Is CoreWeave (CRWV) A Good Investment? Jim Cramer Weighs In

Table of Contents

CoreWeave's Business Model and Competitive Advantage

CoreWeave's business model centers around providing high-performance cloud computing infrastructure, specifically tailored for the growing demands of artificial intelligence (AI) and machine learning (ML) applications. This focus on a rapidly expanding niche gives CoreWeave a significant competitive edge.

Analyzing CoreWeave's Revenue Streams

CoreWeave generates revenue by offering a range of cloud computing services, including:

- High-performance computing (HPC) resources: Providing powerful GPUs and CPUs for AI model training and other computationally intensive tasks.

- Customizable solutions: Tailoring infrastructure to meet the unique needs of specific clients.

- Managed services: Offering support and expertise to ensure optimal performance.

Key clients and partnerships remain largely undisclosed due to the nature of the business, but the company has consistently touted large language models (LLMs) as a key revenue driver. CoreWeave faces competition from established giants like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure, but it differentiates itself through:

- Superior performance: CoreWeave claims to offer faster processing speeds and more efficient resource allocation than competitors.

- Focus on AI/ML: Specializing in this high-growth segment allows CoreWeave to cater to a specialized market with unique needs.

- Strategic partnerships: While the specifics are often confidential, CoreWeave likely collaborates with key players in the AI/ML space to expand its reach and capabilities.

Growth Potential and Market Outlook

The global cloud computing market is projected to experience significant growth in the coming years, fueled by increasing adoption of AI, ML, and big data analytics. This presents enormous potential for CoreWeave. While precise projections vary across analysts, most forecasts suggest a compound annual growth rate (CAGR) exceeding 15% for the foreseeable future.

- Market Size: The market is expected to reach trillions of dollars within the next decade.

- CoreWeave's Potential: CoreWeave is well-positioned to capitalize on this growth, targeting a specific, high-demand niche within the market.

- Expansion Opportunities: CoreWeave could expand its service offerings to include new technologies and potentially enter new geographical markets.

Financial Performance and Valuation

Analyzing CoreWeave's financial performance requires careful consideration of its recent IPO and limited historical data.

Analyzing CoreWeave's Financials

CoreWeave's financial statements since its IPO reveal rapid revenue growth, though profitability remains a key area to watch. Key metrics to monitor include:

- Revenue Growth: Analyze the trend of quarterly and annual revenue increases to gauge the pace of expansion.

- Profitability: Examine gross margin, operating margin, and net margin to understand the company's efficiency and cost structure. As a young company, losses are expected, but the rate of improvement is crucial.

- Debt Levels: Assess the company’s debt levels and its ability to manage its financial obligations.

Is CRWV Overvalued or Undervalued?

Determining whether CRWV is overvalued or undervalued is complex. Several valuation metrics need to be considered:

- Price-to-Sales Ratio (P/S): Compare CoreWeave’s P/S ratio to those of its competitors to assess relative valuation. A high P/S ratio often indicates high growth expectations, but also higher risk.

- Comparison to Peers: Benchmark CoreWeave against similar companies in the cloud computing sector to understand its relative valuation.

- Future Growth Projections: Incorporate future growth expectations into the valuation model, recognizing that future performance is inherently uncertain.

Jim Cramer's Opinion and Analysis of CRWV

Jim Cramer, a prominent figure in financial media, has offered commentary on CoreWeave (CRWV) on his various platforms. His opinions, while not financial advice, are followed closely by many investors.

Summarizing Cramer's Stance

[Insert a direct quote or paraphrase of Jim Cramer's statement on CoreWeave, citing the source. If no statement is readily available, indicate that and explain why.]

- Key Takeaways: Summarize the core arguments and reasoning presented by Cramer.

- Recommendation: Was Cramer's assessment positive, negative, or neutral?

- Past Performance: Consider Cramer's past record in predicting stock performance. While he is a well-known personality, his recommendations are not always accurate.

Weighing Cramer's Opinion Against Other Expert Analyses

It's essential to consider a range of opinions, not relying solely on a single source. Consult reputable financial news outlets and analyst reports to see the consensus view on CRWV.

- Analyst Ratings: Review the ratings and price targets provided by different investment banks and financial analysts.

- Diverging Opinions: Identify any areas of disagreement among analysts and the reasons for these differences.

- Potential Biases: Be aware of potential biases influencing analysts' assessments (e.g., conflicts of interest, investment banking relationships).

Conclusion: Is CoreWeave (CRWV) Right for Your Investment Portfolio?

CoreWeave (CRWV) operates in a high-growth sector and has demonstrated rapid revenue growth. However, its profitability and valuation remain key concerns. Jim Cramer's opinion, while influential, should be considered alongside other expert analyses and your own thorough due diligence. Remember, investing in CRWV, or any stock, entails significant risk.

Before investing in CoreWeave (CRWV), conduct comprehensive research, considering the information presented here as a starting point. Assess your own risk tolerance, investment timeframe, and financial goals. Investing in the stock market always carries risk, and CoreWeave is no exception. Don't invest money you can't afford to lose. Always seek advice from a qualified financial advisor before making any investment decisions. Remember, a successful CoreWeave (CRWV) investment strategy requires careful consideration and responsible risk management.

Featured Posts

-

Stijgende Huizenprijzen Abn Amros Voorspelling En Impact Van Dalende Rente

May 22, 2025

Stijgende Huizenprijzen Abn Amros Voorspelling En Impact Van Dalende Rente

May 22, 2025 -

Aimscap And The World Trading Tournament Wtt A Competitive Analysis

May 22, 2025

Aimscap And The World Trading Tournament Wtt A Competitive Analysis

May 22, 2025 -

Addressing The Allegations Against Blake Lively

May 22, 2025

Addressing The Allegations Against Blake Lively

May 22, 2025 -

Swiss Government Criticizes Prc Military Drills

May 22, 2025

Swiss Government Criticizes Prc Military Drills

May 22, 2025 -

Exploring The Humor And Heart Of The Goldbergs

May 22, 2025

Exploring The Humor And Heart Of The Goldbergs

May 22, 2025

Latest Posts

-

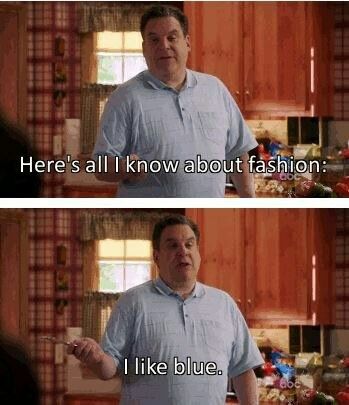

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025

Current Gas Prices In Columbus Ohio A Price Comparison

May 22, 2025 -

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025

Wordle 1358 Answer And Hints For Saturday March 8th

May 22, 2025 -

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Price Survey 2 83 To 3 31 Per Gallon

May 22, 2025 -

Significant Gas Price Variation Across Columbus Stations

May 22, 2025

Significant Gas Price Variation Across Columbus Stations

May 22, 2025 -

Wordle 1358 March 8th Hints And Solution

May 22, 2025

Wordle 1358 March 8th Hints And Solution

May 22, 2025