Is Palantir Stock A Buy Right Now? A Comprehensive Analysis

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies operates primarily through two core platforms: Gotham and Foundry. Gotham caters to government agencies, providing advanced data analytics and intelligence solutions for national security and defense. Foundry, on the other hand, targets the commercial sector, offering similar data integration and analysis capabilities to various industries. Understanding Palantir's revenue streams is crucial when evaluating Palantir stock.

-

Government Contracts and their Impact on Revenue: A significant portion of Palantir's revenue historically stemmed from lucrative government contracts. These contracts, while providing substantial revenue, can be subject to fluctuating government budgets and procurement cycles, impacting the predictability of Palantir's financial performance. This is an important factor for investors considering PLTR stock.

-

Growth in the Commercial Sector and Key Partnerships: Palantir is actively expanding its commercial footprint, forging partnerships with major corporations across diverse sectors. This diversification strategy aims to reduce reliance on government contracts and drive sustainable long-term growth for Palantir Technologies. The success of this strategy is a key factor in the future trajectory of Palantir stock.

-

Recurring Revenue Streams and their Significance: A growing percentage of Palantir's revenue is derived from recurring subscriptions and contracts. This shift towards recurring revenue enhances predictability and stability, making Palantir stock potentially less volatile in the long run. Investors should carefully examine the proportion of recurring revenue when assessing the risk profile of PLTR stock.

-

Analysis of Profit Margins and Operational Efficiency: Analyzing Palantir's profit margins and operational efficiency is vital. Improvements in these areas signal a strengthening business model and increased profitability, positively impacting the value of Palantir stock.

Financial Performance and Valuation

Analyzing Palantir's financial performance is essential for determining whether Palantir stock is a worthwhile investment. Key metrics like revenue growth, earnings per share (EPS), and cash flow provide insights into the company's financial health.

-

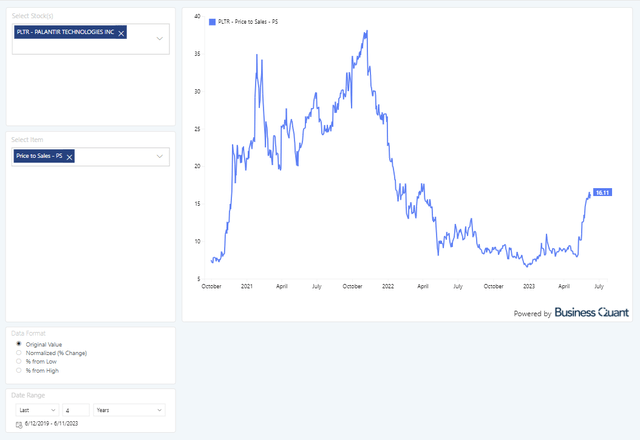

Price-to-Sales Ratio (P/S) Compared to Industry Averages: The P/S ratio offers a relative valuation of Palantir compared to its peers in the software and data analytics sector. A high P/S ratio suggests investors anticipate significant future growth, while a low ratio could indicate undervaluation or lower growth expectations. This is a crucial metric when evaluating Palantir stock.

-

Earnings Per Share (EPS) Growth and Projections: Tracking Palantir's EPS growth and analysts' projections provides an understanding of its profitability trend and future earnings potential. Consistent EPS growth is typically a positive indicator for Palantir stock.

-

Debt Levels and Financial Health: Assessing Palantir's debt levels and overall financial health is crucial for assessing its long-term sustainability. High debt levels can increase financial risk, potentially impacting the value of Palantir stock.

-

Free Cash Flow Generation and its Implications for Future Growth: Strong free cash flow generation allows Palantir to reinvest in growth initiatives, acquire companies, or return capital to shareholders, all positively impacting the value of Palantir stock.

Market Risks and Opportunities

While Palantir presents significant opportunities, investors in Palantir stock must also consider potential risks.

-

Competition from Established Tech Giants: Palantir faces competition from established tech giants like Microsoft, Google, and Amazon, who offer competing data analytics and AI solutions. This competitive landscape is a key risk factor for Palantir stock.

-

Data Privacy Concerns and Regulatory Compliance: Operating in the data analytics space exposes Palantir to data privacy concerns and regulatory scrutiny. Compliance with evolving data privacy regulations is crucial and represents a significant risk for Palantir stock.

-

Potential for Growth in the AI and Big Data Markets: The burgeoning AI and big data markets present significant growth opportunities for Palantir. Its advanced data analytics capabilities position it well to capitalize on these trends, positively affecting the outlook for Palantir stock.

-

Opportunities for International Expansion: Expanding into new international markets can significantly boost Palantir's revenue and market share, contributing positively to the value of Palantir stock.

Analyst Ratings and Investor Sentiment

Understanding analyst ratings and investor sentiment provides valuable insights into the market's perception of Palantir stock.

-

Summary of Buy, Sell, and Hold Ratings from Reputable Analysts: A consensus view from reputable analysts can provide a benchmark for assessing the overall market sentiment towards Palantir stock.

-

Recent Price Movements and Trading Volume: Monitoring recent price movements and trading volume can indicate the short-term market sentiment towards Palantir stock. High trading volume often signals increased investor interest.

-

Significant News Events Impacting Investor Sentiment: News events, such as major contract wins, partnerships, or regulatory changes, can significantly impact investor sentiment and the price of Palantir stock.

-

Hedge Fund Ownership and Insider Trading Activity: Monitoring hedge fund ownership and insider trading activity can provide insights into the confidence of sophisticated investors in Palantir stock.

Conclusion

Analyzing Palantir's business model, financial performance, market risks, and analyst sentiment reveals a complex picture. While Palantir operates in a high-growth market and possesses advanced technology, it also faces significant competition and regulatory risks. The shift towards recurring revenue and expansion into the commercial sector are positive developments, but reliance on government contracts remains a concern. Based on our analysis, we recommend conducting thorough due diligence before making any investment decisions regarding Palantir stock (PLTR). Ultimately, the decision of whether or not to buy Palantir stock depends on your individual investment goals and risk tolerance. However, based on our analysis, a cautious approach may be warranted. Conduct your own thorough due diligence before making any investment decisions regarding Palantir stock (PLTR).

Featured Posts

-

Harry Styles Reaction To A Critically Bad Snl Impression

May 09, 2025

Harry Styles Reaction To A Critically Bad Snl Impression

May 09, 2025 -

Harry Styles On Snl A Hilarious Impression Gone Wrong

May 09, 2025

Harry Styles On Snl A Hilarious Impression Gone Wrong

May 09, 2025 -

Chief Justice Roberts On Being Mistaken For A Republican Leader A Cnn Interview

May 09, 2025

Chief Justice Roberts On Being Mistaken For A Republican Leader A Cnn Interview

May 09, 2025 -

Falling Iron Ore Prices Chinas Steel Industry Slowdown And Its Consequences

May 09, 2025

Falling Iron Ore Prices Chinas Steel Industry Slowdown And Its Consequences

May 09, 2025 -

Putins Victory Day Ceasefire Implications And Analysis

May 09, 2025

Putins Victory Day Ceasefire Implications And Analysis

May 09, 2025