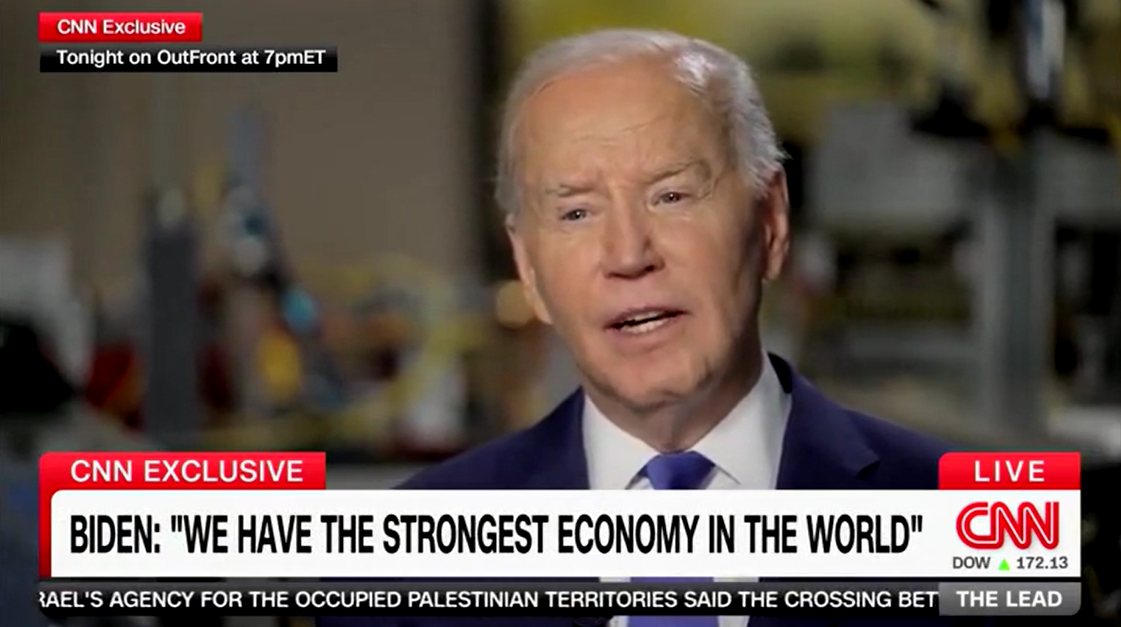

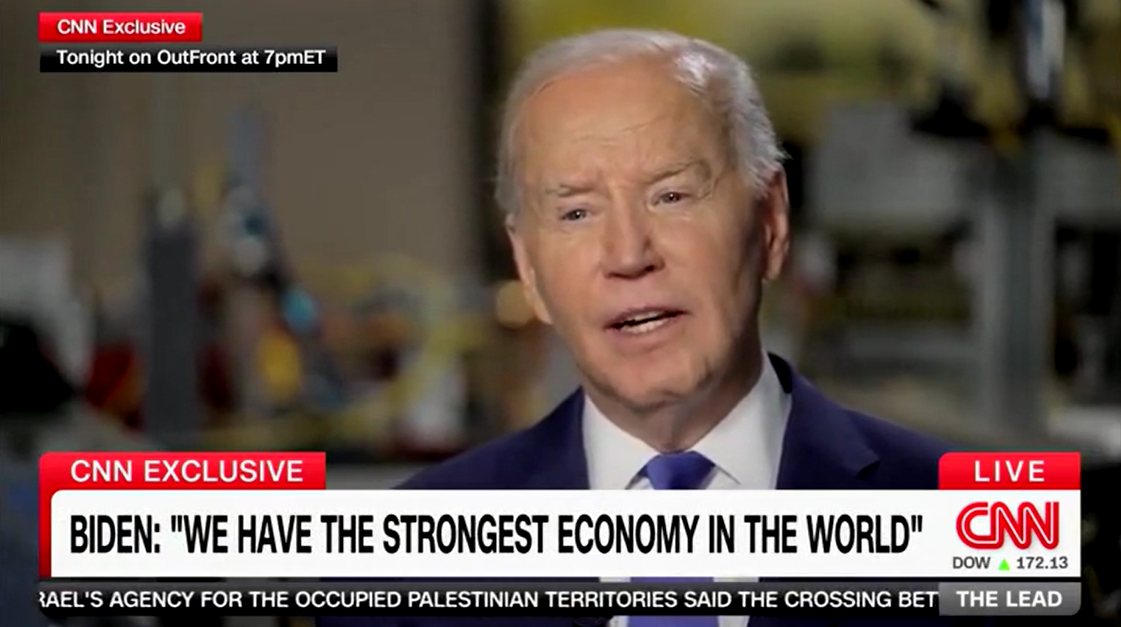

Is Joe Biden Responsible For The Slowing US Economy? A Critical Analysis

Table of Contents

Biden's Economic Policies and Their Impact

President Biden's administration has implemented several significant economic policies, each with potential impacts on the current economic slowdown. Let's examine their effects:

The American Rescue Plan (ARP)

The ARP, a massive stimulus package enacted in early 2021, aimed to alleviate the economic fallout from the COVID-19 pandemic.

- Increased Government Spending: The ARP injected trillions of dollars into the US economy through direct payments, enhanced unemployment benefits, and aid to state and local governments.

- Impact on Inflation: Critics argue that this substantial increase in government spending fueled inflation, contributing to the current economic slowdown. Data from the Bureau of Labor Statistics shows a sharp rise in inflation following the ARP's implementation. [Link to BLS data]. Proponents, however, contend that the ARP was necessary to prevent a deeper economic crisis and that the inflation surge was also driven by global factors.

- Arguments for and Against its Effectiveness: The effectiveness of the ARP remains a subject of ongoing debate. While it undoubtedly provided crucial short-term relief, its long-term impact on inflation and economic growth is still unfolding. Further analysis is needed to fully assess its overall contribution to the current economic situation.

Infrastructure Investment and Jobs Act

This bipartisan bill aims to modernize the nation's infrastructure through significant investments in roads, bridges, public transit, broadband internet, and the electric grid.

- Projected Job Creation: The act is projected to create millions of jobs over the next decade, boosting economic growth in the long term. [Link to relevant government report on job projections].

- Potential for Supply Chain Improvements: Improved infrastructure could enhance supply chain efficiency, reducing transportation costs and easing inflationary pressures.

- Potential Delays and Cost Overruns: Large-scale infrastructure projects are often prone to delays and cost overruns, potentially impacting the timeline and overall effectiveness of the plan. Careful monitoring and management will be crucial to mitigate these risks.

Other Key Policy Decisions

Beyond the ARP and the infrastructure bill, other Biden administration policies have influenced the economy. These include tax changes (e.g., corporate tax increases) and regulatory measures impacting various sectors. The net effect of these policies on economic growth is complex and requires detailed analysis considering their impacts on different economic sectors and compared to preceding administrations' approaches. [Link to relevant policy documents and analyses].

Global Factors Affecting the US Economy

The US economy is deeply intertwined with the global economy. Several global factors have significantly contributed to the current slowdown:

The War in Ukraine

The Russian invasion of Ukraine has had profound global repercussions, significantly affecting the US economy.

- Increased Energy Costs: The war disrupted global energy markets, leading to a surge in oil and gas prices, increasing inflation and impacting consumer spending.

- Disruptions to Global Trade: The conflict has caused major disruptions to global supply chains, further exacerbating existing inflationary pressures.

- Impact on Consumer Confidence: Geopolitical uncertainty stemming from the war has negatively impacted consumer confidence, leading to reduced spending.

Global Supply Chain Disruptions

Supply chain disruptions, beginning even before the war in Ukraine, continue to plague the global economy.

- Shortages of Goods: The scarcity of goods, from microchips to consumer products, has driven up prices and hampered economic activity.

- Increased Transportation Costs: High shipping costs and logistical bottlenecks have further added to inflationary pressures.

- Impact on Manufacturing and Consumer Prices: The combination of shortages and high transportation costs has significantly impacted manufacturing and driven up consumer prices. [Link to data on shipping costs and inventory levels].

Global Inflationary Pressures

Global inflation is a significant factor in the US economic slowdown.

- Comparison of US Inflation with Other Countries: While the US has experienced significant inflation, many other countries are facing similar challenges. [Link to global inflation data].

- Impact of Global Commodity Prices: The surge in global commodity prices, driven by factors such as the war in Ukraine and supply chain disruptions, has significantly fueled inflation worldwide. [Link to charts illustrating global inflation trends].

Other Contributing Factors

Beyond Biden's policies and global factors, several other elements contribute to the slowing US economy:

The Pandemic's Lingering Effects

The COVID-19 pandemic continues to cast a long shadow on the US economy.

- Labor Shortages: The pandemic led to significant labor shortages in many sectors, hampering economic activity.

- Shifts in Consumer Spending: Consumer spending patterns have shifted significantly, impacting certain industries more than others.

- Lingering Health Concerns: Continued health concerns among some segments of the population have impacted labor participation and consumer behavior. [Link to data on unemployment rates and consumer spending].

Interest Rate Hikes

The Federal Reserve's efforts to combat inflation through interest rate hikes have also played a role in the economic slowdown.

- Effects on Borrowing Costs: Higher interest rates increase borrowing costs for businesses and consumers, dampening investment and spending.

- Impact on Investment and Consumer Spending: Reduced investment and consumer spending contribute to slower economic growth. [Include information on the Federal Reserve's monetary policy and its stated goals].

Conclusion

This analysis reveals that attributing the slowing US economy solely to President Biden's policies is an oversimplification. The current economic situation is a complex interplay of domestic policies, global events, and lingering effects of the pandemic. While the American Rescue Plan, the Infrastructure Investment and Jobs Act, and other policy decisions have undoubtedly had an impact, global factors such as the war in Ukraine, supply chain disruptions, and global inflationary pressures have played a significant, and perhaps more dominant, role. Further research and nuanced discussions are vital for a complete understanding.

While this analysis provides valuable insights into the slowing US economy and the role of various factors including President Biden’s policies, further research and discussion are vital. Continue to explore different perspectives on the issue to form your own informed opinion on whether Joe Biden is responsible for the slowing US economy. Engage in thoughtful discussions about the effectiveness of current economic policies and the potential for future improvement.

Featured Posts

-

Fox News Faces Defamation Lawsuit From Trump Supporter Ray Epps Over Jan 6th Coverage

May 02, 2025

Fox News Faces Defamation Lawsuit From Trump Supporter Ray Epps Over Jan 6th Coverage

May 02, 2025 -

Enexis Weigert Aansluiting Kampen Start Kort Geding

May 02, 2025

Enexis Weigert Aansluiting Kampen Start Kort Geding

May 02, 2025 -

School Desegregation Order Terminated Analysis And Potential Impact

May 02, 2025

School Desegregation Order Terminated Analysis And Potential Impact

May 02, 2025 -

Targets Revised Dei Efforts A Deep Dive Into The Negative Consumer Reaction

May 02, 2025

Targets Revised Dei Efforts A Deep Dive Into The Negative Consumer Reaction

May 02, 2025 -

Riot Fest 2025 Full Lineup Announcement With Green Day And Weezer

May 02, 2025

Riot Fest 2025 Full Lineup Announcement With Green Day And Weezer

May 02, 2025

Latest Posts

-

The Rupert Lowe Debate Perspectives From Great Yarmouth

May 02, 2025

The Rupert Lowe Debate Perspectives From Great Yarmouth

May 02, 2025 -

Local Voices The Impact Of The Rupert Lowe Issue On Great Yarmouth

May 02, 2025

Local Voices The Impact Of The Rupert Lowe Issue On Great Yarmouth

May 02, 2025 -

Great Yarmouths Rupert Lowe Row A Community Speaks Out

May 02, 2025

Great Yarmouths Rupert Lowe Row A Community Speaks Out

May 02, 2025 -

Great Yarmouth Residents React To Rupert Lowe Dispute

May 02, 2025

Great Yarmouth Residents React To Rupert Lowe Dispute

May 02, 2025 -

Former Uk Mp Rupert Lowe Analysis Of Evidence Related To Toxic Workplace Claims

May 02, 2025

Former Uk Mp Rupert Lowe Analysis Of Evidence Related To Toxic Workplace Claims

May 02, 2025