Is Palantir A Buy After A 30% Drop? Analyzing The Stock Dip

Table of Contents

Understanding the 30% Palantir Stock Drop

Market Sentiment and Tech Stock Corrections

The recent 30% drop in Palantir's stock price isn't an isolated incident. It's part of a broader market downturn significantly impacting tech stocks. Several factors contribute to this correction:

- Inflation and Interest Rate Hikes: Rising inflation and subsequent interest rate hikes by the Federal Reserve have increased borrowing costs, making it more expensive for companies like Palantir to expand and potentially impacting investor confidence. This macroeconomic headwind has created a risk-off environment, leading to a sell-off in growth stocks.

- Investor Risk Aversion: Uncertainty surrounding the global economy has increased investor risk aversion. Investors are moving away from higher-risk, high-growth stocks like Palantir, opting for safer investments with lower returns.

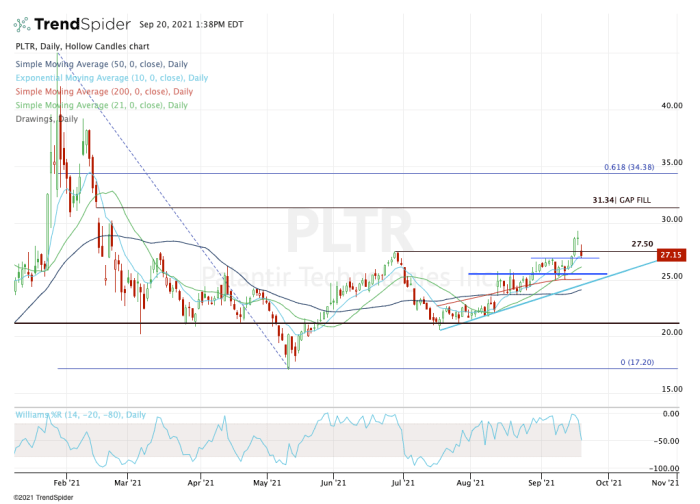

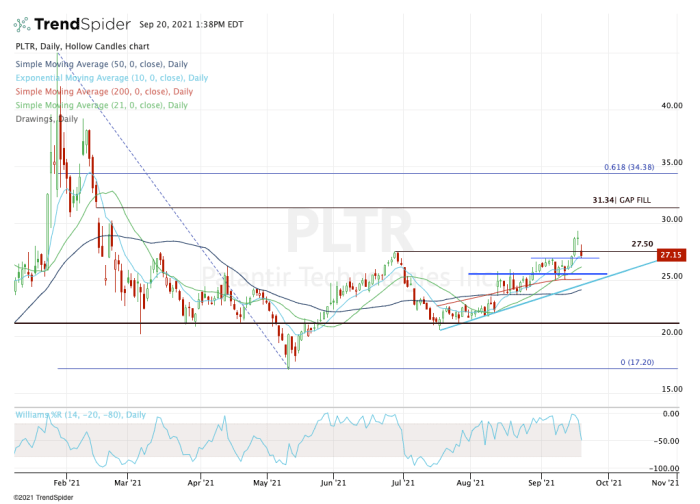

- Comparison to Other Tech Companies: Palantir's performance mirrors that of other tech companies during this market correction. Many growth-oriented tech firms experienced similar drops, reflecting a sector-wide trend rather than company-specific issues. Analyzing the performance of similar companies like Snowflake (SNOW) and Datadog (DDOG) during this period provides valuable context. (Include a relevant chart comparing Palantir's stock performance against its peers).

Palantir's Q[Insert Relevant Quarter] Earnings Report

Palantir's [Insert Relevant Quarter] earnings report played a role in the stock price decline. While [mention specific positive aspects from the report, e.g., strong revenue growth in specific sectors], certain aspects might have disappointed investors:

- Revenue Growth: While revenue showed growth, it might have fallen short of analyst expectations, leading to a sell-off. (Include specific numbers and comparisons to previous quarters).

- Profit Margins: Changes in profit margins, whether positive or negative, and the reasons behind them, should be highlighted. (Include specific data and analysis).

- Customer Acquisition: The rate of new customer acquisition and the retention of existing clients are crucial metrics to analyze. Slowdowns in these areas could contribute to investor concerns. (Include relevant data points).

Analyzing Palantir's Long-Term Growth Potential

Government Contracts and Revenue Streams

Palantir's revenue significantly relies on government contracts, particularly in the defense and intelligence sectors. This presents both advantages and disadvantages:

- Stability and Predictability: Government contracts often offer a degree of stability and predictability, providing a reliable revenue stream.

- Commercial Market Expansion: Palantir is actively diversifying its revenue streams by expanding into commercial markets. Success in this area is crucial for long-term growth and reducing dependence on government contracts. (Include details on successful commercial partnerships and contracts).

Innovation and Technological Advantage

Palantir's cutting-edge technology, particularly its AI capabilities, offers significant long-term growth potential:

- AI Capabilities and Future Revenue Streams: Palantir’s AI-driven data analytics platforms are poised to benefit from increased demand for data-driven insights across various industries. This positions them for substantial growth in the future. (Provide details on specific AI applications and their potential impact).

- New Product Launches and Advancements: Highlight any recent product launches or technological advancements that demonstrate Palantir's commitment to innovation and its ability to adapt to evolving market demands. (Include specific examples and details).

Assessing the Risk and Reward of Investing in Palantir After the Drop

Valuation and Future Price Projections

Evaluating Palantir's current valuation is crucial:

- Price-to-Sales Ratio (P/S): Analyze Palantir's P/S ratio compared to its peers and historical data. A lower P/S ratio might indicate that the stock is undervalued. (Include relevant data and charts).

- Future Price Projections: Incorporate potential future price projections from reputable analysts, acknowledging that these are merely predictions and not guarantees. (Include data from credible sources and highlight the range of predictions).

Risks Associated with Investing in Palantir

While Palantir offers significant potential, investors should consider the risks:

- Competition: Increased competition in the data analytics and AI markets could impact Palantir's market share and growth.

- Geopolitical Risks: Palantir's reliance on government contracts exposes it to geopolitical risks and potential shifts in government priorities.

- Dependence on Large Government Contracts: Over-reliance on a few large contracts could make Palantir vulnerable to contract cancellations or delays.

Conclusion

Palantir's 30% stock drop is partly due to broader market corrections affecting tech stocks and partly due to factors specific to its Q[Insert Relevant Quarter] earnings. However, the company's long-term growth potential, driven by its technological advantages and expansion into commercial markets, remains significant. While risks exist, particularly concerning competition and geopolitical factors, a thorough analysis suggests that the current valuation might present a compelling entry point for long-term investors with a higher risk tolerance. Is Palantir a worthwhile investment for your portfolio? Consider adding Palantir to your watchlist and conducting thorough due diligence before making any investment decisions. Should you buy Palantir stock now? The answer depends on your individual risk profile and investment strategy.

Featured Posts

-

New Report Potential Changes To Uk Visa Application Process

May 09, 2025

New Report Potential Changes To Uk Visa Application Process

May 09, 2025 -

Solve Nyt Strands Game 374 Hints For Wednesday March 12

May 09, 2025

Solve Nyt Strands Game 374 Hints For Wednesday March 12

May 09, 2025 -

Betting On The Oilers Kings Series Odds Predictions And Analysis

May 09, 2025

Betting On The Oilers Kings Series Odds Predictions And Analysis

May 09, 2025 -

Polish Woman And Friend Plead Not Guilty To Mc Cann Family Harassment

May 09, 2025

Polish Woman And Friend Plead Not Guilty To Mc Cann Family Harassment

May 09, 2025 -

New Threats Investigated Madeleine Mc Cann Parents Targeted

May 09, 2025

New Threats Investigated Madeleine Mc Cann Parents Targeted

May 09, 2025