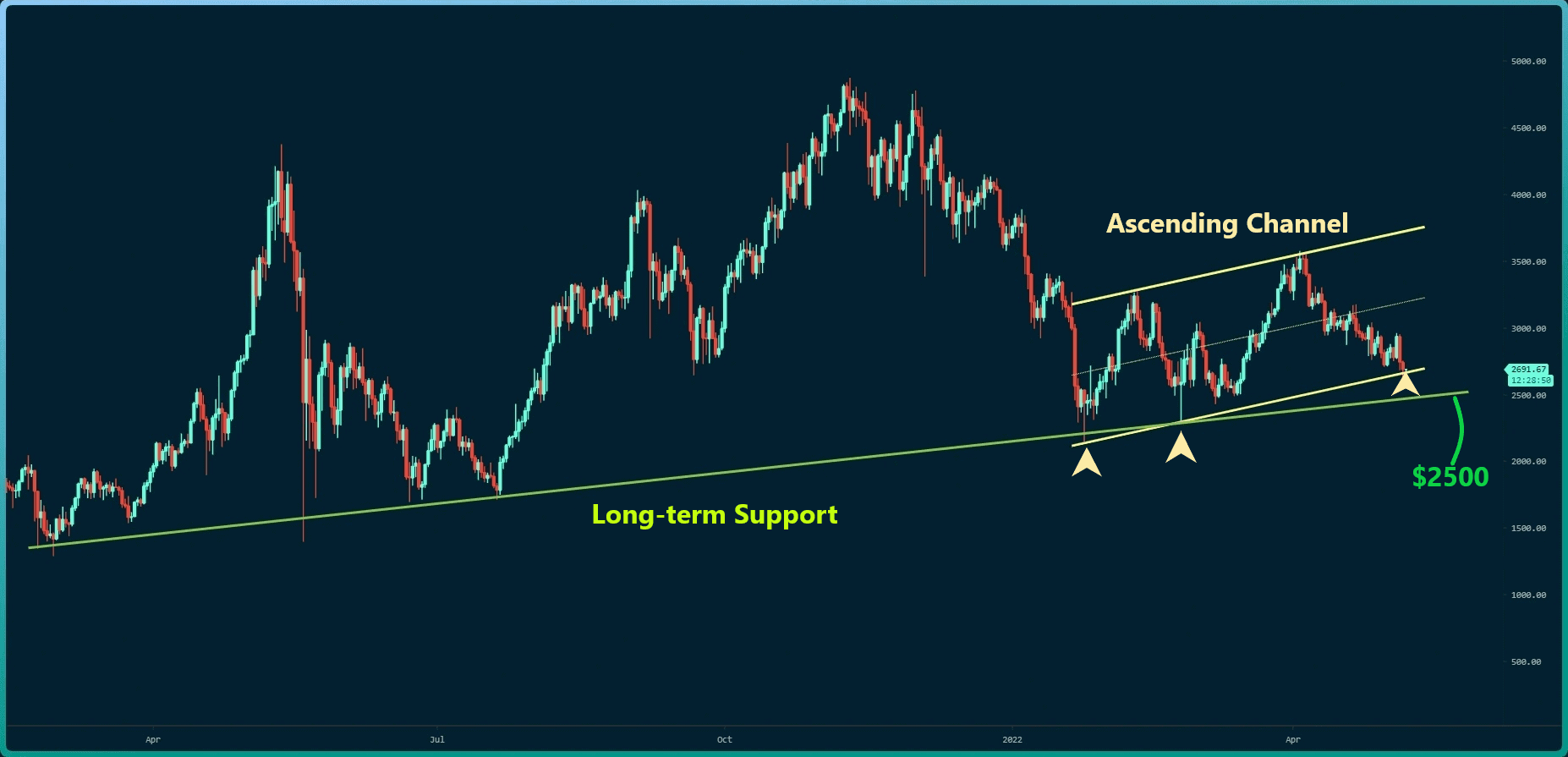

Major Support Levels and Potential Rebound Scenarios

Several key support levels could prevent a sharp Ethereum price drop to $1,500. These include historical price lows and psychological barriers.

- $1,600 - $1,700 Support: A break below this range could signal a more significant decline. However, strong buying pressure at these levels could trigger a rebound.

- $1,500 Psychological Level: This level represents a significant psychological barrier. A break below could lead to panic selling, accelerating the price drop.

Potential rebound scenarios include positive news related to Ethereum's development, improved macroeconomic conditions, or a shift in institutional investor sentiment. Strong buying pressure at support levels could also trigger a recovery.

Conclusion

Determining whether an Ethereum price drop to $1,500 is imminent is challenging. While current market sentiment is mixed, and macroeconomic factors pose headwinds, Ethereum's ongoing development and network activity offer potential support. The presence of significant support levels also suggests the possibility of a rebound. The uncertainty inherent in predicting cryptocurrency prices highlights the need for careful analysis and risk management.

Stay informed about the ever-changing dynamics affecting the Ethereum price and make well-informed decisions regarding your crypto investments. Keep monitoring the potential for an Ethereum price drop to $1,500 and adjust your strategy accordingly.

Featured Posts

-

Mick Jagger E O Pe Frio Impacto Da Aparicao Na Premiacao

May 08, 2025

Mick Jagger E O Pe Frio Impacto Da Aparicao Na Premiacao

May 08, 2025 -

Trump Medias Partnership With Crypto Com Etf Launch And Market Reaction

May 08, 2025

Trump Medias Partnership With Crypto Com Etf Launch And Market Reaction

May 08, 2025 -

Deandre Dzordan I Nikola Jokic Tri Poljupca I Bobi Marjanovic

May 08, 2025

Deandre Dzordan I Nikola Jokic Tri Poljupca I Bobi Marjanovic

May 08, 2025 -

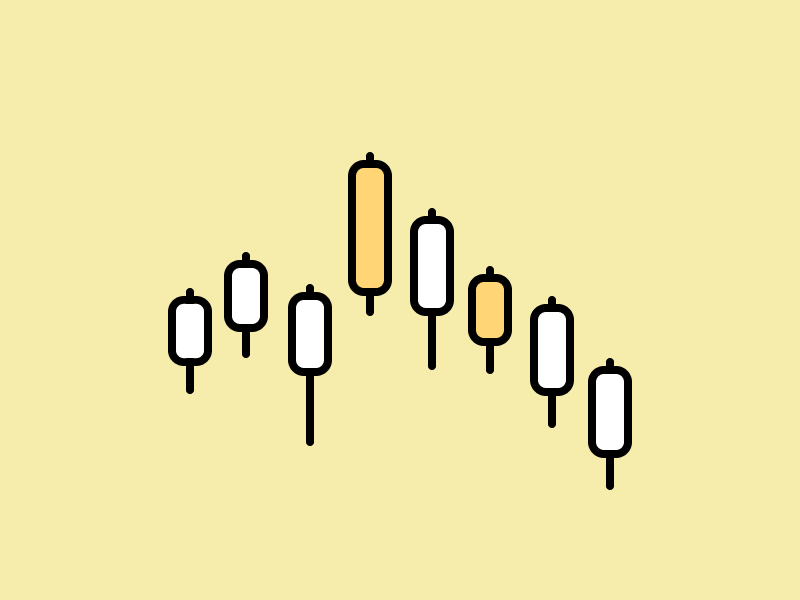

Beat The Ps 5 Price Increase Your Guide To Finding A Console

May 08, 2025

Beat The Ps 5 Price Increase Your Guide To Finding A Console

May 08, 2025 -

Andor Season 2 Trailer Release Date And Plot Speculation

May 08, 2025

Andor Season 2 Trailer Release Date And Plot Speculation

May 08, 2025