Is Palantir Stock A Good Buy Before May 5th? An In-Depth Analysis

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Analyzing Palantir's financial health is paramount to determining whether it's a wise investment before May 5th. Let's delve into its recent performance and future projections.

Revenue Growth and Profitability

Palantir's revenue growth has been a key focus for investors. Examining key metrics like revenue growth, operating margins, and net income is essential for understanding its financial trajectory.

- Q4 2022 Revenue: [Insert actual Q4 2022 revenue figures]. This represents a [percentage]% increase/decrease compared to Q4 2021.

- Full-Year 2022 Revenue: [Insert actual full-year 2022 revenue figures]. Showing a [percentage]% increase/decrease compared to 2021.

- Key Drivers: Government contracts continue to be a significant contributor to revenue, while the growth of commercial partnerships is also accelerating. [Add specific examples if available].

- Profitability: While Palantir is not yet consistently profitable, its operating margins are showing [positive/negative] trends, suggesting [future potential/concerns].

Government vs. Commercial Revenue

Understanding the balance between Palantir's government and commercial revenue streams is crucial. This helps assess the stability and future growth potential of the company.

- Government Contracts: [Insert percentage] of Palantir's revenue comes from government contracts, offering a degree of stability but potentially limiting diversification.

- Commercial Partnerships: The remaining [insert percentage]% comes from commercial partnerships, showcasing growth potential but also potentially more volatility.

- Future Outlook: The company's strategy for expanding its commercial business will be a key factor determining its long-term success.

Analyst Ratings and Price Targets

Analyst opinions offer valuable insight into market sentiment and future expectations for Palantir stock.

- Average Price Target: The average price target among analysts is currently [Insert average price target].

- Buy/Sell Ratings: [Insert the percentage of analysts with buy, hold, and sell ratings].

- Recent Upgrades/Downgrades: [Mention any significant recent changes in analyst ratings and the reasons behind them].

Market Trends and Industry Outlook

Understanding the broader market trends within the big data and AI industry is crucial for evaluating Palantir's prospects.

The Big Data and AI Market

Palantir operates in a rapidly growing market.

- Market Growth: The global big data and AI market is projected to reach [insert market size projection] by [insert year], presenting significant opportunities for Palantir.

- Competitive Landscape: Palantir faces competition from established players like [mention key competitors]. However, its unique platform and focus on data integration provide a competitive advantage.

Geopolitical Factors and their Impact

Geopolitical events can significantly impact Palantir's business, particularly its government contracts.

- Government Spending: Increased government spending on defense and intelligence could positively influence Palantir's revenue.

- Global Conflicts: Conversely, geopolitical instability and potential shifts in government priorities could negatively affect contract awards.

Competitive Landscape and Palantir's Competitive Advantages

Analyzing Palantir's competitive position within the big data and analytics market is essential.

Key Competitors

Palantir competes with several established players.

- Direct Competitors: [List key competitors and briefly describe their strengths and weaknesses in relation to Palantir].

- Market Share: [If available, include information on Palantir's market share and how it compares to its competitors].

Palantir's Technological Differentiation

Palantir's proprietary technologies are key differentiators.

- Foundry Platform: This platform offers a comprehensive solution for data integration and analysis.

- Gotham Platform: This platform is specifically designed for government and intelligence agencies.

- Technological Advantage: These platforms provide Palantir with a significant competitive edge due to their scalability, security, and specialized capabilities.

Risks and Potential Downsides

Investing in Palantir stock involves significant risks.

Financial Risks

Palantir faces several financial risks.

- High Valuation: Palantir's stock valuation is relatively high compared to its current profitability, making it susceptible to fluctuations.

- Dependence on Government Contracts: A significant portion of its revenue relies on government contracts, exposing it to changes in government spending and policy.

- Profitability: Palantir's path to sustained profitability remains a key concern for investors.

Market Risks

External market factors can impact Palantir's stock price.

- Economic Downturn: A broader economic downturn could negatively impact spending on big data and AI solutions, both in the public and private sectors.

- Increased Competition: The big data and AI market is becoming increasingly competitive, potentially impacting Palantir's market share.

Conclusion: Should You Buy Palantir Stock Before May 5th?

This analysis reveals a mixed picture for Palantir. While the company operates in a high-growth market and possesses unique technological capabilities, it also faces financial risks and significant competition. Its dependence on government contracts and relatively high valuation are key considerations. The question, "Is Palantir stock a good buy before May 5th?", doesn't have a simple yes or no answer.

Re-emphasizing key factors: strong revenue growth, expansion into the commercial sector, a competitive landscape, and inherent financial risks. The decision to buy Palantir stock before May 5th is ultimately dependent on your individual risk tolerance and investment goals.

Ultimately, the decision of whether to buy Palantir stock before May 5th is yours. However, this in-depth analysis provides the tools you need to make an informed decision. Conduct your own thorough research and consider your own risk tolerance before investing. Should you buy Palantir stock? The answer depends on your assessment of the risks and rewards. Is Palantir a good investment for you? Only you can decide.

Featured Posts

-

Prediction 2 Stocks Poised To Outperform Palantir In 3 Years

May 10, 2025

Prediction 2 Stocks Poised To Outperform Palantir In 3 Years

May 10, 2025 -

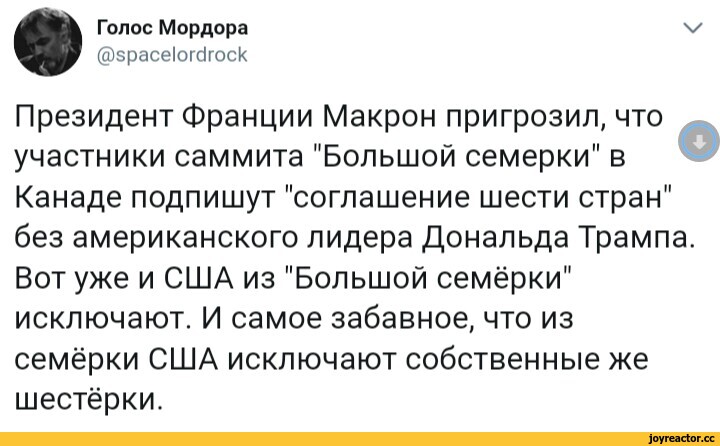

Frantsiya I Polsha Makron I Tusk Podpishut Noviy Dogovor Podrobnosti Ot Unian

May 10, 2025

Frantsiya I Polsha Makron I Tusk Podpishut Noviy Dogovor Podrobnosti Ot Unian

May 10, 2025 -

The Impact Of The La Fires Rising Rents And Price Gouging Concerns

May 10, 2025

The Impact Of The La Fires Rising Rents And Price Gouging Concerns

May 10, 2025 -

Spike In Car Break Ins At Elizabeth City Apartment Complexes

May 10, 2025

Spike In Car Break Ins At Elizabeth City Apartment Complexes

May 10, 2025 -

Proposed Uk Student Visa Changes Concerns For Pakistani Students And Asylum

May 10, 2025

Proposed Uk Student Visa Changes Concerns For Pakistani Students And Asylum

May 10, 2025