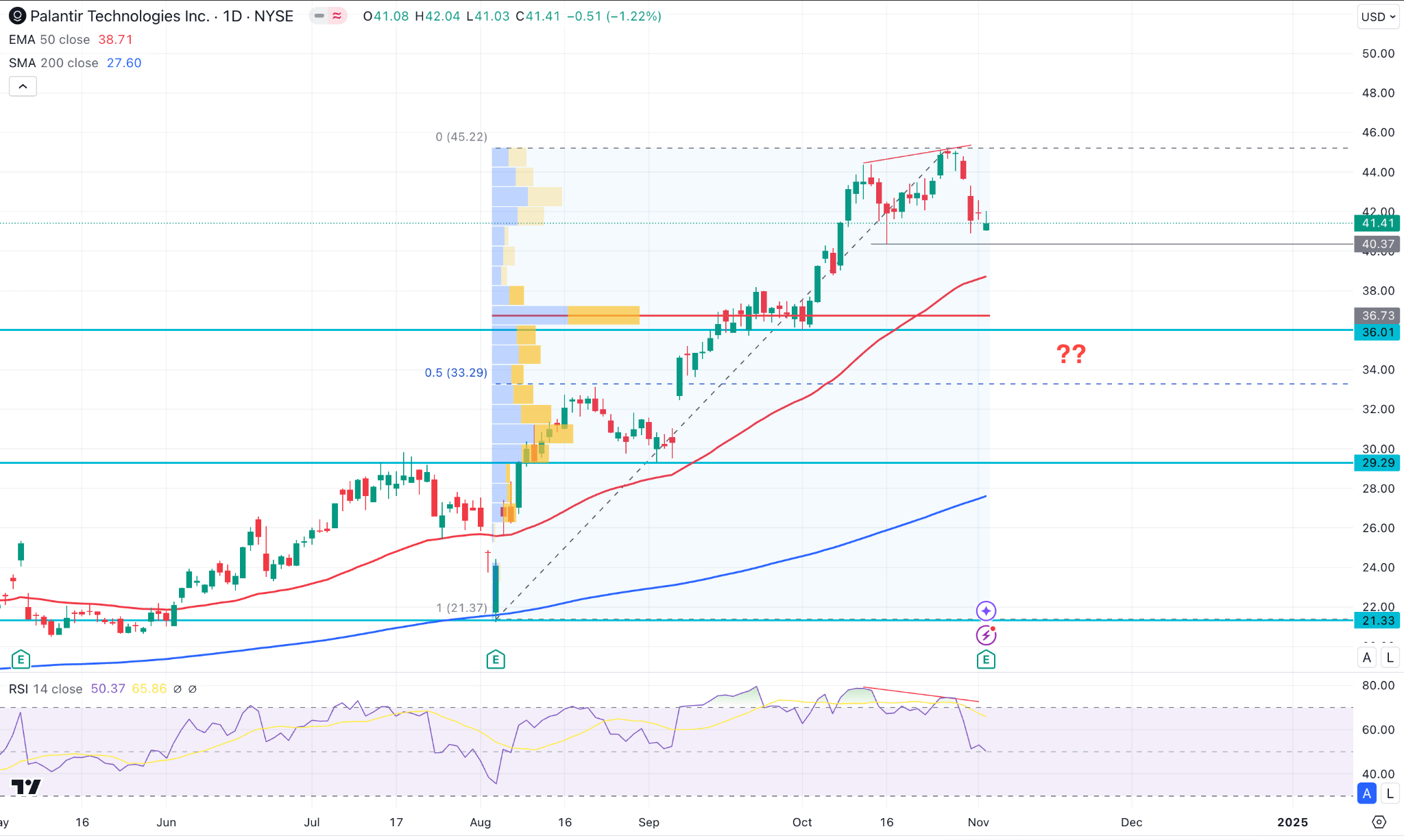

Is Palantir Stock A Buy In 2024? A 40% Growth Prediction Analysis

Table of Contents

Palantir Technologies (PLTR) has seen its stock price fluctuate significantly, but a bold prediction of a 40% growth in 2024 has many investors asking: Is Palantir stock a buy? This article delves into a comprehensive analysis of Palantir's recent performance, future growth projections, and valuation to help you determine whether this data analytics giant is a worthwhile investment in the coming year. Palantir Technologies, known for its powerful data analytics platforms serving both government and commercial clients, presents a compelling case, but careful consideration is crucial before investing. This analysis aims to provide the insights you need to make an informed decision about Palantir stock.

H2: Palantir's Recent Performance and Financial Health

H3: Revenue Growth and Profitability: Palantir's financial performance has been a mixed bag. While the company has demonstrated consistent revenue growth, its path to profitability remains a key area of focus for investors. Examining Palantir earnings reports reveals a trend of increasing revenue, though profitability remains elusive. Analyzing Palantir revenue growth year-over-year is crucial.

- Q3 2023: (Insert actual data here from the Q3 2023 report, including revenue figures, operating margin, and net income. Compare these figures to the previous year's Q3 and provide a percentage change). This indicates (positive or negative trend interpretation).

- Full Year 2023: (Insert actual data here from the full year 2023 report, including revenue figures, operating margin, and net income. Compare these figures to the previous year and provide a percentage change). This suggests (positive or negative trend interpretation).

- Key drivers of this revenue growth include increased government contracts, particularly in defense and intelligence, and growing adoption of Palantir's platforms by commercial clients across various sectors. However, the sustained growth depends on securing new contracts and expanding its commercial client base. Analyzing Palantir financial performance requires a long-term perspective.

H3: Debt and Cash Position: Understanding Palantir's debt and cash position is critical to assessing its financial strength and future prospects. Examining Palantir debt and Palantir cash flow statements provides insights into its financial health.

- Debt Levels: (Insert data on Palantir's current debt levels from the latest financial reports. Analyze whether this debt is manageable given the company's revenue generation and cash flow.)

- Cash Reserves: (Insert data on Palantir's cash reserves and liquidity from the latest financial reports. Analyze the company's ability to meet its short-term and long-term obligations.)

- Overall assessment: Palantir's balance sheet indicates (strong/weak/moderate) financial health.

H2: Growth Projections and Market Analysis

H3: The 40% Growth Prediction: The 40% growth prediction for Palantir stock in 2024 is an ambitious forecast. (State the source of this prediction - e.g., a specific analyst report, a market research firm, etc.). This prediction is based on several factors:

- Increased government spending on data analytics and AI solutions, particularly in defense and intelligence.

- Expansion into new commercial markets, leveraging Palantir's AI capabilities and data integration platforms.

- Strong customer retention and expansion of existing contracts.

However, potential risks exist:

- Increased competition from established tech giants and emerging startups in the data analytics field.

- Economic downturn which may impact government and commercial spending on technology.

- Geopolitical uncertainty affecting the stability of certain contracts. Understanding Palantir stock forecast requires acknowledging these factors.

H3: Market Competition and Industry Trends: Palantir operates in a competitive landscape, facing challenges from established players like Microsoft and Google, as well as numerous specialized data analytics companies. The data analytics market is booming, driven by the growing adoption of artificial intelligence (AI) and the increasing amount of data generated globally.

- Key Competitors: (List Palantir's main competitors and briefly describe their strengths and weaknesses.) Analyzing Palantir competitors is crucial to understanding its market position.

- Industry Trends: (Discuss emerging trends such as the increasing demand for AI-powered analytics, cloud-based data solutions, and cybersecurity within the data analytics sector.)

- Palantir's Competitive Advantages: (Highlight Palantir's unique strengths, such as its strong relationships with government agencies, its advanced data integration capabilities, and its focus on high-value, complex data problems.) The AI market is highly competitive, but Palantir has carved out a niche.

H2: Valuation and Investment Considerations

H3: Price-to-Earnings Ratio (P/E) and other Key Metrics: Evaluating Palantir's valuation requires looking at key financial ratios.

- P/E Ratio: (State Palantir's current P/E ratio and compare it to industry averages and competitors. Discuss whether this ratio suggests the stock is overvalued or undervalued.) Analyzing Palantir PE ratio is a critical part of valuation.

- Other Metrics: (Include other relevant valuation metrics, such as Price-to-Sales ratio (P/S) and Price-to-Book ratio (P/B). Compare these ratios to industry benchmarks.) Palantir valuation requires a multi-faceted approach.

H3: Risks and Potential Downsides: Investing in Palantir stock carries certain risks.

- Geopolitical Risks: Government contracts are subject to political changes and budget fluctuations.

- Regulatory Risks: Data privacy regulations can significantly impact Palantir's operations.

- Competition Risks: Intense competition from larger technology companies and innovative startups poses a threat.

- Market Risks: An economic downturn could adversely affect both government and commercial spending. Thorough consideration of Palantir risk factors is crucial.

3. Conclusion:

This analysis of Palantir stock reveals a company with significant growth potential but also faces substantial challenges. The projected 40% growth in 2024 is ambitious and hinges on several factors, including continued success in securing government contracts, expansion into new commercial markets, and navigating the competitive landscape effectively. While Palantir's financial position shows signs of improvement, its profitability remains a key area of concern. Considering Palantir's valuation, the potential for significant upside is balanced by substantial risks.

Final Verdict: (State whether you believe Palantir stock is a buy, hold, or sell in 2024, providing a clear justification based on your analysis.)

Call to Action: This analysis provides insights, but it's crucial to conduct your own thorough research before making any investment decisions. Is Palantir stock right for your investment portfolio? Consider your risk tolerance and investment goals. Should you invest in Palantir stock in 2024? Only you can answer this question based on your personal circumstances and a comprehensive analysis of the company's performance and market dynamics. Learn more about Palantir stock and its future prospects before investing. Remember, this is not financial advice.

Featured Posts

-

How Trumps Presidency Will Shape Zuckerbergs Next Move

May 09, 2025

How Trumps Presidency Will Shape Zuckerbergs Next Move

May 09, 2025 -

Rethinking Stephen King Four Unexpected Randall Flagg Theories

May 09, 2025

Rethinking Stephen King Four Unexpected Randall Flagg Theories

May 09, 2025 -

Mdkhnw Krt Alqdm Asmae Barzt Wshkhsyat Mwthrt

May 09, 2025

Mdkhnw Krt Alqdm Asmae Barzt Wshkhsyat Mwthrt

May 09, 2025 -

Are You A True Stephen King Fan Test Your Knowledge With These 5 Books

May 09, 2025

Are You A True Stephen King Fan Test Your Knowledge With These 5 Books

May 09, 2025 -

India Pakistan Tensions Impact Sensex And Nifty 50 Today

May 09, 2025

India Pakistan Tensions Impact Sensex And Nifty 50 Today

May 09, 2025