Is D-Wave Quantum Inc. (QBTS) A Smart Quantum Computing Investment?

Table of Contents

Understanding D-Wave Quantum's Technology and Market Position

D-Wave's approach to quantum computing differs significantly from its competitors. Understanding this distinction is crucial for evaluating QBTS as a quantum computing investment.

Quantum Annealing vs. Gate-Based Quantum Computing

D-Wave focuses on quantum annealing, a specialized approach to solving optimization problems. Unlike gate-based quantum computing, which aims to build a universal quantum computer capable of tackling a wide range of computational tasks, quantum annealing is designed to excel at specific types of problems.

-

Advantages of Quantum Annealing: Quantum annealing is particularly adept at finding the optimal solution within a complex landscape of possibilities. This makes it suitable for applications in fields like logistics, materials science, and financial modeling where finding the best solution among many is critical.

-

Limitations of Quantum Annealing: However, quantum annealing's specialized nature means it's not as versatile as gate-based quantum computers. It lacks the universality to handle a wide range of computational problems. Furthermore, scalability—building larger, more powerful annealers—presents a significant challenge. Gate-based approaches, while currently less mature, theoretically offer greater potential for scalability and broader applicability.

D-Wave's Current Market Share and Partnerships

While D-Wave doesn't dominate the overall quantum computing market, it holds a unique position as the only company currently commercially offering quantum annealers. This niche gives them a first-mover advantage, but also limits their market to specific applications.

-

Major Clients and Partners: D-Wave has secured partnerships with prominent organizations across various sectors, including Volkswagen, Los Alamos National Laboratory, and Google. These collaborations provide valuable real-world testing grounds for its technology and generate revenue streams.

-

Competitive Landscape: The quantum computing landscape is highly competitive, with major players like IBM, Google, IonQ, and Rigetti focusing on gate-based approaches. This competition poses a significant challenge to D-Wave's long-term growth and market share.

Technological Advancements and Future Roadmap

D-Wave continues to invest heavily in research and development, aiming to improve its quantum annealers and expand their capabilities.

-

Key Technological Milestones: D-Wave has steadily increased the number of qubits in its systems, improving performance and tackling larger, more complex problems. Ongoing research focuses on enhancing coherence times (the length of time qubits maintain their quantum state) and improving the overall system architecture.

-

Potential Future Applications: Future technological advancements could open doors to new applications for D-Wave's technology, extending its reach beyond its current niche. Improved qubit count and coherence times could allow for solving larger and more complex optimization problems, potentially transforming industries like drug discovery and artificial intelligence.

Assessing the Investment Risks and Rewards

Investing in QBTS requires careful consideration of the financial realities and inherent risks within the quantum computing sector.

Financial Performance and Valuation

D-Wave's financial performance is crucial for assessing its investment viability. While the company has secured funding and partnerships, it’s important to analyze its revenue generation, profitability, and overall financial health.

- Key Financial Figures: Investors should carefully examine D-Wave's revenue streams, operating expenses, and debt levels. Analyzing these figures, along with its path to profitability, offers a clearer picture of its financial stability. Furthermore, monitoring its stock performance and market capitalization provides insights into investor sentiment.

Competitive Landscape and Technological Disruption

The rapid advancement in quantum computing technology presents significant risks for D-Wave.

- Key Competitors: Companies like IBM, Google, and IonQ are pursuing gate-based approaches that, if successful, could render D-Wave's technology less relevant. Technological breakthroughs in gate-based systems could significantly impact D-Wave's market position.

Regulatory and Legal Considerations

The regulatory environment surrounding quantum computing is still evolving.

- Relevant Regulations: Investors need to be aware of any existing or potential regulations that could affect D-Wave's operations or its technology's adoption. Potential legal challenges related to intellectual property or data security also present risks.

Conclusion

Investing in D-Wave Quantum (QBTS) presents a unique opportunity within the exciting but still nascent field of quantum computing. While D-Wave's focus on quantum annealing offers specific advantages, the technology faces competition from gate-based approaches, and the long-term financial outlook requires careful consideration. Understanding the technological landscape, assessing the company's financial performance, and recognizing inherent risks are crucial before making any investment decisions.

Call to Action: Before investing in D-Wave Quantum (QBTS) or any quantum computing stock, conduct thorough due diligence, consult with a financial advisor, and carefully weigh the potential rewards against the significant risks involved. Further research into the intricacies of quantum computing and D-Wave’s specific technology will help you make an informed decision about whether a D-Wave Quantum investment is right for you.

Featured Posts

-

Us Navy Corruption Four Star Admiral Sentenced

May 21, 2025

Us Navy Corruption Four Star Admiral Sentenced

May 21, 2025 -

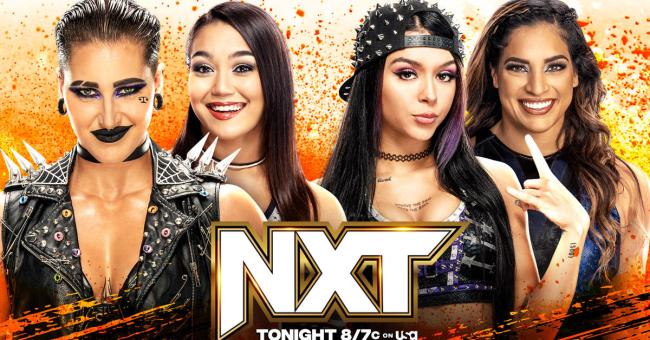

Rhea Ripley And Roxanne Perez Road To The 2025 Money In The Bank Ladder Match

May 21, 2025

Rhea Ripley And Roxanne Perez Road To The 2025 Money In The Bank Ladder Match

May 21, 2025 -

Heres How Michael Strahan Might Have Secured A Major Interview During The Ratings War

May 21, 2025

Heres How Michael Strahan Might Have Secured A Major Interview During The Ratings War

May 21, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 21, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 21, 2025 -

Corruption Scandal Rocks Navy Four Star Admiral Found Guilty

May 21, 2025

Corruption Scandal Rocks Navy Four Star Admiral Found Guilty

May 21, 2025

Latest Posts

-

8 6 Thriller Tigers Prove Doubters Wrong Against Rockies

May 22, 2025

8 6 Thriller Tigers Prove Doubters Wrong Against Rockies

May 22, 2025 -

Delayed Ruling Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 22, 2025

Delayed Ruling Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 22, 2025 -

Rockies Vs Tigers 8 6 Upset Shows Promise For Detroit

May 22, 2025

Rockies Vs Tigers 8 6 Upset Shows Promise For Detroit

May 22, 2025 -

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 22, 2025

Ex Tory Councillors Wife Faces Delay In Racial Hatred Tweet Appeal

May 22, 2025 -

Lucy Connollys Appeal Against Racial Hatred Sentence Denied

May 22, 2025

Lucy Connollys Appeal Against Racial Hatred Sentence Denied

May 22, 2025