Is This XRP's Big Moment? ETF Approvals, SEC Developments, And Market Impact

Table of Contents

The Ripple-SEC Lawsuit and its Implications for XRP

The Ripple-SEC lawsuit has been a major factor shaping XRP's price and market sentiment. Its resolution has had a significant impact, but the ongoing regulatory landscape continues to present challenges.

The Verdict and its Market Reaction

The partial victory for Ripple in the SEC lawsuit significantly impacted XRP's price and trading volume.

- Short-term price surges: Following the ruling, XRP experienced notable short-term price increases as investors reacted positively to the perceived clarity.

- Long-term price stability: While volatility remains inherent, the ruling contributed to a degree of increased price stability compared to the preceding period of uncertainty.

- Institutional investor interest: The decision potentially opened the door for increased institutional investment in XRP, as some of the uncertainty surrounding its regulatory status was alleviated.

- Regulatory clarity (partial): The ruling provided partial clarity, but the overall regulatory landscape for crypto remains complex, particularly regarding the SEC's classification of other cryptocurrencies.

The specifics of the ruling determined that XRP sales on exchanges were not securities, while programmatic sales were deemed unregistered securities. This nuanced decision affected different exchanges and trading platforms differently, with some continuing to list XRP while others paused trading pending further clarification. The immediate aftermath saw a significant increase in trading volume on exchanges that continued to support XRP.

Ongoing SEC Scrutiny of Cryptocurrencies

The SEC's actions against Ripple, and its broader approach to cryptocurrency regulation, continue to impact the market sentiment surrounding XRP and other altcoins.

- SEC's definition of securities: The Howey Test remains central to the SEC's determination of what constitutes a security, creating ongoing uncertainty for the entire crypto industry.

- Impact on other altcoins: The SEC's actions send ripples (pun intended) through the altcoin market, impacting investor confidence and leading to increased scrutiny of other digital assets.

- The future of crypto regulation: The Ripple case, while providing some specific guidance on XRP, sets a precedent and highlights the ongoing need for clearer, more comprehensive cryptocurrency regulations.

The SEC's stance on crypto remains a crucial factor affecting overall market sentiment. Uncertainty surrounding future regulatory actions continues to influence investor decisions and XRP's price volatility.

The Potential Impact of Spot Bitcoin ETF Approvals on XRP

The approval of spot Bitcoin ETFs could have a significant indirect impact on XRP.

Increased Institutional Investment

The approval of spot Bitcoin ETFs is likely to drive increased institutional investment into the cryptocurrency market as a whole.

- Increased liquidity in the crypto market: Greater institutional involvement boosts market liquidity and can lead to more stable prices.

- Spillover effect on altcoins: The increased interest in Bitcoin could create a positive spillover effect, influencing investors to explore other cryptocurrencies, potentially including XRP.

- Potential for increased institutional interest in XRP: With increased institutional participation in crypto overall, more institutional investors may consider diversifying their portfolios into altcoins like XRP.

Historically, Bitcoin's price performance has often correlated with the performance of other cryptocurrencies, including XRP. A bullish Bitcoin market often creates a more favorable environment for altcoin growth.

Ripple's Partnerships and Development Activities

Ripple's ongoing efforts to expand XRP's utility and adoption play a vital role in its long-term prospects.

- On-chain activity: High transaction volumes and active use of the XRP Ledger are positive indicators of growing adoption and utility.

- New partnerships: Ripple actively forms partnerships with financial institutions globally, expanding XRP's reach and use cases in cross-border payments.

- Technological advancements in the XRP Ledger: Constant improvements to the XRP Ledger enhance its speed, efficiency, and scalability, making it a more attractive platform for transactions.

Examples include Ripple's ongoing collaborations with various banks and financial institutions for cross-border payment solutions, using XRP for faster and cheaper transactions. These partnerships contribute significantly to XRP's utility and enhance its value proposition.

Market Sentiment and Technical Analysis of XRP

Analyzing market sentiment and performing technical analysis are crucial for assessing XRP's potential.

Price Prediction and Forecasting

Predicting XRP's price is inherently speculative, but analyzing current trends and considering expert opinions can offer some insights.

- Support and resistance levels: Identifying key support and resistance levels on price charts provides potential indications of future price movements.

- Trading volume analysis: High trading volume often indicates strong market interest and can suggest sustained price trends.

- Sentiment indicators (social media, news): Monitoring social media sentiment and news coverage can provide insights into market psychology and potential price shifts.

Analyzing historical price data, coupled with technical indicators, can provide a visual representation of price trends, support levels, and resistance areas.

Risk Assessment and Investor Considerations

Investing in XRP, like any cryptocurrency, involves significant risk.

- Volatility: XRP's price is highly volatile, making it susceptible to sudden and significant price swings.

- Regulatory uncertainty: The regulatory landscape for cryptocurrencies remains uncertain, potentially impacting XRP's future.

- Market manipulation: The cryptocurrency market is not immune to manipulation, which could impact XRP's price.

Potential investors should always conduct thorough research, diversify their portfolios, and understand the inherent risks involved before investing in XRP or any cryptocurrency. Risk management strategies, including setting stop-loss orders, are crucial for protecting investment capital.

Conclusion

The future of XRP remains uncertain, but recent developments paint a complex picture. The Ripple-SEC lawsuit outcome has provided some clarity, but the regulatory landscape and market dynamics continue to influence XRP's price and adoption. The potential approval of spot Bitcoin ETFs could indirectly benefit XRP, but investors should carefully assess the risks involved. Understanding the interplay of the Ripple-SEC case, ETF approvals, and market sentiment is crucial for navigating the potential of XRP. Stay informed about future XRP developments and conduct thorough research before making any investment decisions. Is this XRP's big moment? Only time will tell, but the current environment presents a compelling narrative for those willing to closely follow XRP's evolution.

Featured Posts

-

Optimiser Vos Thes Dansants Grace Au Numerique

May 01, 2025

Optimiser Vos Thes Dansants Grace Au Numerique

May 01, 2025 -

Pak Fwj Ka Kshmyr Pr Htmy Fyslh Tyn Jngwn Ke Bed Bhy Tyar

May 01, 2025

Pak Fwj Ka Kshmyr Pr Htmy Fyslh Tyn Jngwn Ke Bed Bhy Tyar

May 01, 2025 -

Premier Bebe De L Annee Une Boulangerie Normande Offre Son Poids En Chocolat

May 01, 2025

Premier Bebe De L Annee Une Boulangerie Normande Offre Son Poids En Chocolat

May 01, 2025 -

Mastering The Art Of Crab Stuffed Shrimp With Lobster Sauce

May 01, 2025

Mastering The Art Of Crab Stuffed Shrimp With Lobster Sauce

May 01, 2025 -

Premier Bebe De L Annee Gagnez Son Poids En Chocolat Boulangerie Normande

May 01, 2025

Premier Bebe De L Annee Gagnez Son Poids En Chocolat Boulangerie Normande

May 01, 2025

Latest Posts

-

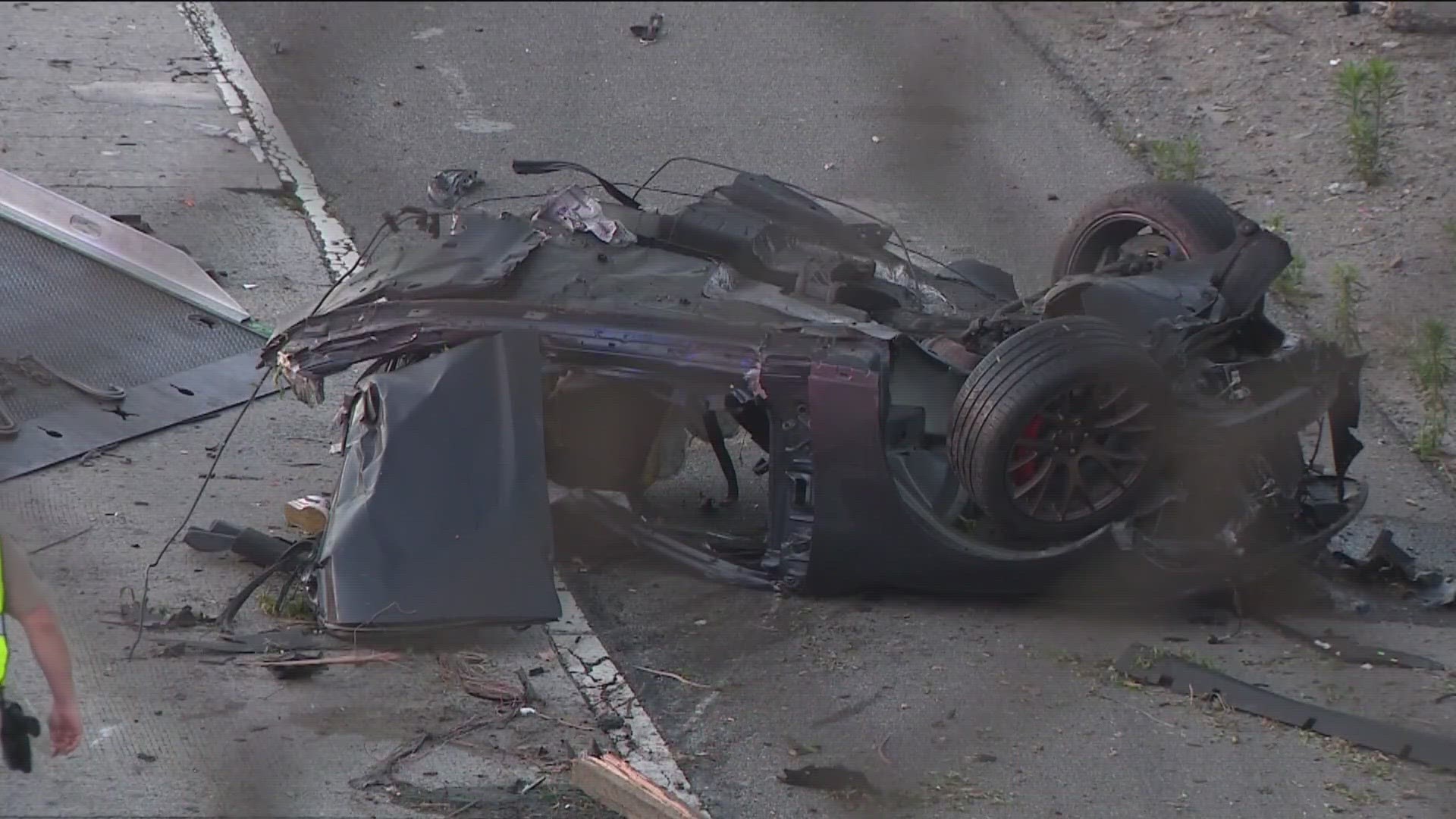

Four Killed Children Included In Horrific After School Camp Accident

May 01, 2025

Four Killed Children Included In Horrific After School Camp Accident

May 01, 2025 -

After School Camp Devastated Car Crash Results In Four Deaths

May 01, 2025

After School Camp Devastated Car Crash Results In Four Deaths

May 01, 2025 -

Guilty Plea Lab Owner Faked Covid 19 Test Results During Pandemic

May 01, 2025

Guilty Plea Lab Owner Faked Covid 19 Test Results During Pandemic

May 01, 2025 -

Multiple Fatalities Children Among Victims Following Car Crash At After School Program

May 01, 2025

Multiple Fatalities Children Among Victims Following Car Crash At After School Program

May 01, 2025 -

Instagram And Whats App Antitrust Battle Ftc Vs Meta Current Status

May 01, 2025

Instagram And Whats App Antitrust Battle Ftc Vs Meta Current Status

May 01, 2025