Is Uber Stock Recession-Proof? Expert Analysis

Table of Contents

Uber's Business Model and Recession Resilience

Uber's core business model, encompassing ride-sharing and food delivery, presents a unique position in the context of economic downturns. The question of its recession-proof nature hinges significantly on the demand elasticity of these services.

Demand Elasticity in a Recession

Ride-sharing and food delivery services possess a degree of resilience compared to purely discretionary spending. While luxury travel or restaurant dining may be curtailed during a recession, essential uses of Uber's services often persist.

- Essential Uses: Commuting to work, accessing essential medical services, transporting goods for small businesses.

- Non-Essential Uses: Night-out transportation, ordering from high-end restaurants, frequent leisure travel.

- Historical Data: While definitive historical data directly correlating Uber usage to specific past recessions is limited due to the company's relatively young history as a publicly traded entity, analyzing usage patterns during periods of economic slowdown reveals valuable insights. A deeper dive into available data from previous economic slowdowns is necessary to understand the full impact.

- Shifting Demand: During economic downturns, consumers may shift towards cheaper alternatives, such as public transportation or cooking at home. This could impact Uber's higher-end service segments more significantly.

Pricing Strategies and Revenue Generation

Uber's dynamic pricing model plays a crucial role in maintaining profitability during fluctuating demand.

- Surge Pricing: Surge pricing, while controversial, effectively addresses periods of high demand, ensuring driver availability and maximizing revenue.

- Fuel Price Fluctuations: Fluctuations in fuel prices directly impact driver earnings and Uber's operational costs, requiring careful monitoring and potential adjustments to pricing strategies.

- Subscription Models: Uber's subscription models, like Uber One, aim to generate stable, recurring revenue streams, less susceptible to immediate economic fluctuations. These provide a buffer against downturns.

Financial Health and Cost-Cutting Measures

Assessing Uber's financial health and cost-cutting capabilities is crucial in evaluating its recession resilience.

Debt Levels and Liquidity

A strong financial position is a key indicator of a company's ability to withstand economic shocks. Examining Uber's financial statements provides key insights.

- Key Metrics: Debt-to-equity ratio, cash reserves, free cash flow, and profitability margins offer critical data points for this assessment.

- Competitor Comparison: Comparing Uber's financial health with that of its major competitors helps determine its relative strength and vulnerability during economic downturns.

- Funding Capacity: Uber's capacity to secure additional funding, if needed, via debt or equity financing, further bolsters its recession-resistance capabilities.

Cost-Cutting Strategies

Uber's ability to implement effective cost-cutting measures is critical during a recession.

- Past Strategies: Previous instances of workforce adjustments and operational efficiency improvements demonstrate Uber's capacity to adapt to challenging economic conditions.

- Technological Advancements: Automation and technological advancements within the company's operations can potentially lower operational costs.

- Service Quality: The balance between cost-cutting and maintaining service quality is essential to retain customer loyalty and market share during economic uncertainty.

External Factors Impacting Uber's Recession Resistance

External factors beyond Uber's direct control can significantly influence its performance during a recession.

Government Regulations and Policy Changes

Government regulations and policies can impact Uber's operational costs and profitability.

- Labor Laws: Changes in labor laws, particularly regarding worker classification and benefits, can significantly affect Uber's expenses.

- Ride-Sharing Regulations: Evolving ride-sharing regulations at local and national levels can impact operations and market access.

- Government Support: Government subsidies or financial aid packages during economic crises can provide a buffer to businesses, potentially impacting Uber positively or negatively depending on the nature of these interventions.

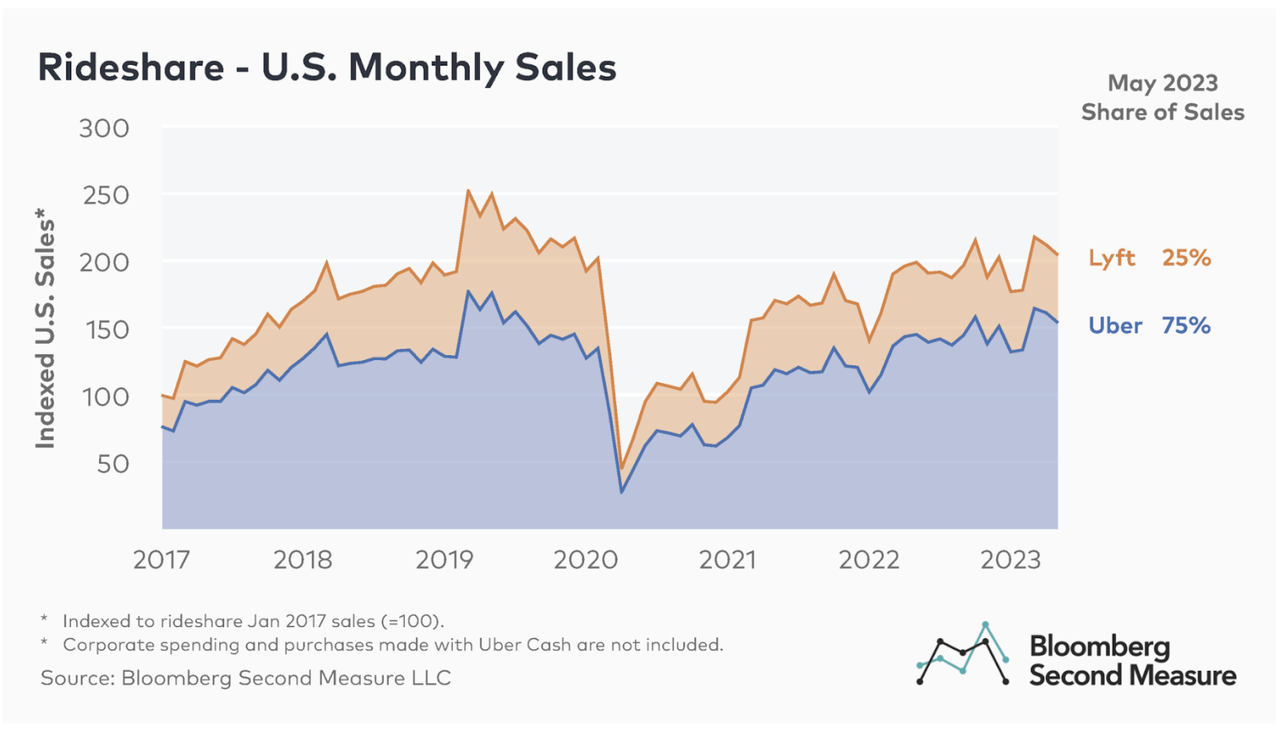

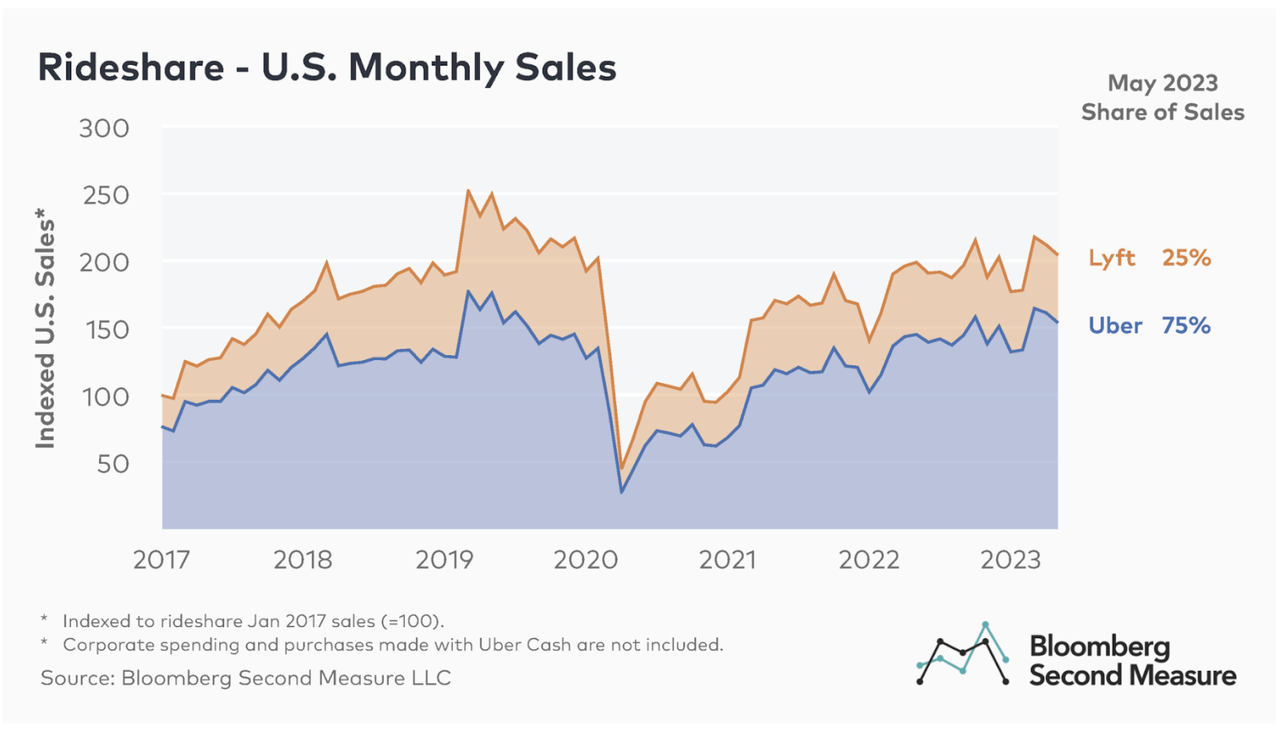

Competition and Market Share

The competitive landscape plays a critical role in Uber's recession resistance.

- Competitor Analysis: Analyzing the competitive landscape and the potential for competitors to gain market share during downturns is vital.

- Market Share Strategies: Uber's strategies to maintain or increase its market share during a recession are paramount. This includes pricing strategies, promotional activities, and expansion into new markets or service segments.

Conclusion: Is Investing in Uber Stock a Recession-Proof Strategy?

Ultimately, whether Uber stock is truly "recession-proof" is a complex question. While its business model possesses elements of resilience, its success during an economic downturn will depend on a confluence of factors: its ability to adapt pricing, cut costs effectively, maintain customer loyalty, and navigate evolving regulatory landscapes and intense competition. Uber demonstrates some resilience due to the essential nature of aspects of its services and its proven capacity for cost-cutting, but it's not immune to economic headwinds. Conduct your own due diligence before investing in Uber stock, considering the factors discussed in this analysis of its recession-proof potential and your personal risk tolerance. Understanding the nuances of Uber's business model and its vulnerability to economic downturns is critical for making informed investment decisions about Uber stock.

Featured Posts

-

Spring Breakout Rosters 2025 Team By Team Breakdown

May 18, 2025

Spring Breakout Rosters 2025 Team By Team Breakdown

May 18, 2025 -

April 16 2025 Daily Lotto Winning Numbers Announced

May 18, 2025

April 16 2025 Daily Lotto Winning Numbers Announced

May 18, 2025 -

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Powerful Performance Radio 94 5

May 18, 2025

Maneskins Jimmy Kimmel Live Appearance Damiano Davids Powerful Performance Radio 94 5

May 18, 2025 -

Could Miles Caton Be The Next Spider Man In The Marvel Cinematic Universe

May 18, 2025

Could Miles Caton Be The Next Spider Man In The Marvel Cinematic Universe

May 18, 2025 -

Burns Vs Morales Ufc Vegas 106 Fight Card Predictions And Betting Odds

May 18, 2025

Burns Vs Morales Ufc Vegas 106 Fight Card Predictions And Betting Odds

May 18, 2025

Latest Posts

-

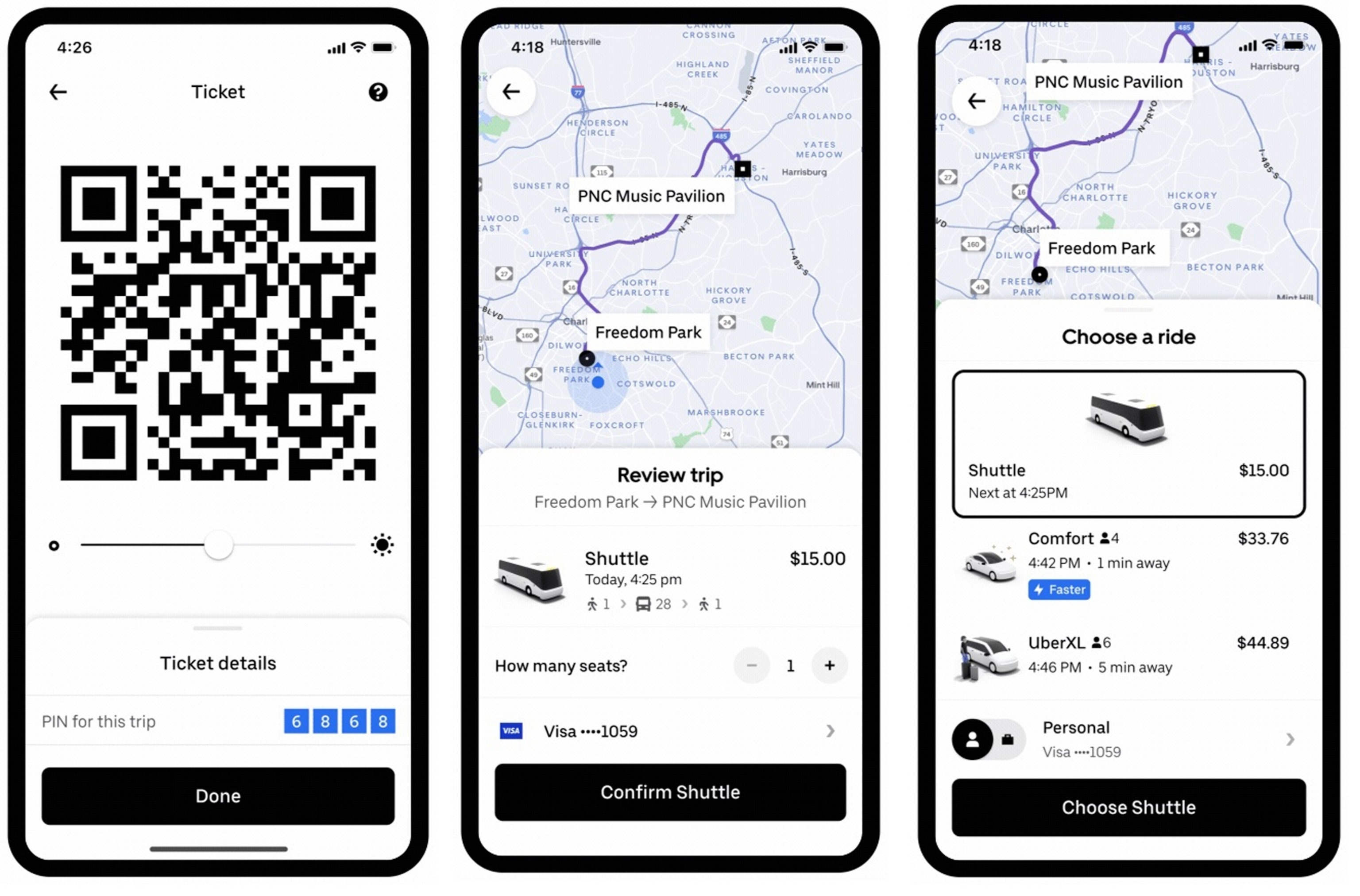

Convenient And Affordable 5 Uber Shuttle Service From United Center

May 19, 2025

Convenient And Affordable 5 Uber Shuttle Service From United Center

May 19, 2025 -

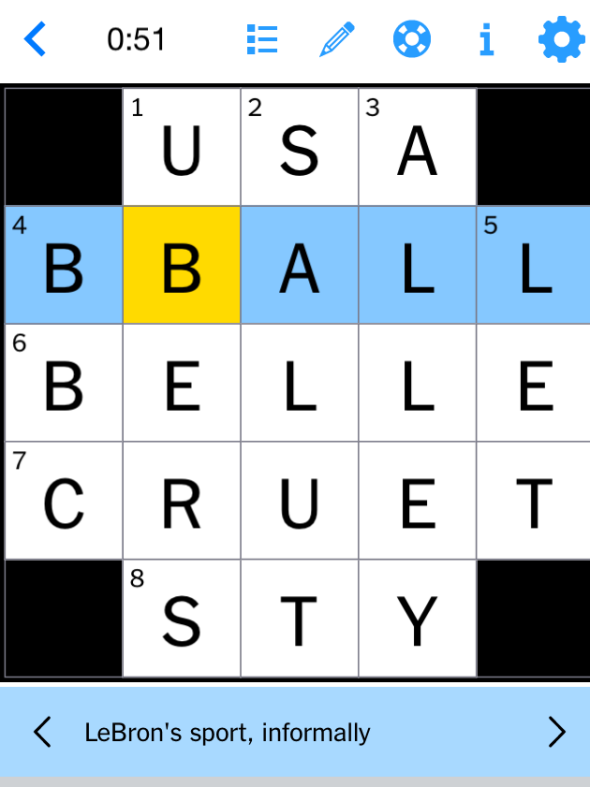

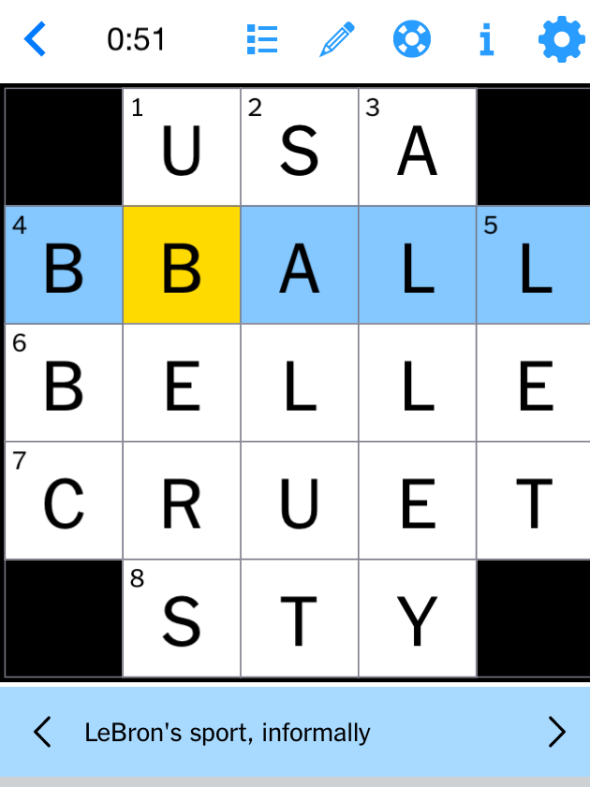

Solve The Nyt Mini Crossword Answers For March 26 2025

May 19, 2025

Solve The Nyt Mini Crossword Answers For March 26 2025

May 19, 2025 -

Nyt Mini Crossword Solutions For March 26 2025

May 19, 2025

Nyt Mini Crossword Solutions For March 26 2025

May 19, 2025 -

5 Uber Shuttle Service Launches For United Center Event Attendees

May 19, 2025

5 Uber Shuttle Service Launches For United Center Event Attendees

May 19, 2025 -

Nyt Mini Crossword March 12 2025 Hints And Solutions

May 19, 2025

Nyt Mini Crossword March 12 2025 Hints And Solutions

May 19, 2025