Is RTL Group's Streaming Service On The Path To Profitability?

Table of Contents

RTL Group's Streaming Service: Current Financial Performance and Challenges

RTL Group's streaming service faces significant headwinds in its quest for profitability. While precise figures are often guarded by the company, publicly available information paints a picture of challenges. The current subscriber base, although growing, is likely still considerably smaller than established players. Average Revenue Per User (ARPU) is also a critical factor. If ARPU remains significantly lower than competitors like Netflix or Disney+, it directly impacts profitability.

Key challenges impacting RTL Group's streaming service profitability include:

- Fierce Competition: Established players command significant market share and brand recognition. Overcoming this entrenched competition requires substantial investment in content and marketing.

- High Content Costs: Securing high-quality programming, both licensed and original, represents a considerable expense. Original content production, in particular, carries significant risk and high upfront costs.

- Marketing and Acquisition Expenses: Attracting and retaining subscribers requires substantial marketing investment, including advertising campaigns, promotions, and user acquisition strategies. The cost of acquiring each new subscriber can be substantial.

- Current subscriber numbers and growth trends: (Insert data if available, otherwise state "Data on precise subscriber numbers and growth rates is currently limited").

- Average Revenue Per User (ARPU) compared to competitors: (Insert comparative data if available, otherwise provide a qualitative assessment).

- Content licensing costs and original production expenses: (Provide estimates or ranges if available).

- Marketing and advertising spend: (Provide estimates or ranges if available).

Key Strategies for Achieving Profitability

To navigate these challenges, RTL Group is likely pursuing several key strategies aimed at increasing revenue and managing costs. A multi-pronged approach is crucial.

- Content Strategy: RTL Group may be focusing on local content to capitalize on regional appeal and avoid direct competition with global giants. International expansion could also be a key component, broadening the subscriber base and diversifying revenue streams. Niche programming, targeting specific demographics or interests, could also prove effective.

- Subscription Pricing Model: Adjustments to subscription pricing tiers may be necessary. Offering a variety of packages – perhaps a cheaper, ad-supported option alongside premium ad-free tiers – can attract a wider audience and increase ARPU.

- Partnerships and Collaborations: Strategic alliances with other media companies or technology providers can offer access to wider content libraries, reduce production costs, or expand distribution channels.

- Expansion into new markets: (Discuss specific market expansion plans if available).

- Development of original content strategies: (Detail any original content strategies, including genre focus, target audience, and production scale).

- Exploring advertising revenue models: (Describe any advertising revenue strategies being implemented).

- Strategic partnerships and mergers: (Discuss any potential or existing partnerships).

- Subscription tier optimization: (Analyze current subscription tiers and potential for improvement).

Competitive Analysis: Benchmarking Against Other Streaming Services

To understand RTL Group's position, a comparison with competitors is essential. Direct competitors include (list specific streaming platforms, e.g., Netflix, Disney+, Amazon Prime Video, local streaming services). Key areas for comparison include subscriber growth rates, content library strength and diversity (including original programming versus licensed content), and ARPU. While RTL Group may excel in specific areas, like local content expertise, it likely needs improvements in areas such as brand recognition and scale.

- Direct competitors: (List specific competitors and their strengths/weaknesses).

- Comparison of subscriber growth rates: (Use comparative data if available, otherwise provide qualitative analysis).

- Analysis of content library strength and diversity: (Compare content libraries in terms of quantity, quality, and genre diversity).

- Comparative ARPU: (Compare ARPU with key competitors).

Long-Term Outlook and Predictions for RTL Group's Streaming Profitability

Predicting the future of RTL Group's streaming service profitability is challenging. However, considering current trends and strategic moves, a balanced perspective suggests a path to profitability is possible, but not guaranteed. Factors that could accelerate profitability include successful content strategies, strategic partnerships, and expansion into new markets. Conversely, intensified competition, rising content costs, and unforeseen regulatory changes could hinder progress.

- Projected subscriber growth in the next 3-5 years: (Provide a reasonable projection based on available data and industry trends).

- Estimated timeline for reaching profitability (if possible): (Offer a tentative timeframe, emphasizing the uncertainties involved).

- Potential risks and opportunities impacting profitability: (List potential risks and opportunities with detailed explanations).

Conclusion: The Future of RTL Group's Streaming Service Profitability

RTL Group's streaming service faces a challenging but not insurmountable path to profitability. While significant hurdles exist – fierce competition, high content costs, and the need for substantial marketing investment – the company's strategic focus on local content, potential for international expansion, and opportunities for partnerships offer avenues for success. The ultimate likelihood of achieving sustainable RTL Group's streaming service profitability hinges on its ability to execute its strategy effectively and adapt to the ever-evolving streaming landscape. We encourage you to share your thoughts on RTL Group's streaming service's financial future and continue following the company's progress in this fiercely competitive market. Will RTL Group find its path to streaming success? Only time will tell.

Featured Posts

-

Gonka Ferrari Pochemu Lekler I Khemilton Byli Diskvalifitsirovany

May 20, 2025

Gonka Ferrari Pochemu Lekler I Khemilton Byli Diskvalifitsirovany

May 20, 2025 -

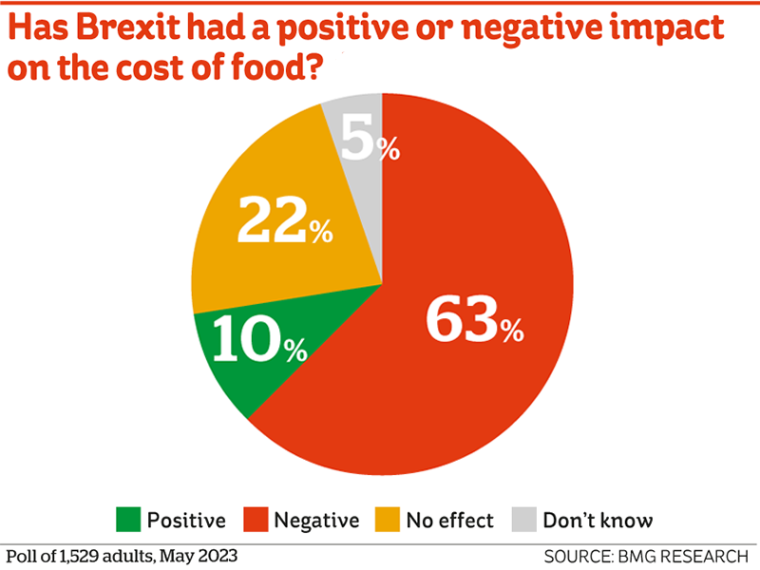

Analysis Brexits Negative Effect On Uk Luxury Exports

May 20, 2025

Analysis Brexits Negative Effect On Uk Luxury Exports

May 20, 2025 -

Nigeria And The Kite Runner A Comparative Analysis Of Ethical Decision Making

May 20, 2025

Nigeria And The Kite Runner A Comparative Analysis Of Ethical Decision Making

May 20, 2025 -

Big Bear Ai Faces Securities Fraud Allegations

May 20, 2025

Big Bear Ai Faces Securities Fraud Allegations

May 20, 2025 -

Mirra Andreeva Put K Vershinam Bolshogo Tennisa

May 20, 2025

Mirra Andreeva Put K Vershinam Bolshogo Tennisa

May 20, 2025