Is Norwegian Cruise Line (NCLH) Stock A Smart Hedge Fund Investment?

Table of Contents

NCLH's Financial Performance and Current Market Position

Analyzing NCLH's Recent Financial Statements

Understanding NCLH's recent performance is crucial for any potential investor. A thorough examination of its financial statements reveals key insights into its financial health and stability.

- Revenue trends: Analyze revenue growth (or decline) year-over-year and quarter-over-quarter to gauge the company's ability to generate income. Look for patterns and assess the impact of external factors like the pandemic.

- Profitability margins: Examine operating margins, net margins, and EBITDA margins to understand NCLH's profitability and efficiency. Compare these to industry averages and historical performance.

- Debt levels: Assess NCLH's debt-to-equity ratio and total debt burden to understand its financial leverage and risk profile. High debt levels can significantly impact the company's financial flexibility.

- Cash flow analysis: Analyze NCLH's operating cash flow, investing cash flow, and financing cash flow to understand its ability to generate cash, invest in growth opportunities, and manage its debt.

- Comparison to competitors: Benchmark NCLH's performance against its main competitors, such as Royal Caribbean (RCL) and Carnival (CCL), to gauge its relative strength and weaknesses within the cruise line stocks sector.

(Insert relevant chart/graph visualizing NCLH's revenue, profitability, and debt levels over time)

The implications of these key financial metrics are significant for investors. A strong cash flow, coupled with manageable debt and improving profitability, would signal a healthier financial outlook. Conversely, high debt levels and declining profitability would raise concerns.

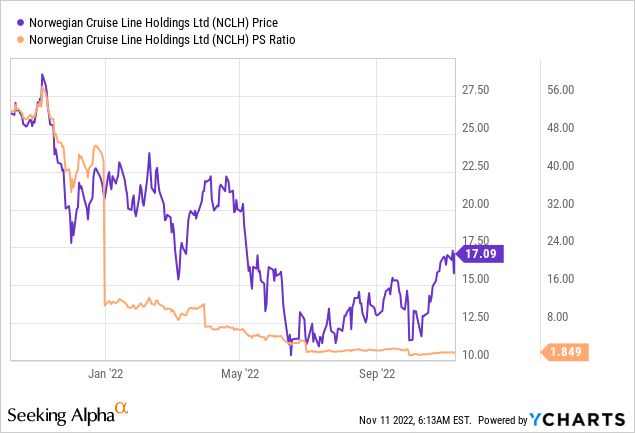

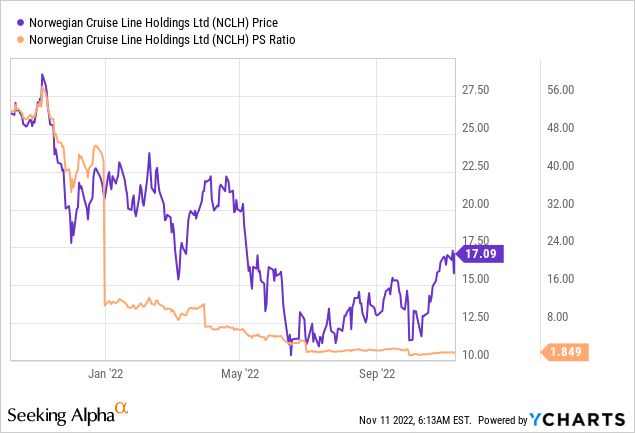

Assessing NCLH's Market Valuation and Share Price

Understanding NCLH's market valuation and share price is essential for determining its attractiveness as a hedge fund investment.

- Current share price: Note the current market price per share of NCLH stock.

- P/E ratio: Analyze the price-to-earnings ratio (P/E) to assess whether the stock is overvalued or undervalued relative to its earnings.

- Market capitalization: Determine NCLH's market capitalization to gauge its overall size and influence within the market.

- Historical share price performance: Review past share price performance to identify trends and understand the stock's volatility.

- Analyst ratings and price targets: Consult financial analysts' ratings and price targets to understand their outlook on NCLH's future share price.

(Insert relevant chart/graph visualizing NCLH's share price performance over time)

By analyzing these factors, a potential investor can develop a clearer understanding of NCLH's current valuation and potential for future growth. An undervaluation, coupled with positive analyst sentiment, could indicate a strong investment opportunity.

Factors Influencing Future Growth Potential for NCLH

The Resurgence of the Cruise Industry

The cruise industry's recovery is paramount to NCLH's future success. Several factors will influence this recovery:

- Post-pandemic travel trends: Analyze shifts in consumer preferences for travel and leisure activities. The pent-up demand for cruises is a significant factor to consider.

- Pent-up demand for cruises: Assess the level of pent-up demand for cruises and how quickly this demand will translate into bookings.

- Anticipated booking growth: Examine forecasts for future cruise bookings and their potential impact on NCLH's revenue.

- Impact of vaccination rates and travel restrictions: Consider the impact of vaccination rates and evolving travel restrictions on the industry's recovery.

NCLH's Business Strategy and Competitive Advantages

NCLH's success hinges on its ability to adapt and compete effectively. Key aspects to consider include:

- NCLH's fleet modernization plans: Analyze plans for upgrading or expanding its fleet. Modern ships attract more customers.

- New ship launches: Assess the impact of new ship launches on capacity and revenue generation.

- Marketing strategies: Evaluate the effectiveness of NCLH's marketing campaigns in attracting new customers.

- Loyalty programs: Assess the effectiveness of NCLH's loyalty programs in retaining existing customers.

- Innovative cruise experiences: Analyze NCLH's efforts to enhance the cruise experience and differentiate itself from competitors.

- Cost-cutting measures: Evaluate NCLH's strategies for controlling costs and improving efficiency.

Geopolitical and Economic Risks to Consider

Several external factors pose risks to NCLH's future performance:

- Impact of fuel prices: Fluctuations in fuel prices significantly impact operating costs.

- Global economic uncertainty: Economic downturns can significantly reduce discretionary spending on leisure activities like cruises.

- Potential future pandemics: The risk of future pandemics disrupting the cruise industry remains a significant concern.

- Impact of changing regulations: New regulations or stricter enforcement of existing regulations can significantly affect operations.

- Currency fluctuations: Exchange rate fluctuations can impact revenue and profitability.

NCLH as a Hedge Fund Investment: Risks and Rewards

Assessing the Risk Profile of NCLH Stock

Investing in NCLH stock carries significant risk, particularly for hedge funds:

- High volatility: NCLH stock is known for its volatility, making it a risky investment.

- Dependence on discretionary consumer spending: The cruise industry is highly sensitive to changes in consumer spending.

- Sensitivity to economic downturns: Economic downturns can severely impact demand for cruises.

- Environmental concerns: The cruise industry faces increasing environmental concerns and scrutiny.

- Reputational risk: Negative publicity or incidents can significantly harm the company's reputation and stock price.

Potential Returns and Investment Strategies

Despite the risks, NCLH presents potential for high returns under certain scenarios:

- Long-term investment strategy vs. short-term trading: A long-term investment strategy may be more suitable given the inherent volatility.

- Diversification within a hedge fund portfolio: Diversification is key to mitigating risk.

- Potential for high returns if the cruise industry recovers strongly: A strong industry recovery could lead to significant gains.

- Hedging strategies to mitigate risk: Hedge funds can employ various strategies to mitigate the risks associated with NCLH stock.

Conclusion

This analysis explored whether Norwegian Cruise Line (NCLH) stock presents a viable investment opportunity for hedge funds. We examined its financial performance, future growth potential, and inherent risks. While the cruise industry shows signs of recovery, significant risks remain. The high volatility, dependence on consumer spending, and susceptibility to external factors like pandemics and economic downturns should be carefully considered.

Call to Action: Thorough due diligence is crucial before considering NCLH as a hedge fund investment. Further research into NCLH's financial statements and a comprehensive assessment of the market conditions are essential to determine if it aligns with your specific investment strategy and risk tolerance. Conduct your own in-depth analysis of NCLH stock before making any investment decisions. Remember to consult with a financial professional before investing in NCLH or any other security.

Featured Posts

-

Angel Home Opener Spoiled By Walks And Injuries

Apr 30, 2025

Angel Home Opener Spoiled By Walks And Injuries

Apr 30, 2025 -

Schneider Electrics Strong 2024 Outlook Revenue And Earnings Growth Driven By Data Center Boom

Apr 30, 2025

Schneider Electrics Strong 2024 Outlook Revenue And Earnings Growth Driven By Data Center Boom

Apr 30, 2025 -

Tanner Bibees First Pitch Homer Guardians Rally Past Yankees

Apr 30, 2025

Tanner Bibees First Pitch Homer Guardians Rally Past Yankees

Apr 30, 2025 -

Trumps Canada Comments Serious Threat Or Political Maneuver

Apr 30, 2025

Trumps Canada Comments Serious Threat Or Political Maneuver

Apr 30, 2025 -

Fotbolti I Dag Dagskra Bestu Deildarinnar

Apr 30, 2025

Fotbolti I Dag Dagskra Bestu Deildarinnar

Apr 30, 2025

Latest Posts

-

14 2025

Apr 30, 2025

14 2025

Apr 30, 2025 -

Investigation Launched Into Police Leaders Tweet Regarding Chris

Apr 30, 2025

Investigation Launched Into Police Leaders Tweet Regarding Chris

Apr 30, 2025 -

Free Speech Inquiry Police Officers Tweet On Chris Sparks Debate

Apr 30, 2025

Free Speech Inquiry Police Officers Tweet On Chris Sparks Debate

Apr 30, 2025 -

Black And Asian Police Leader Faces Investigation Following Tweet About Chris

Apr 30, 2025

Black And Asian Police Leader Faces Investigation Following Tweet About Chris

Apr 30, 2025 -

23 2025 12

Apr 30, 2025

23 2025 12

Apr 30, 2025