Is Palantir Stock A Good Investment In 2024?

Table of Contents

Palantir's Financial Performance and Growth Potential

Revenue Growth and Profitability

Palantir's recent financial reports showcase a company experiencing significant growth, albeit with varying profitability. Analyzing key metrics is crucial for assessing its investment potential. While revenue growth has been impressive, achieving consistent profitability remains a key focus for the company.

- Year-over-year revenue growth comparison: Examine the percentage increase in revenue year-over-year to understand the trajectory of Palantir's top line. This should be compared to industry benchmarks for data analytics companies.

- Profitability trends: Analyze operating margins and net income to assess Palantir's ability to translate revenue growth into profit. Look for trends and explanations for any fluctuations.

- Discussion of government vs. commercial revenue streams: A significant portion of Palantir's revenue comes from government contracts. Understanding the balance between government and commercial revenue is vital, as dependence on one sector can introduce risk. Analyzing the growth rate of each sector provides insight into future revenue streams.

Future Revenue Projections and Analyst Estimates

Analyst estimates for Palantir's future revenue growth vary, reflecting the inherent uncertainty in projecting the future performance of a rapidly evolving technology company. While some analysts are bullish, others express concerns.

- Summary of analyst predictions: Compile a range of revenue projections from reputable financial analysts, noting the high and low estimates.

- Potential catalysts for growth (new product launches, expanded partnerships): Identify potential factors that could drive future revenue growth, such as the successful launch of new products or the expansion of strategic partnerships. This includes examining their expanding presence in the commercial sector beyond government contracts.

- Risks to revenue projections: Discuss potential headwinds that could hinder revenue growth, including increased competition, economic downturns, and changes in government spending.

Palantir's Key Partnerships and Customer Base

Government Contracts and Their Impact

Palantir has a strong presence in the government contracting space. This sector provides a stable revenue stream, but its dependence on government funding presents certain risks.

- Key government clients: Identifying major government clients helps assess the stability and potential for future contract renewals.

- Contract renewal rates: Analyzing contract renewal rates gives insights into the longevity of Palantir's government business. High renewal rates signify strong client relationships.

- Potential impact of changing political landscapes: Changes in government administrations or policies can impact government spending on technology, creating uncertainty for Palantir's revenue.

Commercial Partnerships and Market Expansion

Palantir is actively expanding into the commercial market, aiming to diversify its revenue streams and reduce its dependence on government contracts. This expansion presents both opportunities and challenges.

- Examples of key commercial partnerships: Highlight successful commercial partnerships that demonstrate Palantir's ability to penetrate this competitive market.

- Market penetration strategies: Analyzing Palantir's strategies for entering and expanding within commercial markets provides insight into its long-term growth prospects. This should include analysis of their marketing and sales strategies.

- Challenges in the competitive commercial market: Discuss the intense competition in the commercial data analytics market, and Palantir's ability to differentiate itself and capture market share.

Risks and Challenges Facing Palantir

Competition in the Data Analytics Market

Palantir faces stiff competition from established tech giants and other specialized data analytics firms. Understanding this competitive landscape is essential.

- Key competitors (e.g., AWS, Microsoft, Google): Identify and analyze Palantir's main competitors, highlighting their strengths and weaknesses.

- Analysis of Palantir's competitive edge (e.g., specialized software, government relationships): Determine Palantir's competitive advantages and how these advantages translate into market share and revenue.

- Potential threats from competitors: Assess potential threats posed by competitors, such as price wars, technological innovations, and strategic partnerships.

Valuation and Stock Price Volatility

Palantir's valuation and stock price have experienced significant volatility. Understanding the factors driving this volatility is critical for potential investors.

- Price-to-sales ratio: Analyze Palantir's price-to-sales ratio compared to its competitors to determine its relative valuation.

- Comparisons to competitor valuations: Compare Palantir's valuation to similar companies in the data analytics sector to gain perspective.

- Potential factors influencing stock price (e.g., market sentiment, earnings reports, geopolitical events): Identify factors that can significantly impact Palantir's stock price, including market sentiment, earnings reports, and geopolitical events.

Is Palantir Stock a Buy, Sell, or Hold in 2024?

Investment Recommendation

Based on the analysis above, a definitive "buy," "sell," or "hold" recommendation is difficult to provide without considering individual investor risk tolerance and investment goals. However, the analysis points to both significant growth potential and considerable risk.

- Overall risk assessment: Palantir operates in a dynamic and competitive market. Its dependence on government contracts presents a degree of risk.

- Potential return on investment: The potential for significant returns is balanced by the risks outlined above.

- Suggested investment strategy (e.g., long-term hold, short-term trade): A long-term investment strategy might be more appropriate for those willing to tolerate higher risk for potentially higher rewards. Short-term trading carries significant risk due to the volatility of the stock.

Conclusion

Palantir's financial performance shows substantial revenue growth, but consistent profitability remains a challenge. Its strong government relationships provide stability, while its expansion into the commercial market offers significant growth potential. However, intense competition and stock price volatility pose considerable risks. Whether Palantir stock is a good investment in 2024 depends heavily on individual investor risk tolerance and long-term investment goals.

While this analysis offers insights into whether Palantir stock is a good investment in 2024, remember to conduct your own thorough due diligence before making any investment decisions regarding Palantir stock. Consult with a qualified financial advisor before investing in Palantir or any other stock. This analysis should not be considered financial advice.

Featured Posts

-

Ihsayyat Fyraty Me Alerby Alqtry Mqarnt Badayh Me Alahly Almsry

May 09, 2025

Ihsayyat Fyraty Me Alerby Alqtry Mqarnt Badayh Me Alahly Almsry

May 09, 2025 -

Review St Albert Dinner Theatres Hilarious New Production

May 09, 2025

Review St Albert Dinner Theatres Hilarious New Production

May 09, 2025 -

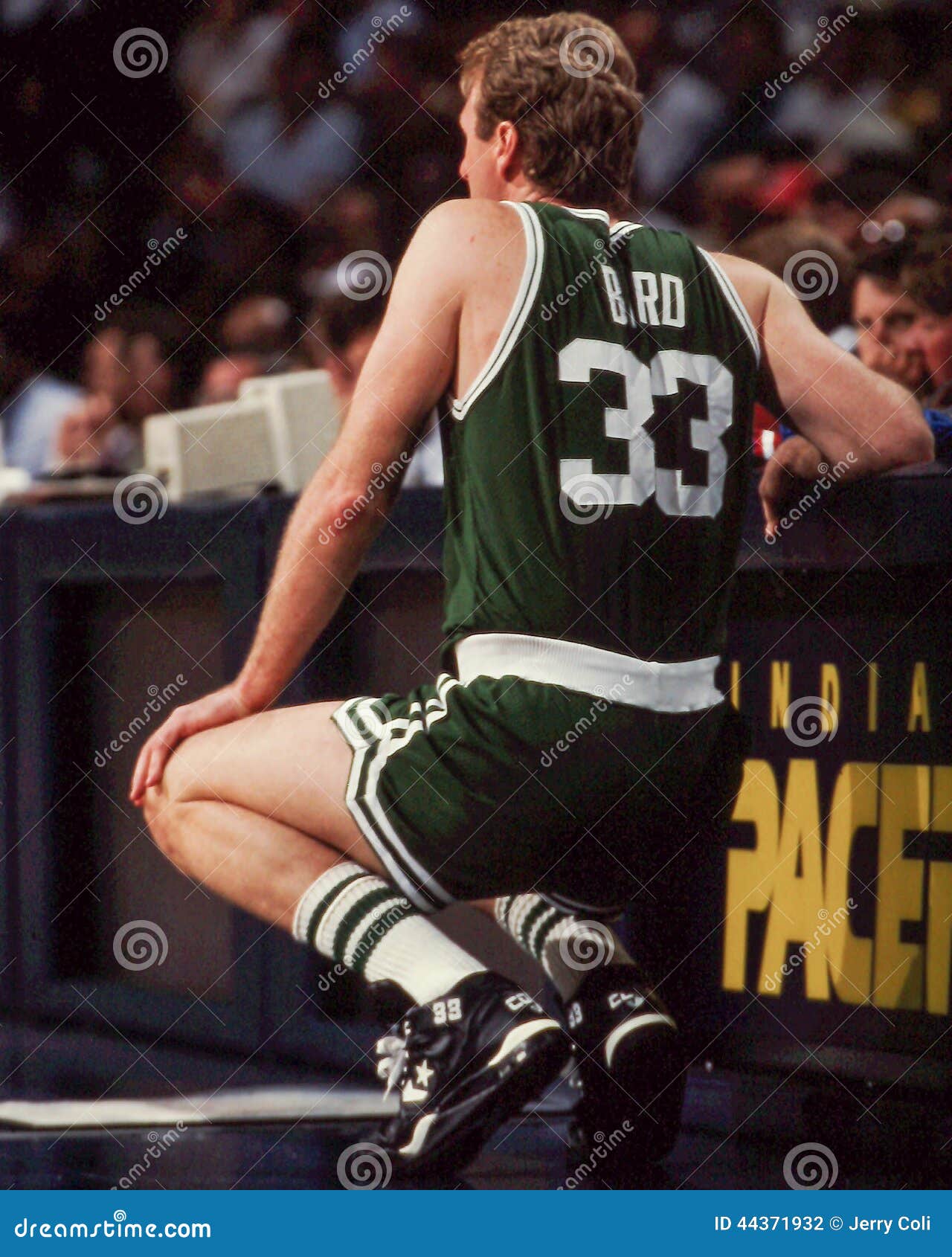

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 09, 2025

Jayson Tatums Honest Assessment Of Larry Bird A Boston Celtics Legend

May 09, 2025 -

Bekam Nepobiten Dokaz Za Negovata Velichina Vo Fudbalot

May 09, 2025

Bekam Nepobiten Dokaz Za Negovata Velichina Vo Fudbalot

May 09, 2025 -

Indias Rise New Global Power Rankings

May 09, 2025

Indias Rise New Global Power Rankings

May 09, 2025