Is Palantir Technologies Stock A Buy Now? A Comprehensive Analysis

Table of Contents

Palantir's Business Model and Growth Prospects

Palantir Technologies is a prominent player in the big data analytics market, providing software platforms to government and commercial clients for data integration, analysis, and visualization. The company's success hinges on its ability to secure and retain contracts, both within the government and commercial sectors.

Government Contracts and Revenue Stability: A significant portion of Palantir's revenue stems from government contracts, particularly within the defense and intelligence sectors. This reliance provides a degree of stability, as government contracts often involve long-term partnerships. However, it also introduces inherent risks.

- Recent Contract Wins: Palantir has secured several substantial contracts recently, demonstrating ongoing demand for its services. These wins often involve multi-year agreements, ensuring a consistent revenue stream.

- Long-Term Prospects: The long-term outlook for government contracts remains positive, driven by increasing government reliance on data analytics for national security and public services. However, changes in government priorities or budgetary constraints could impact future contracts.

- Risks: Dependence on a limited number of government clients poses a significant risk. The loss of a major government contract could severely impact Palantir's financial performance.

Commercial Market Penetration and Growth Potential: Palantir is actively expanding its presence in the commercial market, targeting diverse sectors such as finance, healthcare, and energy. The success of this expansion will be critical for long-term growth.

- Successful Commercial Deployments: Palantir has showcased successful implementations in various commercial sectors, demonstrating the versatility and value of its platform. Case studies highlight improved efficiency and better decision-making for clients.

- Competition: The big data analytics market is highly competitive, with established players and innovative startups vying for market share. Palantir's proprietary technology and strong client relationships give it a competitive advantage.

- Future Growth: The commercial market offers significant growth potential for Palantir, as more businesses recognize the value of data-driven insights. Continued investment in research and development, coupled with strategic partnerships, will be crucial for success in this sector.

Financial Performance and Key Metrics: Analyzing Palantir's financial reports provides insights into its performance and future trajectory. Key metrics include revenue growth, profitability, and cash flow.

- Revenue Growth: Palantir has demonstrated consistent revenue growth, although the rate of growth may fluctuate depending on the timing of large contract wins.

- Profitability: Profitability margins are crucial to assess the sustainability of Palantir's business model. Investors should track operating margins and net income trends.

- Cash Flow: Positive cash flow indicates the company's ability to generate cash from its operations, which is vital for reinvestment and future growth.

Risk Factors Associated with Investing in Palantir Technologies Stock

Investing in Palantir Technologies stock involves significant risk, and investors need to carefully assess these factors before making a decision.

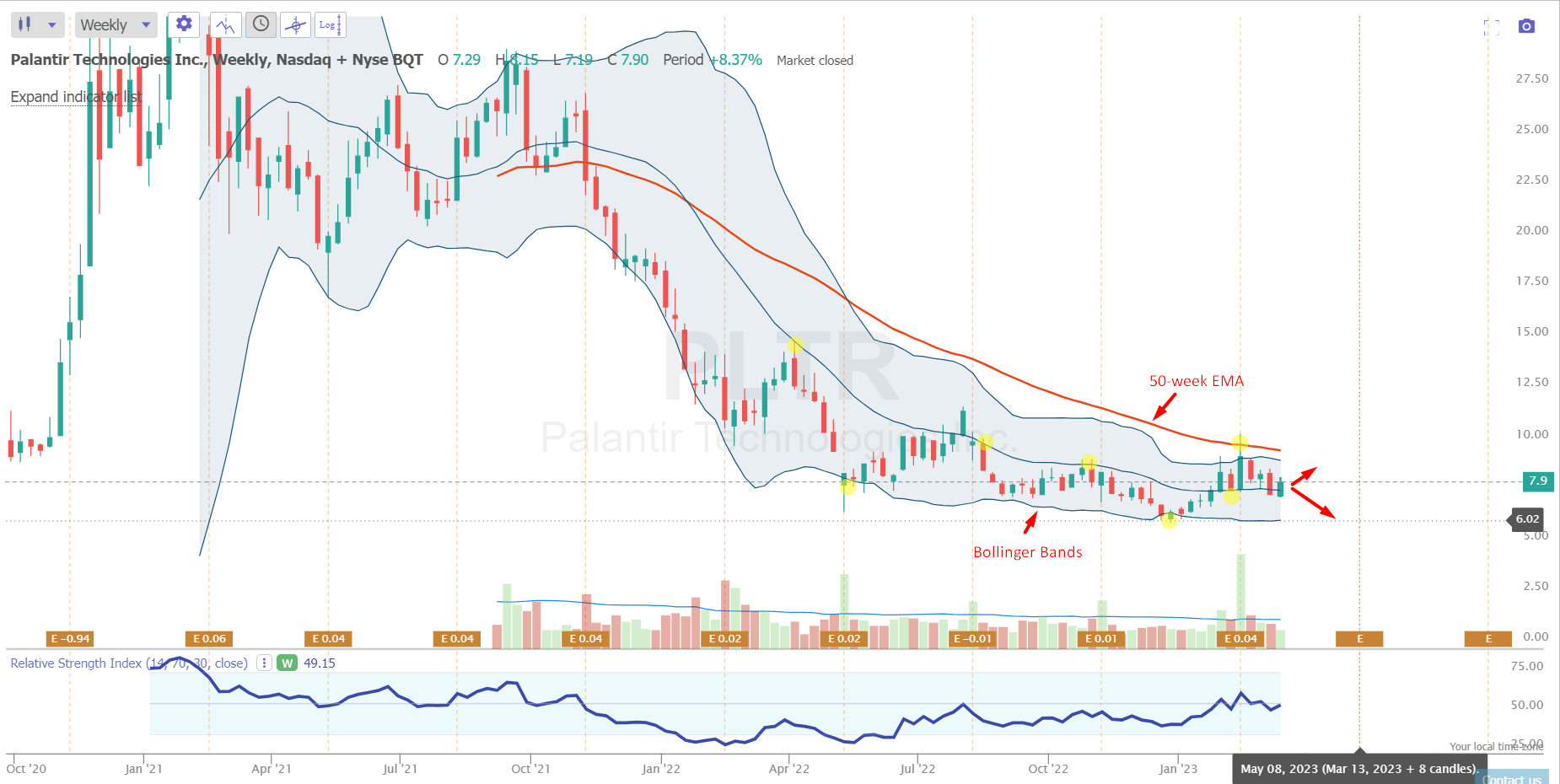

Valuation and Stock Price Volatility: Palantir's stock price has been highly volatile, influenced by market sentiment, financial performance, and overall investor confidence.

- Factors Driving Volatility: News related to contract wins, financial reports, and broader market trends can significantly impact the stock price.

- Valuation Compared to Peers: Analyzing Palantir's valuation relative to its competitors in the big data analytics sector is important in assessing whether the stock is overvalued or undervalued.

- Risk of Further Fluctuations: The inherent volatility of Palantir Technologies stock suggests that future price fluctuations are likely.

Competition and Market Saturation: The big data analytics market is becoming increasingly competitive, with both established players and new entrants vying for market share.

- Key Competitors: Identifying and analyzing the strengths and weaknesses of key competitors is crucial for assessing Palantir's competitive position.

- Market Saturation: The potential for market saturation poses a threat to Palantir's future growth. The company must continue to innovate and expand into new markets.

- Impact on Future Performance: Increased competition could impact Palantir's ability to maintain its current revenue growth and profitability.

Dependence on a Few Key Clients: A significant portion of Palantir's revenue comes from a relatively small number of large clients, particularly government agencies. This concentration poses a risk. The loss of a major client could have a substantial negative impact on the company's financial performance.

Alternative Investment Opportunities in the Big Data Analytics Sector

Several other companies operate in the big data analytics sector, offering alternative investment opportunities. Comparing Palantir to its peers, considering factors like market capitalization, revenue growth, and profitability, will help potential investors make informed decisions based on their risk tolerance and investment goals. Examples of such companies include [mention relevant competitors].

Conclusion

Investing in Palantir Technologies stock presents a complex decision, balancing significant growth potential with substantial risk. While the company's strong technology and government contracts provide a degree of stability, its dependence on a few key clients and the volatile nature of its stock price introduce considerable uncertainty. The competitive landscape also requires careful consideration.

Investment Recommendation: Based on this analysis, determining whether Palantir Technologies stock is a buy now depends heavily on your individual risk tolerance and investment timeline. Given the volatility and potential risks, a cautious approach is warranted. For aggressive investors with a long-term perspective who are comfortable with significant risk, Palantir Technologies stock might be considered a potential addition to a well-diversified portfolio. For more conservative investors, other options in the big data analytics sector or more stable investments may be preferable.

Call to Action: Consider the factors outlined in this comprehensive analysis to determine if Palantir Technologies stock aligns with your investment strategy. Remember to conduct thorough due diligence, including consulting with a financial advisor, before making any investment decisions concerning Palantir Technologies stock or any other investment opportunity.

Featured Posts

-

Harry Styles Reacts To A Hilariously Bad Snl Impression

May 09, 2025

Harry Styles Reacts To A Hilariously Bad Snl Impression

May 09, 2025 -

Tragedi Putra Heights 10 Inisiatif Adn Pas Selangor Untuk Mangsa

May 09, 2025

Tragedi Putra Heights 10 Inisiatif Adn Pas Selangor Untuk Mangsa

May 09, 2025 -

Assessing The Impact Of High Potential An 11 Year Retrospective

May 09, 2025

Assessing The Impact Of High Potential An 11 Year Retrospective

May 09, 2025 -

Oilers Favored To Win Analyzing Edmontons Chances Against The Kings

May 09, 2025

Oilers Favored To Win Analyzing Edmontons Chances Against The Kings

May 09, 2025 -

Woman Claims To Be Madeleine Mc Cann Now Faces Stalking Charges

May 09, 2025

Woman Claims To Be Madeleine Mc Cann Now Faces Stalking Charges

May 09, 2025