Is Palantir Stock A Good Buy Before May 5th? A Detailed Look

Table of Contents

Palantir's Recent Performance and Financial Health

Analyzing Palantir's recent financial health is crucial for assessing its investment potential. Examining quarterly earnings reports reveals key insights into its revenue growth, profitability, and overall financial stability.

-

Revenue Growth: Palantir has demonstrated consistent revenue growth, but the rate of growth compared to previous quarters and industry benchmarks is vital to understanding its trajectory. A slowing growth rate might signal market saturation or increased competition. Investors should compare this data to competitors like Salesforce, Snowflake, and Databricks for context.

-

Profitability Margins: Analyzing profitability margins (gross, operating, and net) is essential. Are these margins expanding or contracting? Improving margins indicate efficient operations and increasing profitability, a positive sign for potential investors. Conversely, shrinking margins raise concerns.

-

Cash Flow and Debt: A strong cash flow position is a critical indicator of financial health. Positive and growing cash flow suggests Palantir can fund its operations and future growth without relying heavily on debt. High debt levels could indicate financial instability and increased risk.

-

Key Performance Indicators (KPIs): Monitoring KPIs such as customer acquisition cost (CAC) and customer churn rate provides valuable insights into the effectiveness of Palantir's sales and marketing efforts and customer retention strategies. Lower CAC and churn rates are positive indicators.

Comparing Palantir's performance to its competitors in the big data and analytics sector provides context and allows investors to gauge its relative strength and position within the market.

Growth Potential and Future Outlook

Palantir's long-term growth strategy hinges on its ability to expand within existing markets and penetrate new ones. The company operates primarily in the government and commercial sectors, both offering substantial growth opportunities.

-

Market Expansion and Technological Advancements: Palantir's growth strategy involves expanding into new markets and leveraging technological advancements like artificial intelligence (AI) and machine learning (ML) to enhance its platform and attract new customers. This innovation is crucial for long-term success.

-

Government Contracts: Government contracts are a significant revenue stream for Palantir. The volume and value of future contracts will significantly impact its financial performance and future growth. Any changes in government spending could affect this revenue stream.

-

Commercial Sector Growth: The adoption rate of Palantir's platforms by commercial entities is a key driver of future growth. Success in this sector will depend on its ability to compete effectively against established players and demonstrate a strong value proposition for businesses.

-

Market Size and Growth Projections: The overall market size and projected growth rate for the big data and analytics industry are also critical factors. A rapidly growing market presents greater opportunities for Palantir to capture market share.

Risks and Challenges Facing Palantir

While Palantir presents significant growth potential, several risks and challenges could impact its stock price.

-

Competition: The big data and analytics market is highly competitive, with established players like Microsoft, Google, and Amazon offering competing solutions. Palantir faces a constant battle to maintain its market share.

-

Government Contract Dependence: Palantir's reliance on government contracts exposes it to the risks associated with government budget cuts or changes in procurement policies. Diversifying revenue streams is crucial to mitigate this risk.

-

High Valuation: Palantir's current valuation compared to its profitability is a significant concern for some investors. A high valuation suggests a high expectation for future growth, which may not always be realized.

-

Regulatory Hurdles: Operating in regulated industries exposes Palantir to potential regulatory hurdles and compliance issues, which could impact its operations and profitability.

Technical Analysis and Stock Valuation

Analyzing Palantir's stock chart using technical analysis can provide insights into potential price movements. However, it's important to remember that technical analysis is not a foolproof method of predicting future price action.

-

Support and Resistance Levels: Identifying support and resistance levels on the chart can help estimate potential price reversals or breakouts.

-

Moving Averages: Following moving averages can help to identify trends and potential momentum shifts in the stock price.

-

Relative Strength Index (RSI): The RSI is a momentum indicator that can help assess whether the stock is overbought or oversold.

Different valuation methods, such as discounted cash flow (DCF) analysis and price-to-sales (P/S) ratio, can be used to estimate the intrinsic value of Palantir's stock. Comparing this intrinsic value to the current market price helps determine if the stock is undervalued or overvalued.

Conclusion

Analyzing Palantir's recent performance, growth potential, risks, and valuation reveals a mixed picture. While the company demonstrates strong revenue growth and operates in a large and growing market, its reliance on government contracts and high valuation present considerable risks. Whether Palantir stock is a good buy before May 5th depends on your risk tolerance and investment horizon. The company's future performance will largely depend on its ability to secure new contracts, expand into the commercial sector, and effectively compete against established players.

Before making any investment decisions regarding Palantir stock (PLTR) before May 5th (or any date), conduct your own thorough due diligence and consider consulting a financial advisor. Remember, investing in Palantir stock involves inherent risks, and past performance is not indicative of future results. Continue your research on Palantir stock to make an informed investment choice.

Featured Posts

-

Illegal Access Of Patient Data Nottingham Stabbing Case Highlights Nhs Security Concerns

May 09, 2025

Illegal Access Of Patient Data Nottingham Stabbing Case Highlights Nhs Security Concerns

May 09, 2025 -

Tarykh Altdkhyn Byn Laeby Krt Alqdm

May 09, 2025

Tarykh Altdkhyn Byn Laeby Krt Alqdm

May 09, 2025 -

Go Compare Advert Wynne Evans Removal Following Strictly Incident

May 09, 2025

Go Compare Advert Wynne Evans Removal Following Strictly Incident

May 09, 2025 -

U S China Trade Talks The Unseen Role Of The Fentanyl Crisis

May 09, 2025

U S China Trade Talks The Unseen Role Of The Fentanyl Crisis

May 09, 2025 -

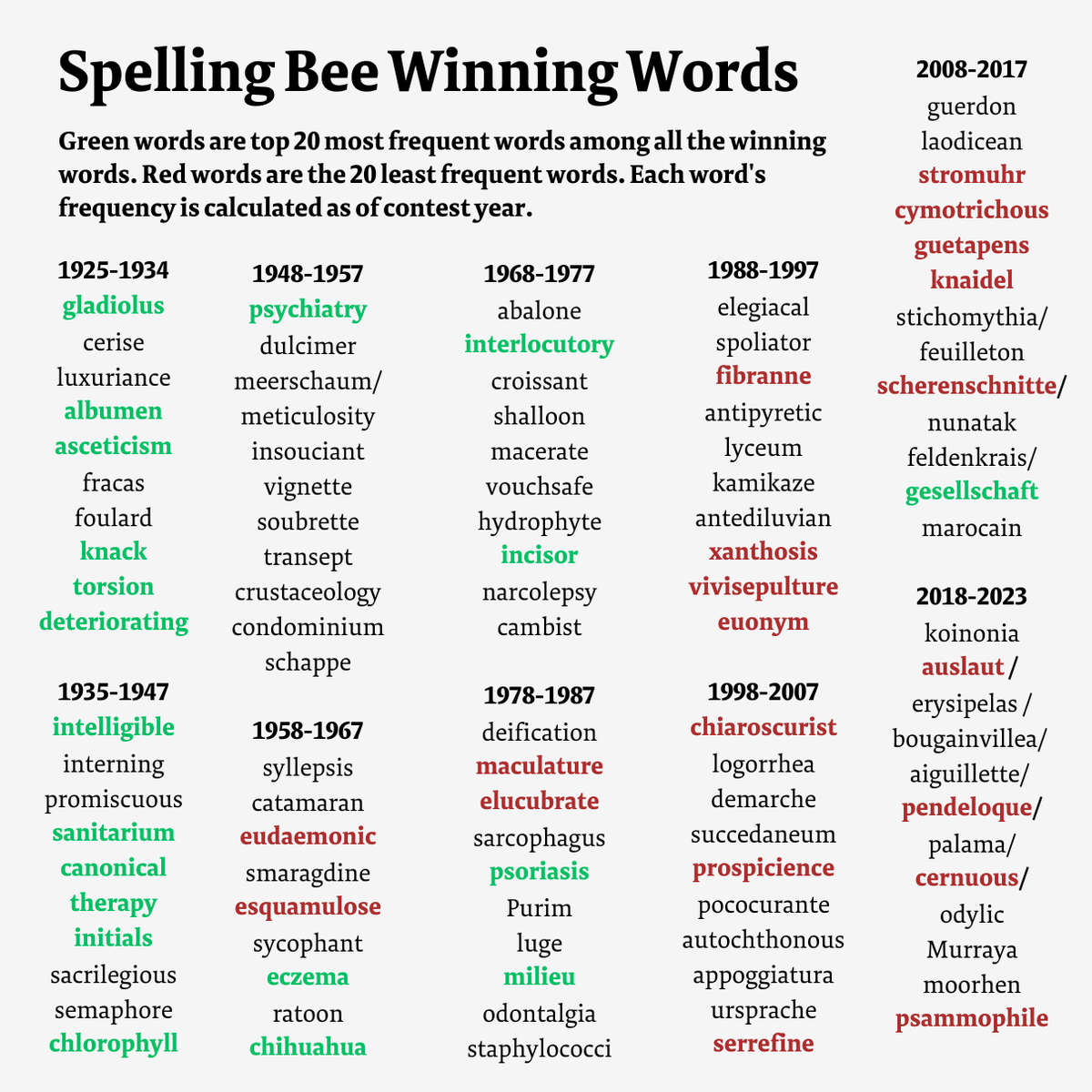

Nyt Spelling Bee April 1 2025 Hints Clues And Pangram

May 09, 2025

Nyt Spelling Bee April 1 2025 Hints Clues And Pangram

May 09, 2025