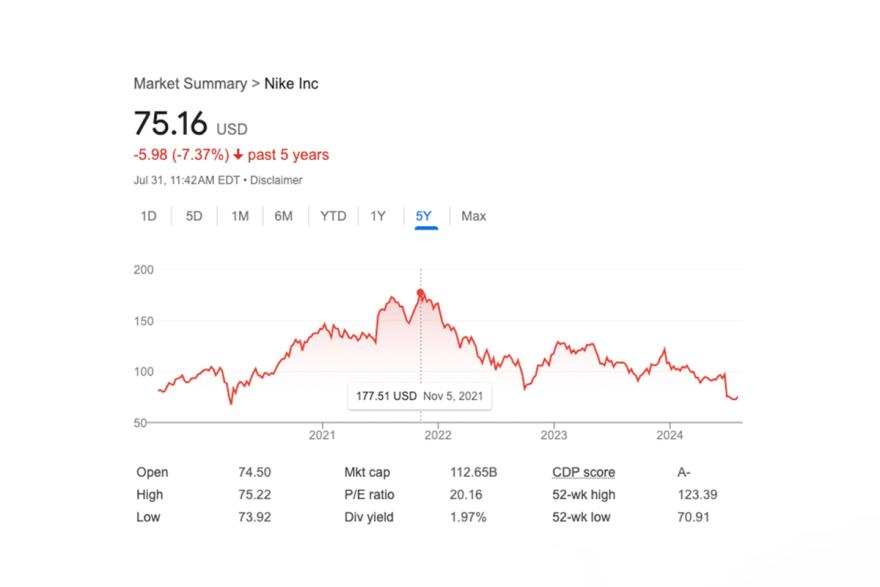

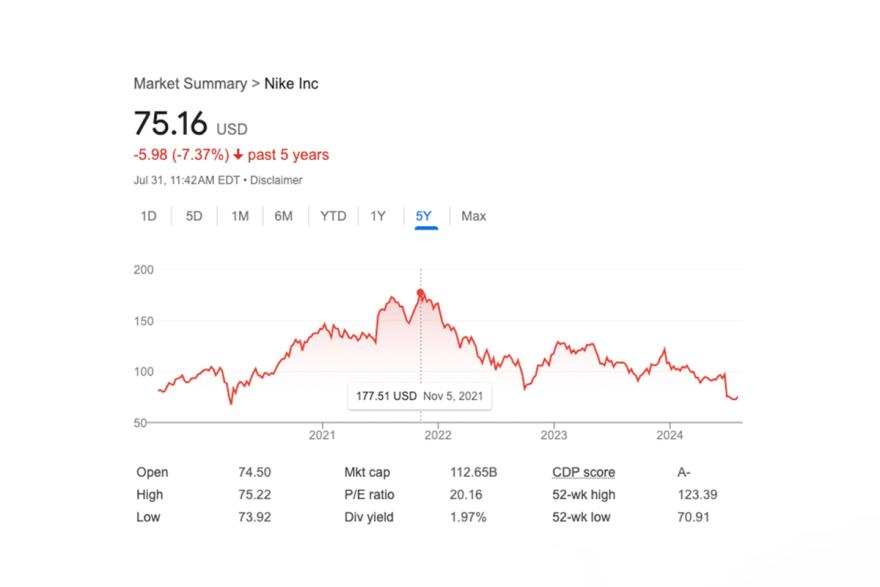

Is Nike Heading For Its Worst Revenue In Five Years?

Table of Contents

Declining Sales Figures and Market Share

Recent quarterly reports paint a concerning picture for Nike's sales performance. The consistent decline in sales figures across key product categories raises serious questions about the company's overall health.

-

Declining Footwear Sales: Reports indicate a significant drop in sales of popular footwear lines, impacting overall revenue. This decline could be attributed to several factors, including increased competition and changing consumer preferences.

-

Apparel Sales Slowdown: Similar trends are observed in Nike's apparel division, with sales growth stagnating and even showing signs of contraction in some key markets. This signifies a broader issue beyond just a single product category.

Several factors contribute to this declining trend:

-

Increased Competition: Fierce competition from brands like Adidas and Under Armour is putting pressure on Nike's market share. These competitors are increasingly innovating and targeting similar customer demographics.

-

Changing Consumer Preferences: The rise of athleisure and sustainable fashion has forced Nike to adapt its product offerings and marketing strategies to meet evolving consumer demands.

-

Economic Downturn: Global economic uncertainties and inflationary pressures are impacting consumer spending, potentially reducing demand for premium athletic wear.

Analyzing Nike's market share reveals a concerning trend: a steady erosion against previous years and key competitors. This "market share decline" directly impacts Nike's revenue potential and underscores the urgency of addressing the underlying challenges. The keywords "Nike sales figures" and "Nike competition" highlight the core issues impacting the company's financial performance.

Supply Chain Issues and Production Challenges

Global supply chain disruptions have significantly impacted Nike's ability to produce and distribute its products effectively. This has created a ripple effect, impacting inventory levels and ultimately, Nike's revenue.

-

Factory Closures and Delays: The COVID-19 pandemic and subsequent geopolitical events caused widespread factory closures and significant production delays, hindering Nike's ability to meet demand.

-

Shipping Delays and Increased Costs: Shipping delays and increased transportation costs have further exacerbated the problem, leading to higher prices and reduced product availability.

-

Material Shortages: A scarcity of raw materials, from fabrics to rubber, has constrained Nike's production capacity, resulting in lower output. This "Nike supply chain" fragility has a direct impact on "Nike inventory" levels and, consequently, Nike's revenue streams. The keyword phrase "global supply chain disruptions" highlights a major external factor affecting Nike's performance.

Increased Production Costs and Inflationary Pressures

The impact of rising raw material costs and general inflation cannot be understated. These pressures squeeze Nike's profitability and force difficult decisions.

-

Increased Labor Costs: Rising wages in manufacturing countries increase the cost of production.

-

Higher Raw Material Prices: The price increases of rubber, cotton, and other materials directly impact Nike's production costs.

-

Transportation Inflation: Increased fuel prices and transportation costs further add to the financial burden.

Nike is attempting to mitigate these rising costs through various strategies:

-

Price Increases: Passing some of the increased costs onto consumers through price hikes is a necessary, yet potentially risky, strategy.

-

Cost-Cutting Measures: Implementing efficiency measures and streamlining operations are crucial for minimizing expenses. The keyword "Nike production costs" emphasizes the financial pressures the company is facing. "Inflation impact Nike" highlights the macroeconomic environment's role in affecting Nike's bottom line.

Changing Consumer Preferences and Marketing Strategies

Understanding and responding to evolving consumer preferences is critical for Nike's success.

-

Sustainability Concerns: Consumers are increasingly conscious of environmental and social responsibility, demanding sustainable products and ethical production practices.

-

Athleisure Trend: The growing popularity of athleisure necessitates adapting designs and marketing to cater to this expanding market segment.

-

Style Preferences: Nike needs to constantly monitor and adapt to changing trends in styles and colors to remain competitive.

Nike's marketing strategies also require careful evaluation:

-

Marketing Campaign Effectiveness: Assessing the effectiveness of current campaigns in reaching target demographics and driving sales is essential.

-

Social Media Engagement: Maintaining a strong social media presence and engaging with consumers is crucial for brand building and loyalty.

-

Brand Perception: Nike's brand perception heavily influences consumer purchasing decisions. Maintaining a positive image is paramount. The keyword phrases "Nike marketing strategy," "consumer preferences," and "Nike brand perception" highlight the critical interplay between consumer trends and Nike's response.

Conclusion: Nike's Future – A Path to Recovery?

Several factors contribute to the potential for Nike to experience its worst revenue in five years: declining sales figures across key product categories, significant supply chain disruptions impacting production and distribution, rising production costs fueled by inflation, and evolving consumer preferences demanding adaptation. These challenges represent significant hurdles for Nike.

However, it's important to maintain a balanced perspective. Nike remains a powerful brand with significant resources and the potential to navigate these challenges. By effectively addressing supply chain issues, adapting to changing consumer preferences, and implementing innovative marketing strategies, Nike can potentially regain momentum.

To stay informed about Nike's financial performance and its ongoing efforts to address these challenges, monitor Nike's financial reports and follow industry news closely. Keeping a keen eye on "Nike's revenue" and its future performance is crucial for both investors and consumers alike. The potential for the worst revenue in five years is a serious possibility, highlighting the importance of continued monitoring of Nike's revenue and overall market performance.

Featured Posts

-

Trumps Trade Deal Cuts Dismissing Economic Concerns

May 06, 2025

Trumps Trade Deal Cuts Dismissing Economic Concerns

May 06, 2025 -

Modni Vikhodi Rianni Shiroki Dzhinsi Ta Bliskuchi Prikrasi

May 06, 2025

Modni Vikhodi Rianni Shiroki Dzhinsi Ta Bliskuchi Prikrasi

May 06, 2025 -

Mindy Kaling A Peplum Moment On The Hollywood Walk Of Fame

May 06, 2025

Mindy Kaling A Peplum Moment On The Hollywood Walk Of Fame

May 06, 2025 -

Celtics Vs Suns Game Time Tv Channel And Live Stream Info April 4th

May 06, 2025

Celtics Vs Suns Game Time Tv Channel And Live Stream Info April 4th

May 06, 2025 -

Colman Domingos Influence On Mens Fashion Trends

May 06, 2025

Colman Domingos Influence On Mens Fashion Trends

May 06, 2025

Latest Posts

-

Ndae Alhjylan Sbl Thqyq Alslam Fy Alymn

May 06, 2025

Ndae Alhjylan Sbl Thqyq Alslam Fy Alymn

May 06, 2025 -

Investitsii Azerbaydzhana V Norvegiyu Vyrosli V 6 2 Raza

May 06, 2025

Investitsii Azerbaydzhana V Norvegiyu Vyrosli V 6 2 Raza

May 06, 2025 -

Ciri Ciri Batu Yaman Habasyi Panduan Lengkap And Terpercaya

May 06, 2025

Ciri Ciri Batu Yaman Habasyi Panduan Lengkap And Terpercaya

May 06, 2025 -

Azerbaydzhan Rezkiy Rost Pryamykh Investitsiy V Ekonomiku Norvegii

May 06, 2025

Azerbaydzhan Rezkiy Rost Pryamykh Investitsiy V Ekonomiku Norvegii

May 06, 2025 -

Ndae Alhjylan Rwyt Ymnyt Khalyt Mn Aldmae

May 06, 2025

Ndae Alhjylan Rwyt Ymnyt Khalyt Mn Aldmae

May 06, 2025