Is Apple Stock A Buy At $200? One Analyst Predicts $254

Table of Contents

The Analyst's Prediction and Rationale

A recent report from renowned financial analyst, [Analyst Name] at [Analyst Firm], projects Apple stock to reach $254. Their bullish outlook is underpinned by several key factors contributing to this $254 Apple stock prediction.

-

Key Factors:

- Robust iPhone Sales: [Analyst Name] highlights the continued strong demand for iPhones, particularly the latest models, as a primary driver of revenue growth and a significant component in their Apple stock analysis.

- Exponential Services Growth: The analyst emphasizes the burgeoning success of Apple's services sector, including subscriptions like Apple Music, iCloud, and the App Store, indicating a resilient and expanding revenue stream for Apple investment.

- Innovation Pipeline: The report cites Apple's ongoing investment in research and development, hinting at future product launches and advancements that could significantly boost the Apple stock price. This includes potential breakthroughs in AR/VR and other emerging technologies.

-

Potential Challenges:

- The analyst acknowledges potential headwinds, such as global economic uncertainty and intensifying competition in certain market segments. These challenges are factored into their Apple stock forecast.

-

Analyst Report Link: [Insert link to analyst report if available]

Current Market Conditions and Apple's Performance

Understanding the broader market context is crucial when assessing the viability of buying Apple stock at $200.

-

Economic Indicators: Current macroeconomic conditions, including [mention specific indicators like inflation rates, interest rate levels, etc.], significantly impact investor sentiment and market volatility, potentially affecting the Apple stock price.

-

Apple's Financial Performance: Apple's recent financial reports reveal [mention key data points such as revenue growth, earnings per share (EPS), etc.]. These figures offer insights into the company's financial health and its capacity for future growth, helping us assess whether $200 is a good price for Apple stock.

-

Recent News and Events: Recent news impacting Apple, such as [mention any relevant news, e.g., new product launches, regulatory changes, supply chain issues, etc.], has played a role in shaping the current Apple stock price and investor expectations.

Apple's Long-Term Growth Prospects

Apple's long-term potential is a critical factor in determining whether investing in Apple stock at $200 is a worthwhile venture.

-

New Market Expansion: Apple's foray into new and emerging markets, such as augmented reality/virtual reality (AR/VR) and potentially electric vehicles, presents substantial growth opportunities. These initiatives could significantly drive future Apple stock performance.

-

Existing Product and Service Growth: The continued growth of existing products and services, such as iPhones, iPads, Apple Watches, and the ever-expanding Apple services ecosystem, provides a solid foundation for sustained revenue generation.

-

Competitive Landscape: Apple's ability to maintain its competitive edge in the face of strong rivals is crucial for its long-term success. The analysis should consider the competitive intensity within each sector.

Valuation and Comparison to Competitors

Assessing Apple's valuation relative to its historical performance and competitors is essential for making an informed investment decision.

-

Valuation Metrics: Apple's current valuation, based on metrics such as its Price-to-Earnings (P/E) ratio, should be compared to its historical valuations and the valuations of similar technology companies. This helps determine if Apple stock is currently undervalued or overvalued.

-

Competitor Comparison: Comparing Apple's valuation and growth prospects to competitors like [mention key competitors, e.g., Microsoft, Google, Amazon, etc.], provides valuable context for determining the attractiveness of buying Apple stock at $200.

Risks and Considerations Before Investing in Apple Stock

Despite the potential upside, investing in Apple stock at any price carries inherent risks.

-

Market Downturns: Broader market downturns can significantly impact even well-established companies like Apple, potentially leading to a decrease in the Apple stock price.

-

Competition: Intense competition from other tech giants could erode Apple's market share and negatively impact its financial performance.

-

Geopolitical Factors: Global political and economic instability can create uncertainty and influence investor sentiment, leading to volatility in the Apple stock price.

Conclusion

The question of whether to buy Apple stock at $200 is a complex one. While one analyst's prediction of $254 suggests significant potential upside, a thorough assessment of current market conditions, Apple's financial performance, long-term growth prospects, and associated risks is crucial. The analysis presented here highlights both the bullish case – driven by strong iPhone sales, expanding services revenue, and innovation – and the potential challenges – including macroeconomic uncertainty and competition. Ultimately, the decision of whether to buy Apple stock at $200, or at any price, rests on your individual risk tolerance and investment objectives. By carefully considering the factors outlined above, you can make a more informed decision about whether Apple stock is the right addition to your portfolio. Remember to conduct your own thorough due diligence and consider consulting a financial advisor before making any investment decisions. Past performance is not indicative of future results.

Featured Posts

-

Assessing The Success Of Le Pens National Rally Demonstration

May 25, 2025

Assessing The Success Of Le Pens National Rally Demonstration

May 25, 2025 -

Amira Al Zuhair A Paris Fashion Week Highlight For Zimmermann

May 25, 2025

Amira Al Zuhair A Paris Fashion Week Highlight For Zimmermann

May 25, 2025 -

Refleksiya Fedora Lavrova Imperator Pavel I I Privlekatelnost Trillerov Dlya Zritelya

May 25, 2025

Refleksiya Fedora Lavrova Imperator Pavel I I Privlekatelnost Trillerov Dlya Zritelya

May 25, 2025 -

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School A Photo Recap

May 25, 2025

Manny Garcias Lego Masterclass At Veterans Memorial Elementary School A Photo Recap

May 25, 2025 -

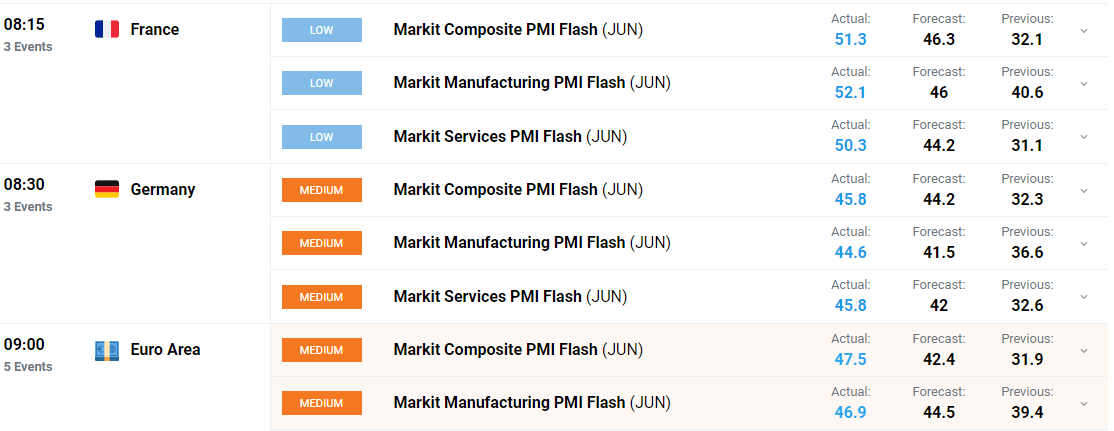

Dow Joness Measured Rise Positive Pmi Data Provides Support

May 25, 2025

Dow Joness Measured Rise Positive Pmi Data Provides Support

May 25, 2025

Latest Posts

-

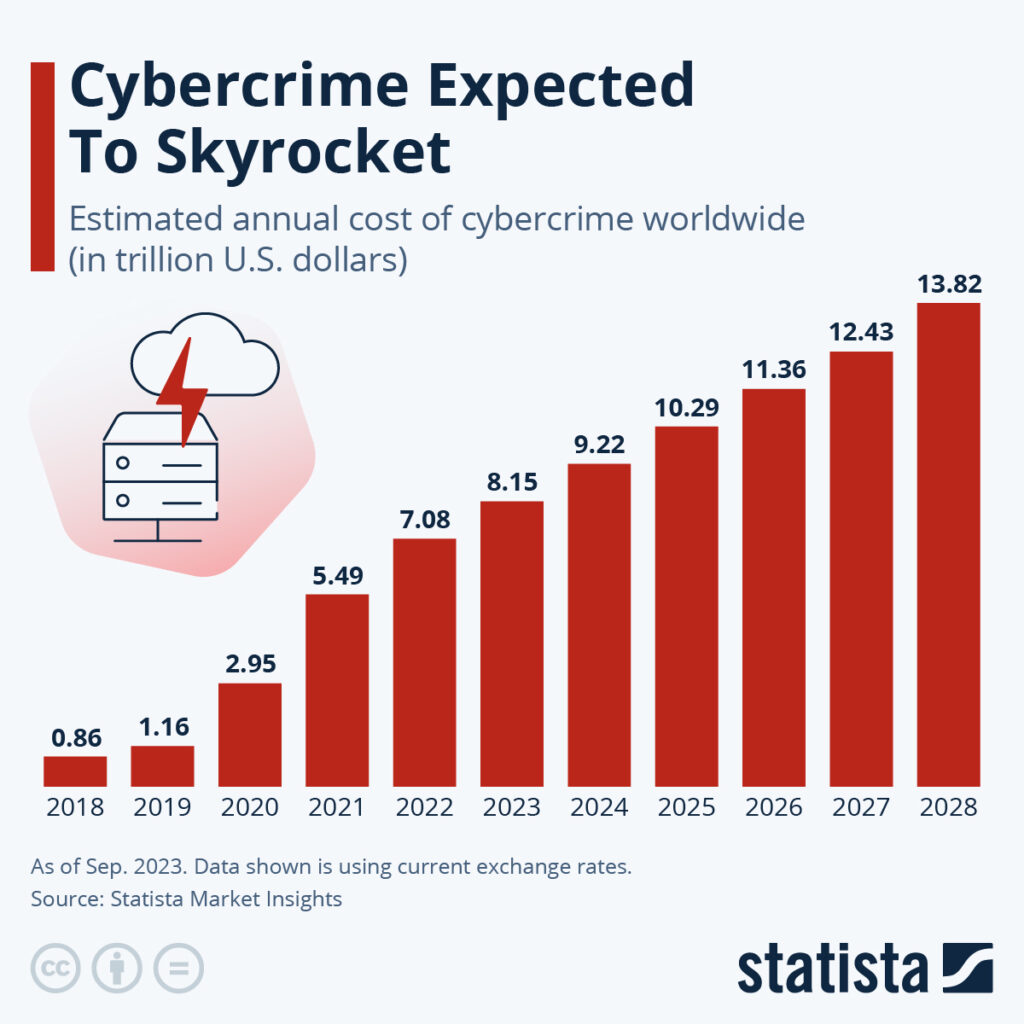

16 Million Fine T Mobiles Data Breach Settlement Explained

May 25, 2025

16 Million Fine T Mobiles Data Breach Settlement Explained

May 25, 2025 -

Elon Musk And Dogecoin Is He Really Leaving

May 25, 2025

Elon Musk And Dogecoin Is He Really Leaving

May 25, 2025 -

T Mobile Data Breaches 16 Million Penalty For Years Of Violations

May 25, 2025

T Mobile Data Breaches 16 Million Penalty For Years Of Violations

May 25, 2025 -

Is Elon Musk Selling His Dogecoin

May 25, 2025

Is Elon Musk Selling His Dogecoin

May 25, 2025 -

Nvidias Rtx 5060 What Went Wrong And What It Means For The Future Of Gpu Reviews

May 25, 2025

Nvidias Rtx 5060 What Went Wrong And What It Means For The Future Of Gpu Reviews

May 25, 2025