Is Riot Platforms (RIOT) Stock A Good Investment? A Comprehensive Analysis

Table of Contents

Financial Performance and Growth of Riot Platforms (RIOT)

Riot Platforms is a leading Bitcoin mining company, operating large-scale mining facilities and striving for operational efficiency to maximize Bitcoin production. Understanding its financial health is crucial when considering RIOT stock as an investment.

Revenue and Profitability

Riot Platforms' revenue is directly tied to Bitcoin's price and its mining capacity. Examining recent financial reports reveals key trends:

- Revenue Growth: Analyze quarterly and annual revenue reports to identify growth trends. (Insert specific data points here, e.g., "Q3 2023 revenue increased by 15% compared to Q2 2023"). This should be corroborated with reliable financial sources.

- Profitability: Assess net income (or losses) to understand Riot's profitability. Mining margins, which represent the profit generated per Bitcoin mined, are also vital indicators. (Insert specific data points, e.g., "Mining margins decreased by 5% due to increased energy costs").

- Operational Efficiency: Evaluate metrics such as cost per Bitcoin mined to assess operational efficiency improvements over time. This illustrates Riot's ability to optimize its mining operations and enhance profitability. (Insert specific data points, illustrating improvements or setbacks).

- Comparison to Competitors: Compare Riot's financial performance to key competitors like Marathon Digital Holdings (MARA) and Core Scientific (CORZ) to understand its relative position within the Bitcoin mining industry.

Bitcoin Production and Hashrate

Riot Platforms' success depends on its Bitcoin production and hashrate, a measure of its computing power used for mining.

- Bitcoin Production Trends: Analyze the amount of Bitcoin mined by Riot over time. (Insert specific data points, e.g., "Riot produced X Bitcoin in Q3 2023, a Y% increase from Q2 2023"). Illustrate any upward or downward trends.

- Hashrate Significance: Explain that a higher hashrate generally means more Bitcoin can be mined. Track Riot's hashrate to observe its mining capacity growth. (Insert data points showing hashrate changes over time, linking them to Bitcoin production).

- Future Projections: Incorporate any official projections from Riot Platforms or credible analyst predictions regarding future Bitcoin production and hashrate growth. Mention any expansion plans that could impact these metrics.

Risks and Challenges Facing Riot Platforms (RIOT)

Investing in RIOT stock involves substantial risks. A thorough understanding of these potential challenges is vital before committing your capital.

Volatility of Bitcoin Price

Bitcoin's price is highly volatile, directly impacting Riot's profitability and the value of RIOT stock.

- Historical Volatility: Discuss historical Bitcoin price fluctuations and their effect on RIOT stock's performance. Show examples of how price swings have affected the company's financials and stock price.

- Risk Mitigation: Explain any strategies Riot employs to mitigate Bitcoin price risk, such as hedging or holding a portion of mined Bitcoin. Analyze the effectiveness of these strategies.

Regulatory and Environmental Concerns

The cryptocurrency mining industry faces regulatory and environmental challenges that could impact Riot.

- Energy Costs and Regulations: Discuss the rising energy costs associated with Bitcoin mining and potential government regulations aimed at reducing energy consumption. Explain how these factors can affect Riot's profitability.

- Future Regulatory Landscape: Analyze potential future regulations that could impact Riot's operations, such as stricter environmental rules or taxes on cryptocurrency mining.

Competition in the Bitcoin Mining Industry

Riot Platforms operates in a competitive landscape. Understanding its competitive advantages is crucial.

- Key Competitors and Market Share: Identify Riot's major competitors and their respective market shares. Assess Riot’s competitive positioning in terms of hashrate, operational efficiency, and geographical location.

- Riot's Strengths and Weaknesses: Analyze Riot's competitive advantages (e.g., access to low-cost energy, advanced mining technology) and disadvantages (e.g., dependence on Bitcoin price, regulatory risks).

Valuation and Investment Considerations for RIOT Stock

Assessing the valuation of RIOT stock is crucial for determining its investment potential.

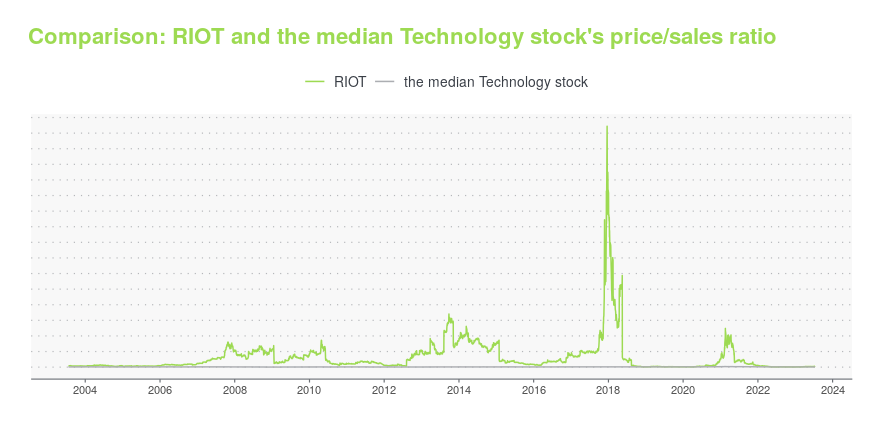

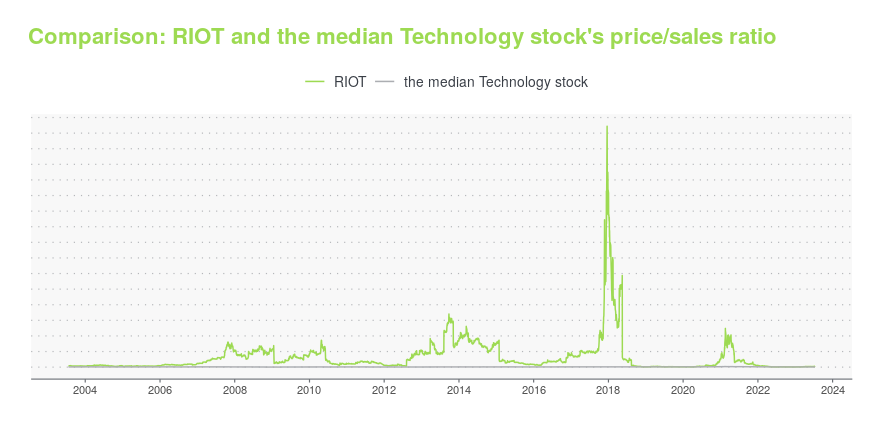

Price-to-Earnings Ratio (P/E) and other Valuation Metrics

- P/E Ratio and Other Metrics: Calculate and interpret Riot's P/E ratio, price-to-book ratio, and other relevant valuation metrics. Compare these ratios to industry averages and historical data to assess whether RIOT is overvalued or undervalued.

- Comparison to Industry Averages: Compare Riot’s key valuation metrics to those of its competitors to determine its relative attractiveness.

Analyst Ratings and Price Targets

- Analyst Consensus: Summarize the consensus view among financial analysts regarding RIOT stock. Cite specific analyst ratings (buy, hold, sell) and price targets from reputable sources.

Long-Term Growth Potential

- Factors Affecting Long-Term Growth: Assess the long-term growth potential of the Bitcoin mining industry and its impact on Riot Platforms. Consider factors such as increasing Bitcoin adoption, technological advancements, and the overall cryptocurrency market growth. Include potential disruptive technologies that could impact Riot’s competitiveness.

Conclusion: Is RIOT Stock Right for Your Investment Portfolio?

Investing in Riot Platforms (RIOT) stock presents both opportunities and substantial risks. While Riot benefits from its position in the growing Bitcoin mining industry and potential long-term growth, its profitability is heavily dependent on Bitcoin's price and the regulatory environment. The company’s financial performance, while showing periods of growth, remains vulnerable to market fluctuations. Before investing in RIOT stock, it's crucial to carefully weigh these factors against your individual risk tolerance and financial goals. Further research into Riot Platforms (RIOT), assessing your risk tolerance before investing in RIOT stock, and considering the long-term potential of RIOT stock are all essential steps in making an informed investment decision. Remember to conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Englands Euro 2025 Path 3 Crucial Questions For Wiegman

May 03, 2025

Englands Euro 2025 Path 3 Crucial Questions For Wiegman

May 03, 2025 -

15 April 2025 Daily Lotto Winning Numbers

May 03, 2025

15 April 2025 Daily Lotto Winning Numbers

May 03, 2025 -

Kellers 500 Point Milestone A Triumph For Missouri Hockey

May 03, 2025

Kellers 500 Point Milestone A Triumph For Missouri Hockey

May 03, 2025 -

Celebrate International Harry Potter Day Shop Official Merchandise Online

May 03, 2025

Celebrate International Harry Potter Day Shop Official Merchandise Online

May 03, 2025 -

Why Middle Management Matters A Critical Analysis Of Their Contributions

May 03, 2025

Why Middle Management Matters A Critical Analysis Of Their Contributions

May 03, 2025

Latest Posts

-

Farage Vs Lowe The Future Of The Reform Party

May 04, 2025

Farage Vs Lowe The Future Of The Reform Party

May 04, 2025 -

Experiment Lowering Dutch Electricity Prices During Solar Surplus

May 04, 2025

Experiment Lowering Dutch Electricity Prices During Solar Surplus

May 04, 2025 -

Lower Electricity Tariffs Dutch Trial During Solar Production Peaks

May 04, 2025

Lower Electricity Tariffs Dutch Trial During Solar Production Peaks

May 04, 2025 -

Is Rupert Lowe The Right Leader To Replace Nigel Farage In Reform

May 04, 2025

Is Rupert Lowe The Right Leader To Replace Nigel Farage In Reform

May 04, 2025 -

Reform Party Leadership Should Farage Step Aside For Rupert Lowe

May 04, 2025

Reform Party Leadership Should Farage Step Aside For Rupert Lowe

May 04, 2025