Is Live Now, Pay Later Right For Your Budget? A Comprehensive Review

Table of Contents

Understanding Live Now, Pay Later Services

How BNPL Works

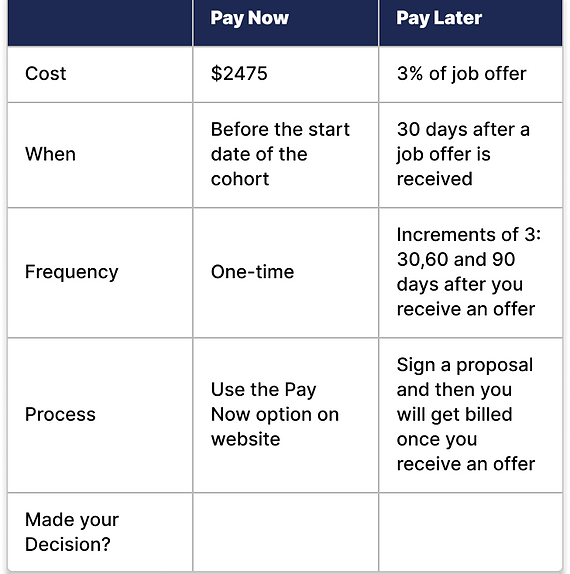

Live now, pay later, also known as installment payment plans or point-of-sale financing, allows you to purchase goods and services and pay for them in installments over a short period. While some BNPL providers offer interest-free options, others may charge late payment fees or interest if payments aren't made on time. These deferred payment options often involve a series of fixed payments spread across a few weeks or months.

- Typical repayment periods: Most BNPL services offer repayment plans ranging from 4 to 6 weeks, occasionally extending to longer terms.

- Potential late payment fees: Missed or late payments can result in significant fees, quickly escalating the cost of your purchase.

- Credit score implications: While some BNPL providers don't report to credit bureaus, others do, and missed payments can negatively impact your credit score. Responsible use, however, can sometimes have a positive impact.

- Examples of popular BNPL providers: Klarna, Afterpay, Affirm, and PayPal Pay in 4 are among the many popular live now, pay later options available.

BNPL and Budget Management

Benefits of BNPL for Budget-Conscious Shoppers

For budget-conscious shoppers, live now, pay later offers certain advantages. Spreading out the cost of larger purchases can make them more manageable, and for responsible users, it can be a preferable alternative to high-interest credit cards.

- Managing large expenses in smaller installments: Breaking down a significant expense into smaller, more manageable payments can ease the financial burden.

- Potential for better budgeting through planned repayments: The structured repayment schedule can help you better budget for the purchase, avoiding unexpected financial strain.

- Avoiding high-interest debt from credit cards: For those who manage their payments responsibly, BNPL can offer a lower-cost alternative to credit card debt.

Potential Downsides of BNPL for Budgets

Despite the potential benefits, budget-friendly payment options like BNPL also carry significant risks. Overspending, accumulating debt, and damaging your credit score are all real possibilities.

- Risk of accumulating debt if repayments are missed: Missed payments can quickly lead to accumulating debt and escalating fees.

- Impact on credit score (hard inquiries and late payments): Late payments can significantly hurt your credit score, impacting your ability to obtain loans or credit in the future.

- The temptation to overspend due to ease of access: The ease of using BNPL can tempt you to overspend, leading to financial difficulties.

- Hidden fees and interest charges that can quickly escalate costs: Always carefully review the terms and conditions to understand all fees and potential interest charges.

Alternatives to Live Now, Pay Later

Traditional Credit Cards

Credit cards offer more flexibility and often higher credit limits than BNPL services. However, they also carry higher interest rates if balances are carried over. Careful management is vital to avoid accumulating substantial debt.

Savings Plans

The most responsible approach is to save up for larger purchases before making them. This avoids debt and interest charges entirely. While it requires discipline, it's the most budget-friendly option in the long run.

- Interest rates comparison (BNPL vs. credit cards): Credit cards typically have higher interest rates than BNPL, but BNPL's late fees can quickly offset any interest savings.

- Flexibility and accessibility (BNPL vs. savings): BNPL and credit cards offer immediate access to funds, while savings require prior planning and saving.

- Long-term financial impact: Saving for purchases promotes responsible financial habits and avoids potential debt traps.

Determining if Live Now, Pay Later is Right for You

Factors to Consider

Before using live now, pay later services, ask yourself these critical questions:

- Can you comfortably afford the repayments? Ensure the monthly payments fit within your existing budget without compromising other essential expenses.

- Do you have a good track record of paying bills on time? Missed payments with BNPL can have severe consequences.

- Will using BNPL help or hinder your long-term financial goals? Consider the overall impact on your financial health.

- Are there alternative payment methods that might be better suited to your budget? Exploring other options, like savings or credit cards (used responsibly), might be more beneficial.

Conclusion

Live now, pay later services offer a convenient way to manage purchases, but they also carry substantial risks. Understanding the mechanics of BNPL, its potential benefits and drawbacks, and available alternatives is crucial. Responsible financial planning is key to avoiding debt and maintaining a healthy credit score. Before utilizing live now, pay later services, carefully consider your budget and financial goals to ensure responsible usage and explore alternative buy now, pay later options if necessary. Remember, responsible spending habits are crucial for long-term financial well-being.

Featured Posts

-

Andre Agassis Pro Pickleball Debut A Complete Analysis And Recap

May 30, 2025

Andre Agassis Pro Pickleball Debut A Complete Analysis And Recap

May 30, 2025 -

Experience Gorillaz The House Of Kong 25th Anniversary Exhibition

May 30, 2025

Experience Gorillaz The House Of Kong 25th Anniversary Exhibition

May 30, 2025 -

Juedischer Sport In Augsburg Rueckkehr Und Wiederaufbau Nach Dem Zweiten Weltkrieg

May 30, 2025

Juedischer Sport In Augsburg Rueckkehr Und Wiederaufbau Nach Dem Zweiten Weltkrieg

May 30, 2025 -

The Suppression Of Press Freedom In Sierra Leone The Bolle Jos Case

May 30, 2025

The Suppression Of Press Freedom In Sierra Leone The Bolle Jos Case

May 30, 2025 -

Apples Os Rename What To Expect

May 30, 2025

Apples Os Rename What To Expect

May 30, 2025

Latest Posts

-

Perspectives Boursieres De Sanofi L Analyse De Loeil Du Loup

May 31, 2025

Perspectives Boursieres De Sanofi L Analyse De Loeil Du Loup

May 31, 2025 -

Dren Bio Et Sanofi Collaboration Strategique Pour Le Traitement Des Maladies Immunologiques

May 31, 2025

Dren Bio Et Sanofi Collaboration Strategique Pour Le Traitement Des Maladies Immunologiques

May 31, 2025 -

Sanofi Quel Potentiel Boursier Reste T Il L Avis De Loeil Du Loup De Zurich

May 31, 2025

Sanofi Quel Potentiel Boursier Reste T Il L Avis De Loeil Du Loup De Zurich

May 31, 2025 -

Acquisition Majeure De Sanofi Un Nouvel Anticorps Bispecifique Ciblant Les Cellules Myeloides

May 31, 2025

Acquisition Majeure De Sanofi Un Nouvel Anticorps Bispecifique Ciblant Les Cellules Myeloides

May 31, 2025 -

Sanofi Croissance Continue Et Potentiel Boursier Analyse De Loeil Du Loup

May 31, 2025

Sanofi Croissance Continue Et Potentiel Boursier Analyse De Loeil Du Loup

May 31, 2025