Is Palantir Stock A Good Investment? Risks And Rewards Considered

Table of Contents

Palantir Technologies (PLTR) has captured significant investor attention as a leading player in big data analytics and government contracting. Its innovative platforms and substantial government contracts have fueled both excitement and skepticism. But is Palantir stock a sound investment for your portfolio in 2024? This comprehensive analysis delves into the potential rewards and inherent risks associated with investing in Palantir, empowering you to make an informed decision.

Palantir's Business Model and Competitive Advantage

Palantir's business model hinges on two primary pillars: lucrative government contracts and burgeoning commercial growth, both leveraging its powerful data analytics platforms and increasingly sophisticated AI capabilities.

Government Contracts

Palantir's substantial revenue stream originates from its extensive government contracts. These contracts provide a degree of revenue stability, crucial for long-term growth. However, dependence on government spending also presents inherent risks.

- Key Government Clients: The CIA, the Department of Defense, and various other intelligence agencies globally.

- Contract Renewal Rates: While Palantir enjoys strong relationships, contract renewals are subject to budgetary considerations and shifting geopolitical priorities. Consistent renewal success is vital for predictable revenue streams.

- Potential for Future Government Contracts: Palantir actively pursues new government contracts, expanding its reach internationally. The success of these pursuits is critical for continued growth.

- Geopolitical Risks: International political instability and shifts in government priorities can directly impact contract awards and renewal rates, introducing volatility.

Commercial Growth

Palantir is actively expanding its presence in the commercial sector, targeting various industries seeking to leverage data analytics for improved decision-making. Success in this arena is vital for diversifying its revenue streams and reducing reliance on government contracts.

- Examples of Commercial Clients: Companies in finance, healthcare, and manufacturing sectors are increasingly adopting Palantir's platforms. Specific client examples are often kept confidential due to the sensitive nature of the data.

- Growth Rate in the Commercial Sector: While showing promising growth, the commercial sector's contribution to Palantir's overall revenue is still developing compared to the government segment.

- Competitive Landscape within the Commercial Data Analytics Market: Palantir faces stiff competition from established players like AWS, Microsoft Azure, and Google Cloud, requiring constant innovation to maintain a competitive edge.

Foundational AI Capabilities

Palantir’s ongoing investment in Artificial Intelligence is a key differentiator. The incorporation of AI into its platforms enhances the value proposition, attracting more clients and enabling more sophisticated data analysis.

- Specific AI Technologies Employed: Palantir utilizes machine learning, natural language processing, and other AI techniques to improve data analysis and automate processes.

- Competitive Advantages Stemming from AI: AI-powered capabilities provide Palantir with a competitive edge by offering more efficient and insightful data analysis than competitors.

- Potential for Future AI-Driven Revenue Streams: As AI technology advances, Palantir can develop new AI-powered products and services, creating new revenue streams and attracting a wider client base.

Financial Performance and Valuation

Understanding Palantir's financial health and stock valuation is crucial for determining its investment potential.

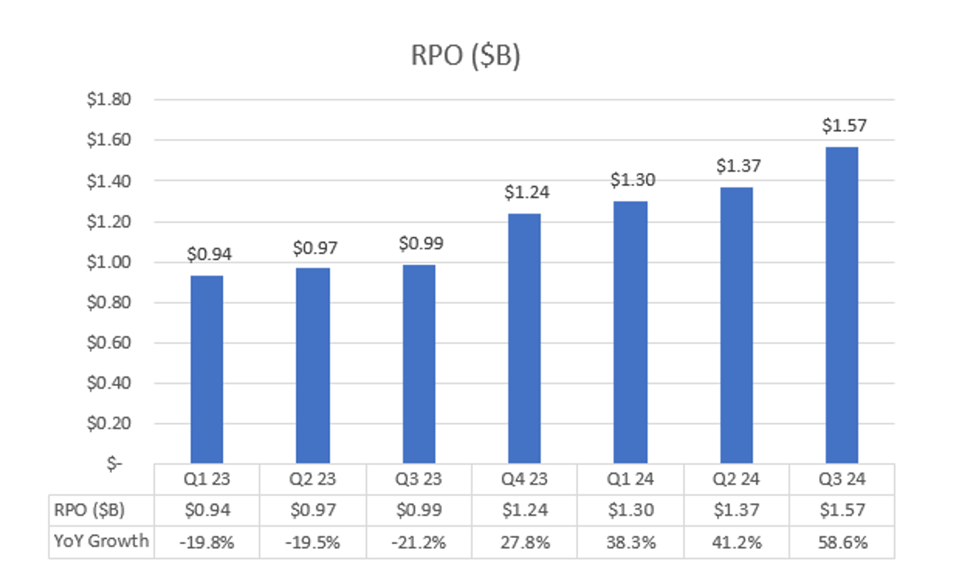

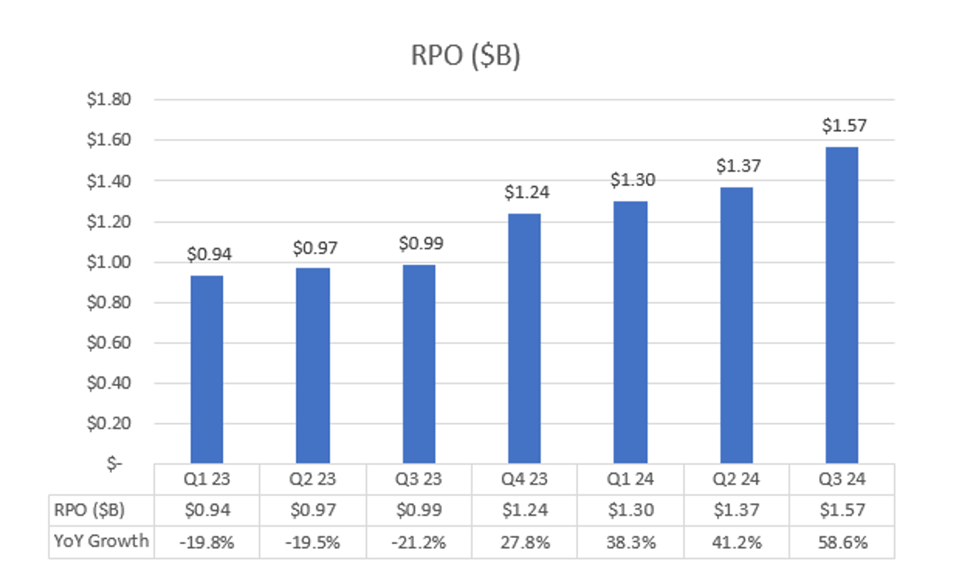

Revenue Growth and Profitability

Palantir has demonstrated revenue growth, but profitability has been a challenge. Analyzing historical and projected financials is essential to assess long-term prospects.

- Key Financial Metrics (Revenue, Earnings, Cash Flow): Investors should carefully examine revenue growth rates, profitability margins, and free cash flow trends to gauge financial health.

- Analysis of Profitability Trends: Palantir's path to profitability is a key factor investors need to evaluate, considering factors like scaling costs and increased competition.

- Comparison to Industry Peers: Benchmarking Palantir's financial performance against its competitors provides valuable context and insights.

Stock Valuation

Evaluating Palantir's stock valuation requires considering several metrics and comparing it to its peers.

- Current Stock Price: The current market price of Palantir stock is volatile and influenced by various market factors.

- P/E Ratio Analysis: The Price-to-Earnings ratio provides an indication of how the market values Palantir's earnings relative to its stock price.

- Comparison to Competitor Valuations: Comparing Palantir's valuation to similar companies in the data analytics sector offers valuable perspective.

- Potential for Future Stock Price Appreciation: Future price appreciation depends on Palantir's ability to execute its business strategy and deliver consistent financial results.

Risks Associated with Investing in Palantir Stock

While Palantir offers potential rewards, significant risks need careful consideration.

Dependence on Government Contracts

The concentration of revenue from government contracts exposes Palantir to potential disruptions.

- Potential for Contract Cancellations: Changes in government priorities or budget cuts could lead to contract cancellations, negatively impacting revenue.

- Impact of Government Budget Changes: Government budget cycles and spending decisions directly influence Palantir’s revenue streams.

- Geopolitical Risks Affecting Contracts: International political events can disrupt contract awards and renewals.

Competition in the Data Analytics Market

The data analytics market is intensely competitive, with many established players and new entrants.

- Key Competitors: Major cloud providers like AWS, Microsoft Azure, and Google Cloud pose significant competition.

- Competitive Strategies: Palantir needs to continue innovating and differentiating its offerings to maintain its market share.

- Potential for Market Share Erosion: Intense competition increases the risk of market share erosion if Palantir fails to adapt or innovate.

High Valuation Concerns

Palantir's stock valuation has at times been considered high relative to its earnings.

- Discussion of Potential Overvaluation: Investors need to assess whether the current market valuation accurately reflects Palantir's future earnings potential.

- Risks Associated with High Valuation Multiples: High valuations make the stock more susceptible to market downturns and corrections.

- Sensitivity to Market Sentiment: Investor sentiment towards Palantir's stock can significantly impact its price, creating volatility.

Potential Rewards of Investing in Palantir Stock

Despite the risks, several factors suggest potential rewards for long-term investors.

Growth Potential in Big Data Analytics

The global big data analytics market is expanding rapidly, presenting significant growth opportunities for Palantir.

- Market Size and Growth Projections: The market for big data analytics is projected to grow considerably, offering Palantir a large addressable market.

- Palantir's Market Share Potential: Palantir’s innovative platforms and established client base position it to capture significant market share.

- Innovative Technologies Driving Growth: Continued advancements in AI and data analytics technologies will drive growth in the market and for Palantir’s offerings.

First-Mover Advantage

Palantir's early entry into the market gives it a significant first-mover advantage.

- Strengths in Data Integration: Palantir's platforms excel at integrating vast amounts of data from diverse sources, a key competitive advantage.

- Network Effects: As more clients join the platform, the value proposition increases, reinforcing network effects.

- Strong Client Relationships: Long-standing relationships with government and commercial clients are valuable assets.

Long-Term Growth Story

Palantir's long-term vision and strategic initiatives suggest potential for sustained growth and profitability.

- Long-Term Market Opportunity: The long-term growth potential of the data analytics market supports a long-term investment thesis.

- Potential for New Product Offerings: Palantir's ongoing innovation enables the creation of new products and services, expanding its market reach.

- Strategic Acquisitions: Strategic acquisitions can accelerate growth and expand capabilities.

Conclusion

Investing in Palantir stock presents a complex equation, balancing considerable potential rewards with significant inherent risks. Its strong presence in government contracting provides a stable revenue stream, but reliance on this sector also introduces vulnerability. Growth in the commercial sector and AI-driven innovations offer considerable long-term promise, but competition is intense. Ultimately, whether Palantir stock is a good investment for you depends on your individual risk tolerance, investment horizon, and due diligence. Before making any investment decisions regarding Palantir stock, remember to conduct your own thorough research and consider consulting with a qualified financial advisor to ensure the investment aligns with your overall financial strategy. Is Palantir stock right for your portfolio? Only careful consideration of the risks and rewards discussed here can provide the answer.

Featured Posts

-

2025 Bitcoin Conference In Seoul Key Industry Players Attend

May 09, 2025

2025 Bitcoin Conference In Seoul Key Industry Players Attend

May 09, 2025 -

The Importance Of Local News Coverage For Anchorages Arts Community

May 09, 2025

The Importance Of Local News Coverage For Anchorages Arts Community

May 09, 2025 -

Caso Madeleine Mc Cann Prisao De Mulher Que Se Apresenta Como A Desaparecida

May 09, 2025

Caso Madeleine Mc Cann Prisao De Mulher Que Se Apresenta Como A Desaparecida

May 09, 2025 -

Elon Musks Net Worth Falls Below 300 Billion Tesla Troubles And Tariff Impacts

May 09, 2025

Elon Musks Net Worth Falls Below 300 Billion Tesla Troubles And Tariff Impacts

May 09, 2025 -

Jayson Tatums Wrist Injury Boston Celtics Head Coachs Latest

May 09, 2025

Jayson Tatums Wrist Injury Boston Celtics Head Coachs Latest

May 09, 2025