Is Posthaste Necessary? Urgent Concerns In The International Bond Market

Table of Contents

Rising Interest Rates and Their Impact on International Bond Yields

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. When interest rates rise, the yields on newly issued bonds increase, making them more attractive to investors. Conversely, the prices of existing bonds with lower coupon rates fall to reflect the higher prevailing interest rates. This impact reverberates throughout the international bond market, affecting various bond types differently.

Rising interest rates significantly impact different types of international bonds. Government bonds, often considered relatively safe haven assets, experience price declines as yields rise. Corporate bonds, carrying higher risk due to the potential for default, are even more sensitive to interest rate increases. Their yields increase to compensate investors for the heightened risk, impacting corporate borrowing costs.

- Increased borrowing costs for governments and corporations: Higher interest rates make it more expensive for governments and corporations to borrow money, potentially slowing economic growth.

- Potential for capital losses on existing bond holdings: Investors holding bonds with fixed coupon rates may experience capital losses as interest rates rise and bond prices fall.

- Increased volatility in the international bond market: Fluctuations in interest rates contribute to increased volatility and uncertainty in the international bond market.

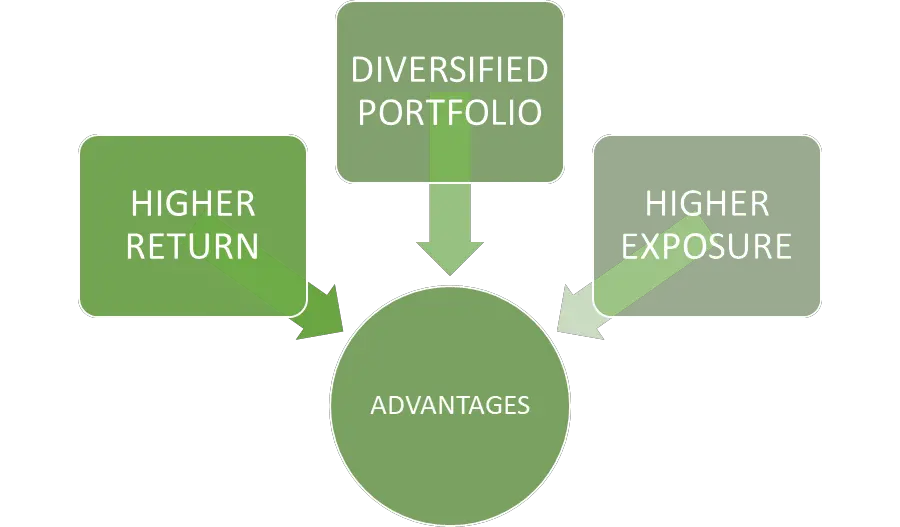

- The need for careful portfolio diversification: Diversification across different bond maturities, credit ratings, and geographies becomes crucial to mitigate the risks associated with rising interest rates.

Geopolitical Instability and Its Influence on International Bond Market Sentiment

Geopolitical events, including wars, sanctions, and political instability, significantly influence investor confidence and sentiment within the international bond market. These events often trigger shifts in capital flows and demand for different asset classes.

Geopolitical instability frequently impacts demand for safe-haven assets. During times of uncertainty, investors often flock to government bonds issued by countries perceived as politically stable and economically strong. This increased demand drives down yields on these bonds, while bonds issued in volatile regions experience increased risk premiums.

- Flight to safety impacting bond yields: Investors seek safety, pushing down yields on government bonds issued by perceived safe havens.

- Increased risk premiums for bonds issued in volatile regions: Bonds from politically unstable regions command higher yields to compensate for the increased risk.

- Difficulty in predicting market reactions to geopolitical events: The international bond market's response to geopolitical events is often unpredictable and depends on several factors, including the severity and duration of the event and investor sentiment.

- The importance of monitoring geopolitical risks: Thorough geopolitical risk assessment is crucial for investors to make informed decisions in this unpredictable market.

The Role of Inflation in Shaping International Bond Market Dynamics

Inflation significantly erodes the purchasing power of fixed-income investments, including bonds. When inflation rises, real bond yields (nominal yield minus inflation) fall, making bonds less attractive to investors. Central banks often respond to inflation by raising interest rates, further impacting bond markets.

- Eroding purchasing power of fixed-income investments: Inflation reduces the real return on bond investments, making them less appealing.

- Central bank rate hikes impacting bond prices: Central bank actions to curb inflation by raising interest rates can lead to declines in bond prices.

- The need to consider inflation-adjusted returns: Investors need to carefully consider inflation-adjusted returns to assess the true value of bond investments.

- Strategies for mitigating inflation risk in bond portfolios: Strategies like investing in inflation-linked bonds or diversifying into other asset classes can help mitigate inflation risk.

Technological Disruption and its Effect on the International Bond Market

Technological advancements, particularly in fintech and automation, have profoundly impacted the international bond market. High-frequency trading (HFT) and algorithmic trading have increased trading speed and frequency, leading to both increased efficiency and potential risks.

- Increased trading speed and frequency: Technological advancements enable faster and more frequent trading, impacting market liquidity and price discovery.

- Potential for flash crashes and market manipulation: The speed and automation of algorithmic trading can increase the risk of flash crashes and market manipulation.

- The need for robust risk management systems: Sophisticated risk management systems are crucial to navigate the complexities and increased risks of the technologically driven market.

- The impact of high-frequency trading on market liquidity: HFT can both improve and diminish market liquidity, depending on market conditions and trading strategies.

The Need for a More Deliberate Approach

Given the complex interplay of interest rates, geopolitical instability, inflation, and technological disruption, a more cautious and considered approach to investing in the international bond market is warranted. The relentless pursuit of speed ("posthaste") can be detrimental.

- Prioritizing long-term investment strategies over short-term gains: Focusing on long-term investment goals reduces the impact of short-term market volatility.

- Focusing on fundamental analysis rather than relying solely on technical indicators: Fundamental analysis helps assess the underlying value of bonds, providing a more stable basis for investment decisions.

- Diversifying across different bond types and geographies: Diversification helps to reduce overall portfolio risk and mitigate potential losses.

- Employing robust risk management techniques: Effective risk management is crucial for navigating the uncertainties of the international bond market.

Conclusion

The international bond market presents significant opportunities, but also considerable challenges. While speed may be valued in some aspects of trading, the urgent concerns outlined above highlight the dangers of prioritizing "posthaste" over careful consideration. A more deliberate approach, emphasizing thorough due diligence, robust risk management, and a long-term perspective, is crucial for navigating the complexities of the international bond market. Investors should carefully assess their risk tolerance and develop strategies that account for the various factors influencing this dynamic sector. Understanding these urgent concerns is vital for successfully investing in the international bond market. Take the time to fully understand the risks and opportunities before making any investments in the international bond market.

Featured Posts

-

Kermit The Frog Confirmed 2025 Umd Commencement Speaker

May 23, 2025

Kermit The Frog Confirmed 2025 Umd Commencement Speaker

May 23, 2025 -

Hamas Deception A Witkoff Emissarys Account

May 23, 2025

Hamas Deception A Witkoff Emissarys Account

May 23, 2025 -

Anonymity At Trumps High Price Memecoin Dinner

May 23, 2025

Anonymity At Trumps High Price Memecoin Dinner

May 23, 2025 -

Cat Deeleys This Morning Outfit A Summer Office Style Guide

May 23, 2025

Cat Deeleys This Morning Outfit A Summer Office Style Guide

May 23, 2025 -

Jonathan Groffs Broadway Opening Lea Michele And Friends Show Support

May 23, 2025

Jonathan Groffs Broadway Opening Lea Michele And Friends Show Support

May 23, 2025

Latest Posts

-

Tfasyl Jdydt Hwl Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025

Tfasyl Jdydt Hwl Mdahmat Alshrtt Alalmanyt Lmshjey Krt Alqdm

May 24, 2025 -

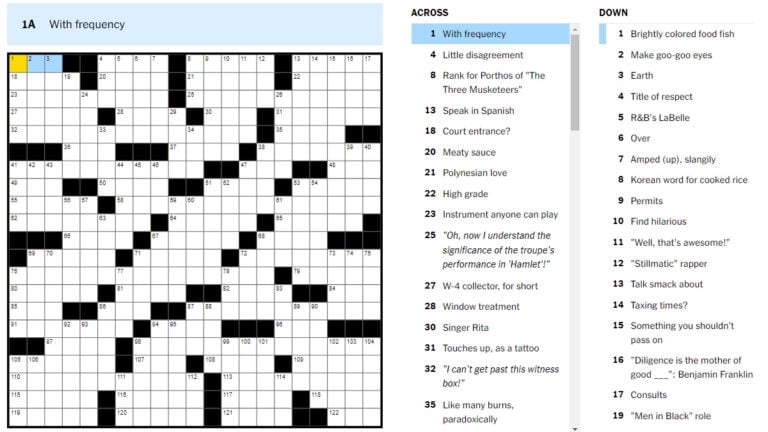

Nyt Mini Crossword Clues And Answers March 16 2025

May 24, 2025

Nyt Mini Crossword Clues And Answers March 16 2025

May 24, 2025 -

Alshrtt Alalmanyt Wmdahmat Almshjeyn Alkhlfyt Walasbab

May 24, 2025

Alshrtt Alalmanyt Wmdahmat Almshjeyn Alkhlfyt Walasbab

May 24, 2025 -

Nyt Mini Crossword Answers For April 18 2025 Your Complete Guide

May 24, 2025

Nyt Mini Crossword Answers For April 18 2025 Your Complete Guide

May 24, 2025 -

Nyt Mini Crossword Answers March 16 2025 Full Solution Guide

May 24, 2025

Nyt Mini Crossword Answers March 16 2025 Full Solution Guide

May 24, 2025