Is Foot Locker (FL) A Genuine Winner According To Jim Cramer?

Table of Contents

Jim Cramer's Past Statements on Foot Locker (FL)

Analyzing Cramer's Bullish and Bearish Calls

Pinpointing exact dates and quotes from Jim Cramer requires extensive archival research of his television appearances and writings. However, anecdotal evidence suggests that Cramer's opinions on Foot Locker have fluctuated over time, reflecting the dynamic nature of the retail and athletic footwear markets. He's likely mentioned Foot Locker in the context of broader market analyses, particularly when discussing the health of the consumer discretionary sector and the performance of other athletic apparel companies.

- Example: One can imagine a scenario where Cramer, during a period of strong consumer spending, expressed optimism about Foot Locker's prospects, citing positive sales figures and a renewed interest in classic sneaker styles.

- Example: Conversely, during periods of economic uncertainty or when major competitors like Nike or Adidas release disruptive new products, Cramer might have voiced concerns about Foot Locker's ability to maintain market share, leading to a more bearish outlook on the stock.

- Example: Assessing the accuracy of his past predictions would require tracking Foot Locker's stock price movements following his pronouncements. This analysis would reveal whether his bullish or bearish calls accurately predicted the subsequent price performance.

Foot Locker's (FL) Current Financial Performance

Key Financial Indicators

To gauge Foot Locker's current health, we need to look at several key financial indicators. Analyzing recent quarterly and annual reports is crucial for a comprehensive understanding. This analysis should include:

- Revenue Growth or Decline: Examining the trend in Foot Locker's revenue over the past few years will reveal whether the company is experiencing growth or decline. A chart illustrating this trend would visually highlight any significant changes.

- Profitability Margins: Analyzing gross and net profit margins helps assess the company's efficiency and ability to generate profits from its sales. Decreasing margins might indicate increased competition or rising costs.

- Debt-to-Equity Ratio: This ratio shows the proportion of Foot Locker's financing that comes from debt versus equity. A high ratio might suggest a higher level of financial risk. Further investigation into the company's debt structure and interest payments would provide additional insight.

Market Trends and Competitor Analysis

The Athletic Footwear Market Landscape

Foot Locker operates in a fiercely competitive market dominated by major brands like Nike, Adidas, and Under Armour. Understanding the dynamics of this landscape is crucial to assessing Foot Locker's prospects.

- Market Growth or Decline: The overall growth rate of the athletic footwear market influences Foot Locker's potential. A declining market would put pressure on the company's sales and profitability.

- Market Share Comparison: Analyzing Foot Locker's market share relative to its major competitors reveals its competitive position and potential for future growth. A shrinking market share could signal difficulties in competing effectively.

- Emerging Trends: Factors like the increasing popularity of sustainable and ethically sourced products, the rise of online retail, and changing consumer preferences (e.g., towards specific brands or styles) can significantly impact Foot Locker's future performance.

Expert Opinions and Analyst Ratings

Diversifying Perspectives Beyond Cramer

While Jim Cramer's perspective is valuable, it's important to consider a broader range of expert opinions. Consulting financial analyst reports and ratings provides a more balanced view.

- Average Analyst Rating: The average rating assigned to Foot Locker stock by various financial analysts provides a consensus view. A higher rating generally indicates more optimism about the stock's future performance.

- Price Targets: Analysts often provide price targets, which represent their estimations of the stock's future price. Comparing these targets to the current stock price helps assess the potential upside or downside.

- Dissenting Opinions: It's essential to identify any dissenting opinions or alternative perspectives, as these can highlight potential risks or opportunities not captured in the consensus view.

Conclusion

Determining whether Foot Locker (FL) is a "genuine winner" according to Jim Cramer requires a nuanced approach. While pinpointing specific past statements from Cramer necessitates further research, analyzing Foot Locker's current financial performance, the competitive athletic footwear landscape, and the opinions of various financial analysts paints a more complete picture. A thorough evaluation of these factors is necessary to form an informed opinion, independent of any single pundit's commentary.

While Jim Cramer's insights can be valuable, remember to conduct your own due diligence on Foot Locker (FL) before investing. Understanding the financial performance of Foot Locker and the broader market trends is critical to informed decision-making. Consider diversifying your investment portfolio and consult with a qualified financial advisor before making any investment in Foot Locker stock or any other stock. Thorough research on Foot Locker's FL investment opportunities is key to successful investing.

Featured Posts

-

Reno Boxing Revival Led By Heavyweight Champion

May 15, 2025

Reno Boxing Revival Led By Heavyweight Champion

May 15, 2025 -

Scrutinizing Bidens Statements A Washington Examiner Perspective

May 15, 2025

Scrutinizing Bidens Statements A Washington Examiner Perspective

May 15, 2025 -

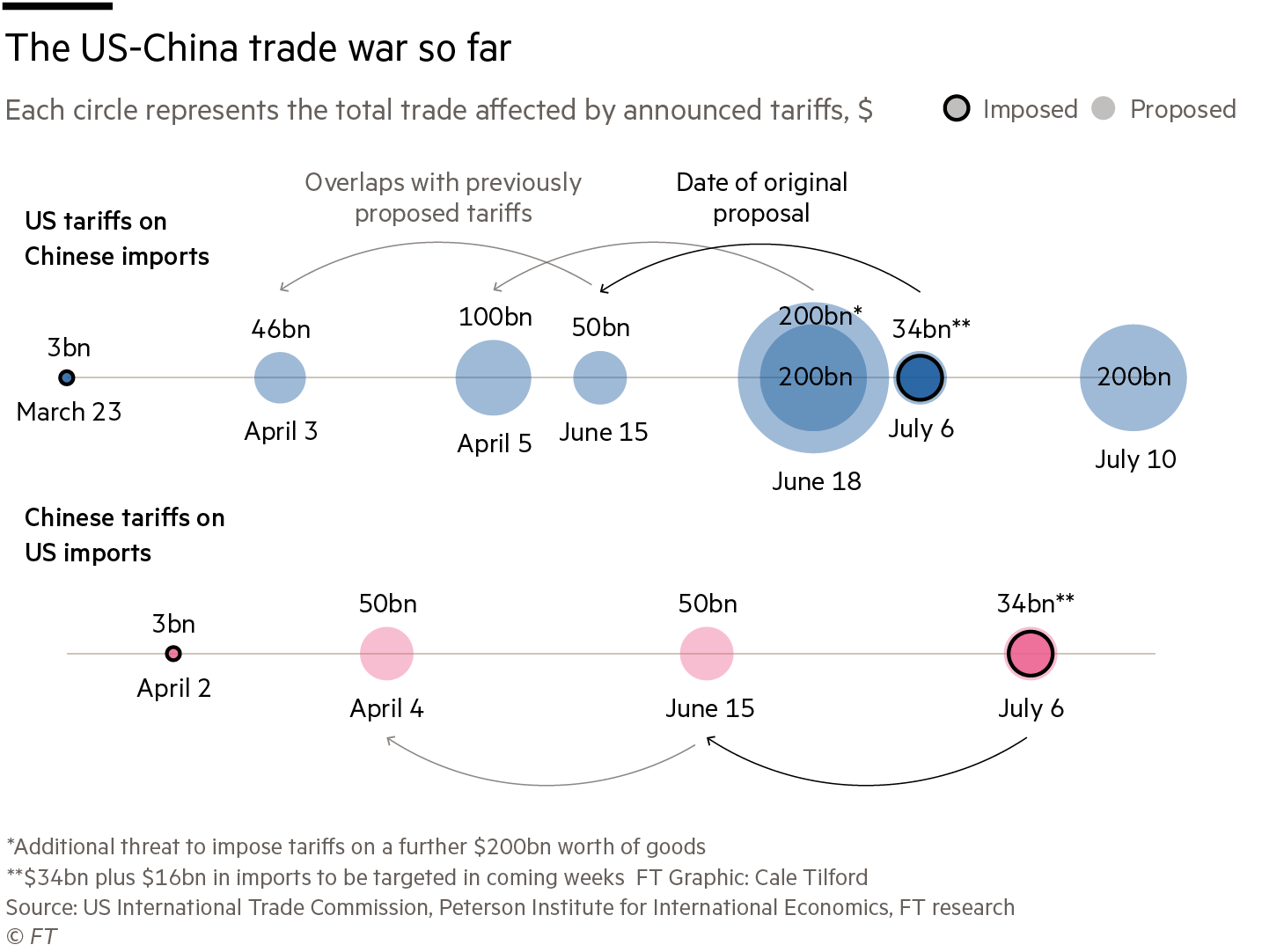

The Us And China Trade Dispute A Comprehensive Analysis Of The Resolution

May 15, 2025

The Us And China Trade Dispute A Comprehensive Analysis Of The Resolution

May 15, 2025 -

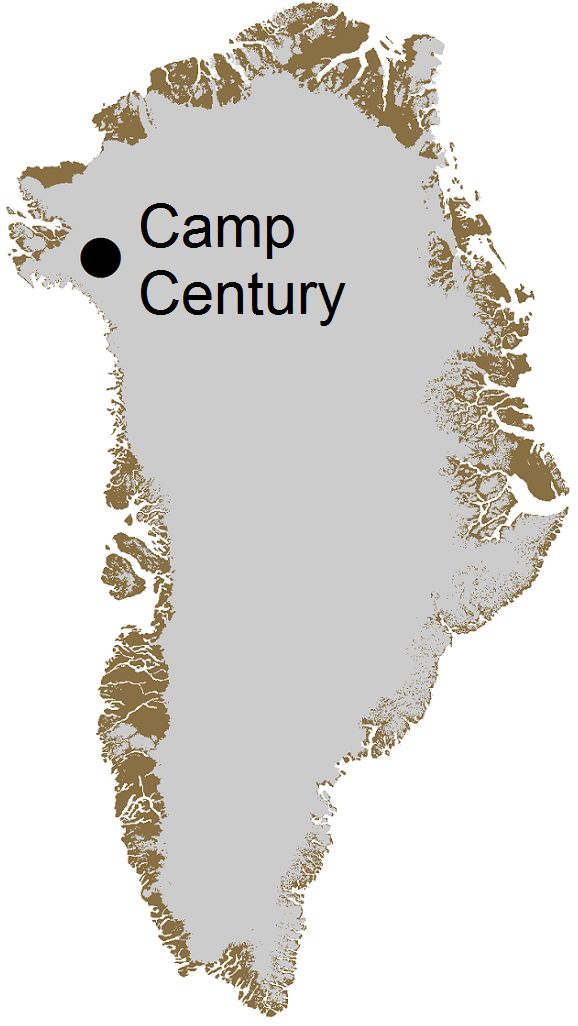

A Cold War Relic Investigating The Greenland Ice Base Conspiracy

May 15, 2025

A Cold War Relic Investigating The Greenland Ice Base Conspiracy

May 15, 2025 -

Leeflang Zaak Bruins En Npo Moeten Toezichthouder Raadplegen

May 15, 2025

Leeflang Zaak Bruins En Npo Moeten Toezichthouder Raadplegen

May 15, 2025