Is BigBear.ai Stock A Buy? A Comprehensive Analysis

Table of Contents

BigBear.ai's Business Model and Competitive Landscape

BigBear.ai's success hinges on its diverse business model and ability to navigate a competitive landscape.

Revenue Streams and Growth Prospects

BigBear.ai generates revenue primarily through government contracts and commercial clients, leveraging its expertise in AI-driven analytics and solutions. While government contracts form a significant portion of their current revenue, the company is actively expanding its commercial footprint. The projected growth relies heavily on securing further government contracts, particularly within the burgeoning national security sector, as well as successfully penetrating the commercial market.

- Government Spending on AI: Increased government spending on AI and cybersecurity presents a significant growth opportunity for BigBear.ai stock. However, securing these contracts is competitive and subject to budgetary constraints.

- BigBear.ai's Competitive Advantages: BigBear.ai differentiates itself through its advanced AI algorithms, strong expertise in data analytics, and proven track record in delivering mission-critical solutions.

- Potential Threats from Competitors: The AI sector is highly competitive, with larger established companies and agile startups posing potential threats to BigBear.ai's market share. Maintaining a technological edge is crucial for long-term success.

- Forecasts for Revenue Growth: While precise forecasts vary across analysts, many predict significant revenue growth for BigBear.ai in the coming years, driven by increased demand for AI-powered solutions. However, realizing this growth depends on successful contract wins and market penetration.

Key Partnerships and Collaborations

Strategic alliances and collaborations are vital to BigBear.ai's growth strategy. Partnerships provide access to new markets, technologies, and expertise, enhancing their competitive position.

- Key Partners: Identifying and analyzing BigBear.ai's key partners is essential for assessing their strategic value and the potential impact on their future performance.

- Description of Collaborations: Understanding the nature of these collaborations, whether technological, commercial, or strategic, is crucial for assessing their potential benefits.

- Assessment of the Impact on BigBear.ai's Success: Evaluating the impact of these partnerships on revenue generation, market access, and technological advancements will help determine their contribution to BigBear.ai's overall success.

Financial Performance and Valuation

A thorough assessment of BigBear.ai's financial performance and valuation is critical for evaluating its investment potential.

Financial Statements Analysis

Analyzing BigBear.ai's financial statements reveals key insights into its financial health and stability. Examining historical trends in revenue, earnings, debt, and cash flow provides a foundation for understanding its performance.

- Analysis of Key Ratios: Analyzing key financial ratios such as Price-to-Earnings (P/E) ratio, debt-to-equity ratio, and current ratio helps to understand the company's financial position relative to its industry peers.

- Comparison to Industry Benchmarks: Comparing BigBear.ai's performance to industry benchmarks offers valuable insights into its relative strength and potential.

- Identification of Potential Red Flags: A careful review of the financial statements may identify potential red flags such as declining revenue, high debt levels, or negative cash flow, which could impact the investment decision.

Valuation Metrics and Investment Potential

Several valuation methods can be employed to assess whether BigBear.ai stock is currently undervalued or overvalued.

- Discounted Cash Flow (DCF) Analysis: DCF analysis estimates the present value of future cash flows, providing a measure of intrinsic value.

- Comparable Company Analysis: Comparing BigBear.ai's valuation metrics to similar companies in the AI sector helps determine its relative valuation.

- Comparison to Current Market Price: Ultimately, the comparison between the estimated intrinsic value and the current market price of BigBear.ai stock determines whether it is considered undervalued, overvalued, or fairly valued.

Risks and Challenges

Investing in BigBear.ai stock involves significant risks and challenges.

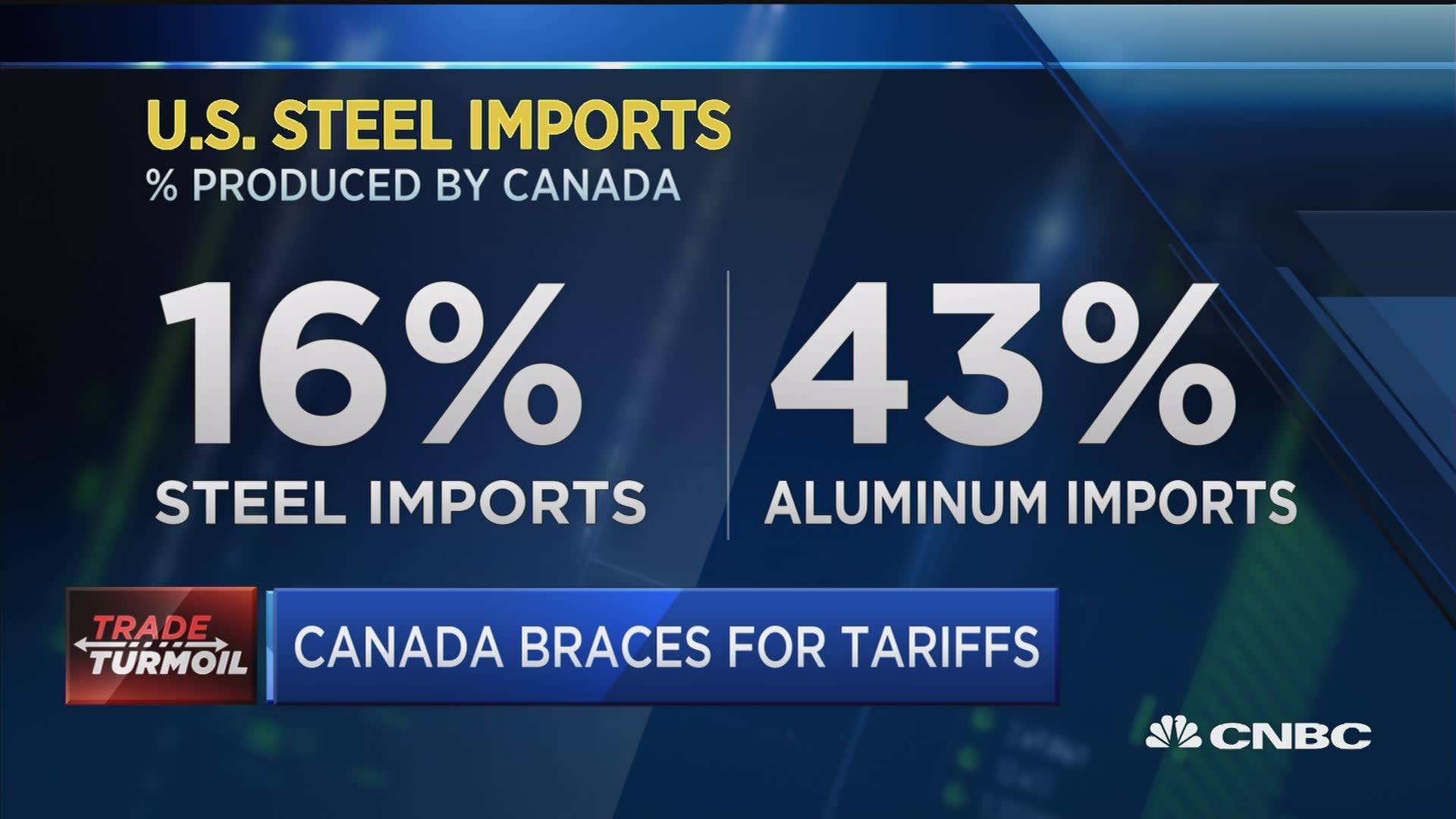

Geopolitical Risks and Government Funding

BigBear.ai's reliance on government contracts exposes it to geopolitical risks and potential disruptions in government funding.

- Potential Risks: Changes in government priorities, budget cuts, political instability, and delays in contract awards can significantly impact BigBear.ai's revenue and profitability.

- Likelihood Assessment: Evaluating the likelihood of these risks requires careful consideration of current geopolitical events and government policy trends.

- Mitigation Strategies: Identifying and assessing potential mitigation strategies, such as diversifying revenue streams, is essential for managing these risks.

Competition and Technological Disruption

The competitive landscape of the AI industry is dynamic and subject to rapid technological advancements.

- Key Competitors: Identifying and analyzing key competitors in the AI sector is essential for understanding the competitive landscape and its potential impact on BigBear.ai.

- Threat of New Technologies: The rapid pace of technological change poses a significant risk, as new technologies could render BigBear.ai's existing solutions obsolete.

- Potential Challenges: Addressing the challenges posed by competition and technological disruption requires continuous innovation and adaptation.

Conclusion

Investing in BigBear.ai stock offers the potential for significant returns, particularly if the company continues to secure major contracts and successfully expands into the commercial market. However, the inherent risks associated with the AI sector, government reliance, and intense competition cannot be ignored. Based on this analysis, while BigBear.ai displays considerable promise, a “wait and see” approach might be prudent until further financial performance and market penetration are demonstrated. The company’s future heavily depends on its ability to secure and execute on large contracts while managing the risk of disruptive technologies.

Call to Action: Conduct further due diligence before investing in BigBear.ai stock. This analysis provides a starting point, but thorough research, including reviewing financial statements and industry reports, is crucial before making any investment decisions related to BigBear.ai stock. Remember that investing in BigBear.ai stock or any stock involves risk, and you could lose money. Learn more about BigBear.ai stock and make an informed investment decision.

Featured Posts

-

Understanding D Wave Quantums Qbts Friday Stock Price Rise

May 20, 2025

Understanding D Wave Quantums Qbts Friday Stock Price Rise

May 20, 2025 -

Will Tariffs Reverse The Buy Canadian Beauty Boom

May 20, 2025

Will Tariffs Reverse The Buy Canadian Beauty Boom

May 20, 2025 -

Dusan Tadic Gelecege Dogru Tarihi Bir Adim

May 20, 2025

Dusan Tadic Gelecege Dogru Tarihi Bir Adim

May 20, 2025 -

D Wave Quantum Qbts Stock Plunge Understanding Thursdays Decline

May 20, 2025

D Wave Quantum Qbts Stock Plunge Understanding Thursdays Decline

May 20, 2025 -

The Assault On Clean Energy Challenges To A Thriving Sector

May 20, 2025

The Assault On Clean Energy Challenges To A Thriving Sector

May 20, 2025