Is Lack Of Funds Holding You Back? Practical Solutions

Table of Contents

Creating a Realistic Budget

The first step to conquering financial strain is understanding where your money goes. Creating a realistic budget is crucial for achieving financial freedom.

Tracking Your Spending

Understanding your spending habits is the foundation of effective budgeting. Use budgeting apps (like Mint or YNAB), spreadsheets, or even a simple notebook to meticulously track your expenses for at least a month.

- Identify areas of overspending: Pinpoint categories where you're spending more than you'd like. Are you eating out too much? Subscribing to services you rarely use?

- Categorize expenses: Organize your spending into clear categories (housing, food, transportation, entertainment, debt payments, etc.). This provides a clearer picture of your financial landscape.

- Analyze spending patterns: Look for trends and recurring expenses. This analysis will reveal unnecessary spending and areas for potential savings.

Setting Financial Goals

Defining clear financial goals provides direction and motivation. These goals will guide your budgeting decisions and help you stay focused on your long-term financial freedom.

- Examples: An emergency fund (covering 3-6 months of expenses), paying off high-interest debt, saving for a down payment on a house, or planning for retirement.

- Set SMART goals: Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of "pay off debt," aim for "pay off $5,000 in credit card debt within 12 months."

Allocating Your Resources

Once you understand your spending and have defined your goals, allocate your resources effectively. Prioritize essential expenses (housing, food, utilities) and find ways to trim non-essential spending.

- Create a budget that aligns with your income and goals: Ensure your spending plan reflects your income and supports your financial aspirations.

- Explore different budgeting methods: Consider the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment), zero-based budgeting (allocating every dollar), or envelope budgeting (assigning cash to specific categories).

Strategies for Reducing Debt

High levels of debt significantly contribute to financial strain. Implementing effective debt reduction strategies is essential for achieving financial freedom.

Debt Consolidation

Combining multiple debts into a single loan can simplify repayment and potentially lower your interest rate.

- Research different consolidation options: Explore balance transfer credit cards (with low introductory APRs) and personal loans.

- Compare interest rates and fees: Carefully compare the terms and conditions before choosing a consolidation option. Be aware of potential fees and the length of the repayment period.

Debt Snowball or Avalanche Method

Choose a debt repayment strategy that suits your personality and financial situation.

- Debt Snowball Method: Pay off the smallest debt first, regardless of interest rate, for a quick win and motivational boost.

- Debt Avalanche Method: Prioritize paying off the debt with the highest interest rate first to save money in the long run.

- Implement your chosen method consistently: Dedicate extra funds to your target debt while making minimum payments on others.

Negotiating with Creditors

Don't be afraid to reach out to your creditors. They may be willing to negotiate more favorable payment terms.

- Explain your financial situation honestly and respectfully: Clearly outline your challenges and propose a solution, such as a lower interest rate or an extended payment plan.

- Document everything: Keep records of all communications and agreements with your creditors.

Increasing Your Income

Increasing your income can significantly alleviate financial strain and accelerate your journey towards financial freedom.

Exploring Additional Income Streams

Look for opportunities to supplement your primary income.

- Identify your skills and talents: What are you good at? Can you offer services like tutoring, freelance writing, graphic design, or virtual assistance?

- Explore online platforms: Use freelance marketplaces like Upwork and Fiverr to find clients and projects.

- Consider a side hustle: Start a small business based on your passions and skills. This could be anything from selling crafts on Etsy to offering pet-sitting services.

Negotiating a Raise

If you're employed, research industry standards for your position and confidently discuss your contributions and value with your employer.

- Document your achievements: Keep track of your successes and contributions to the company.

- Prepare a case for a salary increase: Highlight your performance, skills, and market value.

Improving Your Skills

Invest in your education and professional development to enhance your earning potential.

- Take online courses or workshops: Platforms like Coursera, Udemy, and LinkedIn Learning offer numerous affordable courses.

- Pursue further education or certifications: Investing in your skills can lead to better job opportunities and higher earning potential.

Conclusion

Overcoming a lack of funds requires a proactive and multifaceted approach. By implementing strategies to create a realistic budget, reduce debt, and increase your income, you can take control of your finances and achieve financial freedom. Remember, it’s a journey, not a race. Start with small, manageable steps, and celebrate your progress along the way. Don’t let a lack of funds hold you back any longer – take action today and start building a brighter financial future! Learn more about effective financial solutions and start planning your financial success.

Featured Posts

-

Understanding Cassis Blackcurrant From Berry To Bottle

May 22, 2025

Understanding Cassis Blackcurrant From Berry To Bottle

May 22, 2025 -

De La Suisse A Paris Le Nouveau Defi De Stephane

May 22, 2025

De La Suisse A Paris Le Nouveau Defi De Stephane

May 22, 2025 -

Warner Bros Film Adaptation Of Popular Reddit Story Casts Sydney Sweeney

May 22, 2025

Warner Bros Film Adaptation Of Popular Reddit Story Casts Sydney Sweeney

May 22, 2025 -

Brasserie Hell City Idealement Situee Pour Le Hellfest A Clisson

May 22, 2025

Brasserie Hell City Idealement Situee Pour Le Hellfest A Clisson

May 22, 2025 -

Analiz Rinku Finansovikh Poslug Ukrayini Uspikh Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U 2024 Rotsi

May 22, 2025

Analiz Rinku Finansovikh Poslug Ukrayini Uspikh Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U 2024 Rotsi

May 22, 2025

Latest Posts

-

New Challenger Targets Trans Australia Run World Record

May 22, 2025

New Challenger Targets Trans Australia Run World Record

May 22, 2025 -

Trans Australia Run New Challenger Eyes Record

May 22, 2025

Trans Australia Run New Challenger Eyes Record

May 22, 2025 -

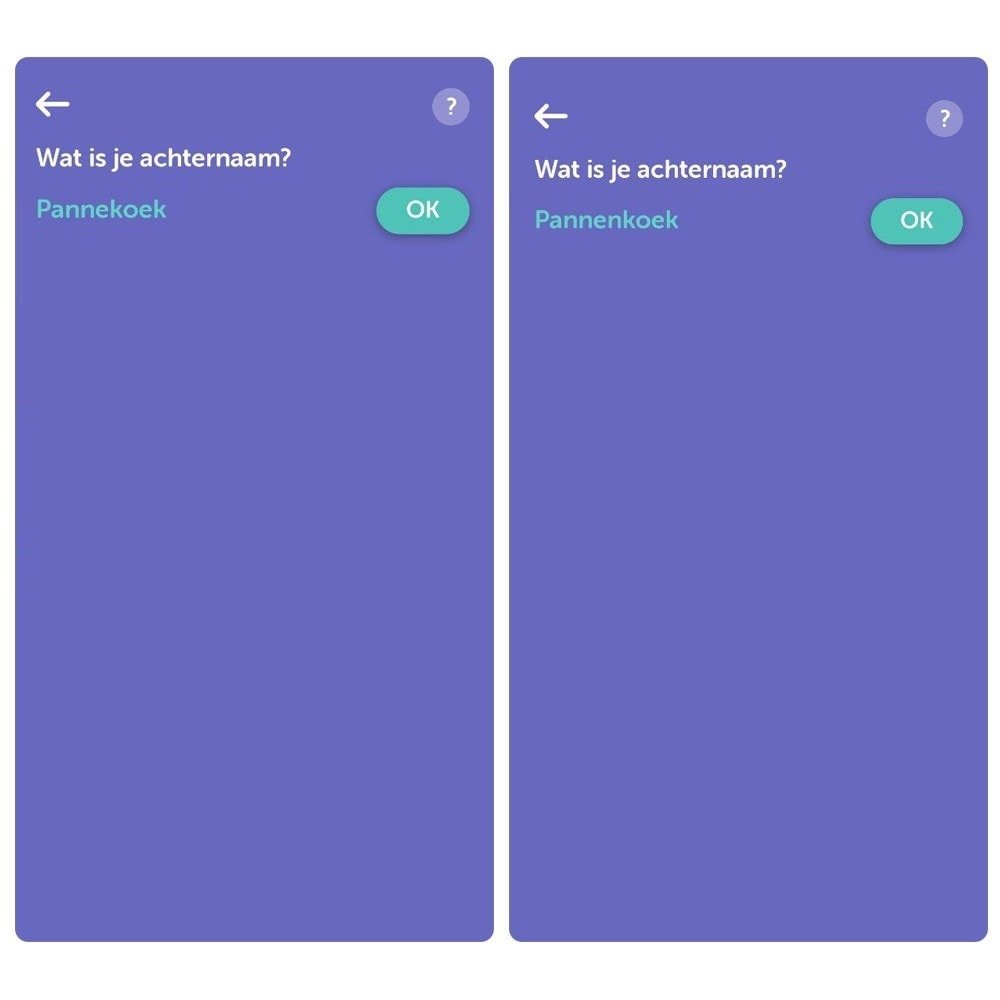

De Voordelen Van Tikkie Voor Nederlandse Gebruikers

May 22, 2025

De Voordelen Van Tikkie Voor Nederlandse Gebruikers

May 22, 2025 -

Alles Over Tikkie Betalen In Nederland

May 22, 2025

Alles Over Tikkie Betalen In Nederland

May 22, 2025 -

Bbc Antiques Roadshow Couples National Treasure Trafficking Conviction

May 22, 2025

Bbc Antiques Roadshow Couples National Treasure Trafficking Conviction

May 22, 2025