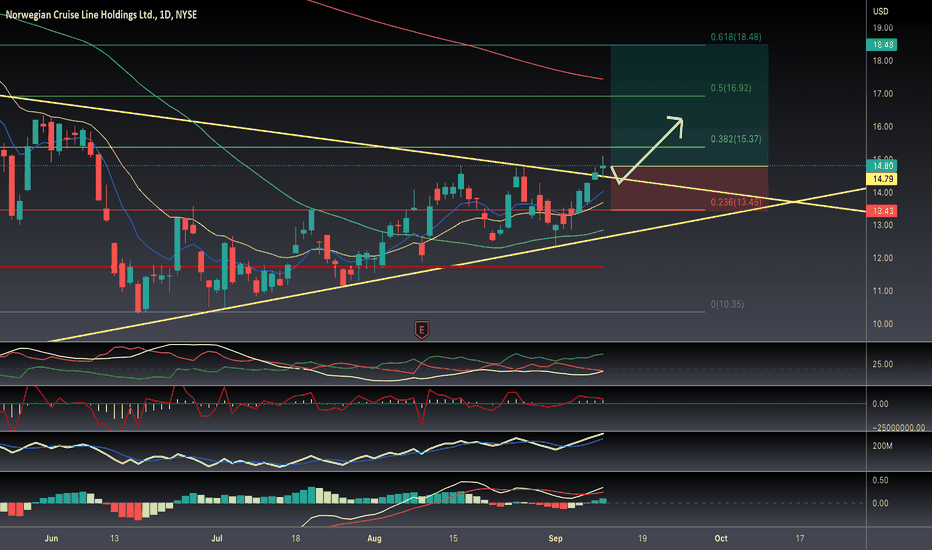

Is NCLH A Top Pick For Hedge Funds? Examining The Cruise Stock's Potential

Table of Contents

NCLH's Financial Performance and Future Outlook

Analyzing NCLH's financial health is crucial for assessing its investment potential. Recent financial reports provide insights into its revenue streams, profitability, and debt levels. While the pandemic severely impacted the cruise industry, leading to significant losses for NCLH, the post-pandemic recovery has been a key focus. Examining key financial metrics is essential for any investor considering NCLH stock.

- Revenue Growth Projections: NCLH's future revenue projections depend heavily on factors like booking trends, fuel costs, and global economic conditions. Analysts offer varying forecasts, so independent research is vital.

- Debt Reduction Strategies: NCLH has undertaken measures to reduce its debt burden, a significant factor influencing its financial stability and attractiveness to investors. Examining the effectiveness of these strategies is crucial.

- Market Share Analysis: NCLH's competitive position within the cruise industry significantly impacts its long-term prospects. Analyzing its market share against competitors like Carnival Corporation (CCL) and Royal Caribbean Cruises (RCL) is crucial.

- Competitive Landscape: The cruise industry is competitive. NCLH's ability to innovate, offer attractive itineraries, and manage operational costs will influence its future profitability. Understanding the competitive dynamics is therefore essential.

Keywords: NCLH financials, cruise industry recovery, NCLH revenue, profitability, debt-to-equity ratio, financial outlook.

Hedge Fund Interest in the Cruise Industry

The cruise industry, despite its inherent volatility, offers potential for high returns, making it attractive to institutional investors like hedge funds. The industry's cyclical nature, however, presents risks that need careful consideration.

- Institutional Investors: The high growth potential of the cruise industry, especially during periods of economic recovery, often attracts institutional investors seeking higher returns.

- Hedge Fund Portfolio Holdings: Publicly available data on specific hedge fund holdings in NCLH might be limited, but analyzing industry trends and investor sentiment can provide valuable insights.

- Risk Assessment: Investing in cruise line stocks carries inherent risks, including susceptibility to economic downturns, geopolitical instability, and unforeseen events like pandemics. A thorough risk assessment is critical.

- Reward Potential: Despite the risks, the cruise industry's growth potential offers substantial rewards. Analyzing potential dividend payouts and comparing NCLH's performance to its competitors (RCL, CCL) is crucial for evaluating the reward potential.

Keywords: institutional investors, hedge fund portfolio, cruise industry investment, high-risk high-reward, NCLH stock price prediction.

Factors Influencing Hedge Fund Investment Decisions in NCLH

Several macroeconomic factors and company-specific elements influence hedge fund investment decisions regarding NCLH stock. Understanding these factors is crucial for a complete assessment.

- Macroeconomic Factors: Interest rates, inflation, and overall economic growth significantly influence consumer spending and travel patterns, directly impacting demand for cruises.

- Consumer Sentiment and Travel Trends: Changes in consumer confidence and evolving travel preferences affect the cruise industry's demand. Analyzing these trends is essential for predicting future performance.

- NCLH Management and Corporate Governance: The quality of NCLH's management team, its corporate governance practices, and its commitment to environmental, social, and governance (ESG) factors influence investor confidence.

- Other Factors: Fuel prices, regulatory changes, environmental concerns, and the company's brand reputation also significantly affect NCLH's stock price and overall attractiveness to investors.

Keywords: macroeconomic factors, consumer spending, travel trends, NCLH management, corporate governance, ESG investing, sustainability.

Conclusion: Is NCLH a Smart Hedge Fund Investment? A Final Assessment

NCLH's financial health, market position, and the broader macroeconomic environment all play crucial roles in determining its suitability as a hedge fund investment. While the post-pandemic recovery offers potential for significant growth, the inherent risks associated with the cruise industry should not be underestimated. The analysis suggests that NCLH presents both opportunities and challenges. Therefore, a thorough understanding of its financials, competitive landscape, and the broader economic climate is essential.

Before making any investment decisions regarding NCLH stock or any other cruise stock investment, conduct thorough due diligence. Consult a qualified financial advisor for personalized guidance on hedge fund strategies tailored to your risk tolerance and investment objectives. Continuous monitoring of NCLH financial performance is vital for informed decision-making.

Featured Posts

-

Fotos Asi Fue La Clase De Boxeo En El Zocalo Capitalino

Apr 30, 2025

Fotos Asi Fue La Clase De Boxeo En El Zocalo Capitalino

Apr 30, 2025 -

Essential Items To Omit When Packing For A Cruise

Apr 30, 2025

Essential Items To Omit When Packing For A Cruise

Apr 30, 2025 -

Tramb Yhdhr Msyr Knda Mrtbt Baldem Alamryky

Apr 30, 2025

Tramb Yhdhr Msyr Knda Mrtbt Baldem Alamryky

Apr 30, 2025 -

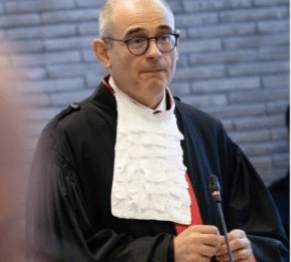

Vaticano Fondi 8xmille E Il Rinvio Del Processo Becciu

Apr 30, 2025

Vaticano Fondi 8xmille E Il Rinvio Del Processo Becciu

Apr 30, 2025 -

German Conservatives And Social Democrats Begin Coalition Talks

Apr 30, 2025

German Conservatives And Social Democrats Begin Coalition Talks

Apr 30, 2025

Latest Posts

-

Verdict Reached In Chris Kaba Police Shooting Case

Apr 30, 2025

Verdict Reached In Chris Kaba Police Shooting Case

Apr 30, 2025 -

Corrections And Clarifications A Guide To Accurate Reporting

Apr 30, 2025

Corrections And Clarifications A Guide To Accurate Reporting

Apr 30, 2025 -

Chris Kaba Shooting Officer Found Not Guilty

Apr 30, 2025

Chris Kaba Shooting Officer Found Not Guilty

Apr 30, 2025 -

Met Police Officer Acquitted In Chris Kaba Shooting

Apr 30, 2025

Met Police Officer Acquitted In Chris Kaba Shooting

Apr 30, 2025 -

26 2025

Apr 30, 2025

26 2025

Apr 30, 2025