Is Apple Stock Overvalued? Considering Tariff Risks And Buffett's Position

Table of Contents

The Impact of Tariffs on Apple's Valuation

Tariffs significantly impact Apple's valuation, primarily through increased production costs and the need for supply chain adjustments.

Increased Production Costs and Price Increases

Tariffs imposed on imported components, a significant part of Apple's manufacturing process, directly increase production costs. To offset these rising costs, Apple might increase product prices, potentially impacting consumer demand. This delicate balance between maintaining profitability and preserving market share directly affects Apple's profit margins and, consequently, its overall valuation. A decrease in profit margins could lead to a downward revision of Apple stock's value.

- Examples of tariff-affected products: iPhones, iPads, MacBooks (many components originate from China and other tariff-affected regions).

- The impact on profit margins is a crucial factor in assessing whether the current Apple stock price is justified.

- Increased prices could lead to decreased sales, partially or fully negating the benefit of offsetting increased manufacturing costs.

Shifting Manufacturing and Supply Chain

To mitigate tariff risks, Apple is actively diversifying its manufacturing base, shifting production away from tariff-affected regions. This, however, presents its own set of challenges. Establishing new manufacturing facilities and supply chains requires substantial investment and time, impacting short-term profitability. Furthermore, geopolitical complexities and potential disruptions in other regions add another layer of risk.

- Relocating manufacturing facilities involves significant capital expenditure and logistical hurdles.

- The long-term impact on Apple's competitiveness in the global market remains uncertain.

- Geopolitical instability in alternative manufacturing locations poses additional risks to the supply chain.

Warren Buffett's Apple Investment: A Bullish or Cautious Signal?

Warren Buffett's Berkshire Hathaway holds a substantial stake in Apple, making it a crucial aspect of any Apple stock valuation analysis.

Berkshire Hathaway's Significant Stake

Berkshire Hathaway's massive investment in Apple represents a significant endorsement of the company's long-term prospects. Buffett's historically cautious investment style adds weight to this decision. His continued holding of Apple shares, despite market fluctuations, suggests a degree of confidence in Apple's future performance. However, this doesn't automatically mean that Apple stock isn't overvalued.

- The size of Berkshire Hathaway's Apple holdings makes it a significant market mover.

- Buffett’s investment strategy historically focuses on undervalued, stable companies.

- Continued holding of Apple shares suggests a long-term optimistic outlook.

Interpreting Buffett's Actions

Interpreting Buffett’s investment in Apple requires nuance. While some see it as a long-term bet on Apple's continued dominance, others view it as a strategic move or simply a high-return opportunity within a diversified portfolio. Any changes in Berkshire Hathaway's Apple holdings should be closely monitored for insights into market sentiment.

- Buffett's investment could be driven by a variety of factors, not solely Apple's intrinsic value.

- Analyzing the timing of Berkshire Hathaway's buy and sell actions provides further insights.

- Comparing Buffett's actions with overall market sentiment on Apple stock valuation is crucial.

Apple's Financial Performance and Future Projections

Analyzing Apple's financial performance and projecting its future trajectory is essential in assessing its stock valuation.

Analyzing Key Financial Metrics

A thorough examination of Apple's recent financial reports reveals consistent revenue generation and earnings growth. Comparing Apple’s performance to competitors like Samsung and Google, and industry benchmarks helps determine whether its growth is sustainable and if it justifies its current stock price.

- Revenue growth, earnings per share, and profit margins are key indicators of financial health.

- Analyzing Apple's market share within different product segments provides additional context.

- Using charts and graphs to visualize key financial data enhances understanding.

Future Market Outlook and Potential Risks

Apple's future growth relies on several factors, including the success of new product launches (e.g., iPhones, wearables), expansion into new markets, and technological innovations. However, potential risks such as intensifying competition, technological disruptions, and macroeconomic headwinds could significantly impact future performance. These factors, in turn, affect Apple's stock valuation.

- New product launches and service offerings drive future revenue growth.

- Expansion into emerging markets offers significant potential but also presents challenges.

- Technological disruptions and intense competition pose significant risks to Apple's future.

Conclusion: Is Apple Stock Truly Overvalued? A Final Verdict and Call to Action

Determining whether Apple stock is overvalued requires a careful consideration of both the positive and negative factors discussed above. Tariff risks undoubtedly present challenges, but Apple's financial strength and Warren Buffett's continued investment suggest a degree of confidence in its future. However, no investment is without risk. The complexities of global markets and technological innovation mean that even a seemingly stable giant like Apple carries inherent uncertainty.

Therefore, before investing in Apple stock, carefully weigh the potential rewards against the risks. Assess your own investment strategy regarding Apple stock, considering your risk tolerance and long-term financial goals. Conduct thorough research and consult with a financial advisor to make an informed decision about whether Apple stock aligns with your individual investment strategy. Don't solely rely on market sentiment or the actions of even prominent investors like Warren Buffett; thoroughly analyze Apple's financial performance and the market environment before committing your capital. Remember to carefully consider the risks and rewards before investing in Apple stock, understanding the potential for both significant gains and losses. A well-informed Apple investment strategy will always consider all potential factors.

Featured Posts

-

Your Dream Country Escape Awaits A Step By Step Planning Guide

May 24, 2025

Your Dream Country Escape Awaits A Step By Step Planning Guide

May 24, 2025 -

Apple Stock Under Pressure Ahead Of Q2 Results

May 24, 2025

Apple Stock Under Pressure Ahead Of Q2 Results

May 24, 2025 -

Seeking Change Facing Punishment A Guide To Protecting Yourself

May 24, 2025

Seeking Change Facing Punishment A Guide To Protecting Yourself

May 24, 2025 -

Tisice Prepustenych Kriza Zasahuje Najvaecsie Nemecke Spolocnosti

May 24, 2025

Tisice Prepustenych Kriza Zasahuje Najvaecsie Nemecke Spolocnosti

May 24, 2025 -

Find Housing Finance Solutions Fun And Kids Activities At The Iam Expat Fair

May 24, 2025

Find Housing Finance Solutions Fun And Kids Activities At The Iam Expat Fair

May 24, 2025

Latest Posts

-

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025 -

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025 -

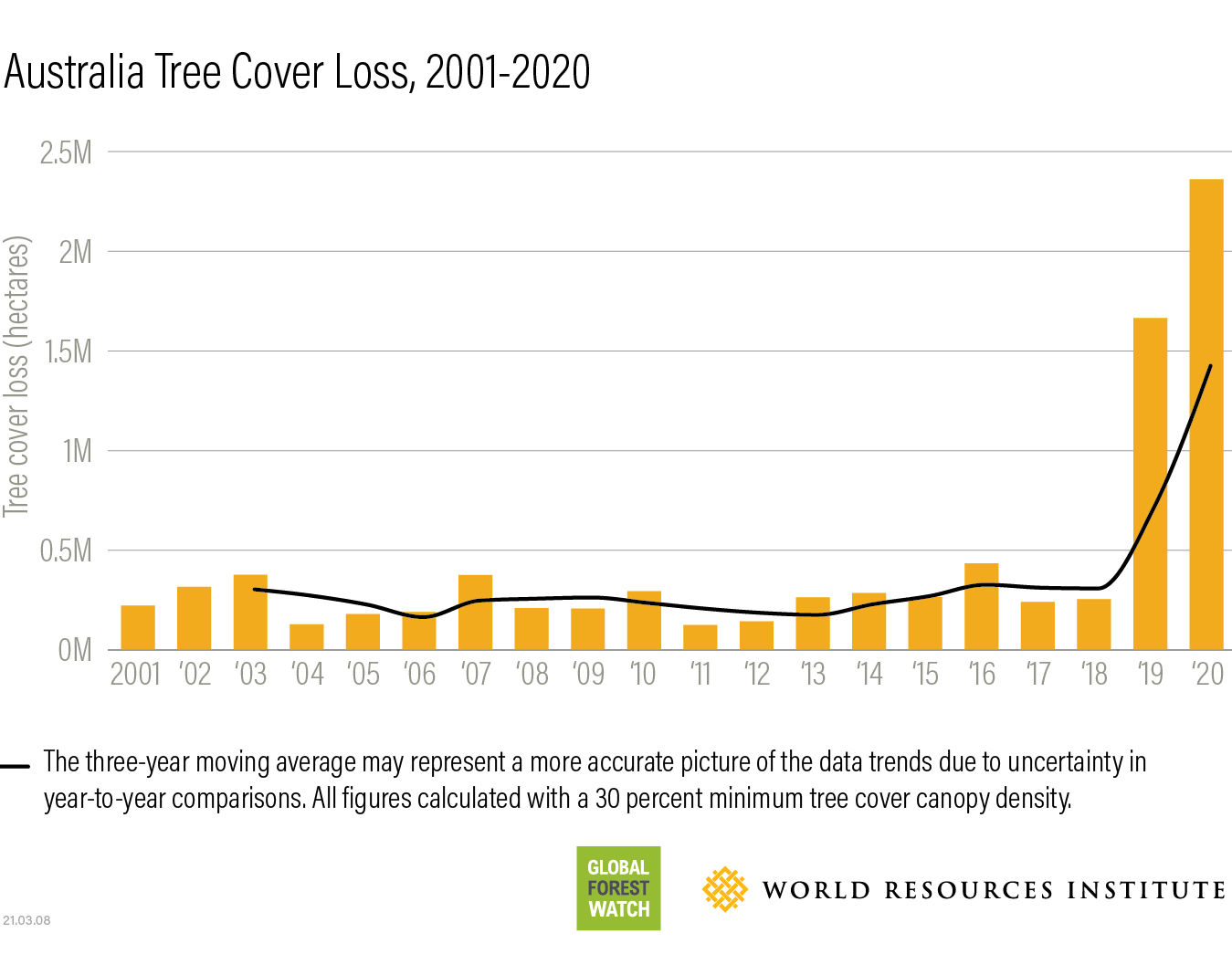

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025