Is The 'Sell America' Trade Back? Moody's 30-Year Yield Hits 5%.

Table of Contents

Understanding the Moody's 30-Year Yield Increase

The Moody's 30-year yield reflects the interest rate investors demand to lend money to the US government for three decades. It's a crucial benchmark for long-term interest rates and a key indicator of investor sentiment towards the US economy. A rising yield generally indicates increased borrowing costs for the government and the private sector, potentially impacting economic growth.

Several factors have contributed to this recent surge:

- Inflationary Pressures: Persistent inflation has forced the Federal Reserve to adopt a more hawkish monetary policy, pushing interest rates higher across the yield curve. High inflation erodes the purchasing power of future bond payments, making longer-term bonds less attractive unless yields rise to compensate.

- Federal Reserve Monetary Policy: The Fed's aggressive interest rate hikes, aimed at curbing inflation, have directly impacted Treasury yields. Higher short-term rates influence longer-term rates, leading to the increase in the 30-year yield.

- Global Economic Uncertainty: Geopolitical instability and global economic slowdown have increased demand for safe-haven assets like US Treasury bonds, putting upward pressure on their prices and lowering their yields. However, this effect is counterbalanced by other factors.

- Potential Flight to Safety (from other assets): Concerns about the stability of other asset classes might lead investors to seek the relative safety of US Treasuries, initially lowering yields. However, increased demand can eventually push yields upwards if the supply remains constant.

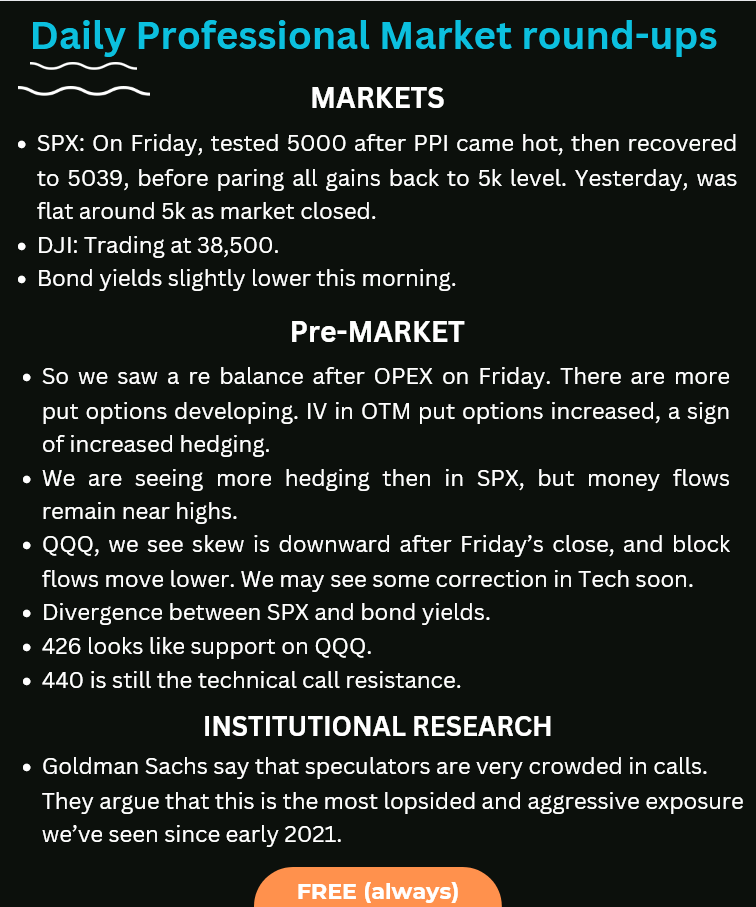

[Insert chart or graph illustrating the movement of the Moody's 30-year yield over the past year.]

The "Sell America" Trade: Definition and Historical Context

The "Sell America" trade refers to a scenario where foreign and domestic investors simultaneously reduce their holdings of US dollar-denominated assets, including Treasury bonds, stocks, and other securities. This mass exodus of capital leads to a weakening of the US dollar, higher interest rates, and potentially slower economic growth.

Historically, periods of heightened global uncertainty or a perceived loss of confidence in the US economy have triggered this trade. The consequences can be severe, leading to currency devaluation, increased borrowing costs, and even recessions.

Connecting the Yield Increase to the "Sell America" Trade

While the rising 30-year yield might seem like a clear indication of a "Sell America" trade in progress, the correlation isn't straightforward. The increase could be primarily driven by domestic factors like inflation and Federal Reserve policy, rather than a massive capital outflow.

Alternative explanations include:

- Increased Demand from Domestic Investors: Domestic investors might be increasing their holdings of longer-term bonds as a hedge against inflation.

- Rebalancing of Portfolios: Institutional investors might be adjusting their portfolios to reflect changing economic conditions, leading to increased demand for long-term bonds.

However, some market analysts believe the yield increase reflects growing concerns about the US fiscal outlook and debt sustainability. "The rising 30-year yield reflects a growing unease about the long-term health of the US economy," notes renowned economist Dr. Anya Sharma. This sentiment, if widespread, could indeed contribute to a "Sell America" scenario.

Potential Economic Consequences of a Resurgent "Sell America" Trade

A full-blown "Sell America" trade could have significant negative consequences:

- Weakening of the US Dollar: A massive outflow of capital would likely depreciate the US dollar, making imports more expensive and potentially fueling inflation further.

- Increased Interest Rates: The increased demand for US Treasury bonds could drive up their yields, leading to higher borrowing costs for businesses and consumers, potentially hindering investment and economic growth.

- Slower Economic Growth: Higher interest rates, reduced investment, and decreased consumer spending could combine to cause a significant economic slowdown.

- Increased Inflation: Although higher interest rates are designed to combat inflation, the initial impact of a "Sell America" trade might be to exacerbate inflationary pressures due to a weakening dollar and supply chain disruptions.

However, the US economy's resilience and the Federal Reserve's ability to manage monetary policy could mitigate some of these negative impacts. The strength of the US economy will play a critical role in determining the ultimate consequences.

Conclusion: Is the "Sell America" Trade Back? A Look Ahead

While the rise in the Moody's 30-year yield is undoubtedly significant, it doesn't definitively signal a full-blown return of the "Sell America" trade. While factors such as inflation and Federal Reserve policy play a major role, growing concerns about US debt and the overall economic outlook cannot be ignored. The interplay of these domestic and global factors will determine the future trajectory of the US economy and the potential for a renewed "Sell America" trend.

To stay informed about the evolving situation and the potential impact of "selling America" on your investments, subscribe to our newsletter for regular updates on market trends and expert analysis. Understanding the nuances of the "Sell America" trade and its potential implications is crucial for navigating the complexities of the current economic climate.

Featured Posts

-

Understanding The Friday Increase In D Wave Quantum Qbts Stock

May 21, 2025

Understanding The Friday Increase In D Wave Quantum Qbts Stock

May 21, 2025 -

A Luxurious Roman Celebration Designer Athena Calderones Milestone Event

May 21, 2025

A Luxurious Roman Celebration Designer Athena Calderones Milestone Event

May 21, 2025 -

Will Trent Actor Ramon Rodriguezs Unexpected Night Three Scorpion Stings

May 21, 2025

Will Trent Actor Ramon Rodriguezs Unexpected Night Three Scorpion Stings

May 21, 2025 -

Echo Valley Images Reveal The Atmosphere Of The Sydney Sweeney Julianne Moore Thriller

May 21, 2025

Echo Valley Images Reveal The Atmosphere Of The Sydney Sweeney Julianne Moore Thriller

May 21, 2025 -

Watch Looney Tunes And Cartoon Network Stars In A New Animated Short 2025

May 21, 2025

Watch Looney Tunes And Cartoon Network Stars In A New Animated Short 2025

May 21, 2025

Latest Posts

-

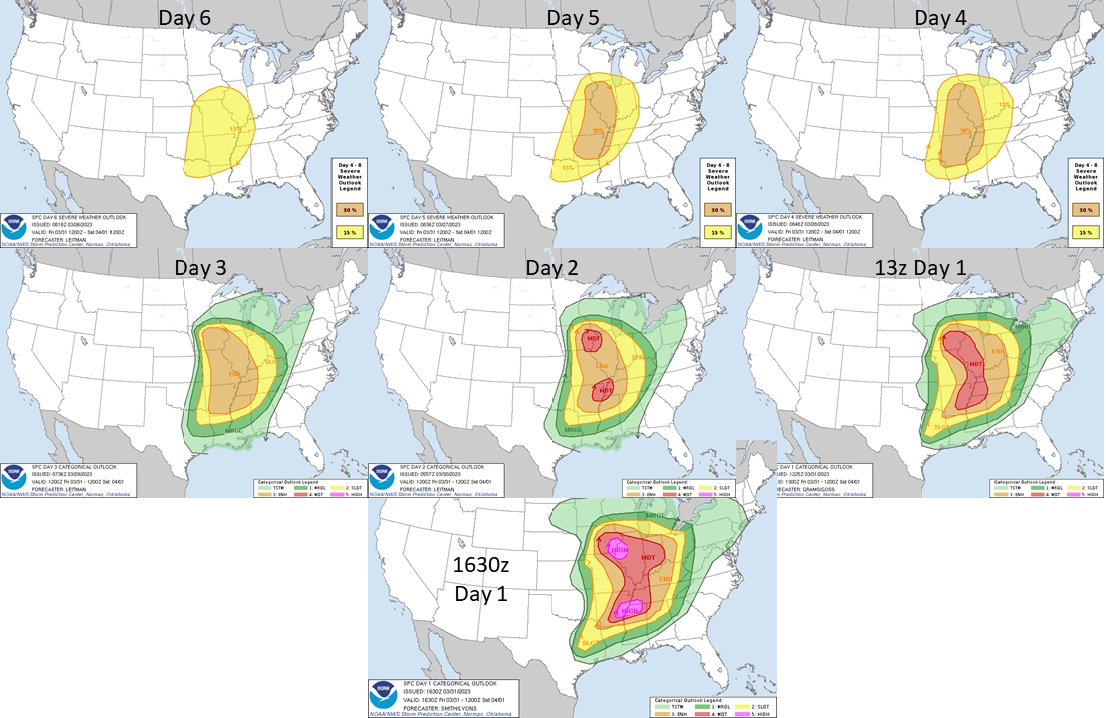

Monday Severe Weather Overnight Storm Potential And Impacts

May 21, 2025

Monday Severe Weather Overnight Storm Potential And Impacts

May 21, 2025 -

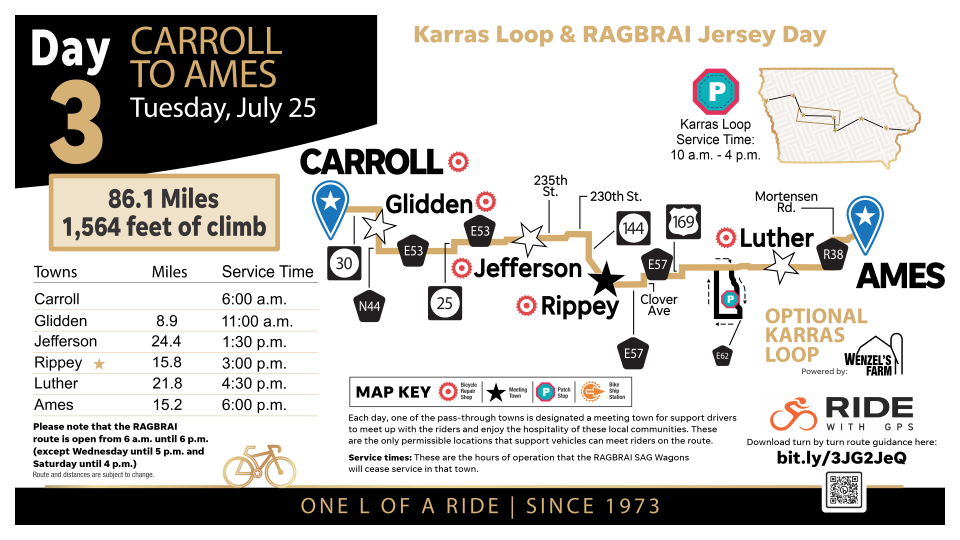

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 21, 2025

Scott Savilles Cycling Journey From Ragbrai To Daily Commutes

May 21, 2025 -

Severe Weather Outlook Storm Chance Overnight Monday Impact

May 21, 2025

Severe Weather Outlook Storm Chance Overnight Monday Impact

May 21, 2025 -

Storm Chance Overnight Severe Weather Potential Monday

May 21, 2025

Storm Chance Overnight Severe Weather Potential Monday

May 21, 2025 -

49 Dogs Removed From Licensed Breeder In Washington County Animal Welfare Concerns

May 21, 2025

49 Dogs Removed From Licensed Breeder In Washington County Animal Welfare Concerns

May 21, 2025