Is Increasing Federal Debt Making Mortgages More Expensive?

Table of Contents

The Relationship Between Government Debt and Interest Rates

The most direct link between increasing federal debt and mortgage costs lies in its effect on interest rates.

How Government Borrowing Impacts Interest Rates

When the government borrows money to finance the national debt, it increases the demand for loanable funds. This increased demand competes with other borrowers, including banks and mortgage lenders, pushing interest rates upward.

- Increased Competition for Funds: The government's borrowing competes with private sector borrowing, creating a "crowding out" effect where private investment is reduced due to higher interest rates.

- Effect on the Bond Market: The government issues Treasury bonds to finance its debt. Increased issuance of these bonds can impact the yield curve, affecting the interest rates at which banks borrow and lend. A steeper yield curve generally suggests higher long-term interest rates, impacting mortgage rates.

- Supply and Demand Dynamics: A simple supply and demand model illustrates the impact. Increased demand for loanable funds (due to government borrowing) shifts the demand curve to the right, resulting in higher equilibrium interest rates.

The Federal Reserve's Role

The Federal Reserve (the Fed) plays a crucial role in influencing interest rates. Its response to rising national debt significantly impacts mortgage rates.

- Federal Funds Rate: The Fed can raise the federal funds rate (the target rate for overnight lending between banks) to combat inflation potentially fueled by increased government spending. Higher federal funds rates indirectly increase mortgage rates.

- Quantitative Easing (QE): During periods of economic crisis, the Fed might use QE, purchasing government bonds to increase the money supply and lower long-term interest rates. However, QE can also contribute to inflation in the long run, potentially leading to future rate hikes.

- Inflationary Pressures: Increased government spending, often financed by borrowing, can lead to demand-pull inflation (increased demand exceeding supply) or cost-push inflation (rising input costs passed onto consumers). The Fed often responds to inflation by raising interest rates, impacting mortgage rates.

Inflation's Effect on Mortgage Costs

Inflation and mortgage rates are directly correlated. Higher inflation generally prompts central banks, including the Fed, to raise interest rates to control price increases.

Inflation and Mortgage Rates

- Consumer Price Index (CPI): The CPI measures the average change in prices paid by urban consumers for a basket of consumer goods and services. Higher CPI indicates inflation, often prompting the Fed to increase interest rates, impacting mortgage rates.

- Inflation's Impact on Housing Prices: Inflation doesn't just affect interest rates; it also directly impacts housing prices. Increased construction costs and material prices, fueled by inflation, contribute to higher home prices, making mortgages more expensive even if interest rates remain stable.

The Impact of Increased Government Spending on Inflation

Increased government spending, often funded through borrowing, can contribute to inflationary pressures.

- Demand-Pull Inflation: Increased government spending can stimulate aggregate demand, potentially outpacing the economy's capacity to produce goods and services, leading to demand-pull inflation.

- Cost-Push Inflation: Increased government borrowing can lead to higher interest rates, increasing the cost of borrowing for businesses. These increased costs can be passed onto consumers in the form of higher prices, contributing to cost-push inflation.

Other Factors Affecting Mortgage Rates

While increasing federal debt can influence mortgage rates, it's crucial to remember that other factors play a significant role.

Supply and Demand in the Housing Market

The availability of housing significantly impacts mortgage rates and affordability.

- Housing Shortages: Limited housing supply in certain areas drives up home prices, making mortgages more expensive regardless of interest rates.

- Population Growth: Increased population in specific regions can exacerbate housing shortages, further driving up prices and mortgage costs.

Credit Scores and Lending Practices

Individual borrower creditworthiness and lending institution practices are crucial in determining mortgage rates.

- Prime vs. Subprime Mortgages: Borrowers with higher credit scores (prime borrowers) receive more favorable interest rates than those with lower credit scores (subprime borrowers).

- Stricter Lending Standards: More stringent lending practices can make it harder for some borrowers to secure a mortgage, but they can also contribute to lower overall risk for lenders, potentially influencing rates.

Conclusion

Increasing federal debt can contribute to higher interest rates through increased competition for loanable funds and the Fed's response to potential inflation. Inflation itself directly impacts both interest rates and housing prices, further increasing mortgage costs. However, it's vital to recognize that factors like housing supply and demand and individual borrower creditworthiness also significantly influence mortgage affordability. Understanding the complexities of the relationship between increasing federal debt and mortgages is crucial for navigating today's housing market. To further your understanding, explore government financial data and reputable financial websites for in-depth analysis on interest rates, inflation, and the housing market.

Featured Posts

-

What Macron Can Teach Merz About The Far Right

May 19, 2025

What Macron Can Teach Merz About The Far Right

May 19, 2025 -

The Academy Dublin Marcus And Martinus Concert Date Announced

May 19, 2025

The Academy Dublin Marcus And Martinus Concert Date Announced

May 19, 2025 -

A Tech Billionaires Spreadsheet Exposing The Woke Policies In France

May 19, 2025

A Tech Billionaires Spreadsheet Exposing The Woke Policies In France

May 19, 2025 -

Solving Todays Nyt Mini Crossword The Marvel Avengers Clue

May 19, 2025

Solving Todays Nyt Mini Crossword The Marvel Avengers Clue

May 19, 2025 -

Blue Origin Rocket Launch Cancelled A Subsystem Malfunction Investigation

May 19, 2025

Blue Origin Rocket Launch Cancelled A Subsystem Malfunction Investigation

May 19, 2025

Latest Posts

-

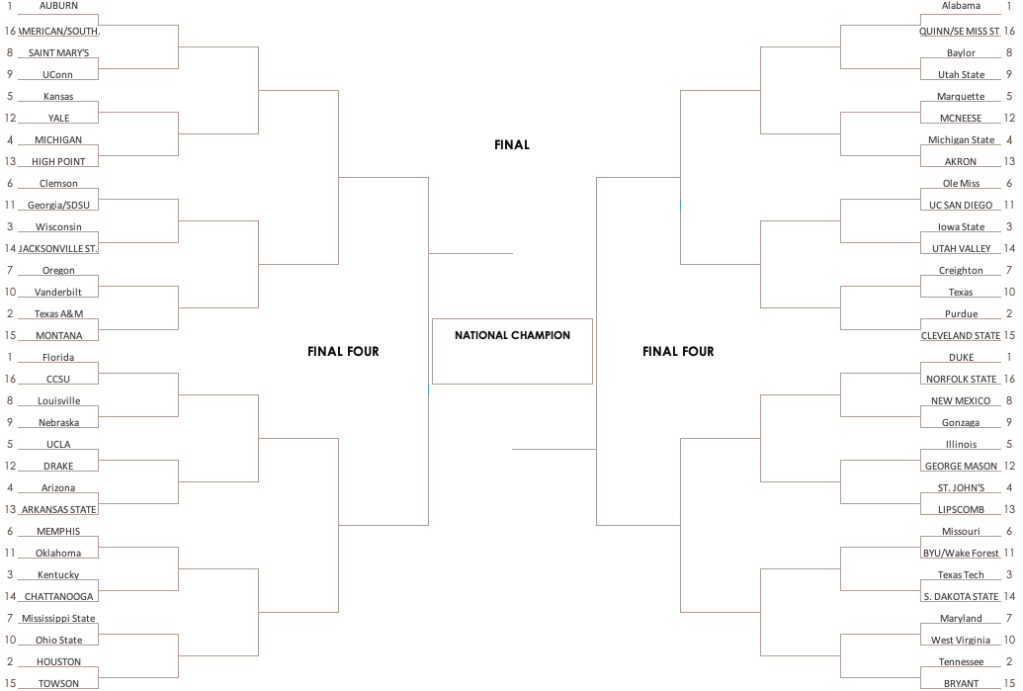

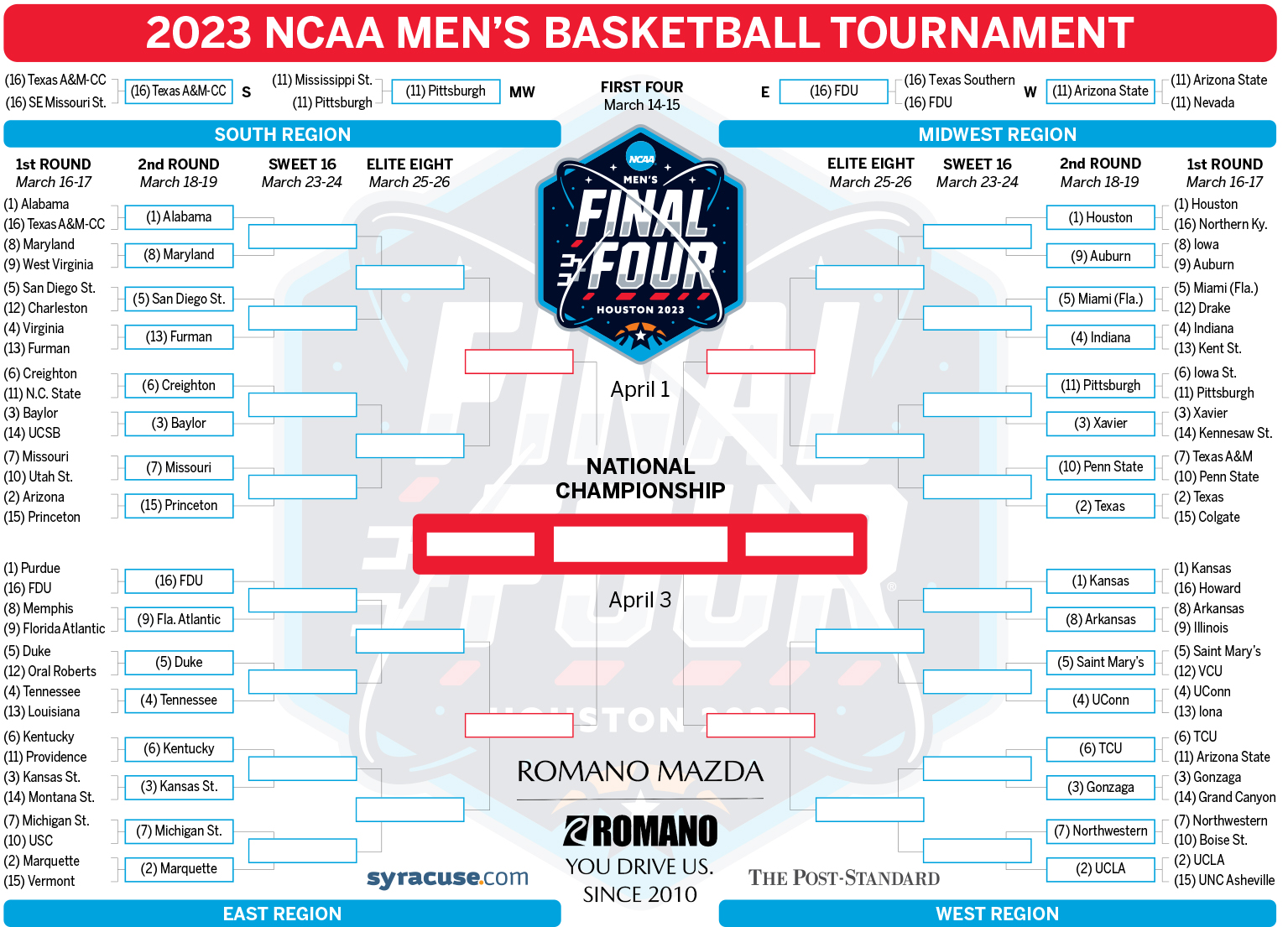

Lipscombs Ncaa Tournament Appearances History And Bracketology

May 19, 2025

Lipscombs Ncaa Tournament Appearances History And Bracketology

May 19, 2025 -

Where Is Lipscomb In The Ncaa Tournament A Complete Guide

May 19, 2025

Where Is Lipscomb In The Ncaa Tournament A Complete Guide

May 19, 2025 -

Lipscomb University Ncaa Tournament History A Bracketology Update

May 19, 2025

Lipscomb University Ncaa Tournament History A Bracketology Update

May 19, 2025 -

Analyzing The Latest Mlb Trade Rumors Luis Robert Jr Pirates And Arenado

May 19, 2025

Analyzing The Latest Mlb Trade Rumors Luis Robert Jr Pirates And Arenado

May 19, 2025 -

Libraries In Crisis Staff And Service Reductions After Agency Closure

May 19, 2025

Libraries In Crisis Staff And Service Reductions After Agency Closure

May 19, 2025