Is Palantir Stock A Good Investment? Analyzing The Risks And Rewards

Table of Contents

Palantir's Business Model and Growth Potential

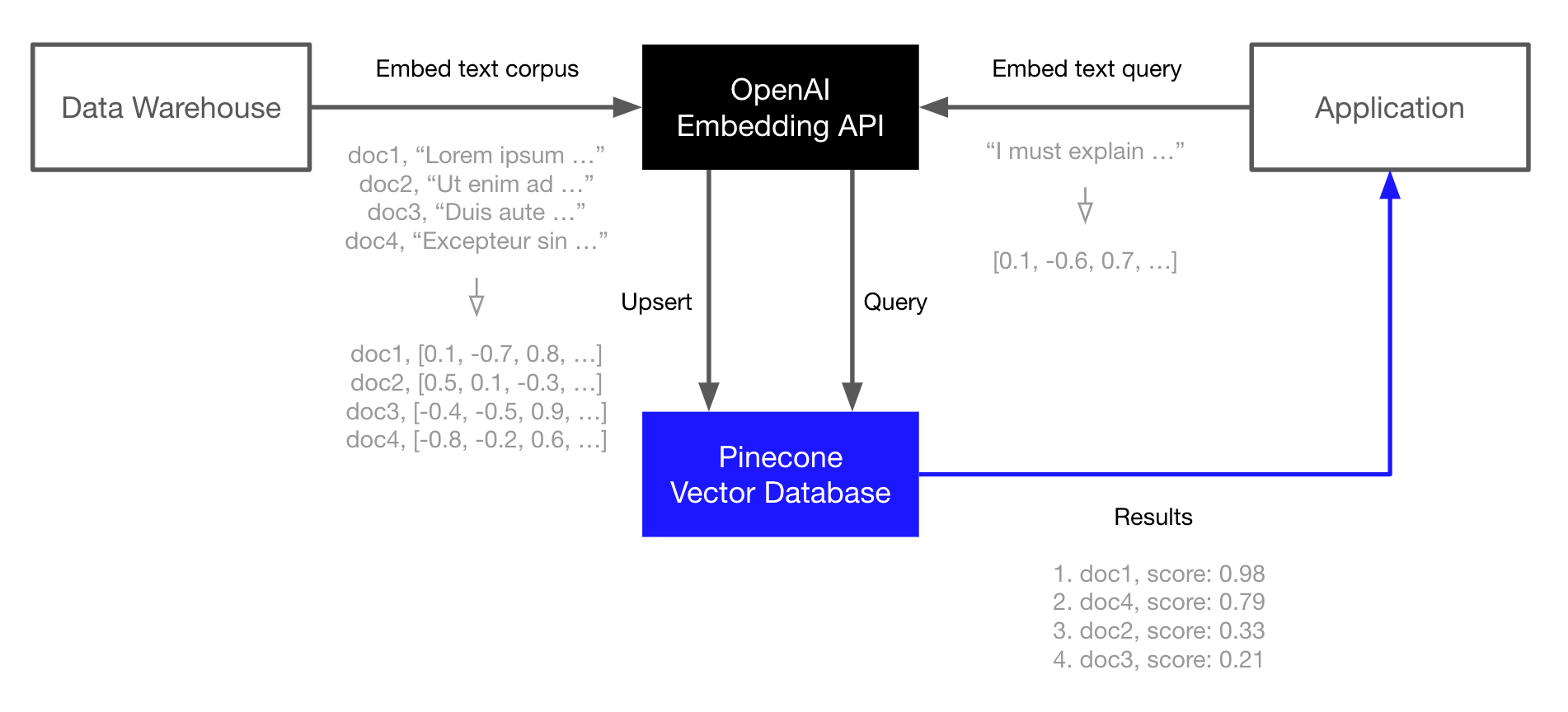

Palantir's business model centers around providing cutting-edge data analytics and artificial intelligence (AI) platforms to both government and commercial clients. Understanding the nuances of each sector is crucial for evaluating Palantir stock.

Government Contracts and their Impact

Palantir's substantial revenue stream historically stems from government contracts, particularly within the defense and intelligence sectors. The stability and longevity of these contracts are key factors influencing Palantir stock performance.

- Analyze the size and longevity of existing government contracts: Many of Palantir's government contracts are multi-year agreements, providing a degree of revenue predictability. However, the specific terms and conditions of these contracts are often undisclosed, making independent analysis challenging.

- Assess the potential for expansion into new government agencies and international markets: Palantir actively pursues contracts with new government agencies both domestically and internationally, aiming to diversify its revenue streams and reduce reliance on any single client or region. Success in this area is vital for future Palantir stock growth.

- Discuss the risks associated with government budget cycles and changing political priorities: Government contracts are subject to budgetary constraints and shifts in political priorities. Changes in administration or defense spending could impact the renewal or awarding of future contracts, posing a risk to Palantir's revenue projections and consequently, Palantir stock price.

Commercial Growth and Market Penetration

Palantir's ambition extends beyond government contracts; its commercial arm is actively seeking to penetrate various industries, including finance, healthcare, and energy.

- Highlight successful commercial partnerships and case studies demonstrating ROI: Palantir showcases case studies highlighting successful implementations and return on investment (ROI) for commercial clients. These demonstrate the value proposition of their platform and are critical in attracting further commercial adoption.

- Discuss the competitive landscape and Palantir's differentiation strategies: The data analytics and AI market is highly competitive, with established players like IBM, Microsoft, and Amazon Web Services (AWS) vying for market share. Palantir differentiates itself through its highly specialized platform, particularly its ability to handle complex, sensitive data sets.

- Evaluate the potential for growth within existing commercial sectors and expansion into new ones: Success in commercial markets hinges on Palantir's ability to secure and retain large clients, successfully navigate the competitive landscape, and continually innovate to meet evolving market needs. This is a critical aspect of assessing the long-term prospects of Palantir stock.

Financial Performance and Valuation

Analyzing Palantir's financial performance and valuation is essential for any investor considering Palantir stock.

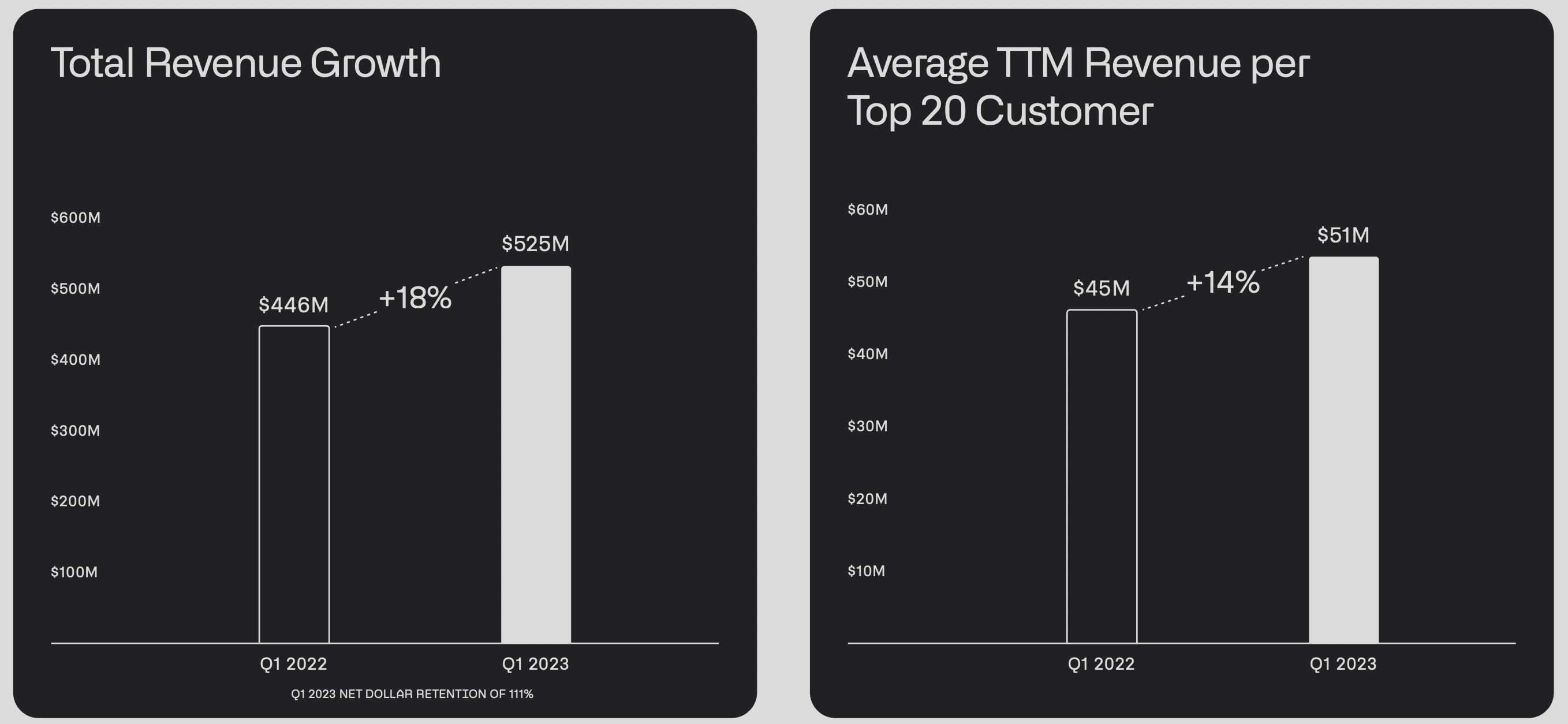

Revenue Growth and Profitability

Palantir has demonstrated significant revenue growth, but profitability has been a key focus area for the company.

- Compare Palantir's financial performance to industry peers: Comparing Palantir's key financial metrics (revenue growth, operating margin, free cash flow) against competitors helps contextualize its performance within the broader data analytics market.

- Discuss the company's path to profitability and its long-term financial outlook: Palantir's commitment to profitability involves optimizing operational efficiency and scaling its commercial business. The company's projected path to sustained profitability is a significant factor influencing Palantir stock valuations.

- Examine the impact of any significant acquisitions or divestitures: Any mergers, acquisitions, or divestitures undertaken by Palantir can significantly impact its financial performance and its stock price.

Stock Valuation and Price-to-Sales Ratio

Palantir's stock valuation, often analyzed through metrics like the price-to-sales (P/S) ratio, is crucial for determining whether the stock is fairly priced.

- Discuss the factors influencing the stock price (e.g., market sentiment, news events, earnings reports): Stock prices are influenced by a range of factors, including investor sentiment, news events (both positive and negative), and the company's financial performance as reported in its quarterly earnings releases.

- Analyze whether the stock is currently overvalued or undervalued based on various valuation models: Various valuation models (Discounted Cash Flow, etc.) can help assess whether Palantir stock is currently trading at a premium or discount compared to its intrinsic value.

- Consider the potential impact of investor sentiment on the stock price: Investor sentiment can significantly impact the stock price, irrespective of the company's fundamental performance. Positive or negative news can lead to substantial price fluctuations.

Risks Associated with Investing in Palantir Stock

While Palantir presents significant growth potential, investors must carefully consider inherent risks.

Competition and Market Saturation

The data analytics and AI market is fiercely competitive.

- Identify key competitors and their strengths and weaknesses: Understanding the strengths and weaknesses of key competitors (e.g., AWS, Microsoft Azure, Google Cloud) is essential for evaluating Palantir's competitive position.

- Assess the potential for market saturation and the impact on Palantir's growth: Market saturation could limit future growth opportunities and put pressure on Palantir's pricing and margins.

- Discuss Palantir's strategies for maintaining its competitive edge: Palantir's ability to innovate and adapt to changing market dynamics, including advancements in AI and cloud computing, is vital for maintaining its competitive edge.

Dependence on Key Clients and Contracts

Palantir's reliance on a smaller number of large clients, particularly government agencies, presents a risk.

- Analyze the potential impact of losing a major client or contract: Losing a significant client could have a substantial impact on Palantir's revenue and profitability, affecting Palantir stock valuations.

- Discuss strategies for diversifying the client base and reducing reliance on any single client: Palantir is actively working to diversify its client base by expanding its commercial business and securing contracts with a wider range of organizations.

- Evaluate the potential for contract renegotiations or disputes: Contract renegotiations or disputes with clients could disrupt revenue streams and negatively impact Palantir's financial performance.

Conclusion

This analysis of Palantir stock reveals a company with significant growth potential fueled by its innovative technology and expanding client base. However, investors should carefully consider the risks associated with its reliance on government contracts, intense competition, and fluctuating stock valuation. Ultimately, whether Palantir stock is a good investment for you depends on your risk tolerance, investment horizon, and due diligence. Before investing in Palantir stock, conduct thorough research and consider seeking advice from a qualified financial advisor. Remember to carefully evaluate the risks and rewards before making any investment decisions related to Palantir stock and its future performance.

Featured Posts

-

Dangote Refinery And Its Potential Effect On Nnpcs Petrol Pricing Strategy

May 10, 2025

Dangote Refinery And Its Potential Effect On Nnpcs Petrol Pricing Strategy

May 10, 2025 -

The Trump Aoc Feud How Fox News Covered It

May 10, 2025

The Trump Aoc Feud How Fox News Covered It

May 10, 2025 -

Europa League Preview Brobbeys Strength A Key Threat For Opponents

May 10, 2025

Europa League Preview Brobbeys Strength A Key Threat For Opponents

May 10, 2025 -

Open Ai Simplifies Voice Assistant Creation Unveiled At 2024 Developer Event

May 10, 2025

Open Ai Simplifies Voice Assistant Creation Unveiled At 2024 Developer Event

May 10, 2025 -

Vegas Golden Knights Win Game 4 Barbashevs Overtime Heroics

May 10, 2025

Vegas Golden Knights Win Game 4 Barbashevs Overtime Heroics

May 10, 2025